- Bitcoin’s 200-day transferring common reached an all-time excessive, suggesting a bullish outlook.

- Brief-term challenges persevered, with some metrics displaying potential bearish alerts.

Bitcoin [BTC] has as soon as once more demonstrated its resilience, rebounding considerably from latest lows.

Regardless of shedding practically 14% from its March peak of over $73,000, the king coin’s latest efficiency has hinted at a promising restoration.

Over the previous week, Bitcoin briefly surged previous the $64,000 threshold earlier than settling at $63,635 on the time of writing.

This slight retreat, marking a 0.9% drop within the final 24 hours, has not dampened the long-term optimism surrounding the flagship cryptocurrency.

Bitcoin: Bullish alerts amid value fluctuations

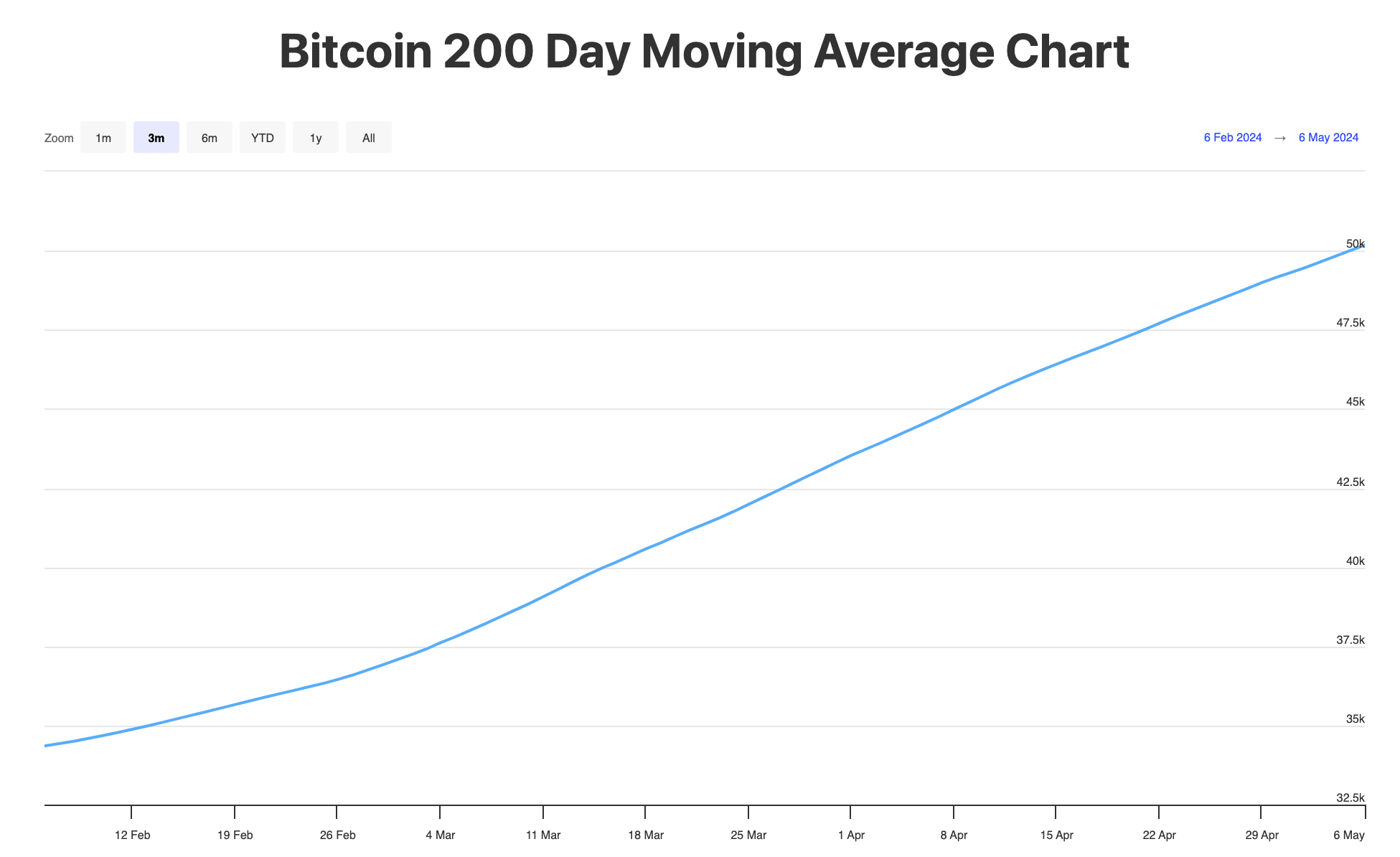

Amidst these fluctuations, the Bitcoin 200-day transferring common—an important indicator for assessing long-term market traits—has reached an unprecedented excessive of $50,178.

This milestone, which AMBCrypto analyzed utilizing BuyBitcoinWorldwide’s knowledge, underscores a doubtlessly bullish outlook for Bitcoin over the lengthy haul.

The 200-day easy transferring common (SMA), by smoothing out day-to-day value volatility, provides a clearer view of the underlying market development.

At press time, Bitcoin’s value remained above this important indicator, suggesting that the long-term momentum was bullish.

Additional reinforcing this sentiment, the 200-day SMA’s sturdy efficiency aligned with insights from outstanding Bitcoin fanatic Anthony Pompliano.

Talking on CNBC’s Squawk Field, Pompliano highlighted the importance of the indicator surpassing the $50,000 mark, emphasizing the continual upward trajectory of Bitcoin regardless of its infamous day-to-day volatility.

He famous in a publish on X,

“Don’t get lulled to sleep by bitcoin going sideways. The long-term thesis is as strong as ever.”

His remarks echoed a broader consensus amongst specialists who imagine in Bitcoin’s enduring worth proposition, even because it skilled periodic value corrections.

Advanced dynamics are revealed

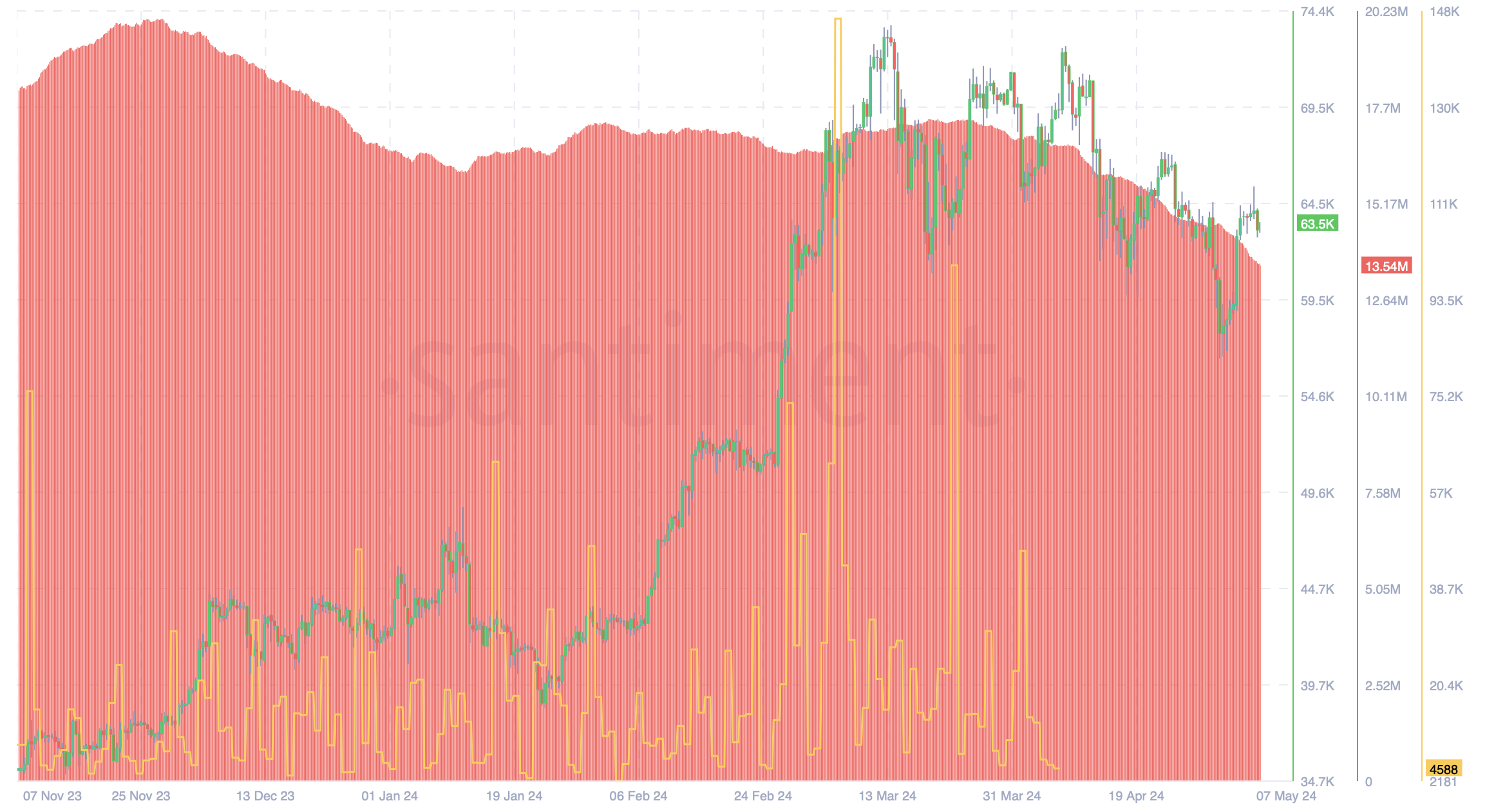

Regardless of the optimistic long-term indicators, AMBCrypto’s take a look at Santiment’s knowledge indicated a lower in dormant Bitcoin circulation and energetic addresses in latest months.

This decline in dormant circulation notably started in early March, simply earlier than Bitcoin reached new heights, hinting at a possible cooling off amongst long-term holders.

As for the dip in energetic tackle, it suggests a lower in community exercise. Such metrics introduce a observe of warning amidst the widely constructive panorama.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Including a layer of complexity, AMBCrypto not too long ago reported that seasoned dealer Josh Olszewicz has identified potential dangers regardless of Bitcoin’s latest positive factors.

His evaluation, utilizing the Ichimoku Cloud, revealed that Bitcoin would possibly nonetheless be navigating by potential market uncertainties, regardless of surpassing the $64,000 resistance degree.