- MicroStrategy inventory has outperformed BTC, miner shares and Coinbase’s COIN.

- Regardless of having extra upside potential on value charts, MSTR might be affected by BTC’s pullback.

MicroStrategy’s inventory [MSTR] was apparently the best-performing share with Bitcoin’s [BTC] publicity final week.

MSTR shares rallied 34% final week and reclaimed the $1500 stage, boosted by the BTC restoration and MicroStrategy’s inclusion within the MSCI Index. The rally prolonged into the present week and hit a excessive of $1740, tucking an additional +4% as of twenty second Could.

Total, the MSTR’s outstanding double-digit efficiency eclipsed even Coinbase [COIN] and several other different Bitcoin miner shares.

MicroStrategy inventory vs different BTC-linked shares

MicroStrategy’s shares recorded 3.6X extra features than Coinbase’s, the most important US cryptocurrency trade, inventory [COIN] when efficiency was adjusted on the weekly chart.

MSTR was up 22% prior to now 5 buying and selling days, in comparison with COIN’s 6% over the identical interval.

Curiously, collective Bitcoin miner shares additionally noticed outstanding double-digit features however have been barely decrease than MSTR over the identical interval.

Notably, Valkyrie Bitcoin Miners ETF [WGMI], which tracks high BTC miner shares, together with Marathon Digital’s inventory [MARA], recorded 12.8% features prior to now five-day buying and selling interval.

That mentioned, MSTR eclipsed COIN, and general BTC miner shares during the last 5-day buying and selling periods. Nevertheless, it’s value noting that COIN’s efficiency has remained comparatively muted, partly due to the continuing lawsuit with the US SEC.

MicroStrategy, underneath the steering of its founder and CEO, Michael Saylor, has maintained its Bitcoin technique.

To date, in Q2, the agency added 122 BTC, bringing its whole BTC warfare chest to 214,400 cash, value over $15 billion based mostly on present market costs.

In comparison with the agency’s present whole of 17.7 million shares as of twenty second Could, its BTC per share was roughly 0.01209 BTC.

However giant variety of traders have thronged to MSTR, generally method increased than BTC, the underlying asset they’re searching for publicity to.

However MSTR’s attract might be irresistible, particularly in comparison with BTC’s efficiency. MSTR has outperformed BTC on a weekly, month-to-month and YTD (Yr-to-Date) foundation.

In Could, MSTR was up 55% in comparison with BTC’s 15%. On the YTD entrance, MSTR’s features have been over 140%, whereas BTC’s worth was +58%.

It meant MSTR holders had higher returns than their BTC counterparts. So, what’s subsequent for MSTR’s value?

What’s subsequent for MSTR’s value?

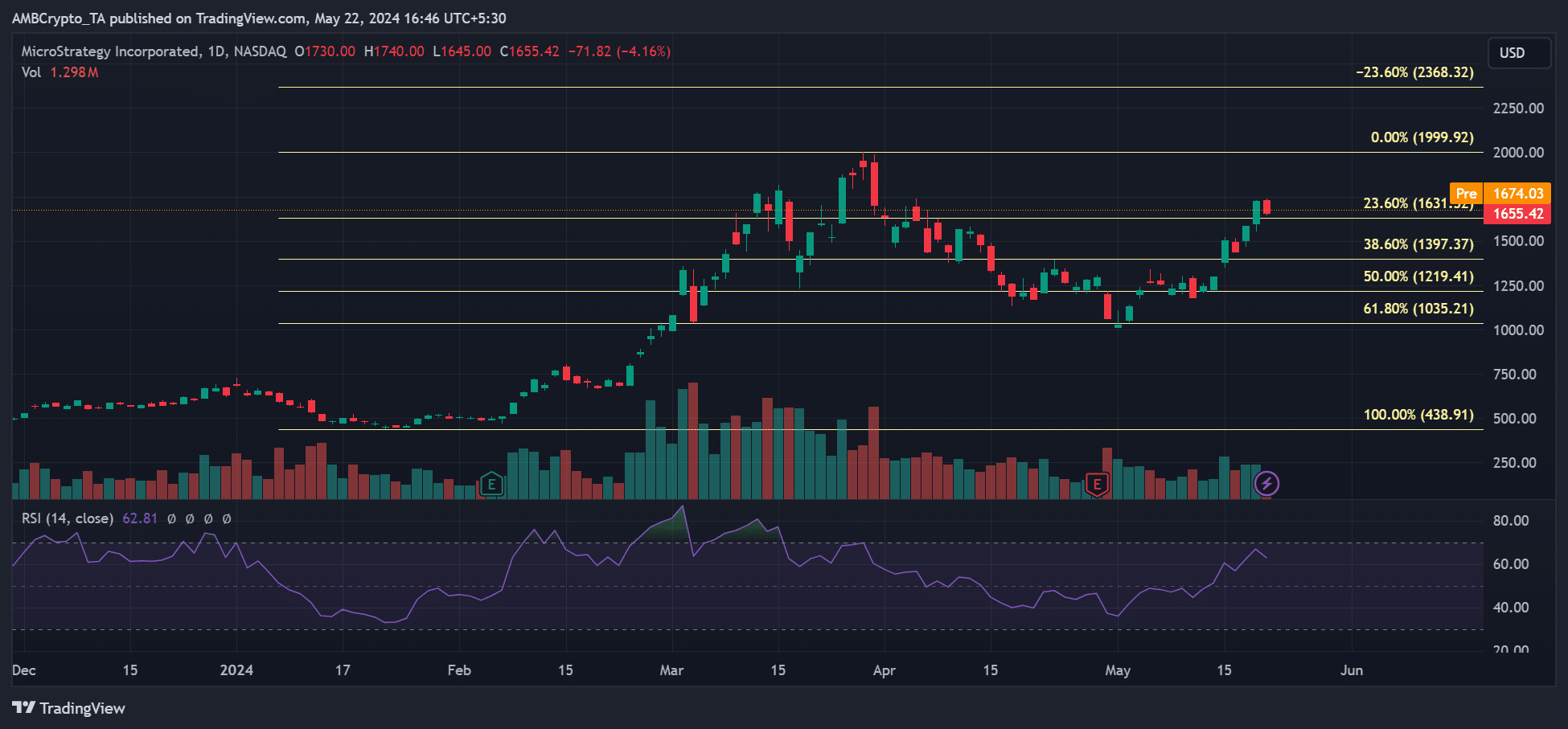

On the each day chart, the important thing subsequent bullish targets have been the ATH of $1999 and $2300 based mostly on the Fib retracement instrument (yellow). The bullish studying on the RSI (Relative Energy Index) indicated that the above bullish targets have been possible.

Nevertheless, regardless of MSTR outperforming BTC on the value charts, a pullback by the king coin might erase a part of the share’s features.

On the time of writing, BTC eased barely under $70K after hitting the range-highs at $71K, whereas MSTR traded at $1650. MSTR’s additional rally might be derailed if BTC extends its retracement.