Market Overview: DAX 40 Futures

DAX futures had a powerful pullback finish final week and went sideways with a bear doji. Friday was a powerful reversal bar that hit bear targets. It is a weak bar for stop-entry merchants. We’ll possible kind a buying and selling vary round this worth and 18000. It’s sturdy sufficient for a second transfer sideways to down.

DAX 40 Futures

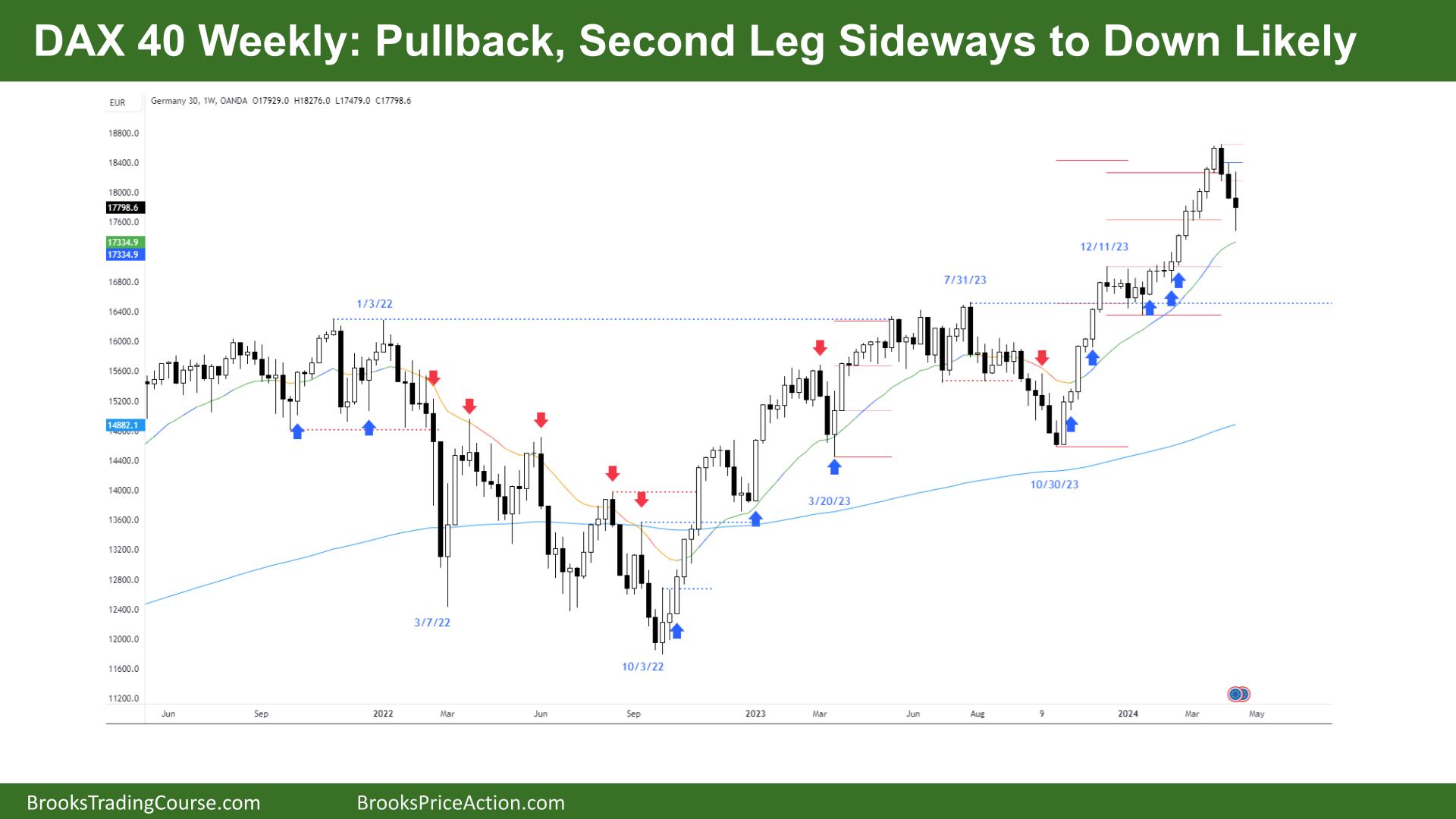

The Weekly DAX chart

- The DAX 40 futures went sideways to down final week with a pullback from measured transfer targets.

- The bulls see a bull spike and channel, two sturdy legs up, so two legs sideways to down earlier than the ultimate push is affordable.

- The bears noticed a buy-climax, and we overshot 18000. They have been searching for a motive to fade again, and so they took it. Now, they’ve hit a swing goal.

- The bulls in all probability want one other leg sideways to all the way down to the MA for one more purchase sign, a excessive 2.

- Bears, I might solely promote excessive if the follow-through has tails. As a result of it was so sturdy on the best way up, I wouldn’t be too wanting to guess in opposition to the bulls.

- It’s a weak promote sign, so extra patrons are possible above fading the Excessive 1.

- There could also be patrons under that bar or close to the MA, however as a result of merchants anticipate a second piece to the pullback, ready for a sign to develop is healthier.

- Bulls have an unlimited bull breakout hole, so the bears can solely flip it right into a buying and selling vary even with a deep pullback.

- Bears want a decrease excessive and a failed purchase sign to get traction.

- When you’re quick, do you get out? I might look ahead to worth motion with a bar like Friday and get out above it. You can argue sellers there, however you took a low-probability commerce, and it hit a goal, so that you’re hoping to get a second likelihood!

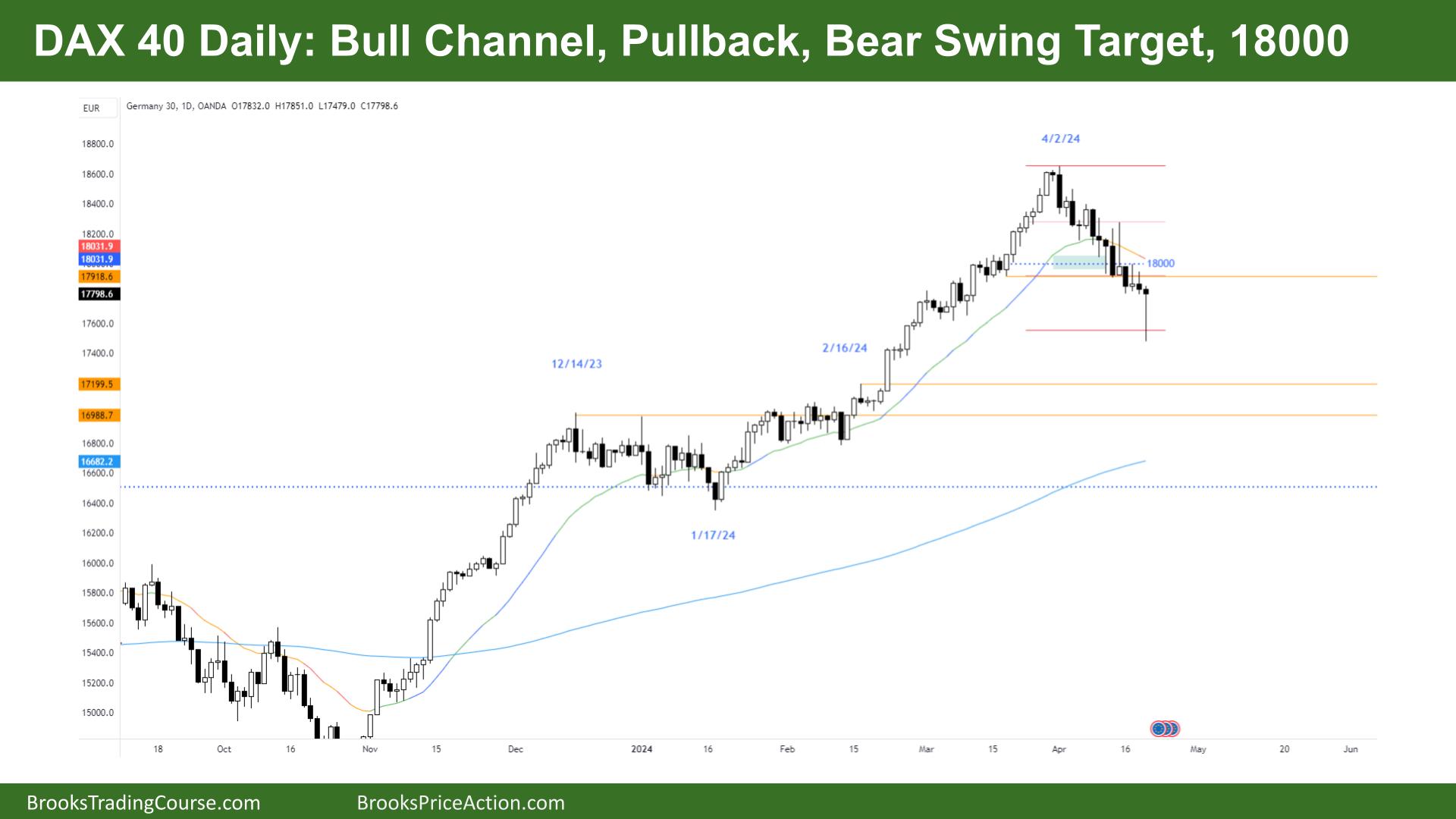

The Day by day DAX chart

- The DAX 40 futures went down final week with an enormous bounce on Friday because the final of the sellers bought out at their targets.

- Sturdy and tight bull channel, we broke a development line however didn’t check it? Doubtless, we return up larger.

- I believe the bears want a double prime to vary this development.

- You may see the shortage of consecutive sturdy bear bars under the MA. Most merchants have been shocked by the pullback depth, however it ought to flip right into a wedge backside anyway.

- The bears did properly to retrace the final leg of the push-up. They even bought to the midpoint of this final rally. In order that’s good.

- Bulls are searching for a better low to kind and a second entry lengthy for a 3-push again as much as a kind of bull bars.

- The bear bar on Friday closed close to its excessive, so it’s technically a bull bar. Nevertheless, it’s a weak reversal bar, so follow-through can be necessary for bulls.

- What number of legs down? You can argue that Excessive 2 on the MA failed, and MM is down. That’s truthful. However most bulls wouldn’t have purchased above the Excessive 2 with no good check of the MA, in order that they have been possible bulls exiting who scaled in from longs above.

- The bulls are shopping for new lows, scaling in decrease, and earning money, so we must always return to the MA quickly.

- Are we at all times briefly? Perhaps. I might nonetheless commerce it like a buying and selling vary and look to purchase low and promote excessive, scalp and take fast earnings.

- The subsequent cease is probably going MA, so subsequent week anticipate sideways to up.

Market evaluation stories archive

You may entry all weekend stories on the Market Evaluation web page.