- How a lot correlation does GME’s rally and its social quantity have with Bitcoin’s worth developments?

- Influence of the identical was seen on the upper timeframes in the course of the earlier cycle

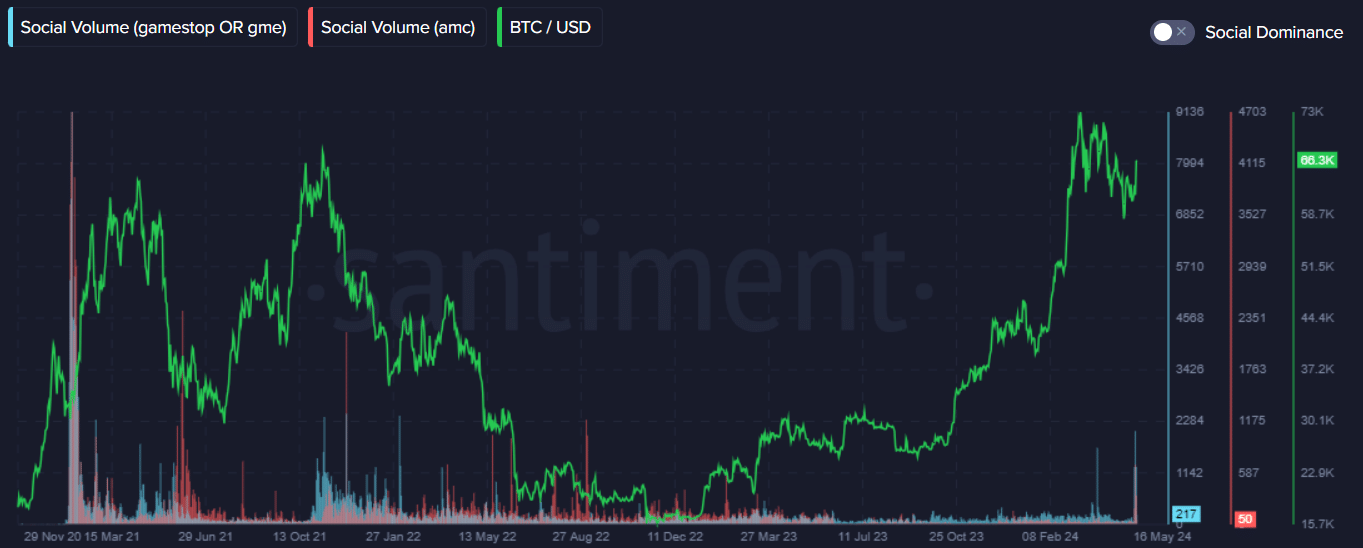

Bitcoin [BTC] climbed above its short-term native resistance at $64.5k on 15 Might, simply two days after GameStop [GME] posted a 284% rally measured from final Friday. In accordance with a latest put up on X (previously Twitter), Santiment claimed that the GME craze had the truth is bled over into crypto.

Given the speculative nature of the crypto-market, particularly within the memecoin sector, this overlap is sensible. To seek out out whether or not crowd sentiment can mark cycle tops and bottoms, AMBCrypto looked for extra parallels.

Brief-term prime and backside coincided with elevated social exercise

Supply: Santiment on X

Within the brief time period, GME/AMC social mentions did mark Bitcoin’s prime and backside over the past three days. And but, it won’t be that these social developments foreshadowed a shift in development. It’s extra possible that they merely coincided with them.

13 Might was the Monday after the weekend when Roaring Kitty marked the tip of a 3-year hibernation with a meme on X (previously Twitter). On 15 Might, the Client Worth Index and inflation knowledge got here out too, and it got here out decrease than anticipated. This led to larger risk-taking tendencies amongst contributors.

Supply: Santiment

GameStop’s social quantity was terribly excessive in January and November of 2021. In January 2021, Bitcoin costs had simply recovered from a deep retracement to $31k, earlier than resuming its blistering rally.

However, November 2021’s social quantity surge marked the highest for the crypto, and BTC costs quickly started to stoop. Therefore, though the latest correlation has an evidence, there could also be some substance to Santiment’s newest observations.

Merchants and buyers may wish to keep watch over these metrics sooner or later.

What concerning the altcoin market’s capitalization?

The January and November 2021 GME social quantity spikes coincided not simply with Bitcoin’s rally and tops, but in addition with the altcoin market’s capitalization. Nonetheless, the Might 2024 one didn’t. In reality, altcoins’ market cap has been increasing since October 2023.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

In conclusion, the connection seems to be that of a surge in GME social exercise strengthening a prevailing bullish development within the crypto-market. Nonetheless, it won’t essentially manufacture one.