Definition of Delta Hedging

Delta hedging is a technique wherein an investor hedges the chance of a value fluctuation in an choice by taking an offsetting place within the underlying safety. That implies that if the value of the choice modifications, the underlying asset will transfer in the wrong way. The loss on the value of the choice will probably be offset by the rise within the value of the underlying asset.

If the place is completely hedged, the value fluctuations will probably be completely matched in order that the identical whole greenback quantity of loss on the choice will probably be gained on the asset.

Typically, hedging is a technique used to scale back danger. An investor hedges a place in a selected safety to attenuate the possibility of a loss. The character of a hedge, although, additionally means the investor will surrender potential good points as effectively. For instance, an investor with an choices contract for Firm ABC that advantages from the inventory value falling would buy shares of that firm simply in case the inventory value rose.

Understanding Delta

Choices Delta is the measure of an choice’s value sensitivity to the underlying inventory or safety’s market value. It’s the anticipated change in choices value with a 1c change in safety value (constructive if it rises/falls with an increase/fall in market value; unfavorable in any other case).

For name choices, the delta ranges between 0 and 1, whereas on put choices, it ranges between -1 and 0. For instance, for put choices, a delta of -0.75 implies that the value of the choice is predicted to extend by 0.75, assuming the underlying asset falls by a greenback. The vice-versa is similar as effectively.

Reaching Delta-Impartial

An choices place might be hedged with choices exhibiting a delta that’s reverse to that of the present choices holding to take care of a delta-neutral place. A delta-neutral place is one wherein the general delta is zero, which minimizes the choices’ value actions in relation to the underlying asset.

For instance, assume an investor holds one name choice with a delta of 0.50, which signifies the choice is at-the-money and needs to take care of a delta impartial place. The investor may buy an at-the-money put choice with a delta of -0.50 to offset the constructive delta, which might make the place have a delta of zero.

Commerce Instance: Hedging Lengthy Inventory With Lengthy Places

On this instance, we’ll have a look at a situation the place a dealer owns 500 shares of inventory. Being lengthy 500 shares of inventory outcomes ready delta of +500. If the dealer wished to scale back this directional publicity, they must add a technique with unfavorable delta. On this instance, the unfavorable delta technique we’ll use is shopping for places.

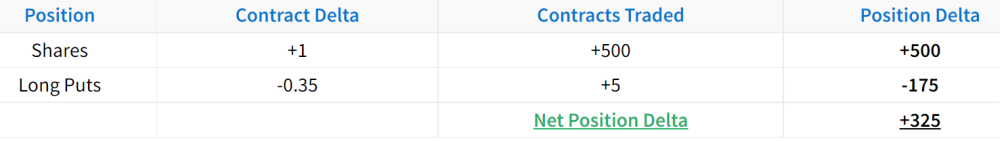

Because the dealer is lengthy 500 shares of inventory, we’ll buy 5 -0.35 delta put choices in opposition to the place. Right here is how the place appears at first of the interval:

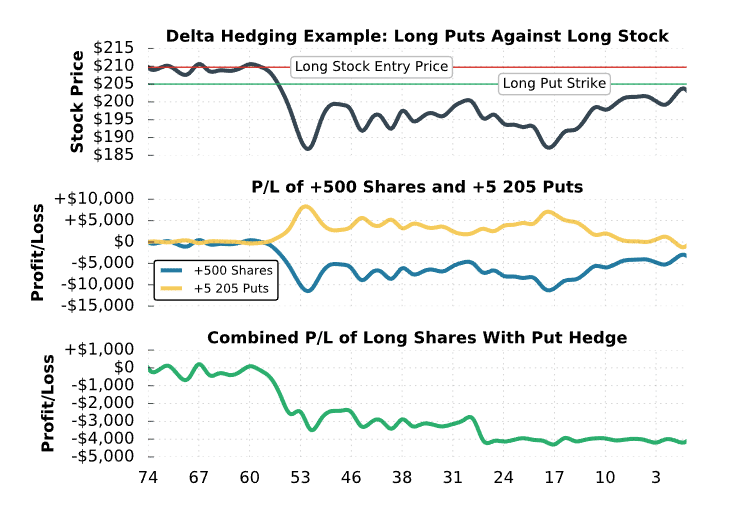

As we are able to see right here, shopping for 5 -0.35 delta places in opposition to 500 shares of inventory reduces the delta publicity by 35%. Let’s check out the P/L of every of those positions when the inventory value falls:

Within the center portion of this graph, the P/L of the lengthy shares and the lengthy places are plotted individually. As you’ll be able to see, when the inventory value collapses, the lengthy inventory place loses cash, however the lengthy places generate income. Within the decrease portion of the graph, the mixed P/L of the lengthy inventory and lengthy places is plotted.

The important thing takeaway from this chart is that the inventory place by itself experiences a drawdown higher than $10,000. Nonetheless, with the lengthy places applied as a delta hedge, the mixed place solely experiences a $4,000 drawdown on the lowest level. By including the unfavorable delta technique of shopping for places to the constructive delta technique of shopping for inventory, the directional publicity is much less important.

Professionals of Delta Hedging

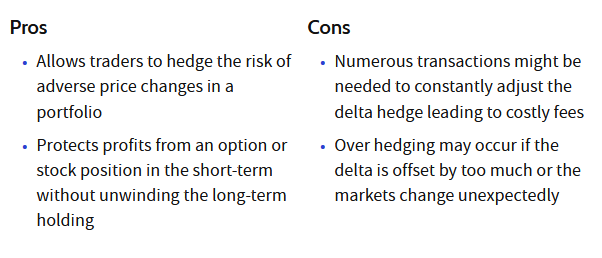

Delta hedging gives the next advantages:

- It permits merchants to hedge the chance of fixed value fluctuations in a portfolio.

- It protects income from an choice or inventory place within the quick time period whereas defending long-term holdings.

Cons of Delta Hedging

Delta hedging gives the next disadvantages:

- Merchants should constantly monitor and regulate the positions they enter. Relying on the volatility of the fairness, the investor would wish to respectively purchase and promote securities to keep away from being under- or over-hedged.

-

Contemplating that there are transaction charges for every commerce performed, delta hedging can incur giant bills.

What Is Delta-Gamma Hedging?

Delta-gamma hedging is an choices technique. It’s intently associated to delta hedging. In delta-gamma hedging, delta and gamma hedges are mixed to chop down on the chance related to modifications within the underlying asset. It additionally goals to scale back the chance within the delta itself. Do not forget that delta estimates the change within the value of a spinoff whereas gamma describes the speed of change in an choice’s delta per one-point transfer within the value of the underlying asset.

Conclusion

Delta hedging is an choices buying and selling technique that goals to hedge the directional danger related to value actions within the underlying. It makes use of choices to offset the chance of a single holding or a whole portfolio. The aim is to achieve a delta impartial state and never have a directional bias.

Delta hedging is a good way to handle the delta (value publicity) of each a place and your total portfolio. For premium merchants, it’s a notably highly effective instrument to maintain your delta impartial positions and portfolio… delta impartial.

There’s extra to cowl on this matter. It is very important notice, that earlier than utilizing choices to delta hedge, it’s essential to totally grasp the dynamic delta behaviors of your hedges. New merchants ought to contemplate risk-defined (pre-delta hedged) positions at commerce entry. It is very important match your technique not solely to your technique’s standards and targets but additionally to your choices buying and selling potential and data.