- Bitcoin’s post-halving hours noticed a 2.31% dip, however ETF inflows surged and boosted investor confidence

- Potential enlargement of crypto-ETFs past Bitcoin and Ethereum may drive mainstream adoption

Seems to be like Bitcoin’s [BTC] halving introduced its personal share of surprises! After all of the hype surrounding Bitcoin’s halving, BTC hit a bump on the street, falling by 2.31% in simply 24 hours. This, regardless of the Bitcoin ETF market noting such a big change. After 5 days of outflows, there was a sudden inflow of constructive web inflows proper earlier than the day of the halving.

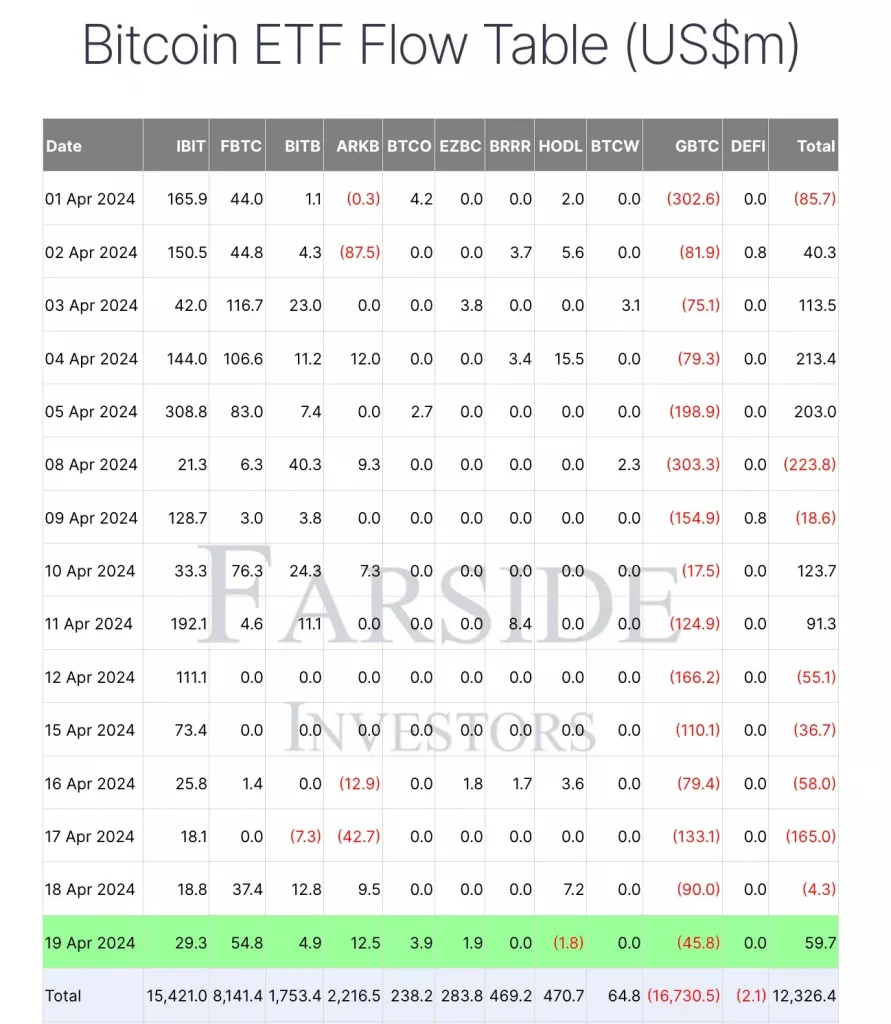

In truth, in line with Farside Buyers’ knowledge, 5 out of 10 ETFs recorded constructive inflows totaling $59.7 million.

This underlined the rising confidence in Bitcoin’s pre-halving and post-halving efficiency amongst traders within the ETF area.

Growth of ETFs resulting in crypto-mainstream adoption

Discussing the potential enlargement of the crypto-ETF area past Bitcoin and Ethereum [ETH], Sergey Nazarov, Co-founder of Chainlink, in a latest interview claimed,

“I think what’s next is more ETFs about coins other than Bitcoin and Ethereum. So, I think the ETF dynamic is going to continue during this year and just grow and grow and grow.”

His feedback highlighted the potential for ETFs to drive broader adoption of digital property and advance the mainstream integration of Web3 applied sciences.

Right here, it’s price noting that in a separate interview, Anthony Scaramucci, Founding father of SkyBridge Capital, additionally chipped in on the topic.

“Bitcoin is on an adoption curve.”

He added,

“You won’t see this inflation hedge, or a store of value as other pundits are saying until you get over a billion users. So, right now it’s gonna be way more volatile than the people like.”

All eyes on Spot Ethereum ETFs

On the again of Hong Kong’s latest approval of Bitcoin and Ethereum ETFs, constructive steps are being taken in the direction of mainstream adoption. Nevertheless, whereas U.S-based ETFs have collected almost $60 billion in property since their launch, Hong Kong’s new ETFs’ success projections fluctuate.

Echoing related sentiments, senior Bloomberg ETF analyst Eric Balchunas lately commented,

“Other countries adding BTC ETFs is no doubt additive, but it’s nickel-dime compared to the mighty U.S market.”

All this leads us to a query – Will the SEC reject the spot Ethereum ETF functions?

In response to the aforementioned query, Hashkey Capital’s Head of Analysis Jupiter Zheng, responded,

“If the ETF is denied, it will not be that bearish, as the market is not pricing in it yet. And, we still have Bitcoin ETFs as the entrance for traditional funds.”

What dictates entry into the crypto-market although? Effectively, in line with Nazarov, adoption does.

In accordance with the exec, to deal with considerations about mainstream adoption, the crypto-industry should deal with enhancing usability, scalability, connectivity, and privateness. Enhancements in these areas wouldn’t solely appeal to broader adoption, but in addition drive the {industry} ahead by pushing its boundaries, he concluded.