Choices Spreads Combos Defined

For instance a dealer could promote one AAPL 170 name and purchase one AAPL 160 name, a sort of name unfold as outlined beneath.

In all such methods, a dealer makes use of the chosen mixtures of places and calls to make a revenue ought to a forecast consequence happen.

That is often that the underlying inventory strikes a selected means – up within the case of the decision unfold above – however in additional complicated trades may be an anticipated motion in volatility, or to make the most of the passage of time (we’ll see how later).

There are three most important varieties of fundamental choices methods:

1. Vertical Name and Put Spreads

So referred to as as a result of choices with the identical expiry date are quoted on an choices chain quote board vertically.

Therefore, vertical spreads contain put and name mixture the place the expiry date is similar, however the strike value is totally different.

Examples embody bull/bear name/put spreads as mentioned beneath, and backspreads mentioned individually.

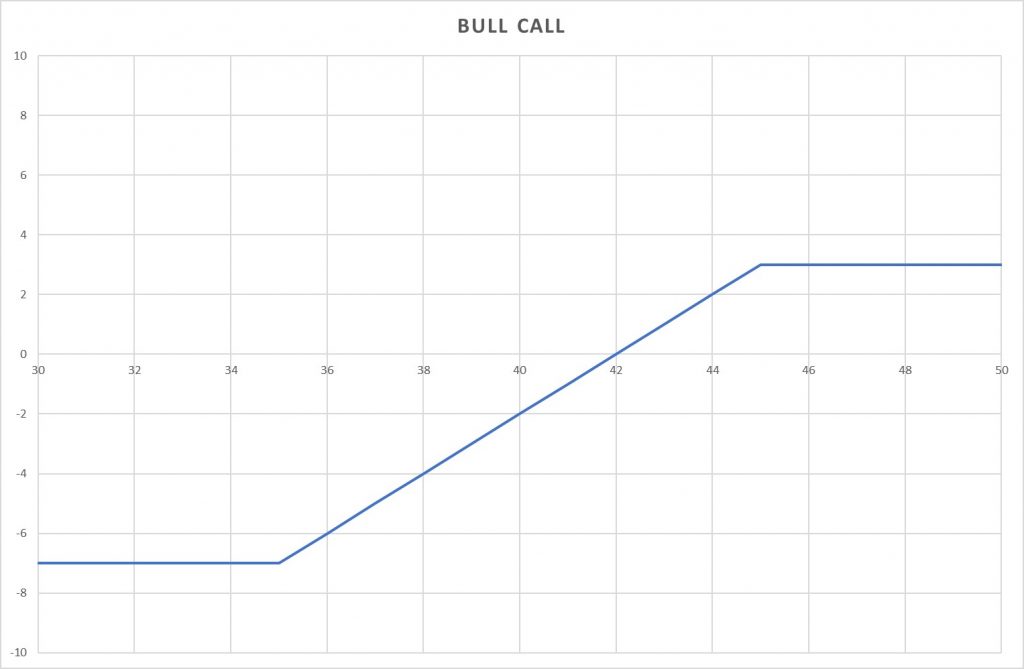

Bull Name Unfold Technique

A Bull Name Unfold is an easy possibility mixture used to commerce an anticipated improve in a inventory’s value, at minimal threat.

It entails shopping for an possibility and promoting a name possibility with a better strike value; an instance of a debit unfold the place there’s a internet outlay of funds to placed on the commerce.

So let’s say that IBM is at $127.

It is perhaps potential to purchase a June 125 name for $5.50 and promote a June 130 name for $3.00, a internet value of $2.50 per contract:

- Purchase IBM June 125 Name 5.50

- Promote IBM June 130 Name 3.00

- Web Value: $2.50

Ought to IBM rise and be above $130 at expiration the unfold can be value $5, thus doubling the invested quantity.

After all, whether it is decrease, the unfold is value much less, with the worst case being if IBM falls beneath $125, whereby the unfold is nugatory and all cash is misplaced.

The commerce is subsequently a threat adjusted ‘bet’ that IBM will rise reasonably over the following three months.

We’ve lined the bull name unfold in additional element right here.

Bear Name Unfold Technique

A Bear Name Unfold is an analogous commerce used to commerce an anticipated fall in a inventory’s value, at minimal threat. It entails promoting a name possibility and shopping for one other with a better strike value.

Notice that it is a credit score unfold: ie that we obtain cash for a commerce and, if we’re appropriate and the inventory does fall, weget to maintain this if each choices expire nugatory.

So, once more, with IBM at $127 we’d promote the $160 June name and buy the $165 June name (ie the alternative of earlier than).

It is perhaps potential to promote a June 125 name for $5.50 and purchase a June 130 name for $3.00, a internet credit score of $2.50 per contract:

- Promote IBM June 125 Name 5.50

- Purchase IBM June 130 Name 3.00

- Web Credit score: $2.50

If IBM falls beneath $125, as hoped, each choices expire and we get to maintain the $2.50.

Nevertheless, ought to IBM rise and be above $130 at expiration, the unfold must be purchased again at no matter worth IBM is above $130. The breakeven level for the commerce is $127.50.

The commerce expectation is subsequently that IBM will fall reasonably over the following three months.

Bull Put Unfold Technique

The put model of the bull name unfold: i.e. a credit score is obtained for ‘betting’ that inventory will transfer in a selected course (up, as in comparison with the bear name unfold the place the ‘bet’ was for the inventory to fall). For instance:

- Purchase IBM June 125 Put 4.00

- Promote IBM June 130 Put 6.50

- Web Credit score: $2.50

The total credit score is saved if IBM is above $130 at expiration.

After all ought to IBM be between 125 and 130 at expiration, the unfold would expire with some worth (equal to the inventory value much less $130). Therefore if this worth is greater than $1.50 – ie the inventory value is beneath $127.50 – the technique has misplaced cash.

This $127.50 is the break even level of this commerce.

Bear Put Unfold Technique

That is the put model of the bull name unfold: ie an quantity is paid up entrance which rises in worth ought to the inventory will transfer in the appropriate specific course (‘down’, in comparison with ‘up’ for the bear name unfold). For instance:

- Promote IBM June 125 Put 4.00

- Purchase IBM June 130 Put 6.50

- Web Value: $2.50

Ought to IBM fall beneath $125 at expiration, the unfold is value $5 (a major improve from the unique $2.50) funding.

Nevertheless, if the inventory is above $127.50, the ultimate worth of the unfold can be lower than the $2.50 paid, and the commerce would have made a loss.

We lined the bear put unfold in additional element right here.

2. Calendar (Horizontal) Unfold Methods

Calendar unfold is so referred to as due to choices with totally different expiries being displayed horizontally on an choices chain quote board.

They, subsequently, contain shopping for and promoting choices with totally different expiry dates, however the identical strike value (and, in fact, underlying). A calendar unfold is an effective instance or horizontal name or put unfold (see extra right here).

3. Diagonal Spreads

Diagonal spreads are a mix of the 2 and are complicated trades involving choices of various strike costs and expiry dates. An instance is a LEAP lined name unfold detailed later.

Coated Name

One widespread technique that doesn’t actually fall into the above classes is the lined name which entails the acquisition of inventory and promote of a name possibility. Extra particulars on the lined name can be found by clicking right here.

Superior Choices Combos: Advanced Put and Name Trades

Choices have a whole lot of benefits; however with a view to take pleasure in these benefits, the appropriate technique is crucial. If merchants perceive methods to use all of the buying and selling methods, they are often profitable.

We already been by way of some fundamental choices mixtures; now it’s time to undergo some extra complicated methods.

Particularly, we’ll have a look at some methods such because the iron condor and butterfly unfold (together with when to placed on and the associated choices greeks).

Strangle Technique

This technique is a impartial one the place an out-of-money put and out-of-money name are purchased collectively concurrently for a similar expiration date and asset. It’s also referred to as “Long Strangle”.

When Would You Put One On?

When the dealer believes that within the close to brief time period, the underlying asset would show volatility, the strangle is apt.

When Does It Make Cash?

On this Possibility technique, limitless cash is made when the underlying asset makes a unstable transfer. It could possibly be downwards or upwards, that doesn’t matter.

- Higher Breakeven Level = Strike Worth of Lengthy Name + Web Premium Paid

- Decrease Breakeven Level = Strike Worth of Lengthy Put – Web Premium Paid

When Does It Lose Cash?

The unfold loses cash when the worth of the asset on expiration is between the Choices’ strike costs.

Loss = Underlying Asset Worth = Between Lengthy Name’s Strike Worth and Lengthy Put’s Strike Worth

Choices Greeks

The Delta is impartial, the gamma is all the time constructive, Theta is worst when the asset doesn’t transfer, and Vega is all the time constructive.

Illustration

Assume that Apple Inventory is at present buying and selling round $98. A strangle could possibly be a very good technique if the dealer is uncertain in regards to the course wherein the inventory will go.

So, the dealer will purchase a 97 put and a 99 name. Allow us to assume they’ve the identical expiration date and worth = $1.65. If the inventory rallies previous $102.3 (3.3+99), the put would don’t have any worth and the decision can be in-the-money. If it declines, the put can be ITM and the decision would don’t have any worth.

Straddle Technique

Straddle Unfold P&L Diagram

This technique can be referred to as Lengthy Straddle. When a put and name are purchased for a similar asset, with the identical expiration date and similar strike value, it’s referred to as a straddle.

When Would You Put One On?

When the dealer believes that within the close to brief time period, the underlying asset will show important volatility, a straddle technique is used.

When Does It Make Cash?

Cash is made by the technique regardless of which course the underlying asset strikes in direction of. The transfer needs to be fairly robust, although.

- Higher Breakeven Level = Strike Worth of Lengthy Name + Web Premium Paid

- Decrease Breakeven Level = Strike Worth of Lengthy Put – Web Premium Paid

When Does It Lose Cash?

If the worth of the underlying asset throughout expiration is similar because the strike value of the purchased name and put, the unfold loses cash.

Loss = Underlying Asset Worth = Lengthy Name/Lengthy Put’s Strike Worth

Possibility Greeks

The Delta is impartial, the Gamma is all the time constructive, Theta rises throughout expiration, and Vega is all the time constructive.

Illustration

Take a brand new instance and assume that Apple inventory is at present round $175. Straddle can be a very good technique if the dealer thinks that a large transfer can be made on both aspect. A name and put with the identical expiration date because the inventory can be purchased by the dealer. Assume that the 175 Name and the 175 Put value $10 every. If the inventory rallies previous $195, the decision can be ITM by at the very least $20 and income will pour in. If the inventory falls beneath $175, the price of the straddle can be lined. There’s a 50/50 likelihood of being proper in regards to the course as a result of the price of the straddle is the utmost loss a dealer can incur.

Butterfly

In a butterfly unfold technique, there are three strike costs. Two calls are purchased – one ITM and one OTM. Two ATM calls are offered.

When Would You Put One On?

When the dealer believes that the rise or fall of the underlying inventory wouldn’t be lots by expiration, butterfly unfold is the perfect.

When Does It Make Cash?

When the worth of the underlying inventory doesn’t change in any respect throughout expiration, this technique achieves its most revenue.

Revenue = Underlying Asset Worth = Brief Calls’ Strike Worth

When Does It Lose Cash?

When the worth of the underlying inventory is lower than or equal to the strike value ITM lengthy name OR when its value is bigger than or equal to the strike value of OTM lengthy name, this unfold loses cash.

- Loss = Underlying Asset Worth lesser than or ITM Name Strike Worth

- Loss = Underlying Asset Worth better than or ITM Name Strike Worth

Possibility Greeks

Delta is all the time constructive, Gamma is lowest at ATM and highest at ITM and OTM, Theta is finest when it stays within the revenue space, and Vega stays constructive so long as the volatility shouldn’t be an excessive amount of.

Illustration

Assume that Apple inventory is buying and selling at $90. Assume that an 80 name is bought at $1100, two 90 calls are written at $400 (x2), and a 100 name is bought at $100. The utmost loss can be the online debit = $400. If the worth of Apple at expiration stays the identical, the 40 calls and the 50 name would don’t have any worth and the revenue can be $600. If, nonetheless, the inventory trades beneath $80, all of the choices can be ineffective. If it trades above $100, the loss from the ITM and OTM calls can be set off by the revenue from the ATM calls.

Iron Condor

On this technique, one OTM put with decrease strike is offered after shopping for one OTM put with strike even decrease, and one OTM name with greater strike is offered after shopping for one OTM name with a strike even greater.

When Would You Put One On?

When the dealer believes that low volatility is to be anticipated, the Iron Condor is chosen.

When Does It Make Cash?

When the worth of the underlying asset is between the strike costs of the offered name and put, this technique makes cash.

Revenue = Underlying Asset Worth = Between Brief Put Strike Worth and Brief Name Strike Worth

When Does It Lose Cash?

The unfold loses cash when the worth of the inventory falls beneath bought put’s strike value or rises above bought name’s strike value. Loss can typically be better than revenue.

- Loss = Underlying Asset Worth better than Lengthy Name Strike Worth

-

Loss = Underlying Asset Worth lesser than Lengthy Put Strike Worth

Possibility Greeks

The Delta is impartial, the Theta ought to keep constructive, Gamma shouldn’t be too massive, and detrimental Vega ought to be minimized.

Illustration

Apple Inventory is buying and selling at $45, Iron Condor can be – shopping for 35 Put at $50, writing 40 Put at $100, writing 50 Name at $100, and shopping for 55 Name at $50. The web credit score ($100) is the utmost revenue. If the expiration worth is similar, all lengthy and brief choices can be ineffective and most revenue can be realized. If it falls to $35 or rises to $55, solely the 40 Lengthy Put can be helpful and the utmost lack of $400 can be realized.

Conclusion

Unfold buying and selling is usually a priceless element of an investing technique. In lots of instances they will considerably cut back the danger in comparison with calls and places methods. It’s vital for these contemplating choices spreads (or any investing technique) to additionally think about how nicely choices match inside their portfolios. Some will need to use a mix of approaches, however they have to first perceive the potential dangers.

Concerning the Creator: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and these days in Australia. His curiosity in choices was first aroused by the ‘Trading Options’ part of the Monetary Occasions (of London). He determined to convey this information to a wider viewers and based Epsilon Choices in 2012.

Subscribe to SteadyOptions now and expertise the total energy of choices buying and selling at your fingertips. Click on the button beneath to get began!