- Miners continued to be worthwhile after the halving, because of Runes.

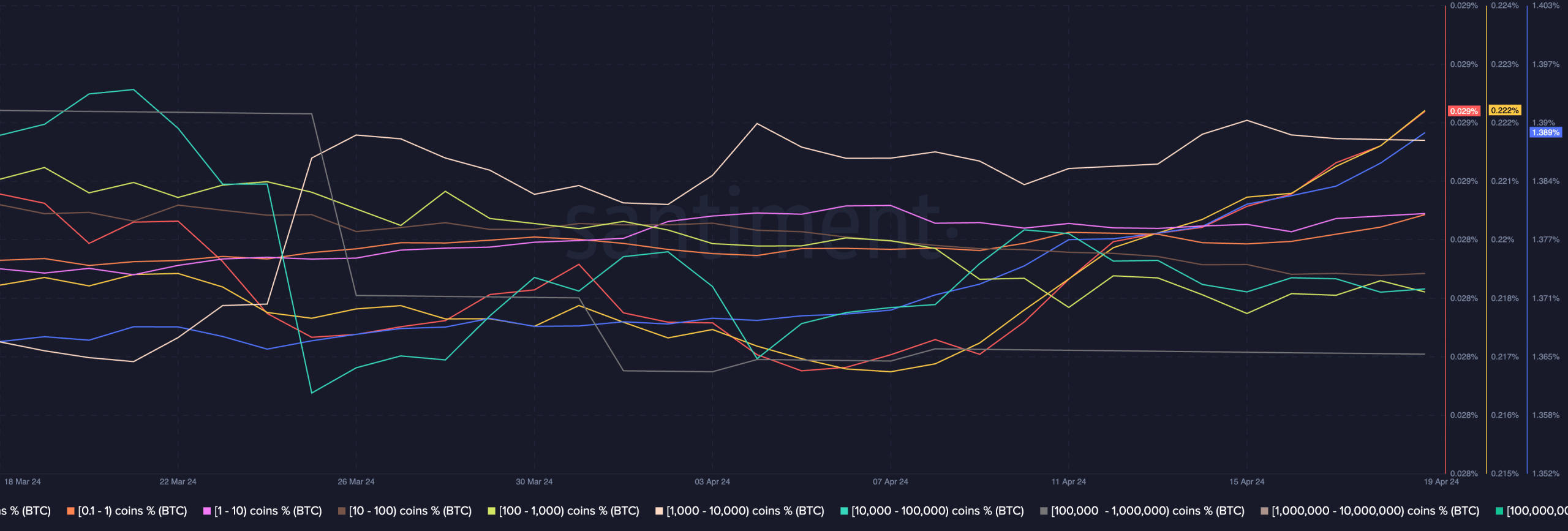

- Retail curiosity in BTC grew, nevertheless, whale curiosity remained stagnant.

Sometimes, after a Bitcoin [BTC] halving, there’s a discount in revenues collected by miners because of the diminished block rewards.

Nevertheless, current developments within the cryptocurrency mining panorama have painted a special image, with miners seeing inexperienced and record-breaking revenues.

Miners profit from Runes

In accordance with Glassnode, Bitcoin miner income surged to a powerful $106.7 million on the twentieth of April.

A good portion, 75.444%, of this income got here from community transaction charges, marking a brand new excessive for Bitcoin miners.

This surge in miner income may be attributed to the rise of Bitcoin runes, a protocol enabling the creation of fungible tokens on the Bitcoin blockchain.

This innovation permits for the creation of latest cryptocurrencies or tokens that function on the identical community as Bitcoin, contributing to elevated mining profitability.

The profitability of Bitcoin mining is crucial for miners because it straight impacts their backside line.

Greater profitability means miners can cowl their operational prices extra effectively and probably reinvest in mining gear or infrastructure upgrades.

This, in flip, strengthens the general safety and resilience of the Bitcoin community.

Furthermore, the excessive profitability of Bitcoin mining may have constructive implications for the broader BTC market.

With miners incomes extra income, there’s diminished promoting strain on BTC as miners could also be much less inclined to promote their newly minted cash.

This dynamic may contribute to cost stability and probably even upward value actions for BTC.

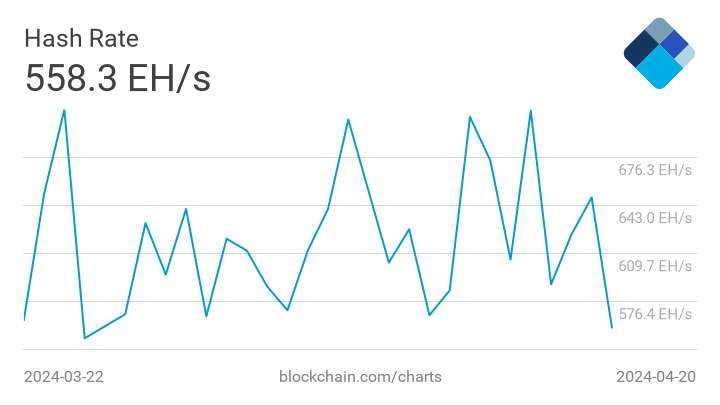

Nevertheless, the hashrate round BTC declined considerably in the previous couple of days, which may impression miners negatively sooner or later.

How is BTC doing?

Talking of value actions, BTC was buying and selling at $64,883.09 at press time, reflecting a 2.10% improve within the final 24 hours.

This uptick in value, coupled with the rising profitability of mining, bodes properly for the general sentiment surrounding BTC.

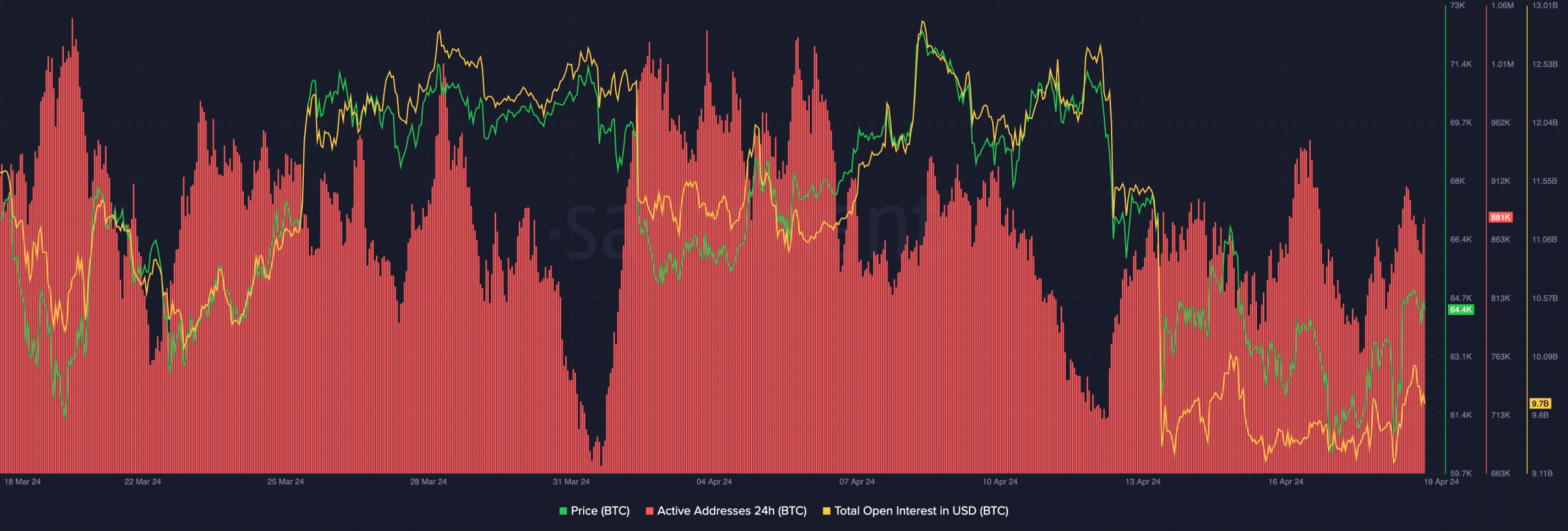

Moreover, energetic addresses on the BTC community have seen vital progress in current days.

This uptick in exercise suggests rising curiosity and engagement with the Bitcoin blockchain, additional supporting constructive value momentum.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Whereas retail curiosity in BTC has been on the rise, whale curiosity seems to have stagnated, indicating a possible shift in market dynamics.

Nevertheless, Open Curiosity, a measure of market exercise and liquidity, has witnessed a slight uptick, prompt continued curiosity from merchants and buyers in BTC futures markets.