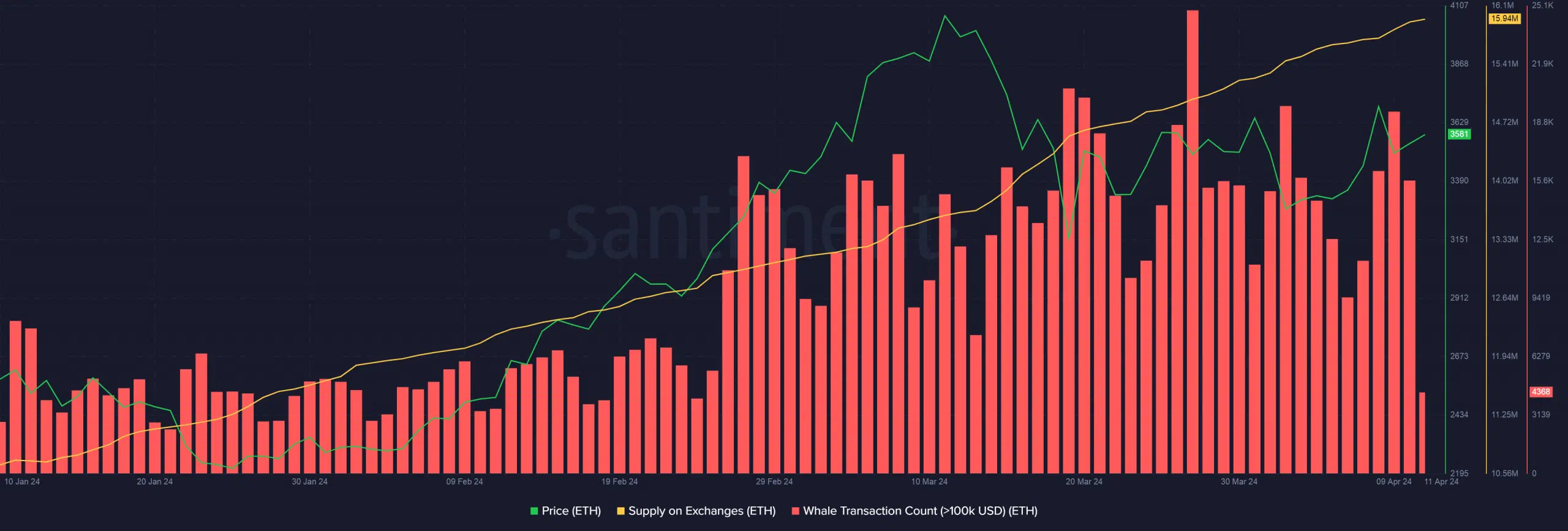

- Whale transactions have spiked since ETH hit $4k final month.

- ETH provide on exchanges additionally elevated sharply.

An influential Ethereum [ETH] whale was seen transferring a large chunk of their holdings to cryptocurrency alternate Binance just lately.

ETH whale turns into richer

In accordance with on-chain knowledge tracker Spot on Chain, the rich investor deposited a whopping 900 ETH cash, price greater than $32 million at prevailing costs, on the eleventh of April. This was the most important quantity the whale had ever deposited on an alternate.

Extra particulars confirmed the investor nonetheless in possession of greater than $100 million price of Ether, promoting which might earn them income of $68.5 million.

Nevertheless, profit-taking on ETH wasn’t simply restricted to this one single entity.

A broader market pattern?

ETH transactions price greater than $100,000, a proxy for whale transactions, have remained on the upper facet within the final month, AMBCrypto seen utilizing Santiment’s knowledge.

Moreover, ETH reserves on exchanges swelled as much as practically 16 million as of this writing, up from 13.62 million a month in the past.

Analyzing the aforementioned indicators, it grew to become clear {that a} whales on a bigger scale had been depositing ETH for income.

Notably, whale exercise spiked since ETH broke previous $4,000, its first since December 2021. Helped by the surge, the portion of ETH’s complete provide in revenue had jumped previous 96%. This might have inspired traders to dump their baggage.

The market appeared to have reached the availability distribution part, the place every worth improve was adopted by heavy profit-taking.

Take as an illustration, ETH’s rise to $3,700 earlier this week, which helped carry the whole provide in revenue to 92% from 86%. The correction in ETH’s worth thereafter implied that traders had been locking income instantly.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Extra downsides to comply with?

As of this writing, the second-largest digital asset was buying and selling at $3,610, up 2.53% within the final 24 hours. The market sentiment was one in all excessive greed, elevating issues a few additional drop in ETH’s worth.