Since Ethereum moved from proof-of-work to proof-of-stake in 2022, it has develop into a deflationary asset. The entire circulating provide of Ethereum (ETH) at the moment stands at 120,105,358 ETH, representing a 415,680 ETH lower from the provision ranges noticed earlier than The Merge.

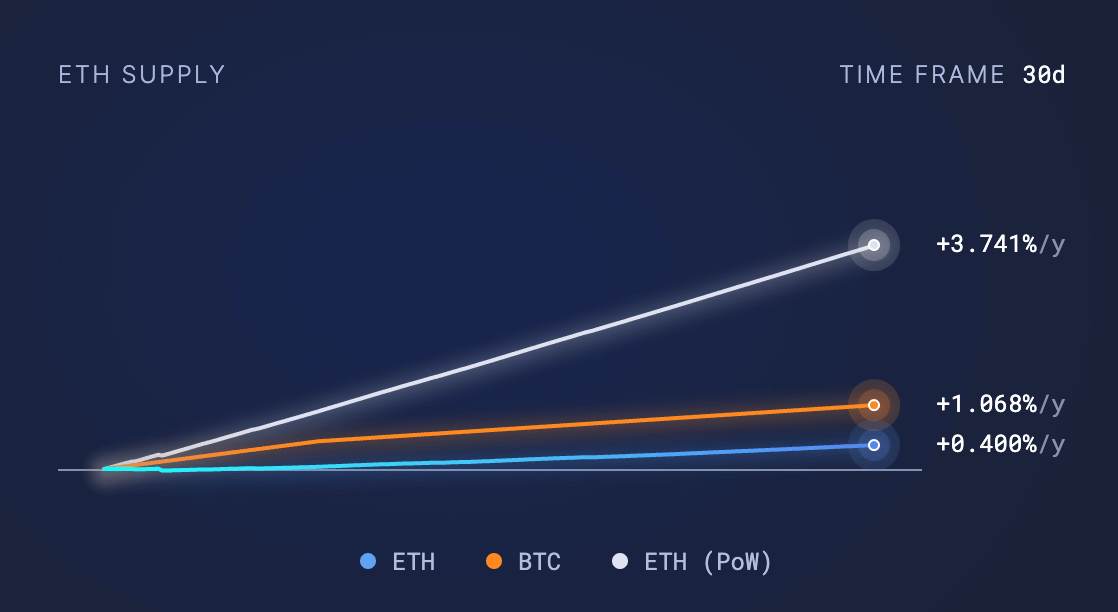

Nonetheless, over the previous 30 days, Ethereum’s provide dynamics have shifted, with 35,548.72 ETH being burned (faraway from circulation) and 75,072.43 ETH being issued as block rewards to validators. The web result’s a provide enhance of 39,523.71 ETH throughout this era. Knowledge from Ultrasound Cash present that, primarily based on the provision change over the previous 30 days, Ethereum’s present annualized inflation price is roughly 0.4%.

As compared, Bitcoin’s inflation price stands at 1.068%, whereas Ethereum’s Proof-of-Work (pre-merge) inflation price would have been considerably greater at 3.74%. If the present 30-day price persists, projections for the subsequent 12 months point out that round 433,000 ETH will probably be burned, and 914,000 ETH will probably be issued, making a web achieve of 481,000 ETH.

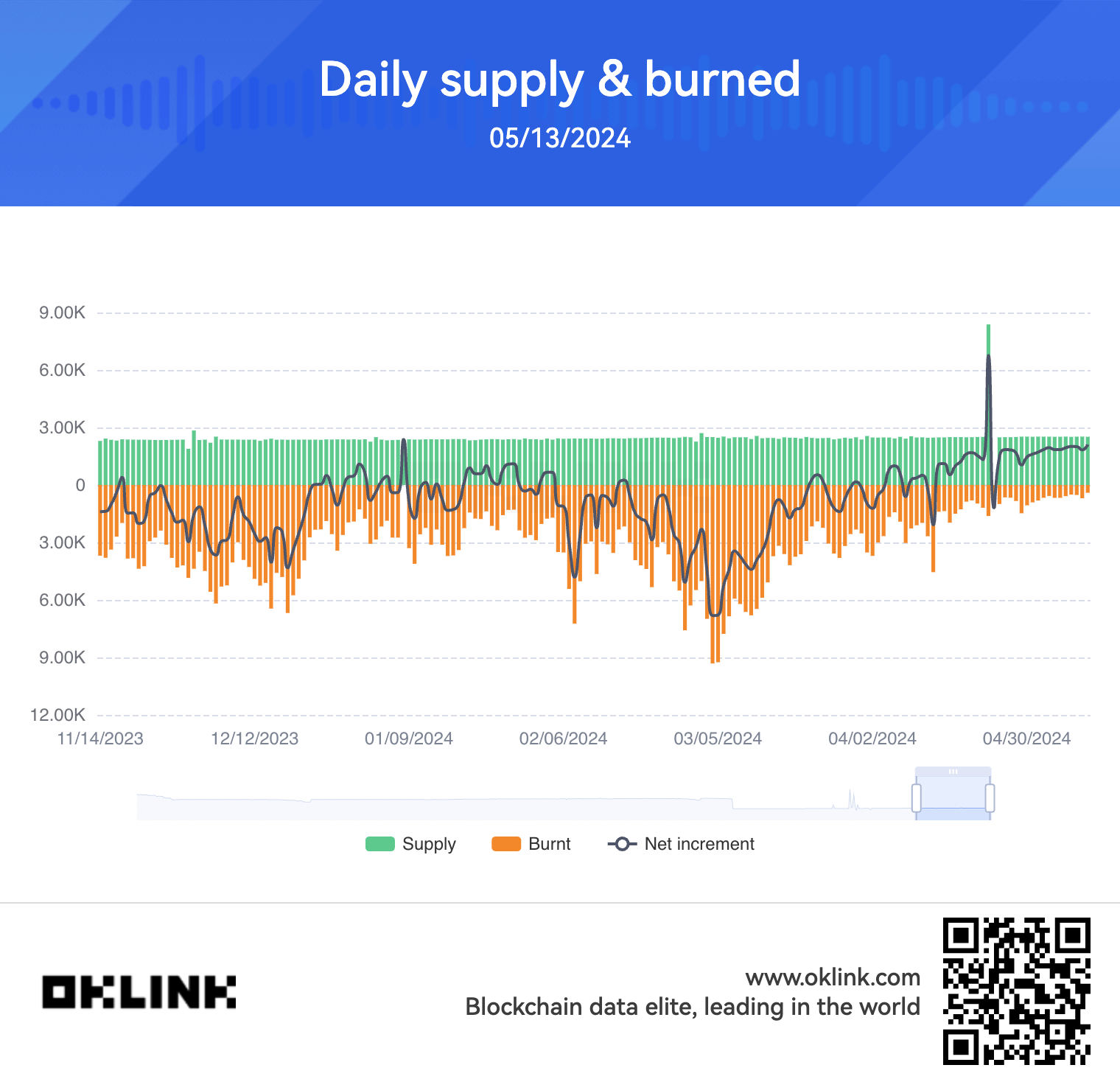

Knowledge from OKLink reveals a continued lower in ETH burned since March, when a mean of round 6,000 ETH was burned each day. Because the begin of Could, solely round 900 ETH has been burned each day, the bottom common ranges since The Merge.

The current Dencun improve on the Ethereum community has had a notable influence on the ecosystem. The improve has led to a lower in layer-2 transaction charges and general community exercise. Consequently, this has seemingly resulted in a decrease burn price, pushing Ethereum’s provide again into an inflationary state.

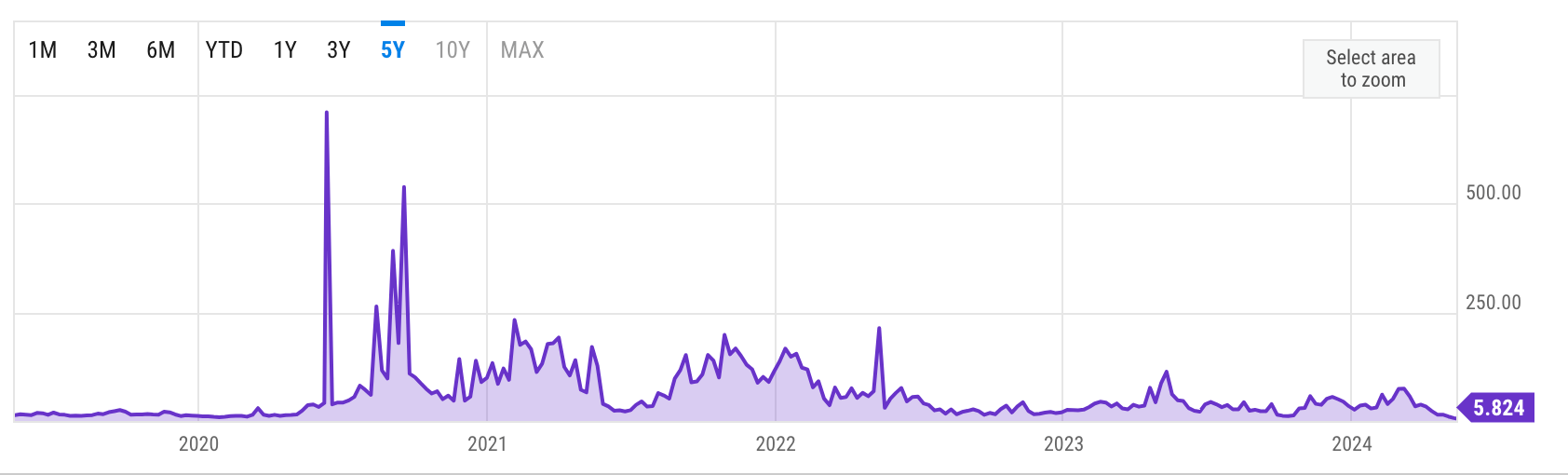

Knowledge from Etherscan and Ycharts reveals that gasoline charges have additionally plummeted to round 5 gwei, the lowest on file.

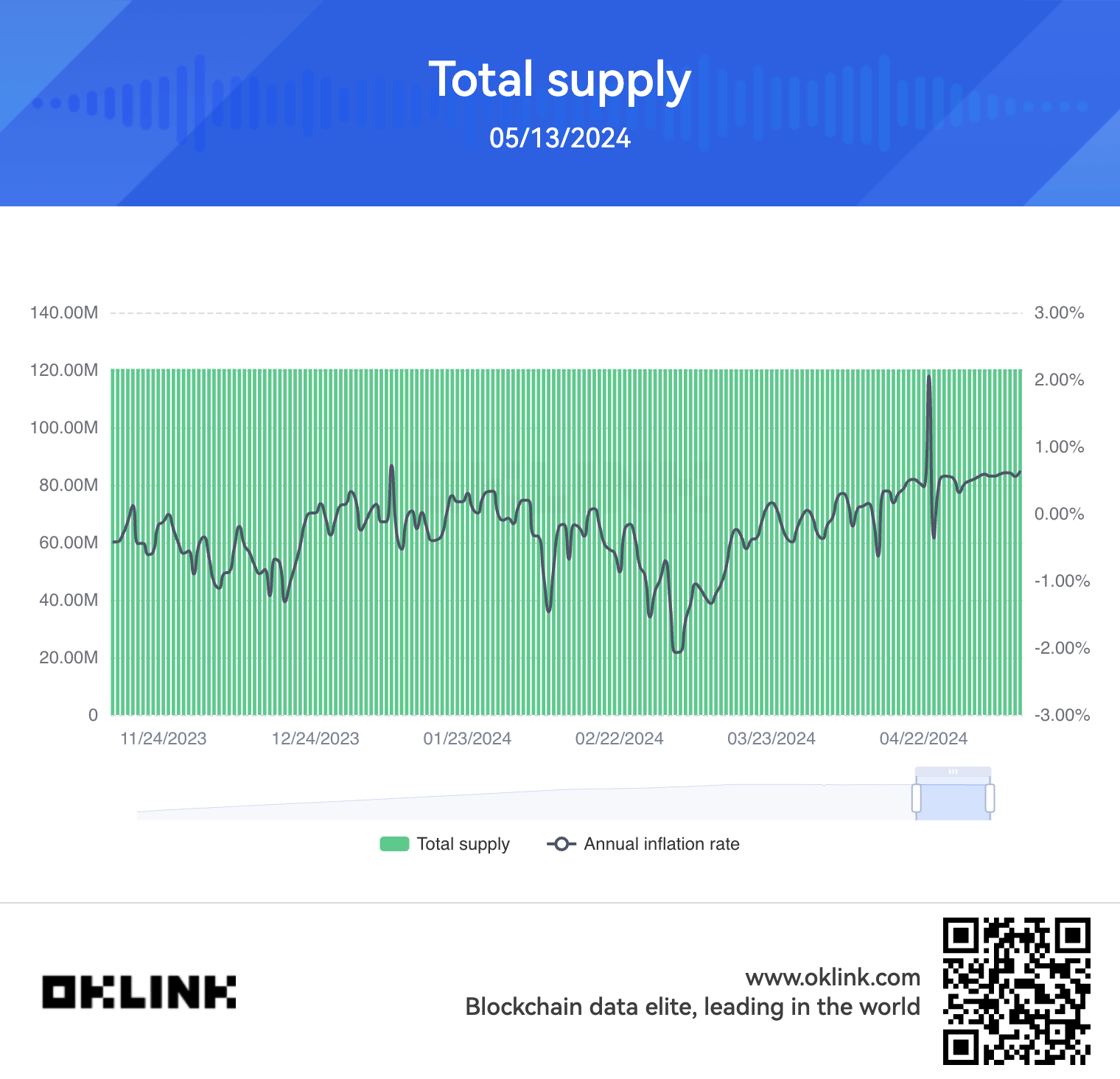

Curiously, Ethereum’s inflation price has drawn nearer to that of Bitcoin, particularly within the aftermath of Bitcoin’s halving occasion final month. As per information from the previous 7 days, Ethereum’s inflation price for the previous week stands at 0.54%, simply 0.29 share factors greater than Bitcoin’s post-halving price of 0.83%.

Ethereum’s inflation price has been steadily rising since February when it reached a neighborhood low of -2%.

Whereas Ethereum’s provide has develop into barely inflationary within the quick time period because of lowered community exercise and burn price, its general provide continues to be reducing on a web foundation. This may be attributed to EIP-1559, which launched a burn mechanism for a portion of transaction charges.

Wanting forward, Ethereum’s inflation price and provide dynamics will possible be influenced by future community upgrades and adoption developments. If transaction charges and burn price stay low, Ethereum could proceed to expertise inflationary stress within the close to time period. Nonetheless, the long-term trajectory will rely upon the success of upcoming upgrades and the general development of the Ethereum ecosystem.

The adoption of layer-2 networks and the current enhance in layer-3 community exercise reduces load from the Ethereum mainnet, but it does so at a price. Nonetheless, the present enhance in L2 and L3 exercise is just not at a stage to create ample L1 transactions to maintain Ethereum deflationary. Solely time will inform whether or not the ultra-sound cash idea for Ethereum will probably be retained in a world dominated by L2 and L3s.