- The stash was acquired in July 2021 when BTC was valued at simply $7.57.

- An analyst attributed such incidents to sell-side liquidity disaster.

About 500 Bitcoins [BTC], inactive for almost 12 years, have been transferred to a number of new wallets not too long ago, piquing the curiosity of the broader cryptocurrency market.

In keeping with Lookonchain, the stash, price $35 million at press time, was acquired in July 2021. At the moment, BTC was valued at simply $7.57.

No conclusive data was out there in regards to the entity and nature of the switch as of this writing.

Nevertheless, if one have been to go by the populist perception that the pockets making ready for a sell-off, they’d most likely find yourself profiting by a whopping 9247x.

A broader market pattern?

AMBCrypto investigated additional and observed a broader pattern of dormant cash changing into lively these days.

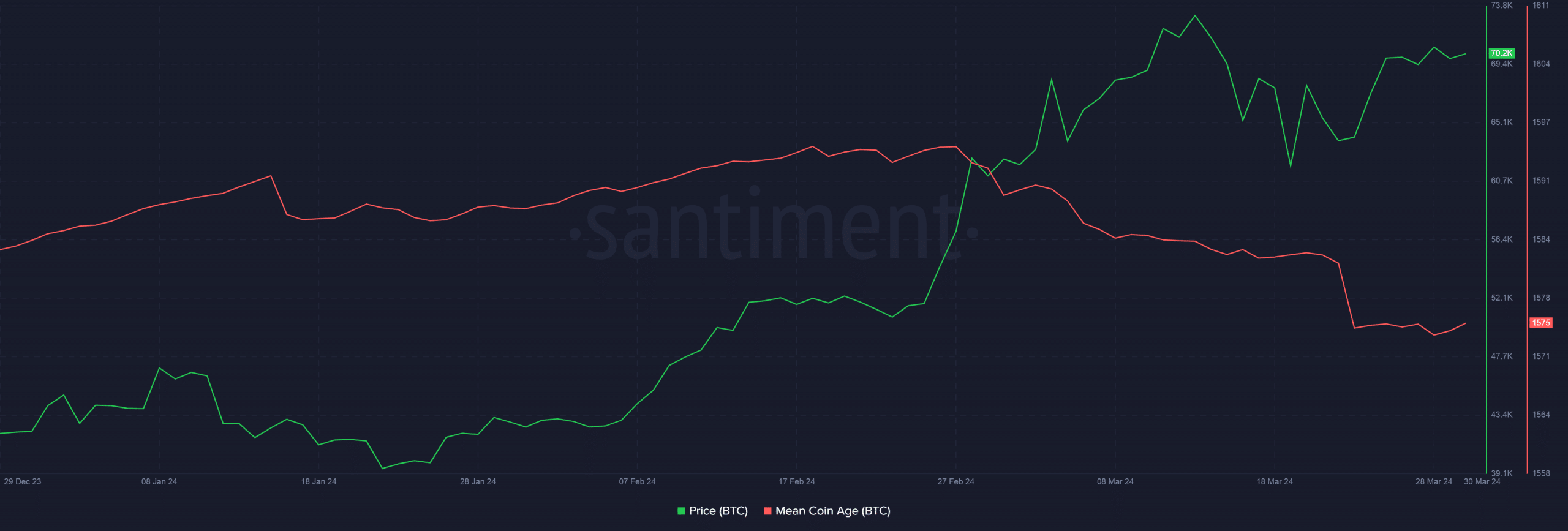

Santiment’s Imply Coin Age indicator — which measures the common quantity of days all BTC tokens stayed of their respective addresses — dropped steadily all through March.

What might be the explanations?

There might be a number of elements behind actually previous Bitcoins transferring on-chain instantly.

Firstly, it might be doable that pockets holder was locked out of their BTCs attributable to lack of personal keys or the chilly pockets. As soon as they retrieve the keys, they begin transferring Bitcoins.

Nevertheless, examples like these are few and much between.

Secondly, numerous long-term holders (LTH), who patiently waited for Bitcoin’s worth to soar exponentially, may lastly determine to promote and lock in good points.

Ki Younger Ju, CEO of on-chain analytics agency CryptoQuant, attributed the latest incidents of previous cash motion to Bitcoin’s sell-side liquidity disaster.

For the uninitiated, a sell-side liquidity disaster happens when there are usually not sufficient Bitcoins to be purchased. This usually occurs when demand strongly exceeds provide.

With the introduction of spot ETFs, Bitcoin’s demand, particularly from institutional buyers, has been unrelenting.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Alternatively, Bitcoin’s manufacturing has did not match this demand, inflicting a scarcity of provide out there for buying and selling.

Because of this, previous cash may begin transferring, hoping to capitalize on the heightened demand.