Market Overview: Nifty 50 Futures

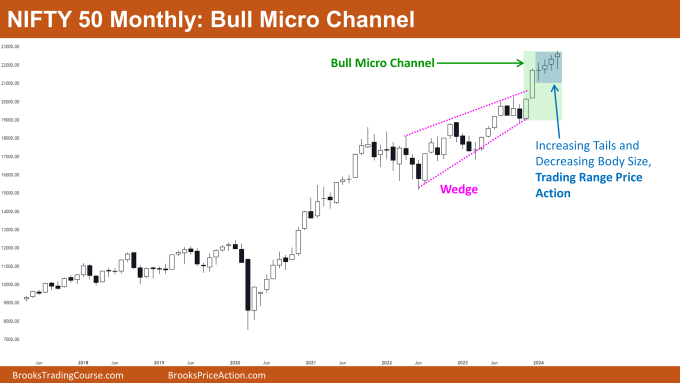

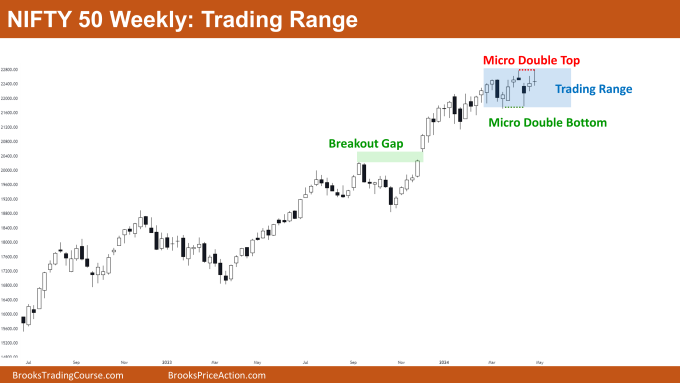

Nifty 50 Bull Micro Channel on the month-to-month chart. This month, the market closed with a weak bullish sample, displaying a small physique and a tail on the backside. At the moment, on the month-to-month chart, the market is experiencing a breakout part due to the bullish breakout of the wedge high. Bulls have been capable of maintain follow-through bars up to now. There’s an observable enhance in buying and selling vary value motion on the month-to-month chart, indicating a possible pullback (bear leg) on this robust bull development. On the weekly chart, Nifty 50 hasn’t entered a buying and selling vary, noticeable by way of the formation of a micro double backside adopted by a micro double high. Bulls have additionally created a breakout hole beforehand, additional strengthening the development.

Nifty 50 futures

The Month-to-month Nifty 50 chart

- Common Dialogue

- The market is at present in a robust development, with bears struggling to create a considerable downward motion for the reason that bull breakout from the wedge high.

- For merchants holding lengthy positions, it’s advisable to keep up these positions till the market reveals consecutive robust bear bars.

- Bears seeking to promote ought to watch for a robust bear bar that closes close to its low earlier than executing their trades.

- Given the robust bull development, shopping for on the present degree is a viable possibility for bulls. The probability of a second leg up earlier than a reversal is excessive, particularly contemplating the power of the final bull leg.

- Deeper into Value Motion

- The chance of a profitable bull breakout from a wedge high is often round 25%. Nonetheless, within the state of affairs described, bulls demonstrated a strong breakout adopted by important follow-through bars. This sequence considerably will increase the probability of success.

- At the moment, the Nifty 50 is buying and selling inside a bull micro channel. Typically, when such a channel weakens and experiences a bear breakout, it tends to transition right into a bull channel quite than signaling a reversal.

- Due to this fact, if bears handle to attain a bear breakout of the bull micro channel, merchants ought to anticipate a minor pullback quite than a whole reversal.

- Patterns

- A bull micro channel is characterised by a particular sample. It happens when the low of the previous bar is decrease than the low of the next bar.

- For instance, let’s take into account Bar A with a low of 100, Bar B with a low of 101, Bar C with a low of 102, and Bar D with a low of 101.

- On this instance, the bull micro channel consists of Bars A, B, and C, however not D. It is because the low of Bar D is decrease than that of its previous bar, Bar C.

The Weekly Nifty 50 chart

- Common Dialogue

- Market is buying and selling inside a buying and selling vary, permitting each bulls and bears to revenue.

- Observe that the buying and selling vary is small, making it appropriate just for skilled scalpers to construction worthwhile trades.

- In the event you lack expertise in scalping, take into account switching to a decrease time-frame chart (like a every day chart) to commerce inside this vary.

- Deeper into Value Motion

- The market has fashioned a breakout hole, indicating power and decreasing the probability of a reversal within the close to time period.

- Moreover, this breakout hole may result in a measuring hole, with a transfer upward (not proven within the chart).

- Double bottoms and double tops are forming close to the identical degree, signaling that the market has entered a buying and selling vary.

- Patterns

- If the bulls handle to attain a bull breakout of the micro double high, this might lead to a measured transfer up based mostly on the peak of the micro double high.

Market evaluation experiences archive

You possibly can entry all weekend experiences on the Market Evaluation web page.