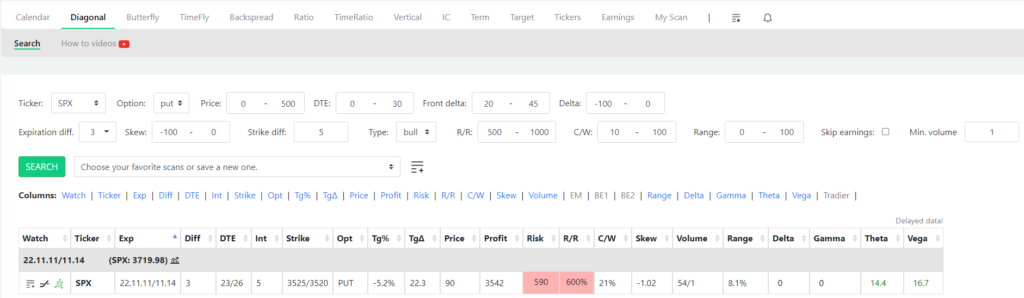

I all the time wished to have a mechanism that scans the marketplace for particular SPX diagonals and alerts me at any time when discover it. That’s the reason I’ve developed an alert algorithm within the scanner in order that I don’t have to manually scan for attention-grabbing setups all day, however it’s going to alert me.

Let’s see what kind of diagonals I like for SPX.

-

Ticker: “SPX” as a result of I’m in search of SPX diagonals;).

-

Choice: “put” means I’m wanting just for put diagonal spreads.

-

Value: “0 – 500” means I’m solely curious about spreads which have a debit between 0 and 500 {dollars}. I’m solely in search of debit diagonals as a result of credit score ones would have completely different directional bets.

-

DTE: “0 – 30”, I’m in search of those with max 30 days to expiration.

-

Entrance delta: “20 – 45” defines the delta distance for the entrance leg of the unfold. This makes it near the cash, however not ATM the place the web delta could be optimistic and I’m in search of destructive delta.

-

Delta: “-100 – 0” is the web delta of the place. On this scan, I’m solely in search of a destructive web delta configuration as a result of then if the market begins to fall, I’m instantly creating wealth on the unfold. This diagonal is accumulating web destructive delta as days go by by way of the impact of allure Greek.

-

Expiration diff: “3”, means I’m in search of diagonals the place there are 3 days in between the expiration dates. That is sometimes Friday/Monday expiration. You can too seek for varied expiration variations.

-

Skew: “-100 – 0”, that is essentially the most essential a part of this setup, the horizontal IV skew. This setting states that I’m in search of destructive skew, which implies the entrance leg has the next IV than the again leg.

-

Strike diff: “5” is the interval between the lengthy and quick strikes of the diagonal. If I need to have the scanner search for all of the variations, I’d set it to 0. However for this setup, 5 is the very best strike distinction.

-

Kind: “bull”, there are two varieties of diagonals for places and calls. Bull diagonals and bear diagonals. On this setup it is a bull put diagonal which implies that the lengthy put has the next strike than the quick put, therefore it’s extra of a spread buying and selling setup.

-

R/R: “500 – 1000” means I’m in search of diagonals which have a reward-to-risk ratio of at the least 500%. The R/R relies on the max potential loss vs. the max potential revenue of the diagonal.

-

C/W: “10 – 100”, stands for the share of credit score/width I get for shorting the embedded vertical that’s discovered within the diagonal unfold. Each diagonal has an embedded vertical unfold and with this setting, I’m ensuring that it’s price promoting that embedded vertical. So if I’m in search of a min. of 10% C/W which means once I quick the vertical I get at the least 10% of the width of the vertical in credit score.

-

Vary: “0 – 100” defines how extensive the breakeven vary in share needs to be in a calendar unfold. I left it on default.

-

Min. quantity: “1” is in search of legs which have at the least a quantity of 1 on the present day. With this, you’ll be able to filter out those who have very low quantity, therefore wider bid/ask spreads.

As you’ll be able to see within the picture above, I’ve solely discovered one SPX put diagonal which had 600% R/R potential and a reasonably flat configuration. Let’s undergo what the columns imply.

-

Watch: with these icons you’ll be able to add a variety to your watchlist, analyze the danger graph or copy the commerce to thinkorswim format.

-

Ticker: nothing to elucidate right here:)

-

Exp: the back and front month expiration of the diagonal unfold.

-

Diff: the day distinction between the legs’ expiration dates.

-

DTE: what number of days are till expiration within the entrance / again leg.

-

Int: the strike distinction between the legs.

-

Strike: the discovered strikes of the diagonal unfold.

-

Choose: choice is both name or put.

-

Tg%: goal %, how far the strike is in share transfer from the present inventory worth.

-

TgΔ: the goal delta of the unfold which is the entrance delta on this case.

-

Value: debit of the unfold.

-

Revenue: the theoretical max. revenue you may make on the particular calendar unfold.

-

Threat: the danger of the commerce, on this case, the debit paid.

-

R/R: reward to danger in share.

-

C/W: share credit score/width of the embedded vertical.

-

Skew: the horizontal IV skew of the legs. Detrimental means it’s backwardated that’s the entrance leg has the next IV than the again month.

-

Vary: what’s the worth vary in share between the breakeven factors of the unfold (how extensive is).

-

Delta: web delta of the unfold.

-

Gamma: web gamma of the unfold. Theta: web theta of the unfold.

-

Vega: web Vega of the unfold.

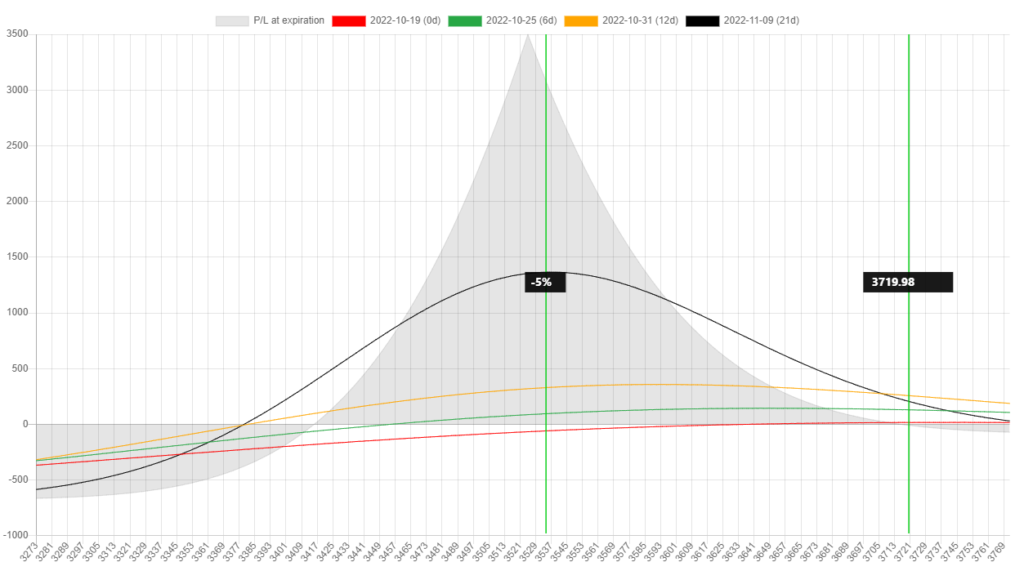

Threat graph of the place

Right here is the danger graph of that one diagonal above.

You possibly can inform from the danger graph that this configuration is fairly extensive and flat by way of web delta. It makes cash with time and course. Since I really like these diagonals, I’ve created a scan template for it and clicking on the alert button, I’ll get notified at any time when this setup comes round in the course of the day. That is fairly uncommon, so I may not get an alert daily, however in a excessive IV atmosphere, it’s extra widespread.

Diagonal scanner information

For a extra detailed clarification of the best way to use the diagonal unfold scanner please watch the next video.

Particular SO provide:

In case you join NinjaSpread till 11.30.2022, you get 30 day free trial as a substitute of 14 day and 20% low cost. Coupon code: SO10