![Will Uniswap [UNI] be a darkish horse post-Bitcoin halving? Will Uniswap [UNI] be a darkish horse post-Bitcoin halving?](https://renewed.energy/wp-content/uploads/2024/04/uni-sentiment-and-mvrv-ratio.png)

- A rise in trade withdrawal and a unfavorable MVRV ratio recommended a possible UNI rally.

- The challenge’s TVL elevated, indicating that merchants had recovered from the sooner FUD.

If the latest motion of a whale is something to go by, Uniswap [UNI] may very well be set for a giant rally within the coming weeks. In accordance with Spot On Chain, a whale withdrew his UNI holdings from Binance for the primary time.

The whole tokens have been 121,871, valued at $954,000. Withdrawing the tokens from the trade implied that the participant doesn’t plan to promote anytime quickly.

For the worth motion, this was a bullish sign. Just a few weeks in the past, UNI was topic to an enormous nosedive after the U.S. SEC publicly revealed that it would sue Uniswap Labs, the agency behind the event of the token.

This information brought about Worry, Uncertainty, and Doubt (FUD) across the token. In addition to that, UNI’s value plunged to $5.86.

Nevertheless, within the final seven days, the worth of the cryptocurrency has elevated by 8.31% whereas altering palms at $7.81.

DeFi’s time to shine?

However one different factor AMBCrypto seen was that the whale additionally eliminated his Compound [COMP] tokens from Binance [BNB].

A situation like this means that it may very well be doable that DeFi tokens, not UNI alone, may soar.

In contrast to the final bull market, DeFi has not been one of many high narratives this cycle. As a substitute, meme cash, Actual World Belongings (RWAs), and AI tokens have been dominating.

Will the latest growth change the state of issues? Properly, we checked the likelihood by trying on the sentiment round UNI.

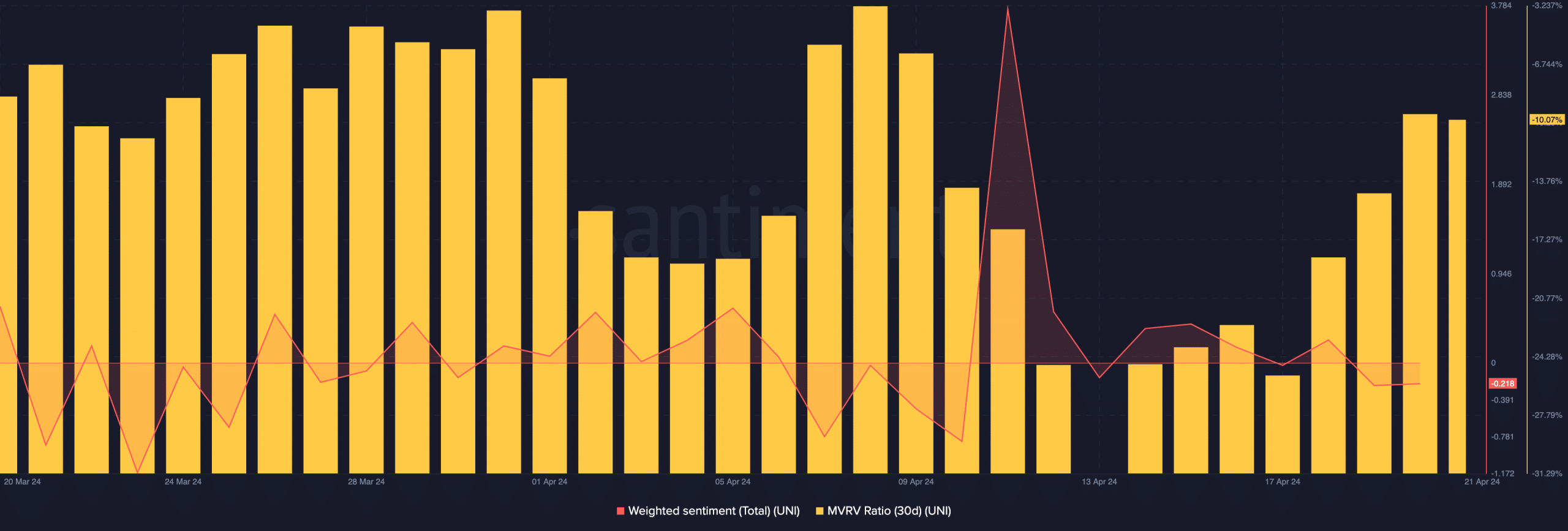

As of this writing, Uniswap’s Weighted Sentiment had dropped to the unfavorable zone. This decline implied that almost all feedback concerning the challenge have been extra gloomy than they have been enthusiastic.

Sometimes, the state of the metric is meant to indicate that UNI may lack demand. However a have a look at the Market Worth to Realized Worth (MVRV) ratio recommended in any other case.

At press time, the 30-day MVRV ratio was -10.01%. Which means that if each UNI holder sells at press time value, the common return can be a ten% loss.

UNI regains belief

However that isn’t one thing most holders would do. As such, a shopping for alternative might exist between $6.50 and $8. If shopping for stress will increase, UNI’s value may rally again to double-digit numbers.

Moreover, a forthcoming altcoin season may also assist its costs, as targets between $15 and $20 may very well be doable.

AMBCrypto obtained additional proof that Uniswap was recovering from the FUD from its Complete Worth Locked (TVL).

Sensible to not, right here’s UNI’s market cap in BTC’s phrases

In accordance with DeFiLlama, the TVL had elevated by 138% within the final 30 days. This improve was an indication that members perceived the protocol to be reliable.

Therefore, the worth of belongings staked and locked in surged. Ought to this TVL proceed to rise towards 2021 ranges prefer it has proven in the previous couple of weeks, UNI’s value may also get near its all-time excessive.