- An important resistance at $68,000 may set off a BTC pullback.

- Whereas the coin may get better to $72,000 later, the value may development greater.

AMBCrypto’s market evaluation revealed that Bitcoin’s [BTC] bounce to $67,740 doesn’t imply that the value would now not nosedive. In actual fact, there’s a probability that BTC may drop to $60,000.

To reach at this conclusion, the liquidation heatmap got here into play. The liquidation heatmap helps merchants to forestall additional losses. Excessive liquidation areas could possibly be assist or resistance areas.

North just isn’t the one method

In line with knowledge from Coinglass, there was an enormous cluster of liquidity from $67,626 to $68,000, indicating that Bitcoin may method the degrees yet one more time.

On the draw back, there was a serious stage at $60,160. As such, resistance between $67,000 and $68,000 may power BTC to drop to $60,000 which may later act as assist.

Nevertheless, probably the most concentrated space of liquidity was $72,000, which means that the subsequent uptrend may push Bitcoin thus far. Establishing this bias was the Realized Value.

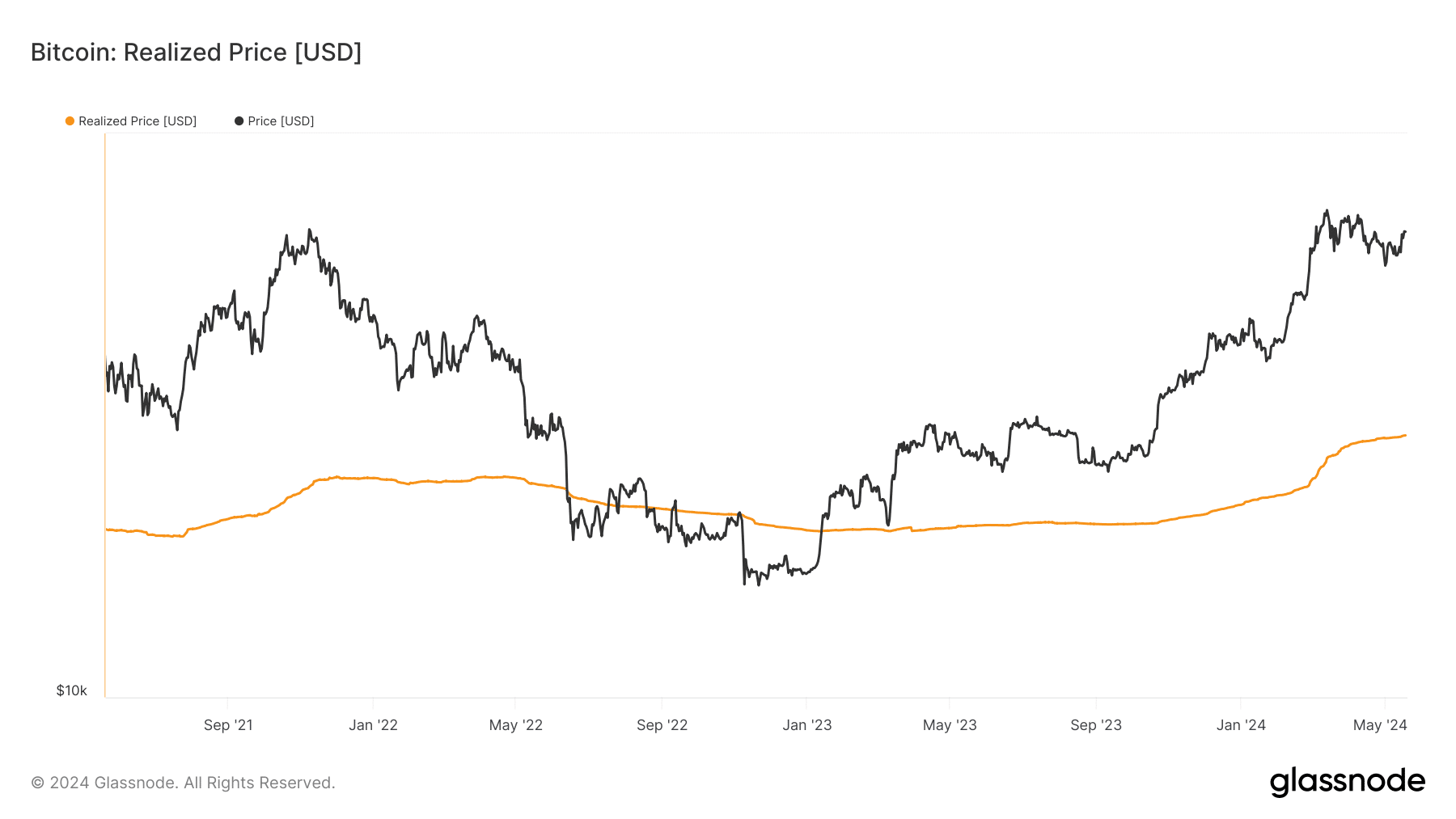

Realized Value measures the typical worth divided by Bitcoin’s provide. This helps to know the financial state of the coin. Just like the liquidation heatmap, this metric can act as on-chain assist or resistance.

Bitcoin just isn’t again to the bear market

If the Realized Value hits or crosses Bitcoin’s worth, it implies that the coin has fallen right into a bear part. For instance, the metric flipped BTC in November 2022, confirming a crash within the worth.

As of this writing, the Realized Value was $29,142— two occasions lower than the press time worth. With this place, one can infer that BTC has not hit the highest of this cycle.

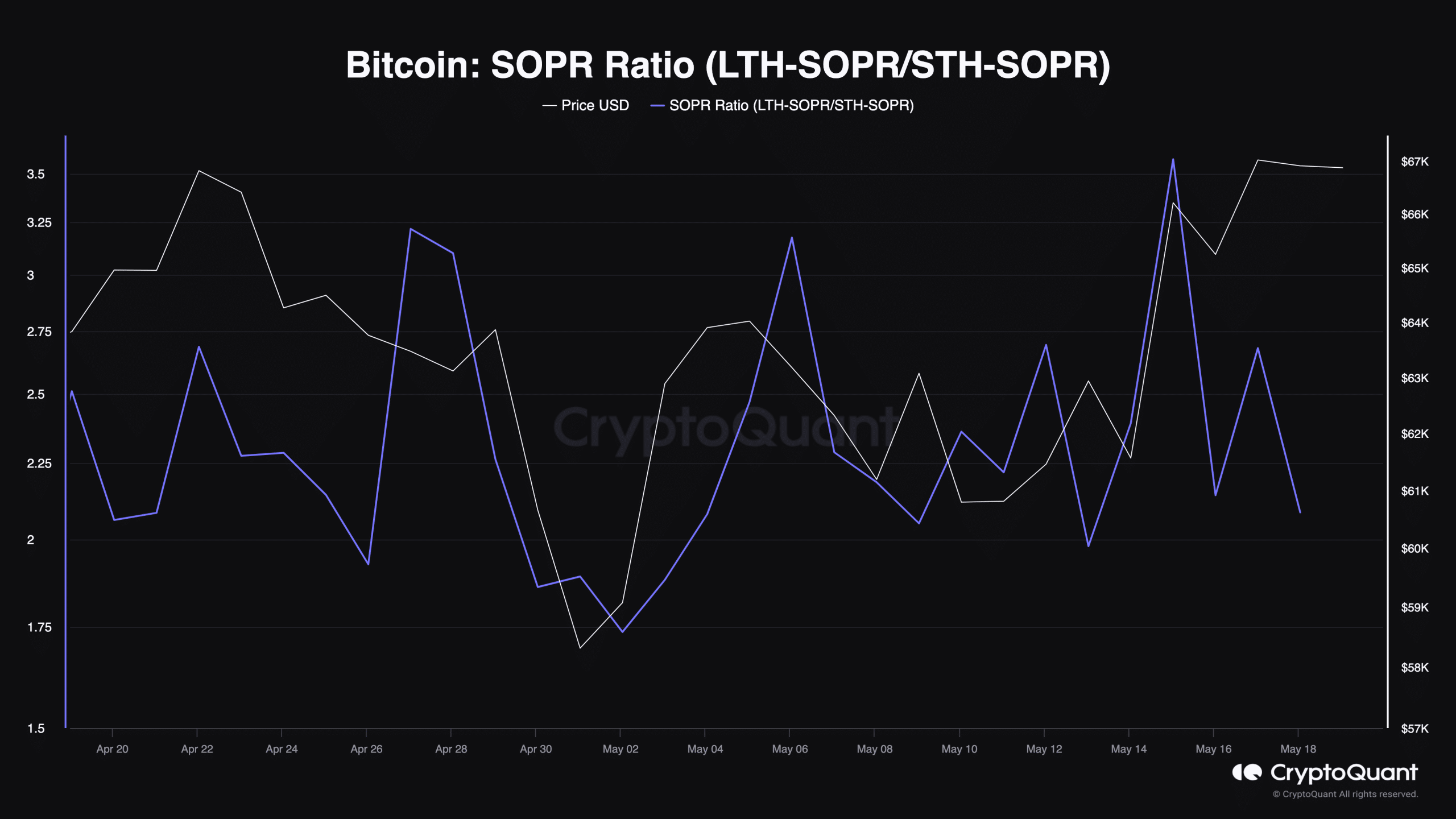

As well as, we assessed the SOPR Ratio. SOPR stands for Spent Output Revenue Ratio. By definition, SOPR measures the revenue ratio of the complete market.

The worth of this metric is calculated because the division of the long-term holder’s SOPR by that of the short-term holder. A excessive SOPR ratio means greater income for long-term holders than short-term holders.

If that is so, it implies that the market is near the highest. Conversely, a low SOPR ratio signifies that short-term holders have made extra good points than their long-term counterparts.

At press time, the ratio was 2.08. Falling to this stage suggests that Bitcoin’s worth can transfer greater. For instance, the ratio hit the identical studying earlier than Bitcoin’s all-time excessive in March.

Moreover, the present state of the metric implied that BTC may rally once more. This time, a transfer to $72,000 could possibly be validated.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

However as talked about earlier, step one to hitting the area could possibly be a correction to $60,000.

Within the meantime, BTC may bear a consolidation part first. After that, extra liquidity may stream out of the coin which may propel the downturn earlier than the upswing.