Market Overview: FTSE 100 Futures

FTSE 100 futures went decrease final week with profit-taking excessive in a bull breakout. Again on the highs of the buying and selling vary for the final 12 months, it seems just like the bull development is gathering momentum once more for a brand new excessive. Bears argue for extra buying and selling vary, however many promote alerts failed. Pullbacks can nonetheless be deep, however higher to be lengthy or wait to purchase.

FTSE 100 Futures

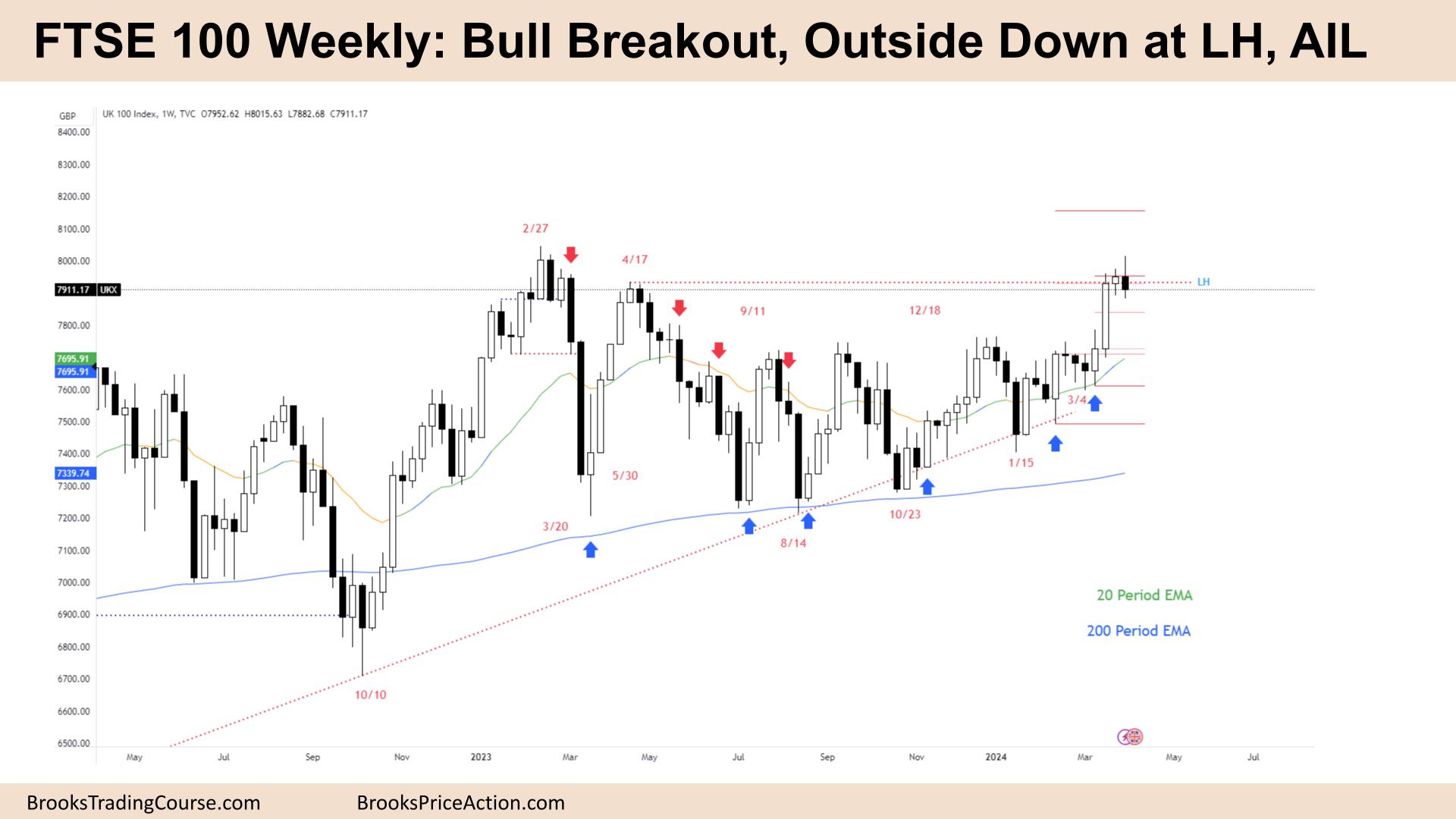

The Weekly FTSE chart

- The FTSE 100 futures went decrease final week with a bear exterior down bar closing close to its low.

- It was a four-bar bull microchannel, and final week was the primary week to go under the low of a previous bar, the place consumers have been prone to be ready.

- Bulls see a HTF bull channel, a bull Breakout of BOM and a breakout above a double prime.

- I’ve chosen a couple of measured strikes I used to commerce it, all of which acquired hit prior to now few weeks.

- We’re at all times in lengthy, so it’s higher to be lengthy or flat. There’s nothing to promote right here until you’re taking income on longs.

- We might pull again right here. Bears would love it to go to the December breakout level. That’s the final breakout hole, and gaps shut in buying and selling ranges.

- And that’s what the bears see – a buying and selling vary.

- For the bears, it’s an try at a double prime at a previous decrease excessive, a swing excessive. They may argue that just one shut above it’s vital.

- Take a look at the final 20 bars. What number of good promote alerts are there? Perhaps 3 or 4? So, there’s an 80% probability this week can be not a promote sign.

- Bulls will seemingly be by the midpoint of that massive bull bar from a couple of weeks in the past. So even when we pull again for a couple of bars, we are going to seemingly go greater.

- Did the depend restart? I believe seemingly. The shifting common slopes up sooner now, and the area between the value and the MA is bigger. So the momentum is more and more bullish.

- Bulls can count on deep pullbacks however depend on your cease.

- I believe some bears acquired caught above the three bear bars. However most merchants ought to have exited when the Excessive 2 and Excessive 3 arrange.

- Merchants ought to have guidelines for exiting trades, and the excessive chance reverse sign bars are a really dependable cause to get out!

- Count on sideways to up subsequent week.

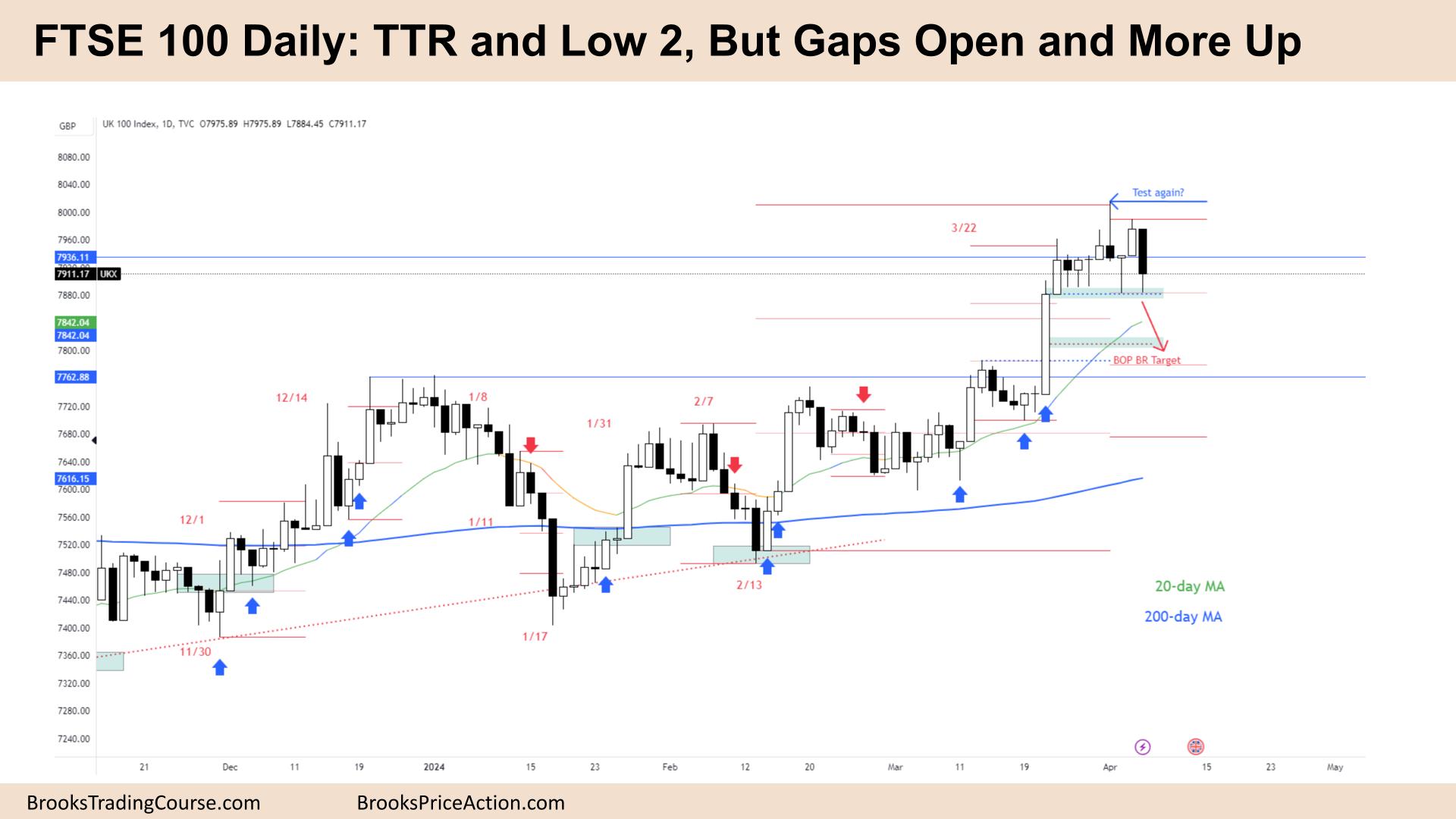

The Every day FTSE chart

- The FTSE 100 futures went decrease on Friday with a giant bear bar with a tail under it.

- It was the bottom shut all week, so we are going to see if there may be extra promoting on Monday.

- The bulls see a robust bull breakout bar with follow-through, so count on a second leg up.

- The pullback instantly after left a spot, displaying simply what number of purchase orders have been sitting there. They weren’t crammed till Wednesday.

- For the bulls, its a Excessive 1 scalp and now they’re most likely ready on a greater sign bar for a Excessive 2. They need it nearer to the shifting common.

- Huge tails up and massive tails down so a buying and selling vary. After such a robust breakout, it’s extra seemingly a continuation sample greater.

- However bears need this to remain right here lengthy sufficient to disappoint the bulls.

- Bears see a DT on the weekly chart, however no bears need to promote so low in a bull breakout. They see the next low and need a breakout under right down to the MA and to shut the breakout hole.

- I believe merchants needs to be lengthy or flat right here. It’s higher to keep away from the brief trades in case you get trapped out of the upper chance lengthy.

- Now now we have been in a buying and selling vary for a very long time they usually have a magnetic impact, bringin contemporary new breakouts again into its zone.

- So bulls must preserve that hole open, however odds are nonetheless on a broad channel, the place consumers watch for the deepest pullback to purchase. Usually this traps newcomers as they see it go at all times in brief.

- Count on sideways to up subsequent week.

Market evaluation reviews archive

You’ll be able to entry all weekend reviews on the Market Evaluation web page.