- The share of BTC provide in revenue has declined by 15% since 5 March

- Coin’s Age Consumed and Community Realized Revenue/Loss metrics refuted claims of a worth backside

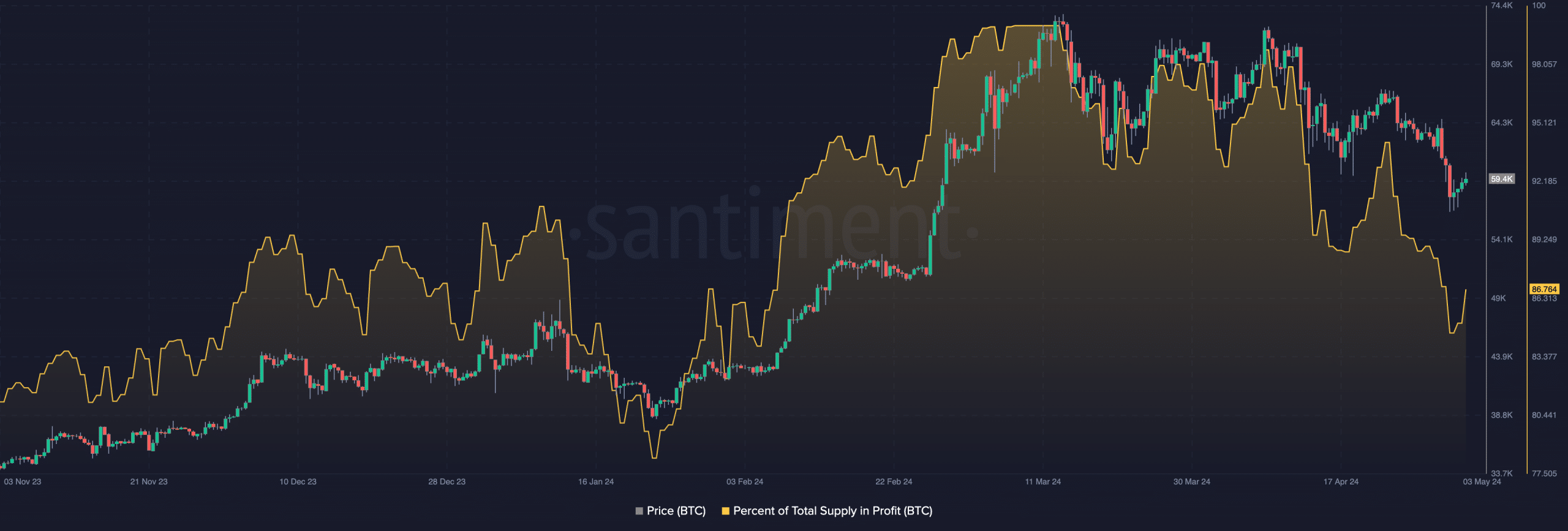

The share of Bitcoin [BTC] provide in revenue has dropped to a two-month low of 84.4%, based on Santiment’s newest replace on X (Previously referred to as Twitter).

In truth, based on the on-chain knowledge supplier, figures for a similar rallied to a year-to-date peak of 99.93% on 5 March. Nevertheless, it has since fallen on the charts.

When this ratio declines on this method, it signifies that an rising portion of BTC buyers maintain their cash at a loss. This usually occurs when BTC’s worth see a slight correction and short-term holders who purchased comparatively just lately at larger costs panic and start to promote their holdings.

In its put up, Santiment assessed the metric’s historic efficiency and concluded that “lower levels generally justify more bullish conditions.”

This, as a result of a low supply-in-profit ratio might be considered as a contrarian indicator. When it falls, it signifies that weak/paper arms have been faraway from the market, making means for brand new demand out there. A declining supply-in-profit ratio may sign that an asset’s worth is approaching its backside, as there are fewer sellers left out there.

Is the underside in?

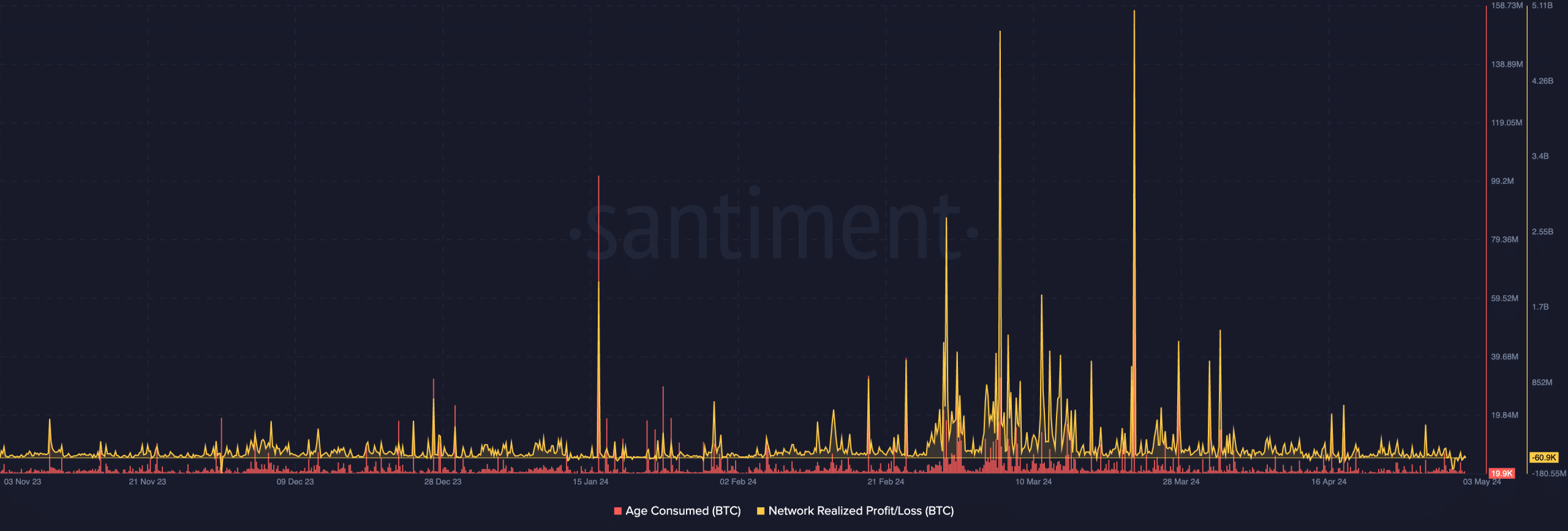

To evaluate whether or not BTC’s worth has reached its backside and if a rally is subsequent, a key metric to think about is the coin’s Age Consumed. This metric tracks the motion of its long-held idle cash. This metric is deemed to be a very good marker of belongings’ native worth tops and bottoms as a result of long-term holders not often transfer their dormant cash round. As such, once they do, it’s noteworthy because it usually leads to main shifts in market tendencies.

When this metric rises, it indicators {that a} important variety of beforehand held idle tokens have begun to vary addresses.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Conversely, when it falls, it signifies that long-held cash stay in pockets addresses with out being traded.

In line with Santiment, BTC’s Age Consumed has been comparatively flat since 3 April, suggesting that there has not been any important motion of dormant cash, which may have marked a neighborhood backside.

One other necessary metric to think about is BTC’s Community Realized Revenue/Loss (NPL). It tracks the distinction between the worth at which cash have been final moved on the blockchain and their present market worth. Traditionally, NPL declines are a marker for when an asset has reached a neighborhood backside. This, as a result of when these dips occur, they sign the short-term capitulation of ‘weak hands’ and the re-entry of latest cash into the market.

As per the identical, there is no such thing as a indication {that a} worth backside has been reached on the charts but.