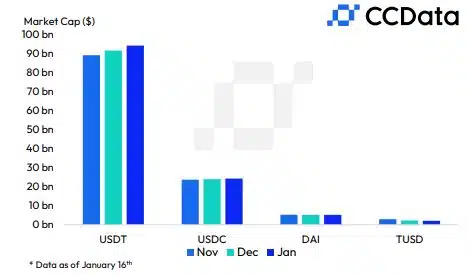

- USDT solidified its place with greater than 70% market share.

- USDC’s market cap rose for second consecutive month.

Stablecoins proceed to be an essential barometer of the digital asset market’s well being.

A rise in stablecoin provide usually suggests growing capital inflows into the crypto market. It is because most merchants from conventional markets would use stablecoins to enter and exit trades on crypto exchanges.

Stablecoins proceed their profitable streak in 2024

In keeping with the newest report by digital property market information supplier CCData, the stablecoin sector prolonged its profitable streak into the brand new yr.

The overall stablecoin marketcap rose 2.45% to $134 billion as of the sixteenth of January, marking the fourth straight month of development. This was additionally the very best market worth of stablecoins in almost an yr.

The primary month of 2o24 proved to be historic for cryptocurrencies because the long-awaited spot Bitcoin [BTC] ETFs have been formally cleared for buying and selling within the U.S. market.

The constructive sentiment prompted buyers to present house to cryptos of their portfolios, in flip creating demand for stablecoins.

As of the tenth of January, $579 billion in stablecoins had been exchanged, with the determine anticipated to surpass December’s complete of $995 billion.

USDT hits contemporary ATH, USDC sees hope

Being the most important stablecoin, Tether is taken into account a bellwether for stablecoin sentiment out there.

USDT’s market cap jumped 3.61% to $95 billion in January, setting a brand new all-time excessive (ATH). With the newest transfer up, the king of the stablecoins recorded its fourth straight month of market worth development.

USDT solidified its place with greater than 70% market share of the stablecoin panorama, the very best since December 2020.

There was additionally a ray of sunshine for the second-largest stablecoin USD Coin [USDC].

The market cap rose 2.02% to $24.5 billion in January, marking the second consecutive month of development following eleven months of decline.

Recall that final yr’s banking disaster caused a droop in USDC’s provide. The stablecoin didn’t recuperate from the blows inflicted throughout this time and ended up dropping 45% of its market capitalization in 2023.

TUSD depegging hogs limelight

One other key stablecoin-related occasion which grabbed the headlines up to now in 2o24 was the depegging of True USD [TUSD]. The stablecoin dropped to as little as 98 cents on the fifteenth of January amidst huge redemptions in favor of USDT.

What adopted was a pointy decline, with TUSD falling behind First Digital USD [FDUSD] because the fifth-largest stablecoin by market cap.

The report additionally famous a gradual decline in TUSD buying and selling volumes in latest months, tumbling to $6.96 billion in December when in comparison with the yearly peak of $60 billion in June.

The rise of FDUSD

On the contrary, FDUSD continued to ascend. The Binance [BNB]-backed stablecoin elevated 16.6% to $2.10 billion in January, recording a 7-month profitable streak since its launch in July 2023.

Additionally not like TUSD, FDUSD buying and selling pairs have clocked excessive volumes over the previous few months. Furthermore, the stablecoin pair was on monitor to register a better quantity in January, in comparison with December’s ATH of $81 billion.