- The crypto market is down at present on account of a big correction part.

- Bitcoin struggles across the $56,000 assist stage, with technical indicators suggesting a possible reversal.

Checking the crypto market at present, you will notice nothing however purple. The complete market appears to have tumbled, with Bitcoin [BTC] and Ethereum [ETH] taking most hits, dropping far beneath their vital assist ranges.

Bullish sentiments in the neighborhood appear to be virtually utterly gone. As soon as once more, traders are panicking, presumably on the fringe of giving up. So, what’s going on? Why is the crypto market down now?

2024 is usually anticipated to be a extremely bullish yr for the markets. And it has. However we’re at the moment coping with a robust case of the corrections.

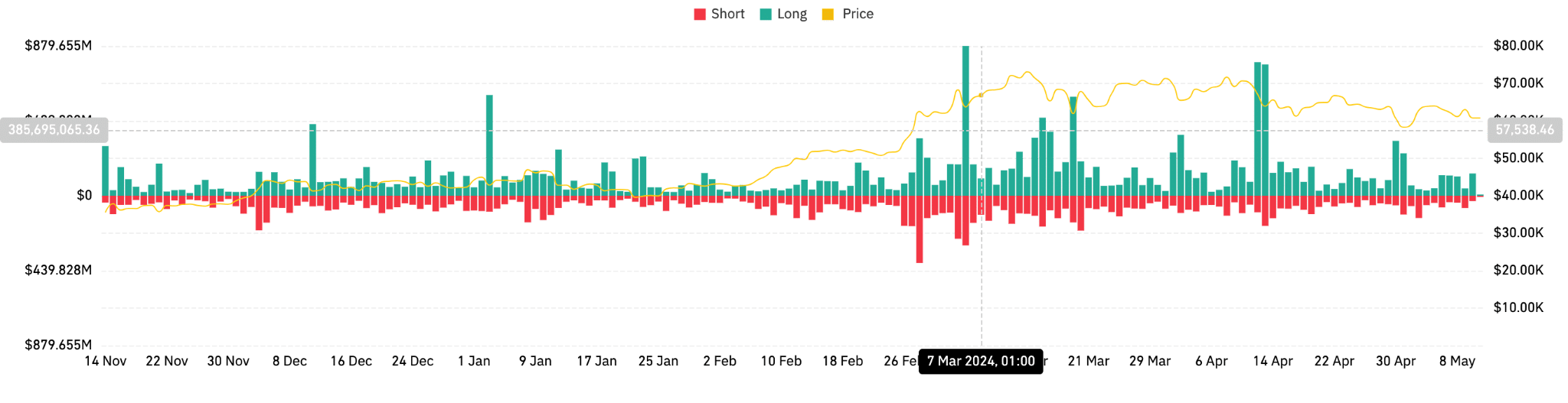

Knowledge from Coinglass exhibits us that each tokens have seen extra inflows than outflows previously twenty-four hours. Additionally, liquidations are comparatively low.

On the tenth of Might, titans of the U.S. banking sector, JPMorgan and Wells Fargo, made headlines with their disclosures of holding spot Bitcoin ETFs.

But, this revelation has barely made a ripple within the total market dynamics. Bitcoin, for one, appears caught in a chronic correction cycle, stubbornly testing investor endurance.

Why is the crypto market flailing?

The instant assist stage for BTC now’s someplace round $56,000, for merchants. Breakout remains to be imminent, as is extensively anticipated by the group.

Knowledge from TradingView tells us that that is the place worry and optimism collide, the place merchants hover between hope for a breakout and dread of additional decline.

Bitcoin is retesting its former all-time excessive resistance ranges, now as new assist zones.

This exercise exhibits a typical case of RSI Bullish Divergence on the 4-hour chart, hinting that the downtrend’s momentum is shedding steam and may quickly reverse.

But, the foreign money remains to be navigating by the perilous falling wedge sample—a technical indicator suggesting that whereas the top of the tunnel could also be close to, the highway stays stuffed with worry and uncertainty.

The group’s consensus leans in the direction of an eventual breakout, which might catapult Bitcoin’s worth to new heights, probably reaching as excessive as $78,000 within the bullish surges to return.

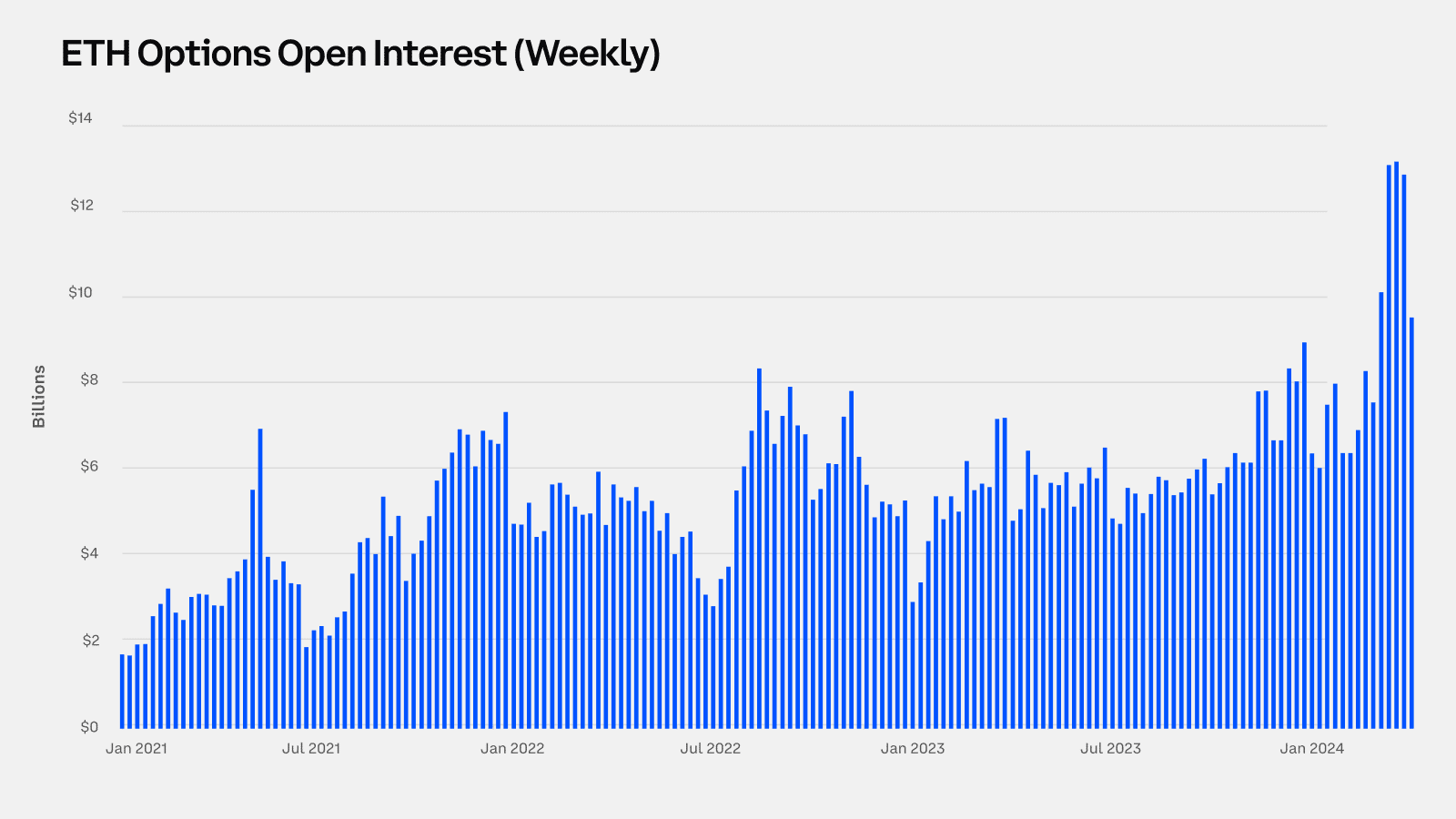

As for Ethereum, its present trajectory is barely totally different from Bitcoin’s. The Ethereum derivatives market is displaying indicators of elevated exercise and investor curiosity, in line with Glassnode.

Open Curiosity has surged by 50%, indicating a robust engagement with Ethereum’s monetary merchandise.

Nevertheless, regardless of these constructive indicators in derivatives, Ethereum’s efficiency relative to Bitcoin this cycle is far slower.

The lag in speculative curiosity, notably from the Quick-Time period Holder group, is a cautious strategy amongst these traders.

In the meantime, Lengthy-Time period Holders appear to stay on the sidelines, eyeing extra profitable alternatives for profit-taking in future rallies.

At press time, Ethereum was value $2,897.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Even because it battles by the present market downturn, the rising curiosity in its derivatives means that these holders could quickly see the favorable situations they’re ready for.

All in all, the explanation for the retreat is that the market remains to be consolidating, and consultants anticipate a breakout regardless. Buyers are suggested not to surrender. 2024 remains to be crypto’s yr.