Market Overview: Nifty 50 Futures

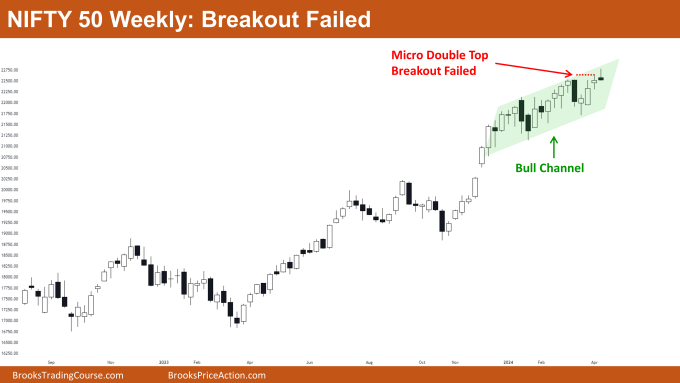

Nifty 50 Breakout Failed on the weekly chart. This week, the market confirmed a small bear doji bar with a brief tail on the prime, nonetheless buying and selling throughout the bull channel. Final week, there was a micro double prime formation out there. Though the bulls managed to interrupt above the neckline of this sample, they couldn’t maintain the momentum, leading to a failed breakout try. If bears handle to type one other bear bar, merchants would possibly anticipate the start of a buying and selling vary. The Nifty 50 on the day by day chart is at present buying and selling close to the highest of the broad bull channel, having fashioned two bear bars that closed close to their lows. Moreover, the bulls have been unsuccessful in attaining a robust breakout of the top and shoulders sample

Nifty 50 futures

The Weekly Nifty 50 chart

- Common Dialogue

- Bulls failed to provide a robust bull breakout of the micro double prime sample and the bull channel. So, bulls ought to keep away from taking lengthy positions till the market varieties a robust bull bar above the neckline of the micro double prime.

- Because the market is buying and selling close to the excessive of the bull channel and bulls failed to provide a breakout, bears can take a scalp brief place.

- As soon as the market reaches the underside of the bull channel, bears ought to exit their commerce as this may be a scalp commerce and never a swing commerce.

- Deeper into Worth Motion

- Each time a bull development is powerful, then the possibilities of a significant development reversal are solely round 20%. So, merchants who can be taking a reversal commerce for main development reversal should keep a danger to reward better than 1:3.

- See the above chart, word that the bull development could be very sturdy and at present the bears have solely fashioned a small doji bear bar. This doji bar is just not sturdy sufficient to reverse this sturdy development, so merchants ought to keep away from taking a swing brief place; as an alternative, they’ll take a scalp place.

- Patterns

- Market is buying and selling within the bull channel and now bulls failed to provide a bull breakout of the channel and of the micro double prime.

- Now, the possibilities of a bear breakout have elevated because of the above causes. However, because the market is in a robust bull development, the perfect bears can get for now can be a buying and selling vary and never a significant development reversal.

- If the bears are in a position to type sturdy bear consecutive bear bars solely then the possibilities of a significant development reversal can be excessive.

The Day by day Nifty 50 chart

- Common Dialogue

- Market is buying and selling close to the highest of the broad bull channel, suggesting that bulls ought to chorus from shopping for till the market revisits the underside of the bull channel.

- Bears can take into account promoting at this stage. Moreover, bears have fashioned two strong bear bars closing close to lows, growing the chance of a bearish motion.

- Bears looking for additional affirmation earlier than initiating a brief place would possibly await a low-2 sign bar or watch for the following sturdy bear bar closing close to the low to enter a brief place.

- Deeper into Worth Motion

- The market has been exhibiting quite a few bars with lengthy tails and small our bodies. Over the previous few weeks, there have been frequent formations of double bottoms and double tops.

- This means that the market is at present in a buying and selling vary section. To transition again right into a development section, bulls or bears sometimes must generate a robust breakout from a breakout mode sample.

- Patterns

- Bulls have did not provoke a bull breakout of the top and shoulders sample, possible resulting in the transformation of the sample right into a buying and selling vary.

- The market is working inside a broad bull channel, permitting each bulls and bears to capitalize by promoting excessive and shopping for low.

Market evaluation stories archive

You’ll be able to entry all weekend stories on the Market Evaluation web page.