They’re promoting choices to merchants on the lookout for massive wins, and when these choices expire nugatory, the vendor of the choice will get to maintain the premium he collected.

Many merchants use these spreads to commerce range-bound markets, the place there’s a sustained technical vary with well-defined help and resistance ranges. These are successful trades ought to the market stay inside the outlined vary by the lifetime of the commerce.

Whereas Iron Condors and Iron Butterflies each benefit from the identical market dynamics, there are conditions the place it is smart to make use of one over the opposite.

Promoting Choices: Shorting Volatility

Each Iron Condors and Iron Butterflies are non-directional, restricted threat possibility spreads. As a substitute of attempting to revenue by being bullish or bearish, these possibility spreads are instruments to generate income from choices you suppose will expire nugatory.

In the event you had the prospect to have a look at the choices market throughout the GameStop insanity in 2021, you witnessed insane possibility costs. So many merchants needed to guess towards the inventory however did not need to get destroyed in a brief squeeze, so that they most popular to purchase places. This made put choices insanely costly to the purpose the place you may be proper on the commerce and nonetheless lose cash.

Consequently, promoting places was a prevalent technique to benefit from overpriced choices. These conditions happen on daily basis to various levels.

Once you brief an possibility, you are promoting it to a different purchaser. For instance, for instance you promote a name with a strike worth of $20 on a $15 inventory for $1. The inventory remains to be at $15 at expiration, and the choice expires nugatory. You get to maintain the complete $1.

It is well-known that the majority choices expire nugatory, so this can be a compelling commerce to many merchants. Nonetheless, the draw back is your limitless threat when shorting choices. Suppose the inventory within the instance above was $30 at expiration. The choice is now value $15, and also you’re $14 within the gap.

Because of this, many merchants use spreads like Iron Condors and Iron Butterflies to cap their draw back. These spreads contain shorting choices however shopping for additional OTM choices to restrict threat.

What’s an Iron Condor?

In the event you’re accustomed to different choices spreads, an iron condor combines a brief vertical name unfold and a brief vertical put unfold. Put one other means, it is a brief strangle the place you purchase “wings” (OTM choices) to cap your draw back.

In the event you’re unfamiliar with the dictionary filled with the lingo we choices merchants use, an Iron Condor entails shorting an out-of-the-money (OTM) put and name and shopping for an additional OTM put and name.

These additional OTM choices we purchase are used to cap our draw back. As a result of shorting choices comes with a limiteless draw back, the Iron Condor has the advantages of shorting choices with the additional advantage of limiting our draw back.

An iron condor is an possibility unfold that entails utilizing choices to revenue from a inventory staying inside a sure worth vary. Put merely, the iron condor permits merchants to make income even when a inventory doesn’t transfer in any respect.

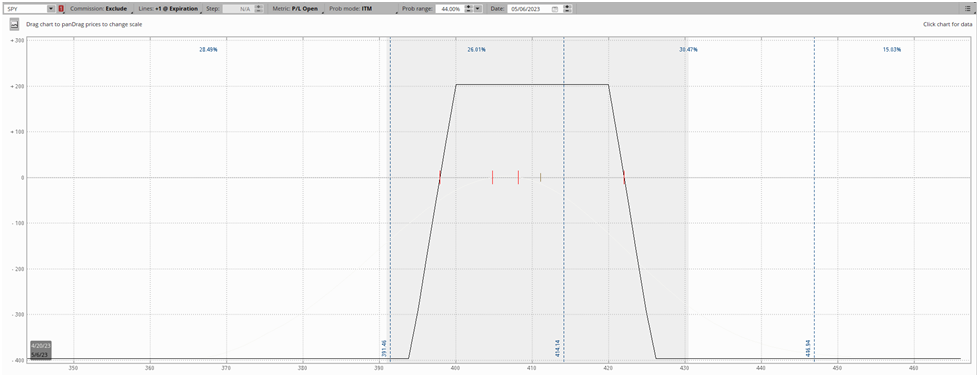

The iron condor consists of 4 choices, a protracted put and name, and a brief put and name. Right here’s an instance of an iron condor unfold:

- BUY (1) 394 PUT

- SELL (1) 400 PUT

- SELL (1) 420 CALL

-

BUY (1) 426 CALL

As you may see, you’re promoting an inside choices unfold, and defending the limitless loss by shopping for low cost out-of-the-money (OTM) “wings” that backstop the losses in case your commerce thought is improper.

Right here’s what the payoff diagram for this commerce seems like:

The objective of this selection unfold is for the underlying inventory worth to stay inside the vary you outline together with your brief strikes. As a result of we’re promoting a $400 strike put and $420 strike name, we would like the inventory to commerce inside that worth vary. Ought to it stay inside this vary, we make our most revenue at expiration as a result of the choices expire nugatory.

Nonetheless, as you may see, our lengthy OTM choices cap our draw back, mitigating the largest threat of promoting choices: the limitless losses. In fact, as a result of there’s no free lunch, this prices us cash as a result of we have now to purchase choices that we hope finally expire nugatory.

Traits of the Iron Condor

The Iron Condor is Market Impartial

The iron condor is market impartial, that means it doesn’t take a directional worth view, and as a substitute income from the shortage of directional worth motion. Merchants typically confer with this attribute as “short volatility” since you’re betting that the inventory worth will transfer lower than the choices market is pricing in.

You’d use an iron condor if you count on the underlying inventory to remain inside a decent buying and selling vary and never bounce round loads.

The Iron Condor is a Theta Decay Technique

As a result of iron condors acquire a web credit score and are therefore web brief choices, it’s a constructive theta technique, that means it advantages from the passage of time.

Iron Condor Payoff and P&L Traits

Iron condors have restricted most revenue potential in addition to a restricted most loss.

The utmost revenue is equal to the web credit score collected from initiating the commerce. You may simply calculate this by subtracting the price of your lengthy OTM wings out of your brief choices.

Let’s use our earlier instance:

- BUY (1) 394 PUT @ 2.28

- SELL (1) 400 PUT @ 3.20

- SELL (1) 420 CALL @ 3.45

- BUY (1) 426 CALL @ 1.47

First, let’s sum the costs of our brief choices.

Our 400 put prices $3.20 and our $420 name prices $3.45, that means we acquire $6.65 for promoting these two choices.

Then, we merely add collectively the worth of our lengthy choices, giving us a debit outlay of $1.47 + $2.28 = $3.75.

Now we simply subtract the debit from our credit score to seek out our web credit score, $6.65 – $3.75 = $2.90. Our most revenue is $2.90

The utmost lack of an iron condor is just the “wing width” minus the web credit score obtained. Wing width refers back to the distance between the strike costs two calls or two places. On this case, we’d simply subtract the 426 name from the 420 name, giving us a wing width for $6. Now we simply subtract our web credit score of $2.90 giving us a max lack of $3.10.

Iron Condor Professionals and Cons

Professional: Low Capital Necessities

As a result of the iron condor is a restricted threat technique, you may execute it with considerably much less margin than promoting the equal brief strangle (which is identical commerce, besides with out the lengthy OTM choices capping your losses). This makes it a very fashionable means for undercapitalized merchants to reap premium.

Professional: Construction Trades With Excessive Chance of Revenue and No Big Draw back

Many possibility merchants method the market with a systematically short-volatility positioning. They’re continually promoting choices and rolling them out additional if the commerce goes towards them. It is a technique that may print cash for a very long time till you’re on the improper facet of a volatility occasion. Many merchants, like James Cordier of OptionSellers.com have blown up consequently.

Because of this, some merchants take an analogous method utilizing iron condors, avoiding catastrophic losses. Nonetheless, this technique has important drawbacks as you’re harvesting considerably much less premium since you’re shopping for the OTM choices and decreasing your web credit score.

Con: Excessive Fee Prices

The iron condor requires 4 choices per unfold, making it twice as costly to commerce in comparison with most two-option spreads like straddles, strangles, and vertical spreads. In contrast to the inventory market, the place commissions are zero throughout all retail brokers, possibility commissions nonetheless go away a dent in your P&L, with the usual introductory fee being $0.60/contract, which you must pay to each open and shut, bringing it to $1.20 per contract.

So even for a one-lot, you’re paying $4.80 to open and shut an iron condor, which is usually structured with a low most revenue, that means that your commissions is usually a hefty share of your P&L when buying and selling iron condors.

Con: Much less Liquidity

The mix of requiring simultaneous execution of 4 completely different possibility contacts often means it takes longer to get stuffed on these trades, making energetic buying and selling tougher.

What’s an Iron Butterfly?

The Iron Butterfly is like an Iron Rental with a better reward/threat ratio however a decrease chance of revenue.

The first distinction is the brief strikes. In selecting your strikes in an Iron Condor or Iron Butterfly commerce, you’re defining the vary you count on the underlying to stay inside.

Iron Condors are extra forgiving, as that vary is far wider. Iron Butterflies, then again, brief places and calls on the identical strike, making your outlined vary narrower and making it much less doubtless that you will revenue on the commerce. You’ll, nevertheless earn more money in the event you’re proper on the commerce.

Iron butterflies and iron condors are sisters. They specific very related market views and are structured equally. The first distinction in apply is that the iron butterfly is a much more exact technique. It’s more durable to be proper, however in case you are proper, you make way more cash.

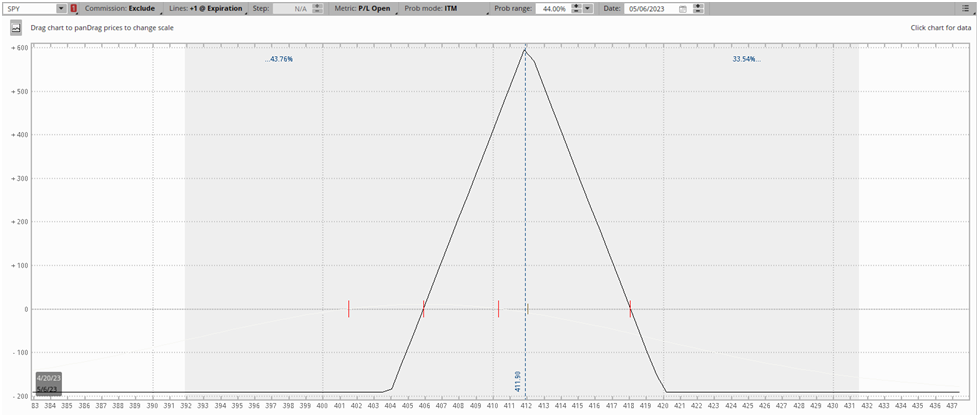

The iron butterfly consists of 4 choices: two lengthy choices and two brief choices on the identical strike. Right here’s an instance:

- BUY (1) 404 Put

- SELL (1) 412 put

- SELL (1) 412 name

- BUY (1) 420 name

And right here’s what the payoff diagram for this commerce seems like:

As you may see, the character of the commerce is kind of just like the iron condor apart from the truth that it has a extra slim alternative to make revenue. Nonetheless, when the commerce is in-the-money, the income are a lot increased.

So whereas most iron condors have comparatively low reward/threat ratios and excessive win charges, iron butterflies are the other. They’ve a decrease probability of success with a a lot increased reward/threat ratio.

On this means, you may have the identical view (the market will keep inside a comparatively tight vary) and construction dramatically completely different trades round it. The iron condor will in all probability work out and web you a small revenue, whereas the iron butterfly is a extra assured method providing you with the prospect for fatter income.

Like every little thing in choices buying and selling, it’s all about tradeoffs.

Traits of the Iron Butterfly

The Iron Butterfly is Market Impartial

Similar to the iron condor, brief strangle, and brief straddle, the iron butterfly has no directional worth bias. It doesn’t care which path the underlying inventory strikes. As a substitute, the iron butterfly is worried with the magnitude of the worth transfer. It income when the underlying inventory stays inside a slim vary and doesn’t make any important worth strikes.

Because of the iron butterfly utilizing only one brief strike, the underlying inventory should keep in a way more slim vary than with the iron condor. Whereas the iron condor has the liberty to outline a variety utilizing a brief put and name, the iron butterfly is brief just one strike, resulting in the cone-shaped payoff diagram.

Because of this, the utmost revenue is far increased with the caveat that the chance of reaching the utmost revenue is much decrease than that of the iron condor.

On this means, the iron butterfly allows you to specific a market-neutral and short-volatility market outlook with a excessive reward/threat ratio that may often be a trait of a web debit technique.

The Iron Butterfly is a Theta Decay Technique

The objective of the iron butterfly technique is for the brief choice to expire nugatory, or at the least with much less worth than you initially bought it for.

As with every brief choices technique, a lot of the revenue comes from the inventory worth not shifting, ensuing within the possibility quickly shedding time worth because of theta decay.

Iron condors capitalize on the identical phenomenon however with a special commerce construction.

The Iron Butterfly Has Restricted Revenue and Threat Potential

The max revenue and loss math for the iron butterfly is kind of just like that of the iron butterfly.

The max revenue is the web credit score obtained when opening the place

The max loss math works equally to easily shorting a name or put. The additional away the inventory is from the strike worth, the extra the losses construct till your lengthy possibility hedges kick in and cap the losses.

Iron Butterfly Professionals and Cons

Professional: Quick Volatility With Excessive Reward/Threat Ratio

On the whole, market-neutral methods that capitalize on theta decay are likely to have poor reward/threat ratios, solely making up for this disadvantage with a excessive win fee. The iron butterfly turns this on its head and as a substitute has a a lot decrease win fee than conventional short-volatility methods with a better reward/threat ratio, providing you with the potential for uneven income.

Professional: Promoting Choices With Restricted Threat

For a lot of merchants who lean in the direction of promoting premium, the potential for limitless, catastrophic losses retains them up at night time. Regardless of the low chance of an excessive worth transfer, black swans appear to creep up greater than anybody expects.

The iron butterfly permits merchants to imitate the payoff construction of merely promoting a put or name whereas capping losses with lengthy choices on both facet of their brief possibility strike.

Con: Slender Vary of Profitability

An iron butterfly has a slim vary of profitability in comparison with the iron condor as a result of there is just one brief strike. This implies there’s a far larger margin of error for strike choice, whereas the iron condor permits you to select two strikes and outline as broad of a variety as you’d like.

Abstract

Iron Condors are made up of each a brief vertical unfold and a brief vertical put unfold.

:max_bytes(150000):strip_icc()/IronCondor2-16a0be248c6949438b44ad617011a0f5.png)

Iron Butterflies are made up of two brief choices on the identical strike and two lengthy “wings” that shield your draw back.

:max_bytes(150000):strip_icc()/dotdash_Final_Iron_Butterfly_Jan_2020-01-ee7129aab2dc4dfcbf8ab95f6d600e4a.jpg)

Keep in mind that possibility spreads are commerce constructions, not commerce methods. There isn’t any inherent edge in buying and selling Iron Condors or Iron Butterflies. They’re simply instruments to use to market dynamics the place its extra doubtless for markets to remain range-bound.

Associated articles