- MSTR prolonged its weekly losses to about 20%.

- Bitcoin’s halving and ‘over-valuation’ considerations may supply sellers extra edge

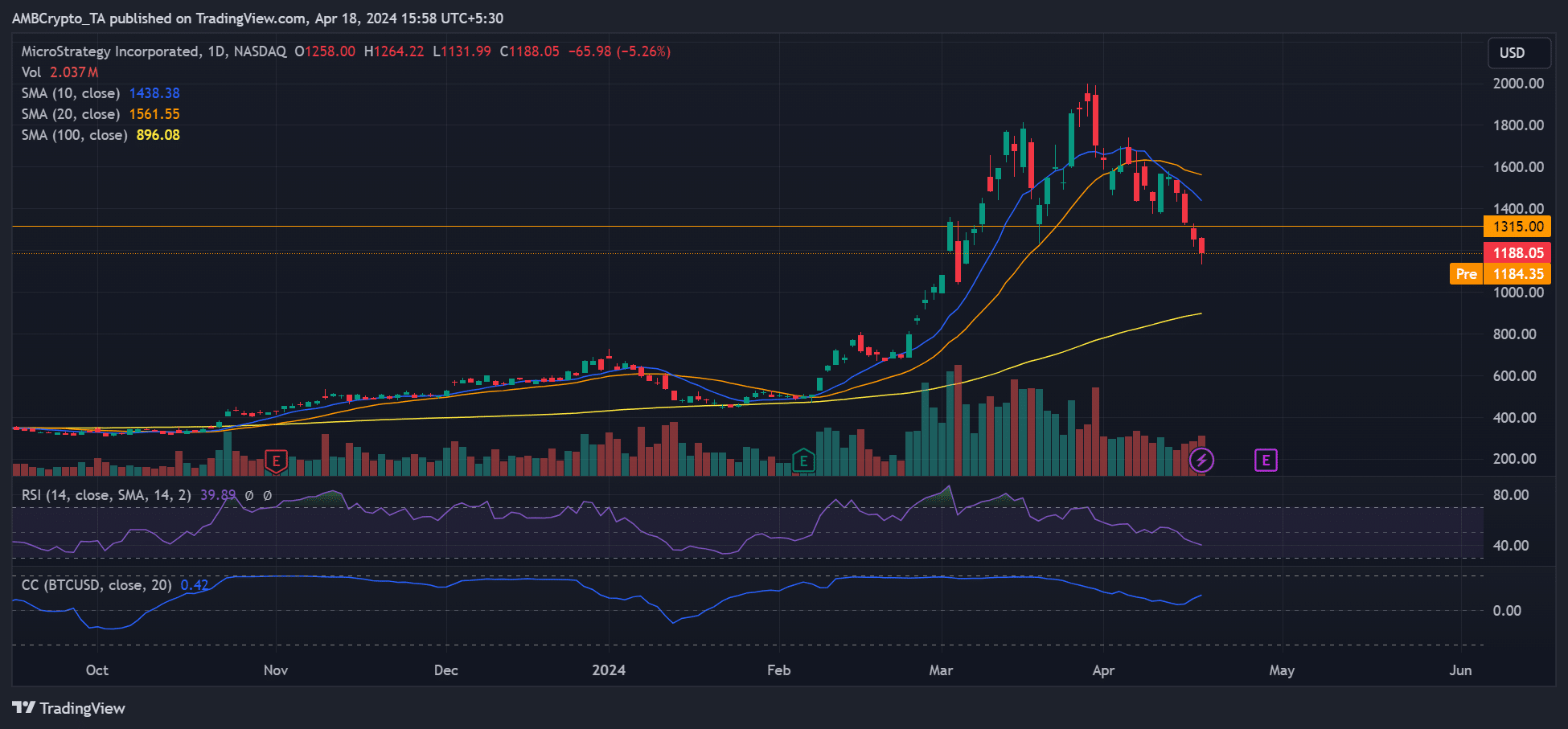

MicroStrategy’s (MSTR) inventory prolonged its weekly losses to over 19%, simply hours earlier than Bitcoin’s [BTC] fourth halving. After hitting a recorded excessive of $1999.99 on 27 March, the inventory retraced, reversing a part of its month-to-month features. MSTR’s weekly losses marked a three-week-long prolonged pullback on the charts.

On a quarterly foundation, the inventory was down 30% in Q2. Quite the opposite, its Yr-to-Date efficiency had a studying of +73.4%, on the time of writing.

On 17 April, MSTR closed at $1188.05, an enormous low cost for anybody who missed leaping on the inventory beforehand. Even so, macro circumstances and worth charts revealed that extra juicy reductions should still be possible for anybody selecting to dive in.

Will MSTR lengthen losses amidst Bitcoin halving?

As one of many companies with a Bitcoin technique, MSTR’s inventory strongly correlates with BTC. This was evidenced by its constructive correlation coefficient since mid-February.

What this implies is that BTC’s prolonged worth dump has been dragging MSTR inventory too.

Between 27 March and 18 April, BTC dropped by 13%, from $71.7K to $62.4K on Bitstamp. Over the identical interval, MSTR slumped by 40%—Greater than 3x BTC’s drop.

Proper now, bears have extra leverage after dropping MSTR beneath the 10- and 20-day SMA (Easy Shifting Common), marked blue and orange, respectively.

Ought to bears push additional, the following goal is the 100-day SMA ($896), which is able to mark an effort to drag MSTR’s worth beneath $1000. If this occurs, it might be a greater low cost for bulls who missed the earlier motion.

The below-average studying on the RSI (Relative Power Index) is an indication of heightened promote strain – Supporting the prolonged drop projection.

Bitcoin halving and MSTR being “overvalued”

Moreover, Bitcoin’s halving may embolden MSTR bears if BTC promoting strain spikes across the occasion.

MicroStrategy’s present BTC holdings stand at 214,246 cash, value over $13B primarily based on present market costs. Most of them have been acquired by means of company-issued convertible notes.

Nonetheless, the continued dump additionally resonates with some market watchers who really feel MSTR inventory is overvalued. Final month, non-public funding supervisor Kerrisdale Capital acknowledged the identical,

“We are long Bitcoin and short shares of MicroStrategy, a proxy for Bitcoin which trades at an unjustifiable premium to the digital asset that drives its value.”

Kerrisdale Capital argued that new spot BTC ETFs supply options to achieve publicity to BTC, which denies MicroStrategy any distinctive benefit for the premiums it expenses.

For perspective, some buyers had beforehand most well-liked shopping for MSTR to achieve an oblique publicity to BTC.

Merely put, the non-public funding supervisor sees MSTR’s truthful worth as $700 – $800. The higher estimate is nearer to the bearish goal marked by the 100-day SMA (yellow).

Nonetheless, the projection might be invalidated, particularly within the unlikely occasion of an enormous Bitcoin rally across the halving.