- Bitcoin’s worth now has a powerful correlation to macro occasions, together with Fed price choices

- Analysts count on a spread breakout, however they disagree on when it’d occur

Bitcoin [BTC] rallied by 7.5% to faucet $66,000 on the worth charts following the discharge of lower-than-expected key U.S inflation knowledge. The optimistic response to cooler inflation knowledge is a part of Bitcoin’s broader motion following main macro occasions, together with Fed price expectations.

Rob Hadick, Basic Companion on the crypto-venture agency Dragonfly, just lately commented on the identical, referring to Bitcoin as a ‘macro’ asset. In response to the exec,

“I think Bitcoin is a macro asset, it seems to trading in line with how much liquidity is in the market.”

He went on so as to add that the market will react to something that impacts liquidity, together with quantitative easing, discount in steadiness balances, or Fed price choices.

Will ‘better’ macro circumstances assist Bitcoin in 2024?

In response to CoinShares’ knowledge, the stronger correlation between BTC and macro occasions, particularly Fed price choices, intensified just lately after flows into new U.S spot BTC ETFs dried up.

Most market watchers famous that total liquidity was sluggish, which defined BTC’s muted worth motion over the previous couple of weeks. In truth, one of many watchers, crypto-analyst Jamie Coutts, claimed that whereas world liquidity was on an uptrend, momentum has been flat.

One other market watcher and Bitcoin analyst, Willy Woo, confirmed the ‘sluggish’ liquidity tempo however projected a breakout in October 2024.

“Global liquidity forming a bullish ascending triangle. Expected breakout before Oct 2024. #Bitcoin 2025 will be one for the record books.”

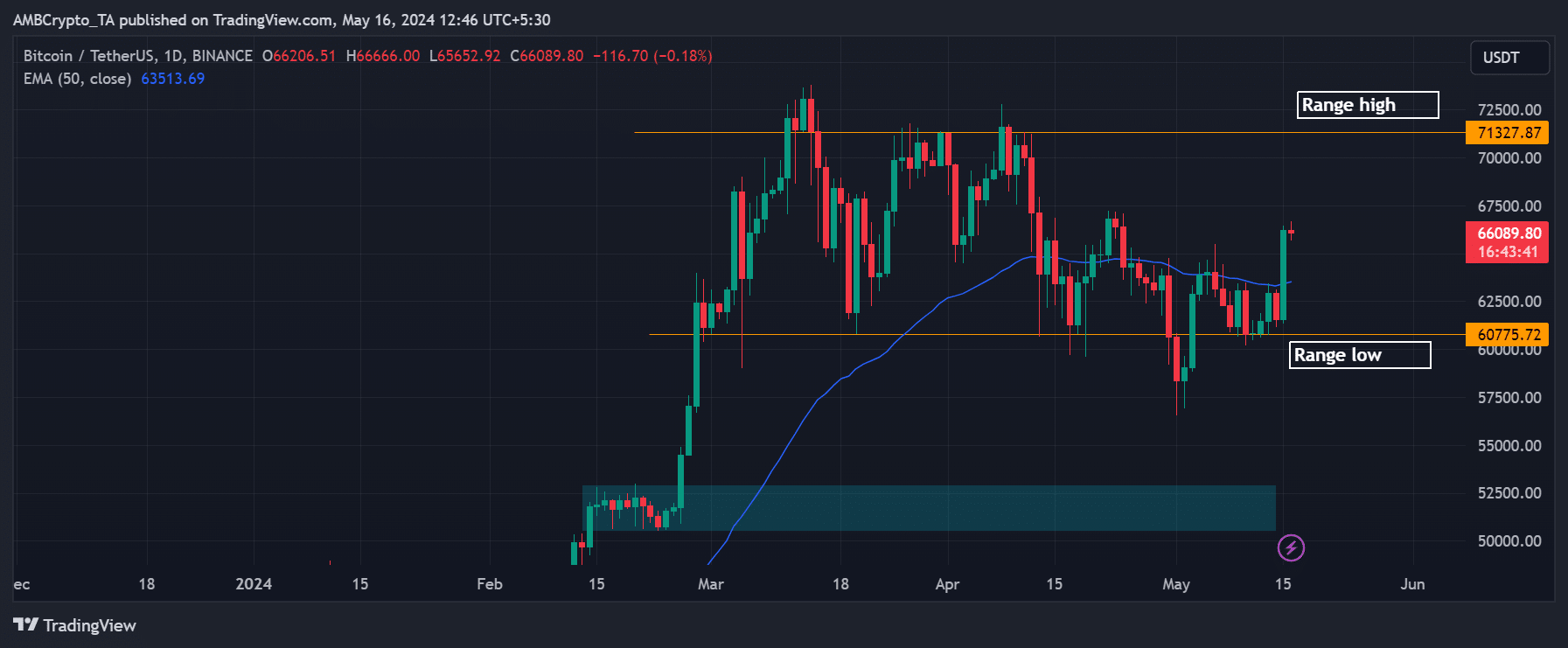

Primarily based on the aforementioned world liquidity projections, BTC might prolong its ongoing consolidation ($60K—$72K) till early This fall 2024. The timeline of the above forecast is barely totally different from Mike Novogratz’s predictions.

Mike Novogratz, Founding father of Galaxy Digital, projected a potential vary breakout by the tip of Q2.

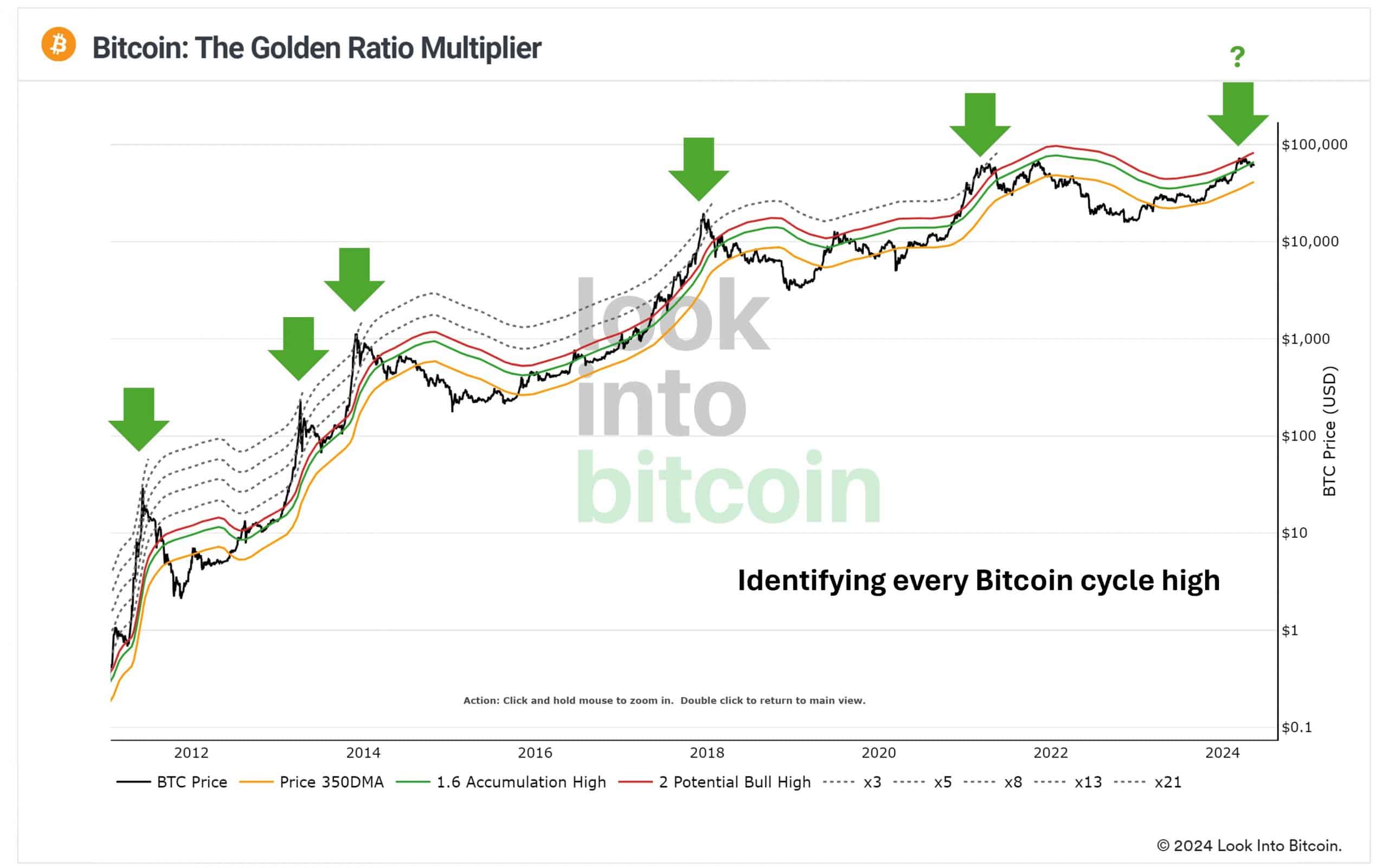

He’s not the one one both. Philip Swift, founding father of the evaluation platform Look Into Bitcoin, talked about that primarily based on the Golden Ratio Multiplier, BTC might explode twice or thrice its present worth.

“The GR Multiplier did a great job in Bitcoin’s adoption phase. We’re now entering a new phase (supercycle?! kek)”

The GR multiplier gauges quick and long-term worth projections primarily based on Bitcoin’s adoption curve and market cycles.

Though it precisely predicted earlier market cycle tops, Swift believes that the present GR Multiplier ‘top’ suggests BTC’s adoption part is coming to an finish.

“Bitcoin is coming to the end of its Adoption growth phase and entering a more mature phase, integrated into global markets. See recent Bitcoin ETF’s as evidence.”

Ergo, analysts count on BTC to interrupt from the vary and surge additional, however have totally different timelines for the breakout.

Within the quick time period, BTC might eye the range-high at $71k after flipping the decrease and better timeframe market buildings to bullish.