- Grayscale noticed constructive BTC ETF inflows for the primary time in over 4 months.

- BTC was buying and selling above the $64,000.

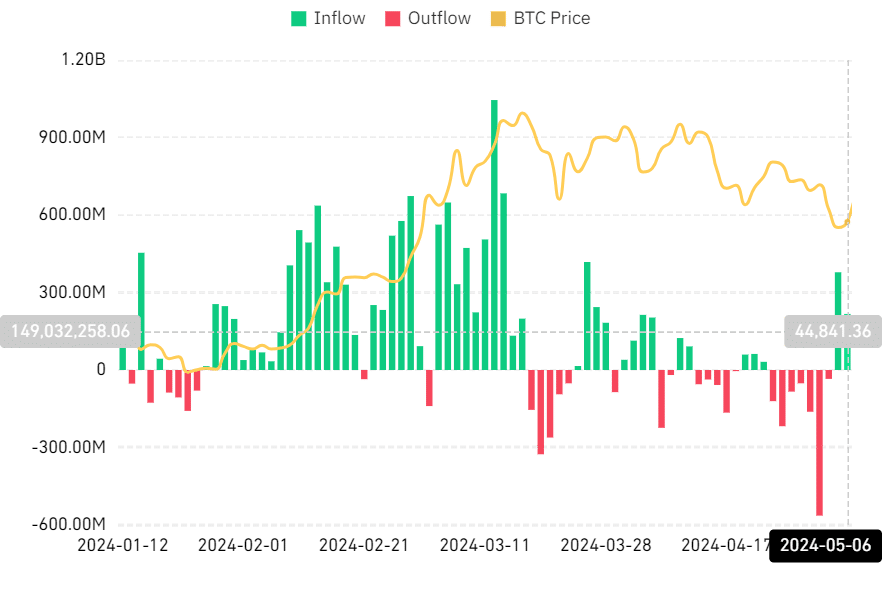

Over the previous few weeks, the spot Bitcoin ETF skilled steady outflows, reaching a peak with the most important outflow quantity recorded on the first of Might.

Equally, Grayscale, at present holding the most important Asset Below Administration (AUM) and ETF market cap, additionally witnessed outflows till lately. Might the reversal in ETF move affect the value pattern of BTC?

Bitcoin ETF sees the second day of influx

Evaluation of the Bitcoin ETF Internet Influx revealed a notable shift because it returned to constructive territory following a number of consecutive days of outflows.

AMBCrypto’s examination of the move chart indicated that the spot ETF skilled outflows from the twenty fourth of April to the 2nd of Might. It reached its peak outflow quantity on the first of Might, exceeding $563 million.

Nonetheless, on the fifth of Might, it marked a big turnaround with the primary influx in weeks, amounting to over $378 million.

This constructive pattern continued on the sixth of Might, recording a consecutive influx of $217 million. After over 4 months, Grayscale noticed its first influx throughout this era.

Grayscale information its first Bitcoin ETF influx in months

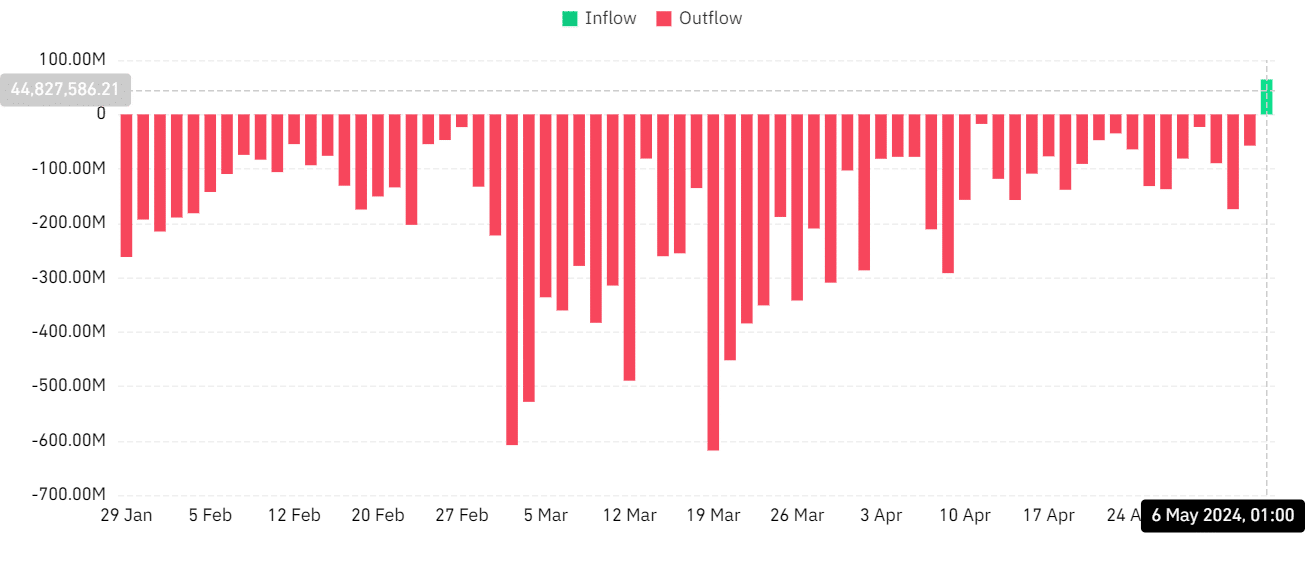

AMBCrypto’s evaluation of the Grayscale Bitcoin ETF Netflow metric on Coinglass indicated a constant pattern of outflows since January.

In keeping with knowledge from Coinglass, Grayscale boasts the most important spot BTC ETF market cap, exceeding $18 billion on the time of this writing.

Moreover, it maintains the most important Asset Below Administration (AUM), surpassing $18 billion. Given the substantial measurement of its holdings, the continuing outflows in latest months have prompted inquiries.

Nonetheless, on the sixth of Might, a big shift occurred as Grayscale skilled its first influx. The chart displayed a $64 million influx, marking the tip of the outflow streak.

Since its transition from a belief to a readily tradable ETF, GBTC has witnessed withdrawals of about $17.46 billion.

A few of these outflows could also be attributed to repayments by crypto corporations that confronted chapter in recent times.

What the ETF influx means

Inflows for a spot Bitcoin ETF signify the capital invested within the ETF by traders. These inflows enhance the AUM of the ETF and may signify heightened investor urge for food for Bitcoin publicity.

Conversely, outflows denote the funds switch out of the spot Bitcoin ETF. This happens when traders divest their shares within the ETF, resulting in a discount in its AUM.

Outflows might transpire on account of numerous components, together with traders realizing earnings, adjusting their portfolio allocations, or reacting to shifts in market dynamics.

Affect of BTC’s worth?

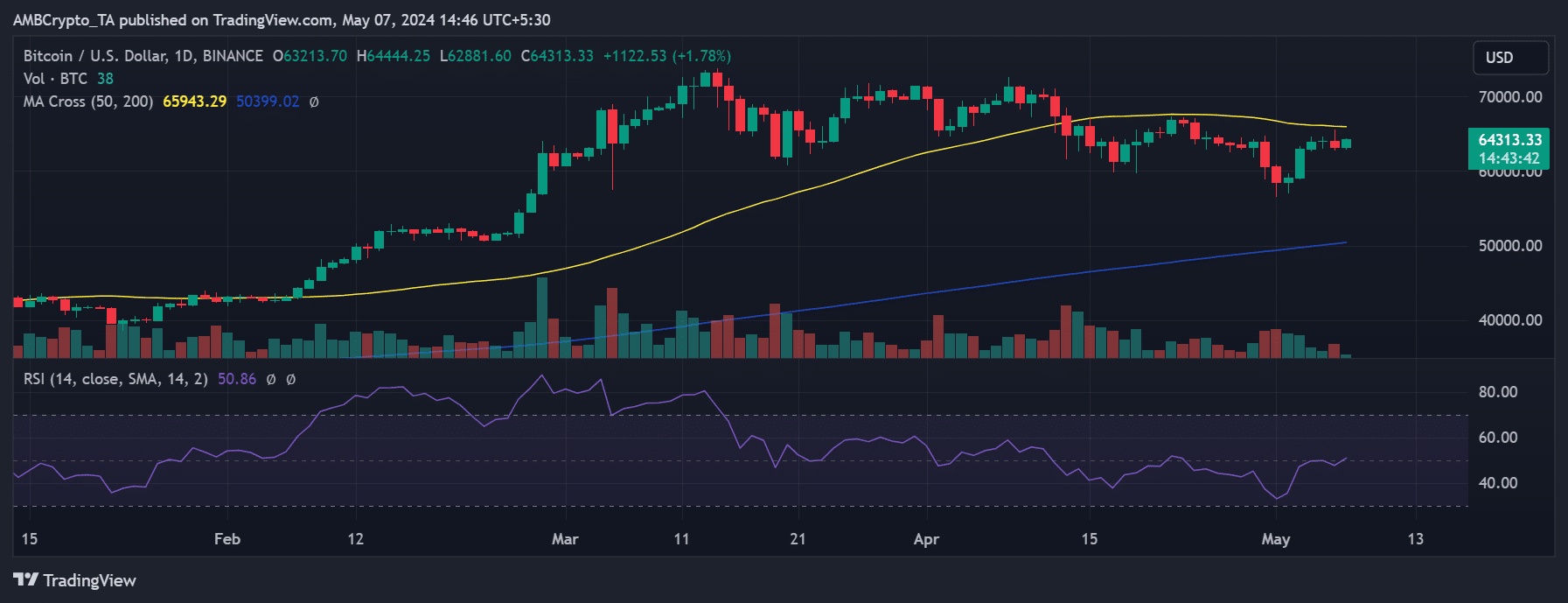

The current uptick in ETF inflows might counsel a resurgence of investor curiosity following a part of revenue realization. This renewed engagement might bolster the value of BTC within the quick time period.

Nonetheless, whereas alterations in ETF flows may affect short-term fluctuations in Bitcoin’s worth, they represent merely part of the bigger image.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Quite a few different variables exist that would exert affect on the overarching worth trajectory over the lengthy haul.

AMBCrypto’s have a look at Bitcoin’s worth pattern revealed a notable restoration from its earlier dip beneath the $60,000 mark. As of this writing, it was buying and selling at round $64,290, showcasing a rise of over 1.7%.