Market Overview: DAX 40 Futures

DAX futures went greater forming a Excessive 1 from a reversal up from 18000. Such a powerful spike wanted a correction and the pullback was deep. It’d want a second leg sideways to down earlier than bulls purchase once more. The shifting common is just under and there are probably patrons within the space as effectively if we get there.

DAX 40 Futures

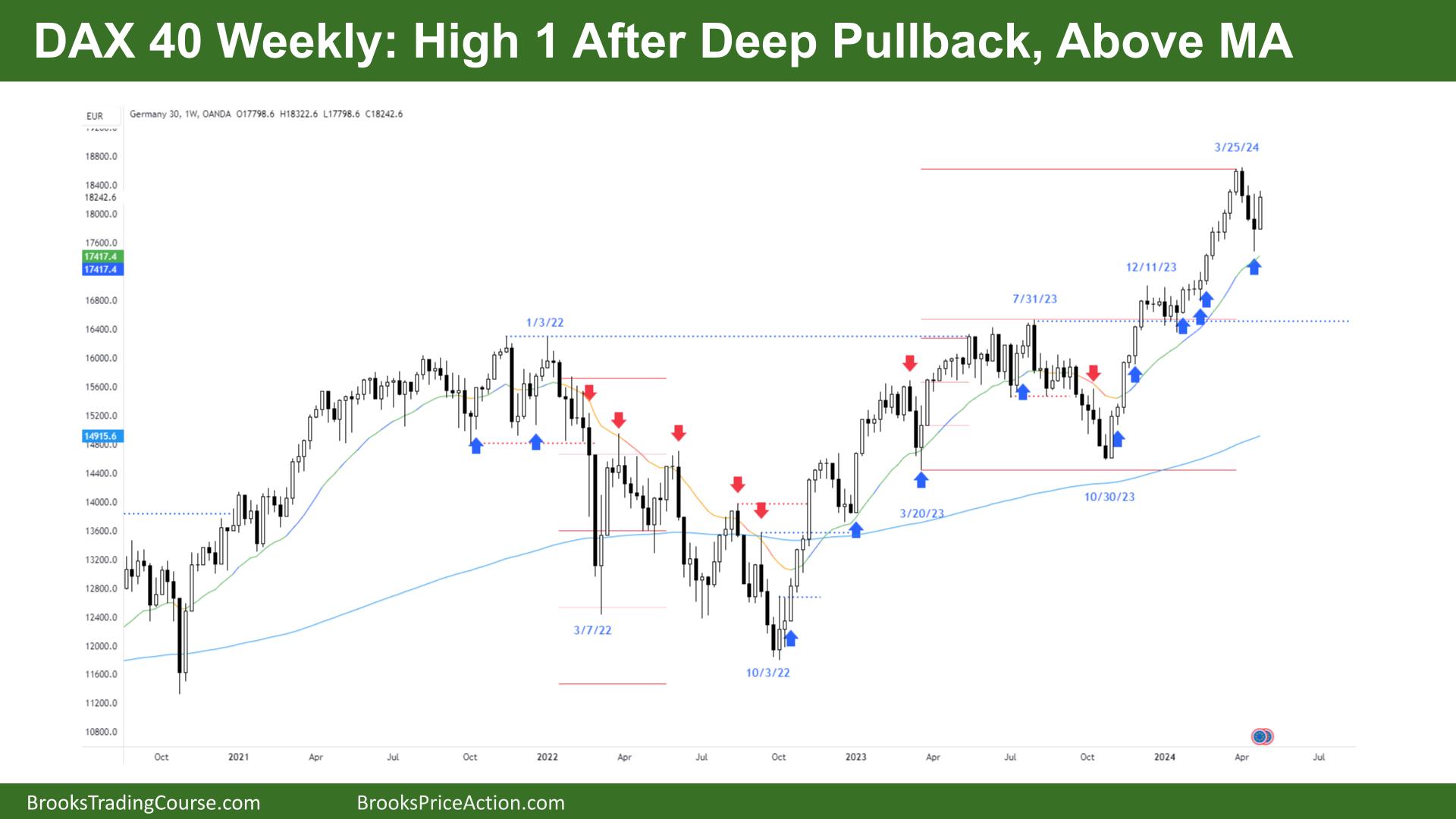

The Weekly DAX chart

- The DAX 40 futures went greater final week with a Excessive 1, a powerful bull bar that went above final week’s excessive however didn’t shut above it.

- It was a powerful pullback down from the ATH. Three consecutive bear bars are uncommon in a powerful bull pattern, so we would transition right into a buying and selling vary up right here.

- With such a decent channel, the primary reversal must be minor. However sufficiently big now for a second leg sideways to down.

- The bulls see an enormous breakout and a purchase climax. The pattern was probably exhausted. Most bulls need two legs sideways to carry their stops up and search for one other transfer.

- Different bulls had hit the three measured-move targets up right here, so it was largely profit-taking that took the worth again down.

- Final week, we mentioned that bears would probably promote the Excessive 1 above that bear doji. We’ll see in the event that they make cash subsequent week.

- A Excessive 1 in a late-stage spike shouldn’t be a high-probability entry, so I believe most bulls will look to purchase decrease.

- We’d must get again to the MA.

- The bulls desire a good follow-through bar subsequent week to entice any bears and take a look at again to the highs. I believe we’re going again there; the query is whether or not it’s proper now or after we go sideways first.

- Bulls who purchased underneath the low of the final robust bar within the bull microchannel made cash. They scaled in decrease, getting a break-even on their first entry and earning money on their second.

- Bears will in all probability do the identical above this week and make cash, additionally.

- Nonetheless all the time in lengthy, which means I wouldn’t be promoting under something. However it’s probably that the bulls acquired out and are in search of a brand new entry.

- Count on sideways to up subsequent week.

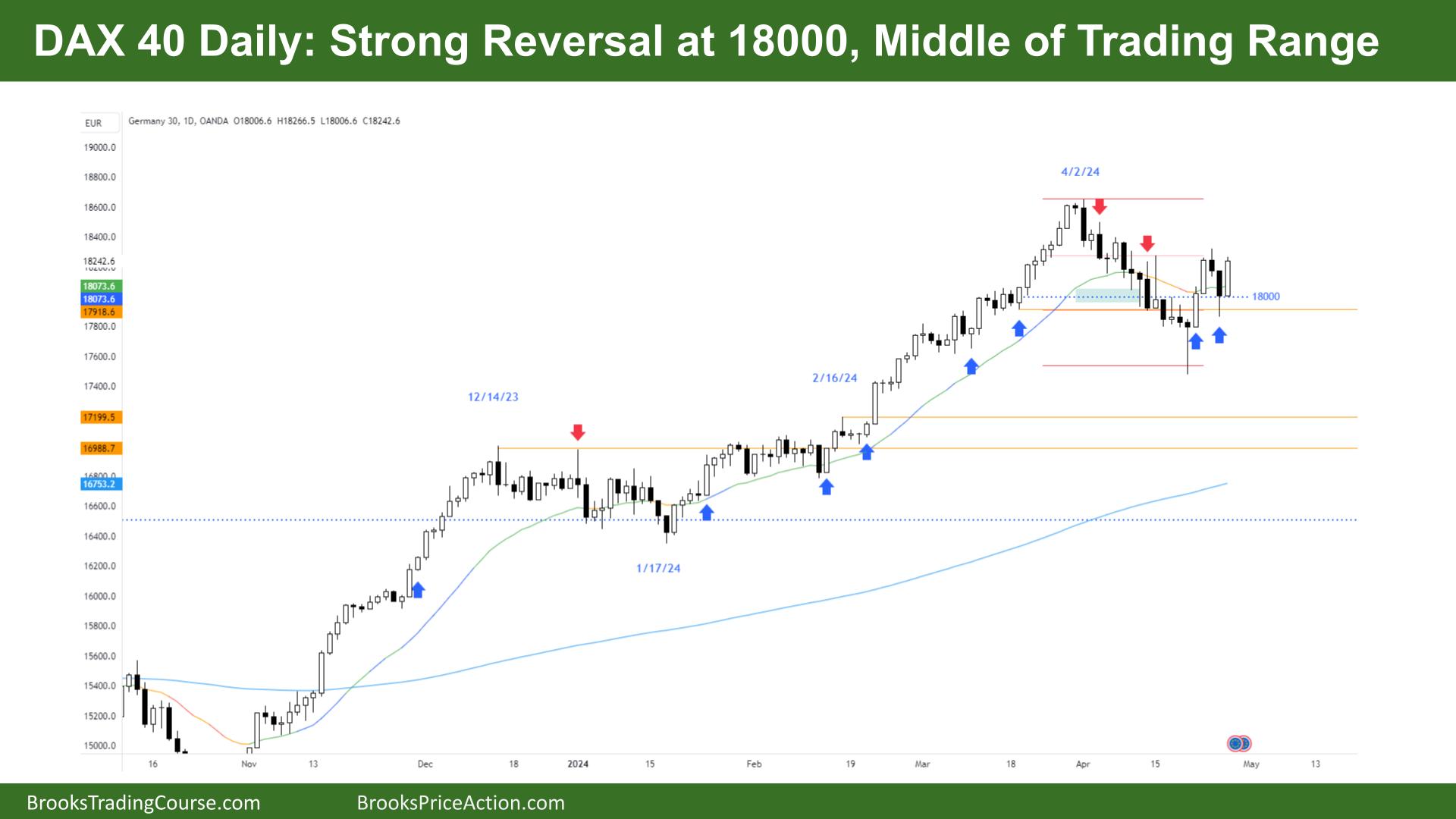

The Each day DAX chart

- The DAX 40 futures on Friday was a powerful bull bar closing on its excessive, so we would hole up on Monday.

- The bears had three pushes down in a wedge bull flag and we broke out of the channel down and now examined the breakout level.

- The bulls see robust bull bars above the MA, however it’s forcing you to purchase excessive in lots of buying and selling vary PA these days.

- It is perhaps higher to purchase the midpoint or under the bar.

- There’s a probability the low of the buying and selling vary is that bear tail under from final week.

- And so scaling within the decrease third is a safer approach to commerce it lengthy.

- Bears see it as a promote zone in a buying and selling vary however would possibly anticipate tails above the bars earlier than shorting it for extra affirmation.

- The bears needed extra bars under the shifting common however have been shocked by consecutive robust bull bars closing on their highs and above the MA.

- For some merchants, that transfer places the market again into all the time in lengthy.

- However I believe it’s higher to commerce it like a channel, anticipating pullbacks to be deeper than you want to and count on to scale in.

- A Excessive 1 above a bear bar is decrease chance than above a bull bar, so it Friday will get follow-through that might be a greater commerce.

- The bears needed a second entry promote sign on the MA for a much bigger correction down however have been shocked. They must promote greater.

- It’s in all probability all the time in lengthy on this timeframe, so it’s higher to be lengthy or flat.

- Count on sideways to up subsequent week.

Market evaluation reviews archive

You possibly can entry all weekend reviews on the Market Evaluation web page.