Market Overview: FTSE 100 Futures

FTSE 100 futures went larger final month with a Excessive 3, a wedge bull flag proper above the shifting common. Breakout mode lasted for a very long time so merchants need the market to maneuver rapidly to targets. However in a buying and selling vary the pullbacks are deep so count on extra sideways nonetheless. Robust purchase sign right here in a broad bull channel so ought to get comply with by way of. Some merchants will anticipate the pullback into the bar earlier than scaling into longs.

FTSE 100 Futures

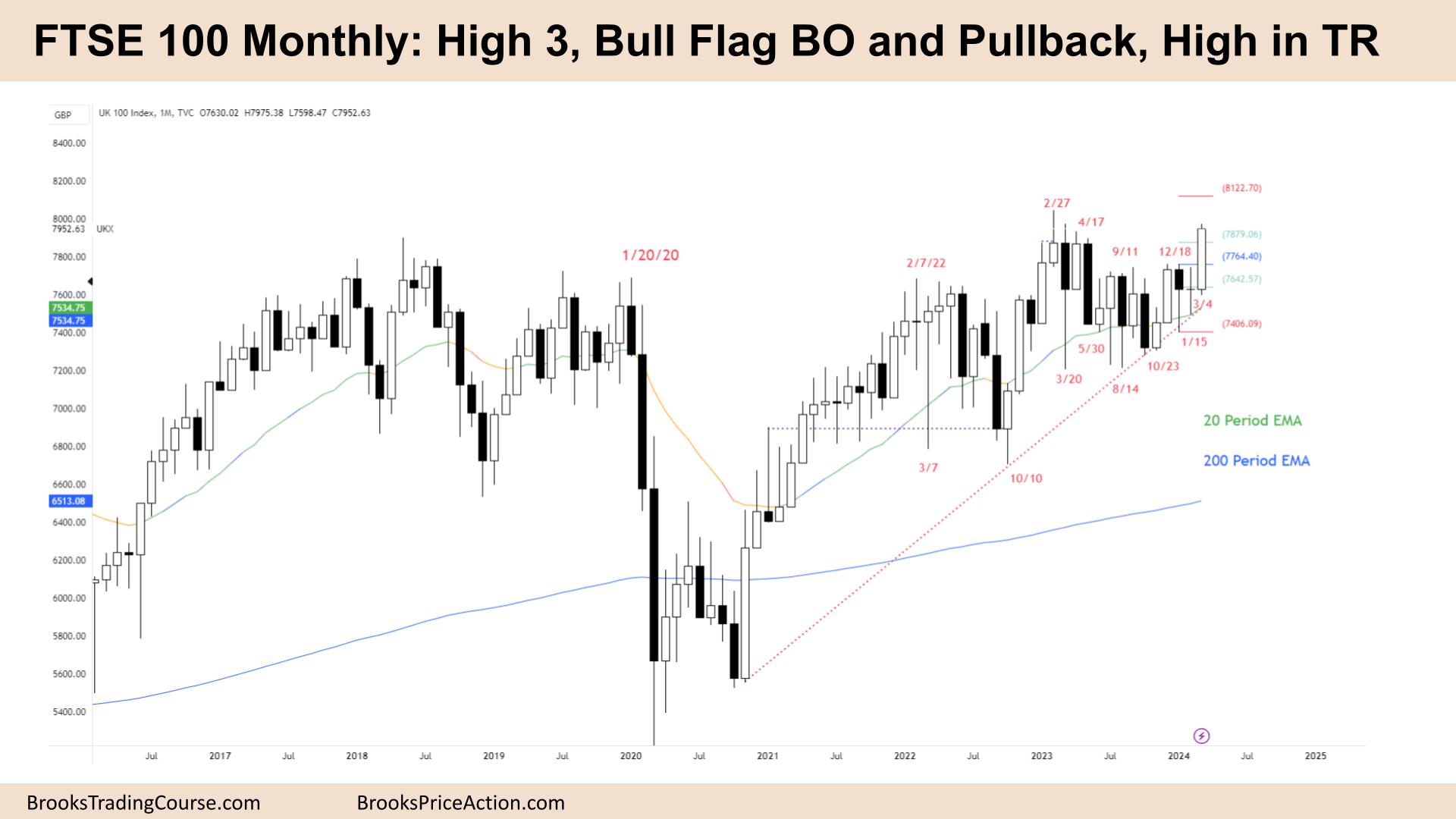

The Month-to-month FTSE chart

- The FTSE 100 futures went larger with a bull breakout and pullback from a bull flag, a Excessive 3.

- The upper time-frame bulls see two clear legs up from the COVID crash and the previous 12 months as the two legged pullback from the top of the second leg.

- This push up would make leg 3 and may flip sideways right into a buying and selling vary.

- Usually the ultimate leg in a transfer is a parabolic wedge, so a PWT right here.

- There’s a measured transfer above the prior excessive which is the place we could be heading.

- The bears see a buying and selling vary and a failed breakout above the excessive. There are a variety of sideways bars they usually retraced greater than 50% of the prior leg.

- They are going to probably promote above the highs and scale in larger.

- However now we’re above each shifting averages it’s higher to be lengthy or flag.

- Robust purchase sign proper above the shifting common in a bull development so it’s a purchase the shut and purchase above commerce.

- What’s the expectation? No two consecutive bull bars in a very long time so more likely to pullback subsequent bar.

- If we break strongly to the upside that may be extra of a shock and a second leg extra probably.

- Some bulls will anticipate a pullback into the purchase zone earlier than coming into. You are able to do this on many indicators together with the Excessive 3.

- This technique reduces danger however the price is lacking 20-30% of trades.

- March and April are usually fairly bullish.

- At all times in lengthy so count on sideways to up subsequent month.

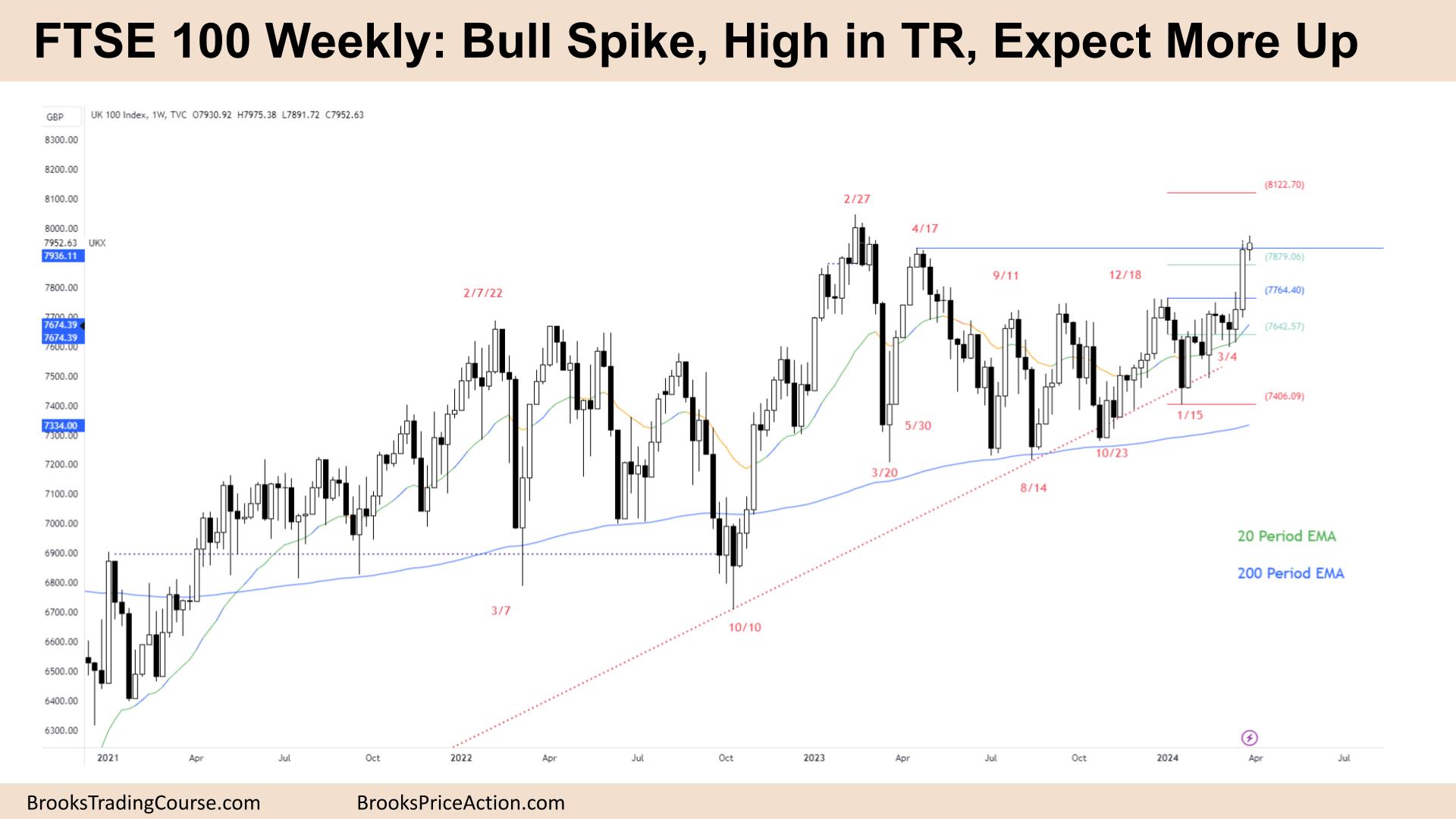

The Weekly FTSE chart

- The FTSE 100 futures went above final weeks excessive however didn’t shut above it so extra sideways.

- Bulls see a breakout and comply with by way of after an enormous bull spike. They need 2 legs up, possibly three in a spike and channel bull development.

- Bears see a purchase climax with unhealthy comply with by way of excessive in a buying and selling vary after breakout mode.

- Each time the market does one thing to make you imagine there may be readability, it’s best to assume it is going to pullback quickly.

- There should at all times be two cheap reverse trades. In any other case the market rushes again to assist or resistance.

- Very clearly at all times in lengthy right here, however how come nobody purchased final week?

- Massive bull spike so likelihood is excessive which means danger reward is unhealthy. Bears can brief up right here with a small cease and a 40% likelihood of constructing 2:1.

- Bears had 3 good bear bars and would have shorted above it. So they’re caught. Some would have exited and a few others can be scaling in. Most merchants shouldn’t do that. The losses will probably be too giant to have an affordable fairness curve.

- Bears might argue 3 legs up from January. However the final one broke strongly above the prior swing level.

- Broad bull channel on the upper time-frame so deeper pullbacks are to be anticipated. Merchants ought to commerce a smaller dimension and look to scale in decrease than they want.

- For those who look left, the pullbacks have been 60%+ so we might pullback to the breakout level.

- Though I believe we’ll keep above that now the month-to-month is a robust purchase sign.

- At all times in lengthy so it’s higher to be lengthy or flat.

- Anticipate sideways to up subsequent week.

Market evaluation reviews archive

You may entry all weekend reviews on the Market Evaluation web page.