- Prudent Bitcoin merchants may wish to keep sidelined as a substitute of bidding.

- A drop beneath the native low might ship costs careening decrease by shut to fifteen%.

Bitcoin [BTC] crashed by virtually 10% from the native excessive it set earlier on 30 April. At press time, it was buying and selling slightly below $58k, properly outdoors the earlier demand zone of $59.2k-$61k.

Right here, it’s price stating that BTC crashed by over 3.5% within the final 1 hour alone.

Supply: BTC/USD, TradingView

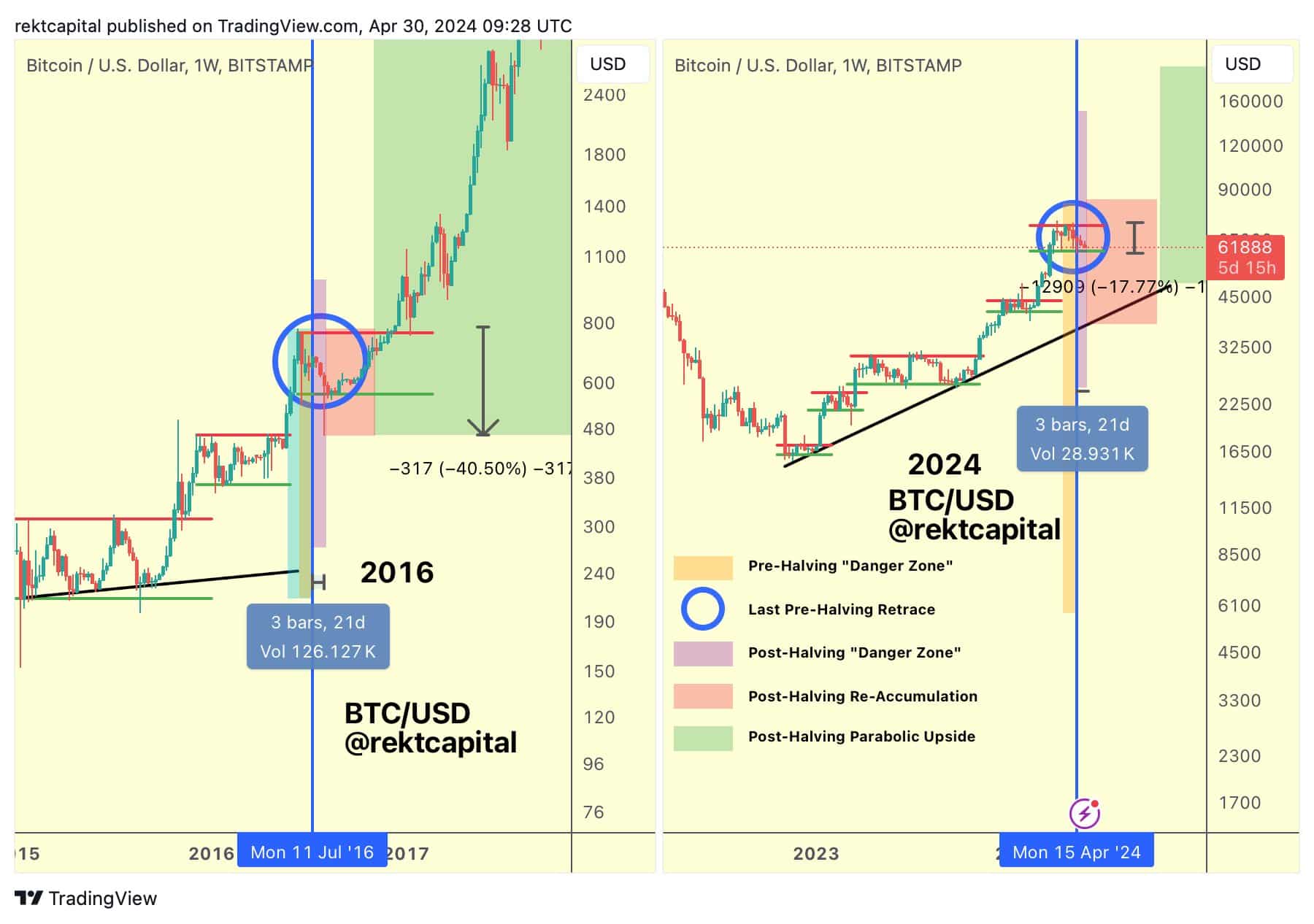

Nevertheless, in response to crypto-analyst Rekt Capital, Bitcoin shouldn’t be but out of the hazard zone.

The analyst in contrast the present Bitcoin value motion with what occurred within the 2020 and 2016 cycles, proper after the halving. Whereas historical past may not repeat precisely, it actually does rhyme.

Are we near the underside?

Supply: RektCapital on X

The 2024 value motion after the halving extra carefully resembled 2016 than 2020, asserted RektCapital. Again then, an 11% wick downward got here 21 days after the halving.

If the identical had been to repeat, we might anticipate BTC costs to plunge to $52k.

The $60k area has been a technically sound help zone previously two months. Nevertheless, every retest of the help weakens it. This could be the wave that breaches it.

Till it does, consumers might look to purchase the dip.

The tightrope is hard to stroll, and most merchants may desire staying on the sidelines to attend for a constructive response, or a drop beneath the $59k mark to go quick.

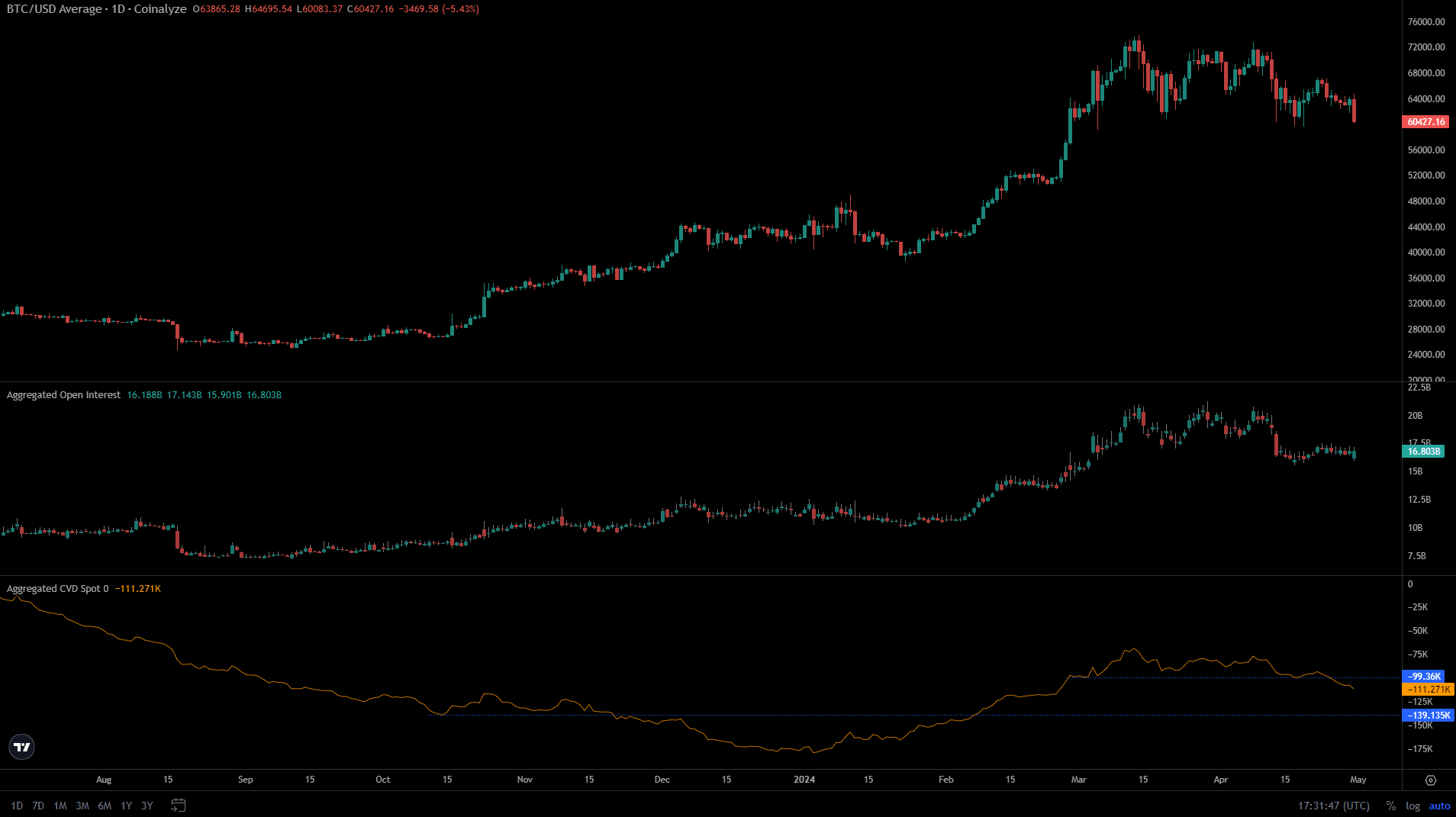

Supply: Coinalyze

The spot CVD gave traders a motive to be apprehensive. It has been in a downtrend since mid-March and broke beneath a help stage that stretched again to late February.

This confirmed the bearish energy on the HTF, and decreased the probabilities of one other bounce from the $60k demand zone. The Open Curiosity was additionally in decline and outlined bearish sentiment.

Right here’s why this retracement is wholesome in the long term

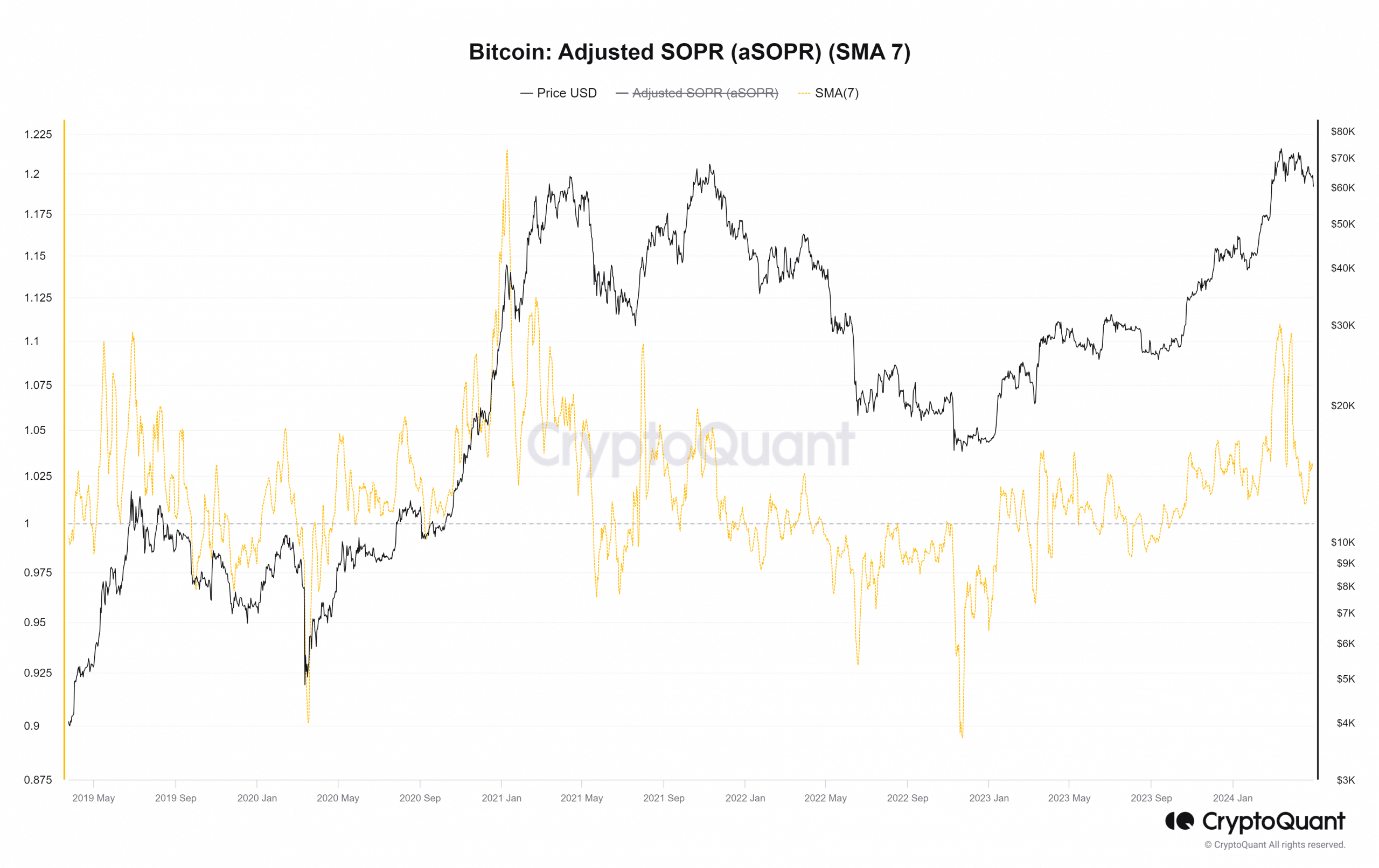

Supply: CryptoQuant

The adjusted spent output revenue ratio (aSOPR) noticed an enormous upward transfer to 1.1 a month in the past however has fallen to 1.029 at press time. In Might and August 2020, an analogous situation performed out.

As soon as the overeager bulls had been pressured to deleverage, the market noticed a extra sustainable rally, supported by spot demand.

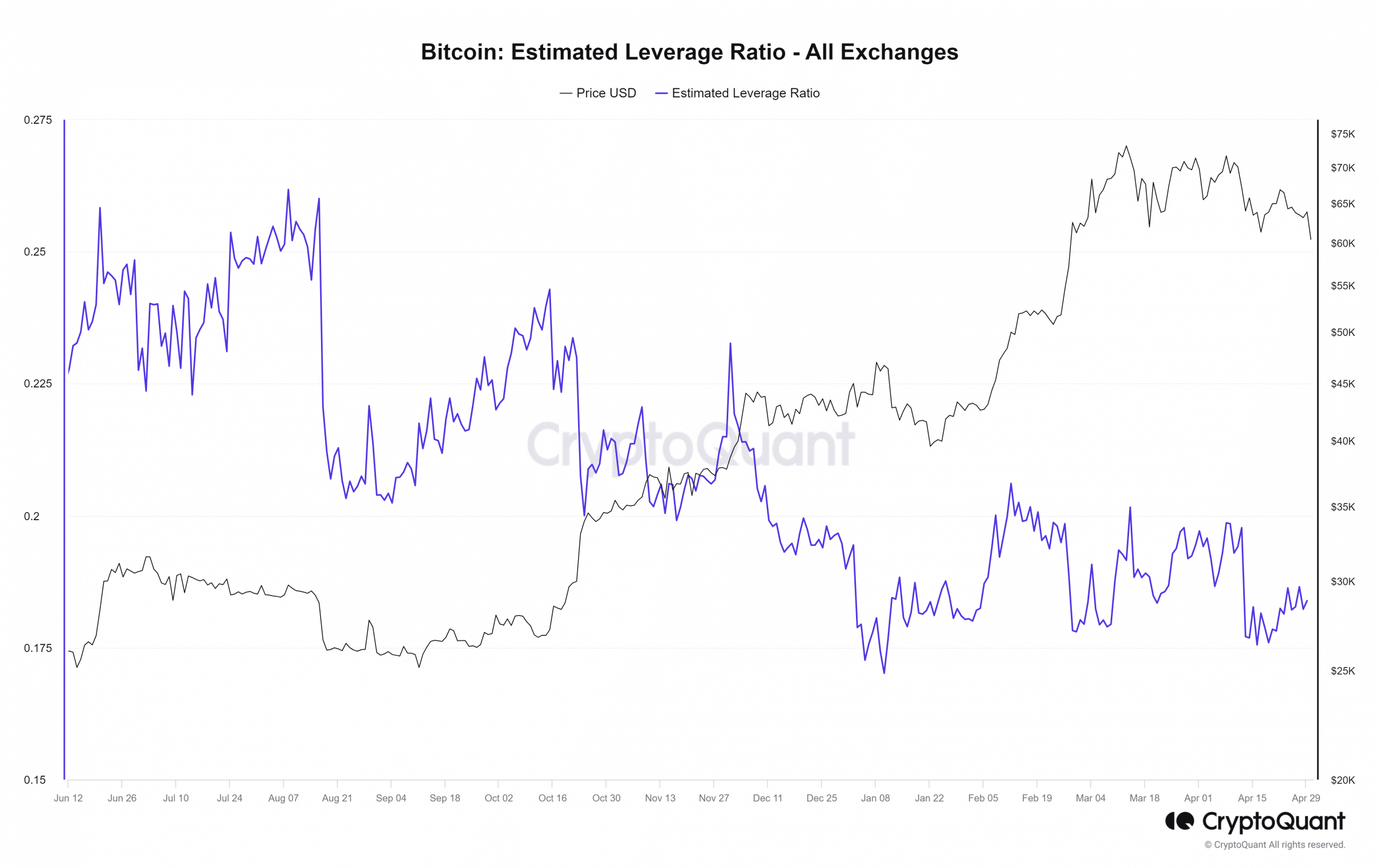

Supply: CryptoQuant

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The estimated leverage ratio jumped previous 0.18 a number of occasions in 2024 however was pressured to fall again. This confirmed that overleveraged positions have largely been worn out by the most recent drop.

Nevertheless, it doesn’t imply BTC will see a constructive value response. A transfer beneath the $59.4k mark will seemingly see costs fall to the $55k and $52k help zones.