Market Overview: S&P 500 Emini Futures

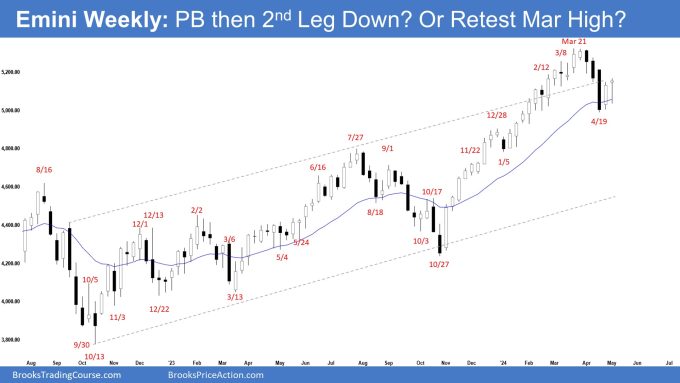

The weekly chart is forming a minor Emini pullback. The bulls desire a robust retest of the March 21 excessive adopted by a powerful breakout above, beginning the bigger bull channel part. The bears need at the least a small second leg sideways to down after a pullback. If the market trades increased, they need a reversal from a decrease excessive main pattern reversal.

S&P500 Emini futures

The Month-to-month Emini chart

- The April month-to-month Emini candlestick was a bear bar closing under March’s low with a outstanding tail under.

- Final month, we mentioned that till the bears can create a powerful promote sign bar, odds proceed to favor the market to commerce sideways to up.

- April’s candlestick fashioned a promote sign bar following 5 months of robust rally.

- The bulls bought a powerful rally beginning in October within the type of a 6-bar bull microchannel.

- Typically, there could also be consumers under the primary pullback following such a powerful bull microchannel.

- If there’s a deeper pullback, the bulls need one other robust leg up finishing the wedge sample with the primary two legs being July 27 and March 21.

- They need any pullback to be sideways and shallow (crammed with weak bear bars, bull bars, doji(s) and overlapping candlesticks).

- They need the pullback to type the next low and the 20-month EMA or the bull pattern line to act as help.

- The bears desire a failed breakout above the all-time excessive, a reversal from the next excessive main pattern reversal and a big wedge sample (Dec 2, July 27, and March 21).

- They bought a promote sign bar in April. They might want to create follow-through promoting to extend the percentages of testing the 20-month EMA.

- Since April was a bear bar closing in its decrease half, it’s a promote sign bar for Might.

- The market stays At all times In Lengthy and the transfer up from October is in a 6-bar bull microchannel.

- There could also be consumers under the primary pullback from such a powerful bull microchannel (maybe holding the market up within the first half of Might).

- The rally has lasted a very long time and is barely climactic. April was the primary signal of a doable pullback part.

- For now, the bears have to create follow-through promoting to extend the percentages of the pullback part lasting at the least 2-3 months.

- Merchants will see if the bears can get a follow-through bear bar, or will the market reverse up retesting the prior excessive (Mar 21) as a substitute.

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bull doji with a protracted tail under closing close to its excessive and buying and selling above the 20-week EMA.

- Final week, we mentioned that merchants would see if the bulls can create a powerful follow-through bull bar this week. The stronger the pullback (bounce), the extra it’s going to forged doubt on the power of the bear’s resolve.

- The market traded sideways to down for a lot of the week however gaped up on Friday and closed the week as a bull doji with a protracted tail under. The bulls managed to get a follow-through bar albeit not a powerful one.

- The bulls have a powerful rally within the type of a decent bull channel.

- They hope that the rally will result in months of sideways to up buying and selling after a pullback (broad bull channel).

- They need a powerful retest of the March 21 excessive adopted by a powerful breakout above, beginning the bigger bull channel part.

- On the very least, they hope to get a small retest of the prior pattern excessive excessive (Mar 21), even when it solely results in a decrease excessive (thereby forming a decrease excessive main pattern reversal).

- If the market trades decrease, they need the 20-week EMA to proceed appearing as help.

- The bears bought a reversal from the next excessive main pattern reversal and a big wedge sample (Feb 2, July 27, and Mar 21),

- Additionally they bought a remaining flag reversal (ioi sample in March).

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of at the least 5-to-10%. They need at the least a take a look at of the 20-week EMA.

- The selloff has retraced greater than 5% and has examined the 20-week EMA.

- The bears need at the least a small second leg sideways to down after a pullback.

- If the market trades increased, they need a reversal from a decrease excessive main pattern reversal.

- Since this week’s candlestick is a bull doji with a protracted tail under, it’s a purchase sign bar albeit weaker.

- The market might nonetheless be within the sideways to up pullback part.

- Nevertheless, merchants must be open to the potential for a second leg sideways to down after the present pullback.

- Merchants will see if the 20-week EMA will proceed to act as help if the market retests it within the weeks forward.

- For now, merchants will see if the bulls can create a powerful follow-through bull bar or will the market stall across the present ranges adopted by a second leg sideways to down.

- If the market retests the March 21 excessive as a substitute however is weak (with doji(s), bear bars, and overlapping candlesticks), the percentages of one other robust leg down from a decrease excessive main pattern reversal will improve.

Trading room

Al Brooks and different presenters speak in regards to the detailed Emini worth motion real-time every day within the BrooksPriceAction.com buying and selling room. We provide a 2 day free trial.

Market evaluation experiences archive

You’ll be able to entry all weekend experiences on the Market Evaluation web page.