- Much less environment friendly miners are starting to go away the community.

- On-chain metrics flash a purchase sign.

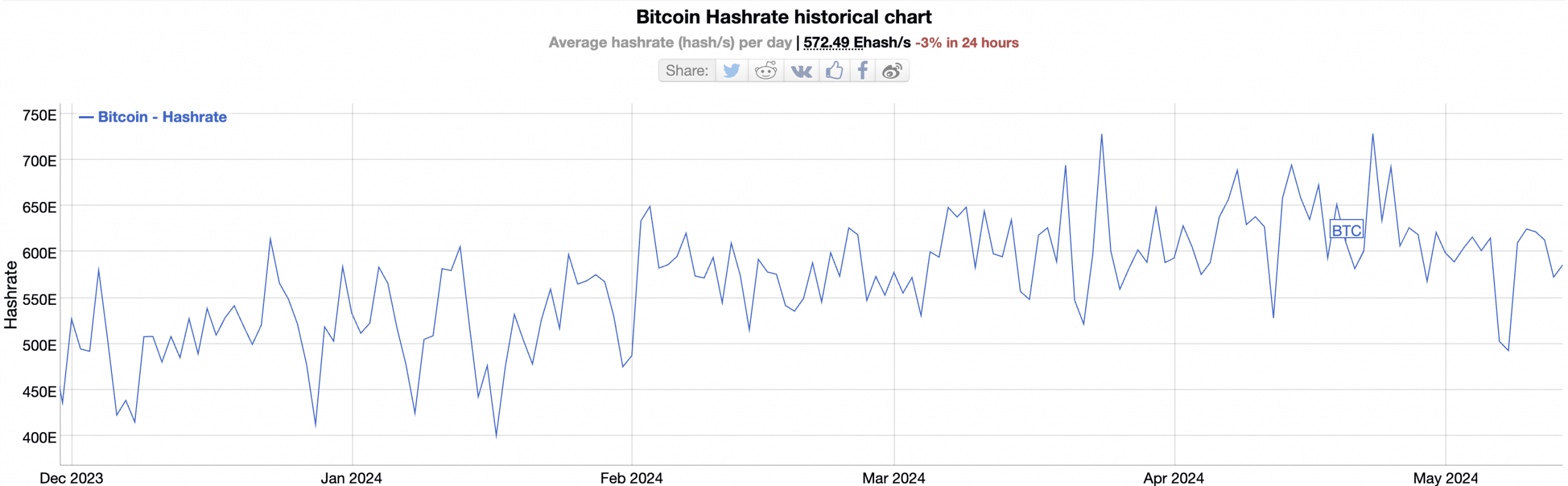

The decline in Bitcoin’s [BTC] hashrate post-halving hinted at a possible miner capitulation, pseudonymous CryptoQuant analyst Maartunn famous in a brand new report.

The 2024 halving occasion diminished mining rewards from 6.25 BTC to three.125 BTC, Bitcoin’s hashrate.

After this, the overall mixed computational energy used to mine and course of transactions on the community, rallied to a year-to-date excessive of 728.27E on the twenty third of April.

Consequently, it initiated a decline. At 585.7E at press time, the community’s hashrate has since dropped by 20%, in keeping with information from BitInfoCharts.

In line with Maartuun.

“Although this decline is still modest and brief, it stands out because the hashrate typically rises. This trend shifted after the halving.”

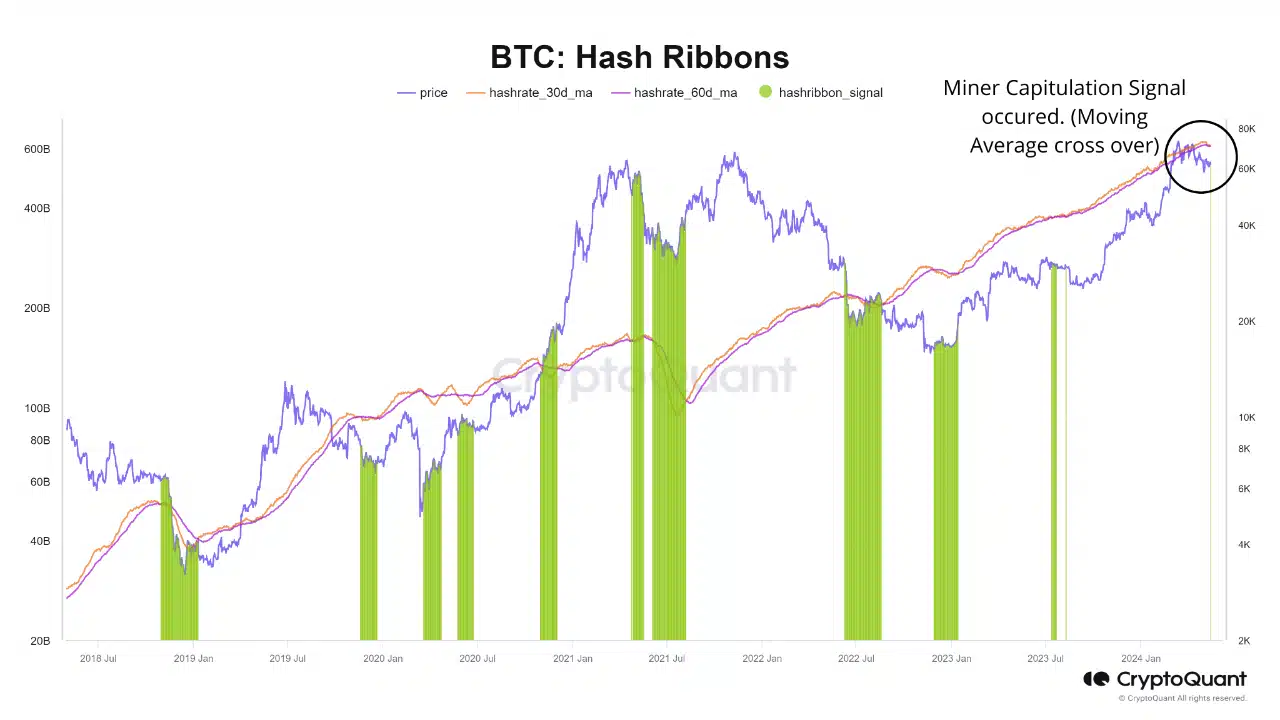

When Bitcoin’s hashrate declines, it triggers an uptick in Hash Ribbons. The community’s Hash Ribbons observe the connection between short-term and long-term shifting averages of Bitcoin’s hashrate.

When it spikes, it suggests diminished mining exercise on the Bitcoin community, which alerts the exit of much less environment friendly miners from the market as a result of decreased profitability.

The latest decline in Bitcoin’s hashrate has led to a spike within the community’s Hash Ribbons, therefore the chance of miner capitulation. Maartun famous,

“Periods of rapid declines in the hashrate are marked in green on the bitcoin price chart below, often indicating “miner capitulation.”

Mining exercise on the Bitcoin community

For the reason that halving occasion, BTC’s Miner Reserve has declined. This metric measures the quantity of cash held in affiliated miners’ wallets. When its worth declines, it means that miners are offloading their cash.

The community’s Miner Reserve, at 1.8 million BTC at press time, has decreased by 1.1% because the nineteenth of April, in keeping with CryptoQuant’s information.

Additional, as a result of decline in miner income brought on by the low transaction depend on the Bitcoin community after the halving, the share of BTC’s quantity contributed by the miners on its community has fallen.

Good time to purchase?

In line with Maartun, Bitcoin’s hiked Hash Ribbons supply shopping for alternative for market individuals who could also be keen to make the most of the coin’s low value motion. The analyst stated,

“Hash Ribbons operates under the assumption that such circumstances often coincide with significant price lows for BTC, eventually offering an opportune moment to capitalize on price dips.”

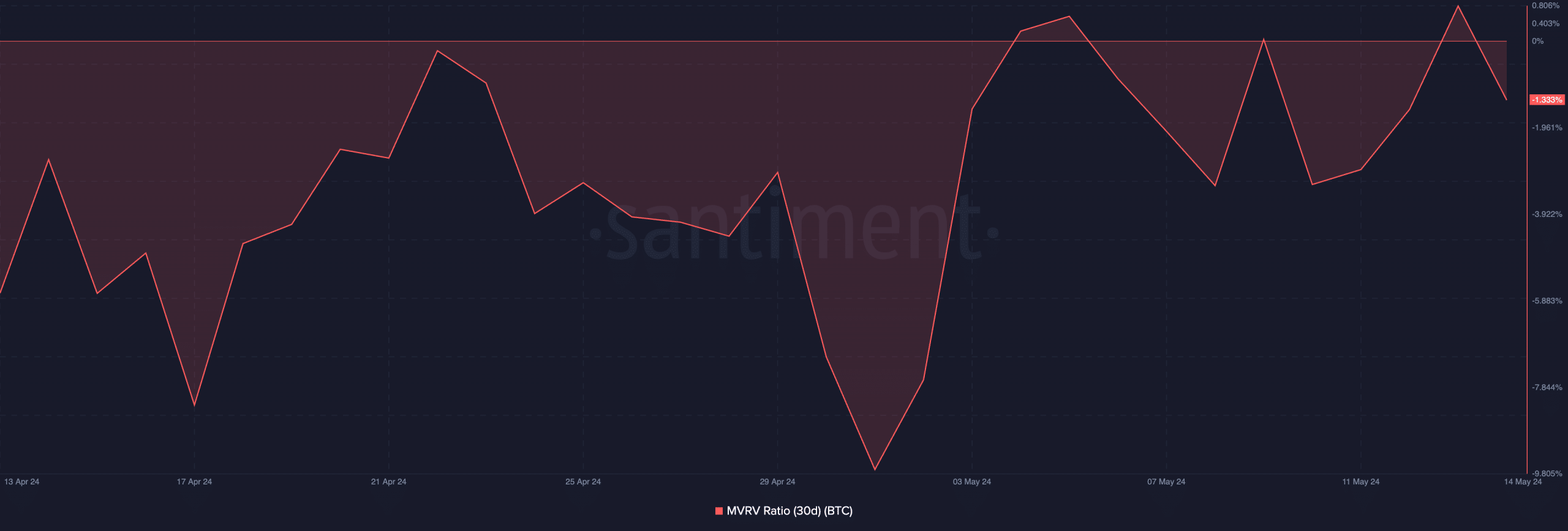

This place was confirmed by BTC’s Market Worth to Realized Worth (MVRV) ratio, which returned a adverse worth of -1.33% at press time.

This metric tracks the ratio between BTC’s present market value and the typical value of each coin or token acquired for that asset.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

When its worth is adverse, the coin is claimed to be undervalued, as its market worth is beneath the typical buy value of all its cash in circulation.

A adverse MVRV ratio is taken into account a purchase sign as a result of it implies that the asset in query now trades at a reduction relative to its historic value foundation.