- Bitcoin has an HTF bullish outlook, however the present retracement might go deeper.

- The ETF inflows quickly buoyed bullish spirits.

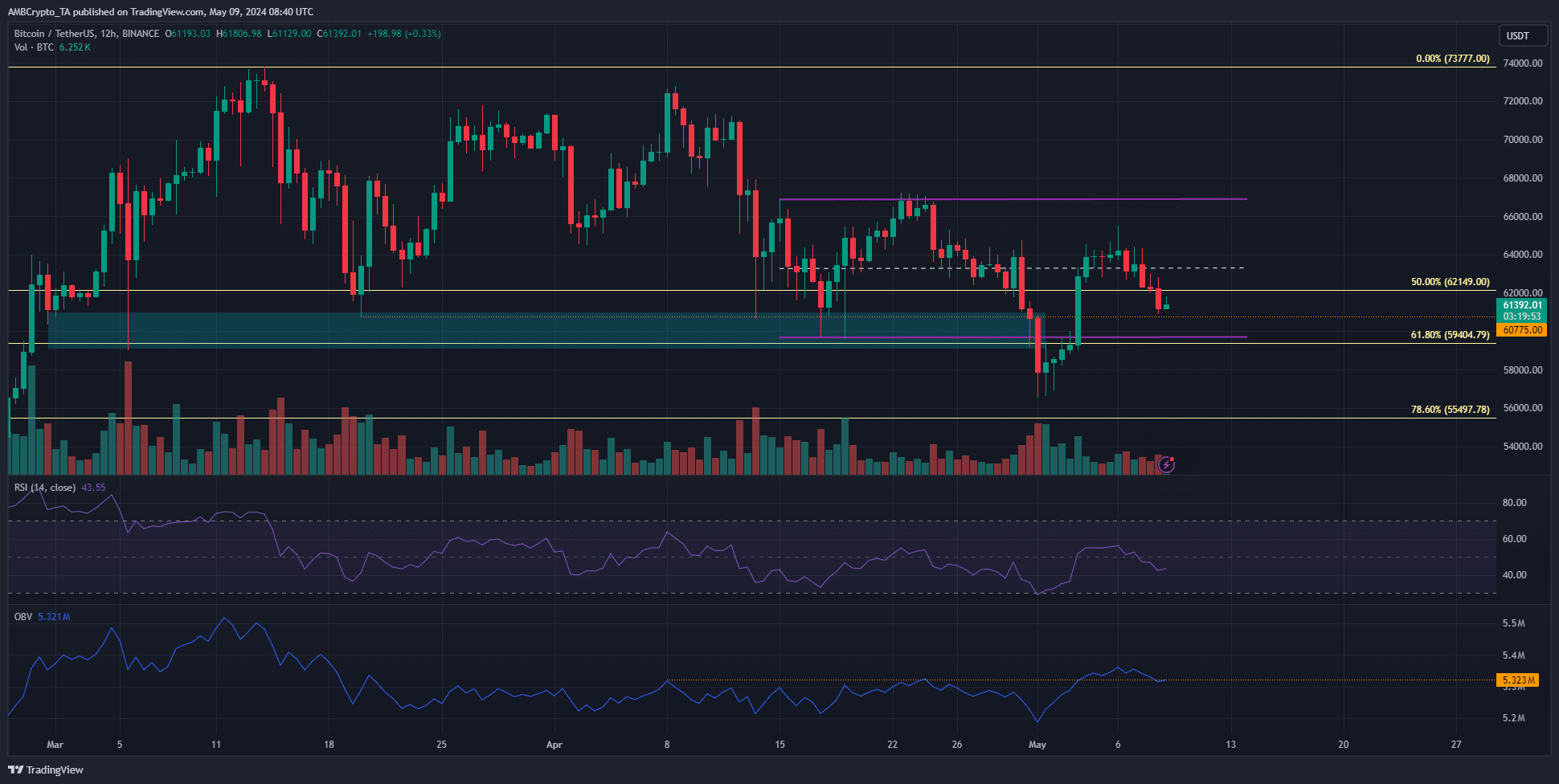

Bitcoin [BTC] turned bearish on the decrease timeframe worth charts after racing to $65.5k at the beginning of the week on Monday, the sixth of Could.

The $63.3k help stage caved to the promoting stress and was flipped to resistance on the seventh of Could.

Reviews of a decline within the accumulation of BTC might see additional depreciation as a consequence of an absence of demand. But, the outlook remained bearish for Bitcoin regardless of promising inflows on Monday.

The $62.1k stage falters because the downtrend gathers power

The vary that BTC was beforehand buying and selling inside had its lows at $59.7k. The worth motion on the first of Could noticed this stage breached, and the $65k area retested as resistance.

This meant that the market construction was bearish.

The RSI on the each day timeframe additionally fell under impartial 50 to point bearish momentum. Conversely, the OBV leaped above an area resistance stage and continued to defend it at press time.

Nonetheless, it was possible that Bitcoin would droop towards the $55k low or additional downward within the coming weeks.

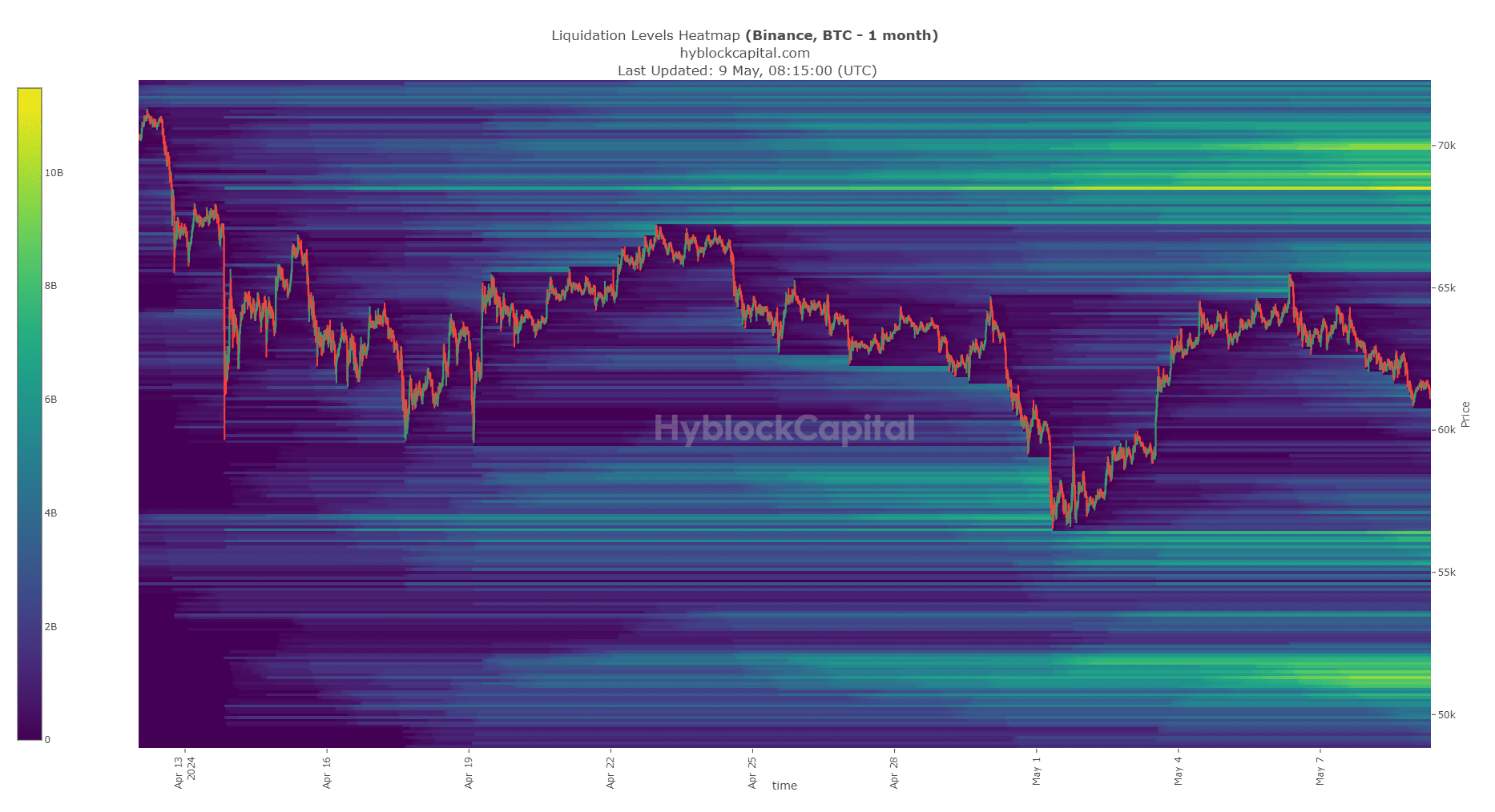

Previously two months, promoting stress has been intense, and the liquidity to the south might appeal to costs decrease.

Why Bitcoin can’t bullishly reverse immediately

Supply: Hyblock

The technical outlook highlighted a bearish bias. After a robust development, costs want time to consolidate.

By breaking under the vary low at $59.7k, BTC hinted that the consolidation section was not but upon us and that the downtrend endured.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The liquidity pockets at $56k and $51.5k are the subsequent magnetic zones for Bitcoin. To the north, the $68.5k-$70k area was an fascinating place for a bearish reversal.

Given the technical elements, a transfer southward appeared extra possible.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.