- Shopping for sentiment remained dominant available in the market.

- Market indicators hinted at a number of extra slow-moving days.

The Bitcoin [BTC] halving triggered a bull rally for altcoins, however BTC itself didn’t showcase a lot volatility. Nevertheless, if historic information is to be believed, then issues would possibly flip bullish for BTC as nicely.

Due to this fact, AMBCrypto analyzed BTC’s state to know what to anticipate from it after a number of days of halving.

Bitcoin stays calm post-halving

Just some days after the much-awaited BTC halving, altcoins started bull rallies, permitting a number of cryptos to register double-digit progress. In the meantime, BTC laid low, because it didn’t push its worth up by an enormous margin.

In response to CoinMarketCap, BTC was up by 2% within the final 24 hours. On the time of writing, it was buying and selling at $64,992.95 with a market capitalization of over $1.28 trillion.

However there was extra to the story, as BTC up to now has displayed related conduct. Rekt Capital, a well-liked crypto analyst, posted a tweet about previous incidents.

As per the tweet, BTC’s worth has at all times consolidated throughout the halving months again in 2020 and 2016. This indicated that traders would possibly witness much less volatility in April.

However the development would possibly change in Could and June, as traditionally, BTC’s worth has gained bullish momentum within the months that adopted halvings. Due to this fact, the possibilities of BTC closing Q2 on a very good notice appeared excessive.

What lies forward within the quick time period?

If historical past repeats itself, issues would possibly flip risky for BTC subsequent month, however to see what traders ought to count on within the quick time period, AMBCrypto analyzed BTC’s metrics.

Our evaluation of CryptoQuant’s information revealed that BTC’s alternate reserve was dropping. This meant that purchasing sentiment was dominant.

The king of crypto’s Binary CDD indicated that long-term holders’ actions within the final seven days have been decrease than common, suggesting that they’ve a motive to carry their cash.

Shopping for sentiment amongst US traders was additionally dominant, as evident from its inexperienced Coinbase Premium. This meant that traders have been assured in BTC and anticipated its worth to rise within the coming weeks.

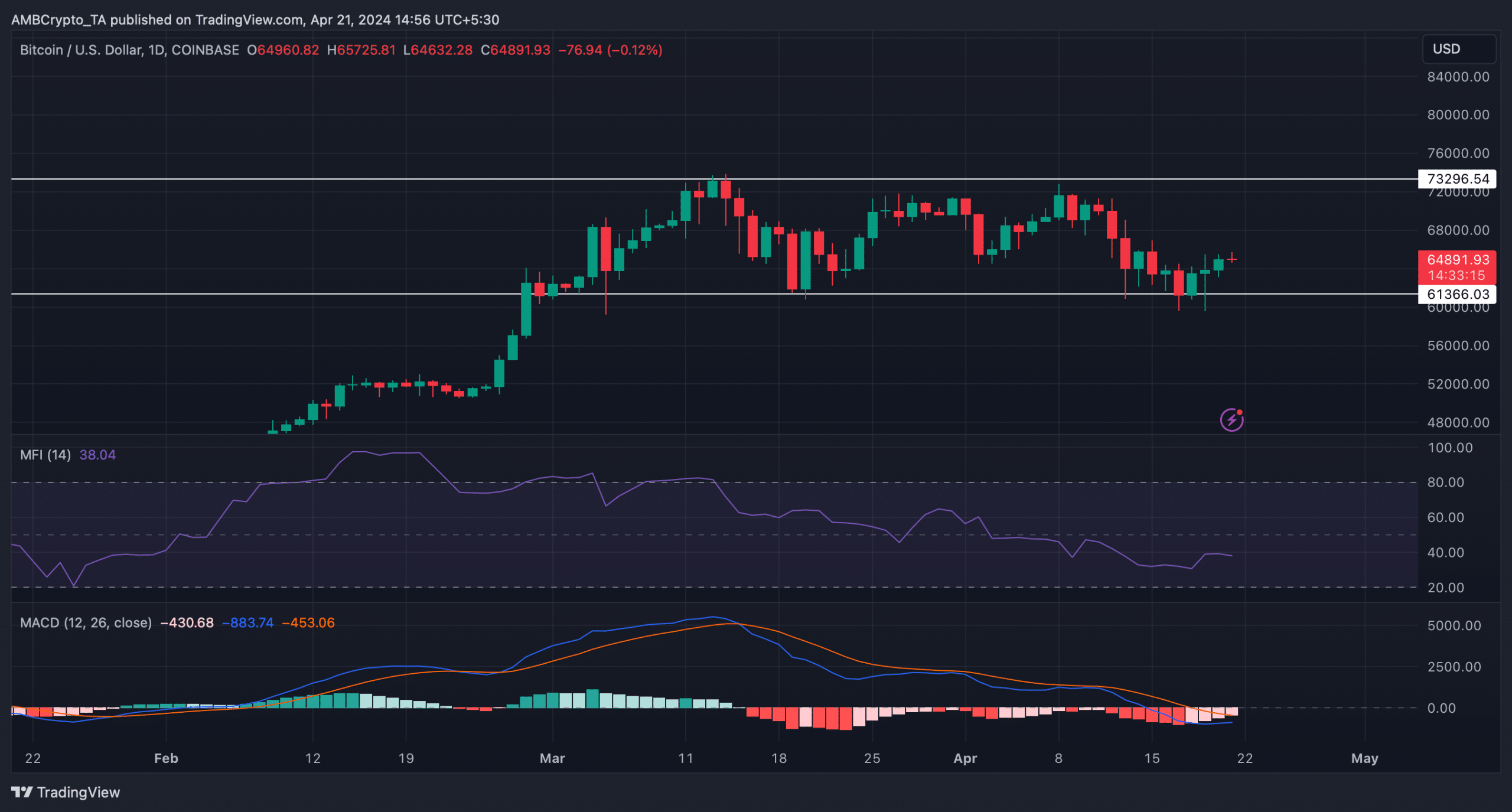

To see which path BTC would possibly head throughout the upcoming week, AMBCrypto took a take a look at its each day chart. As per our evaluation, BTC’s worth would possibly proceed to maneuver in a parallel channel between its ATH and $61k.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Its Cash Stream Index (MFI) went sideways underneath the impartial mark, additional indicating a number of extra slow-moving days.

Nevertheless, the MACD displayed the potential for a bullish crossover, which, if it occurs, would possibly enable BTC to show risky.