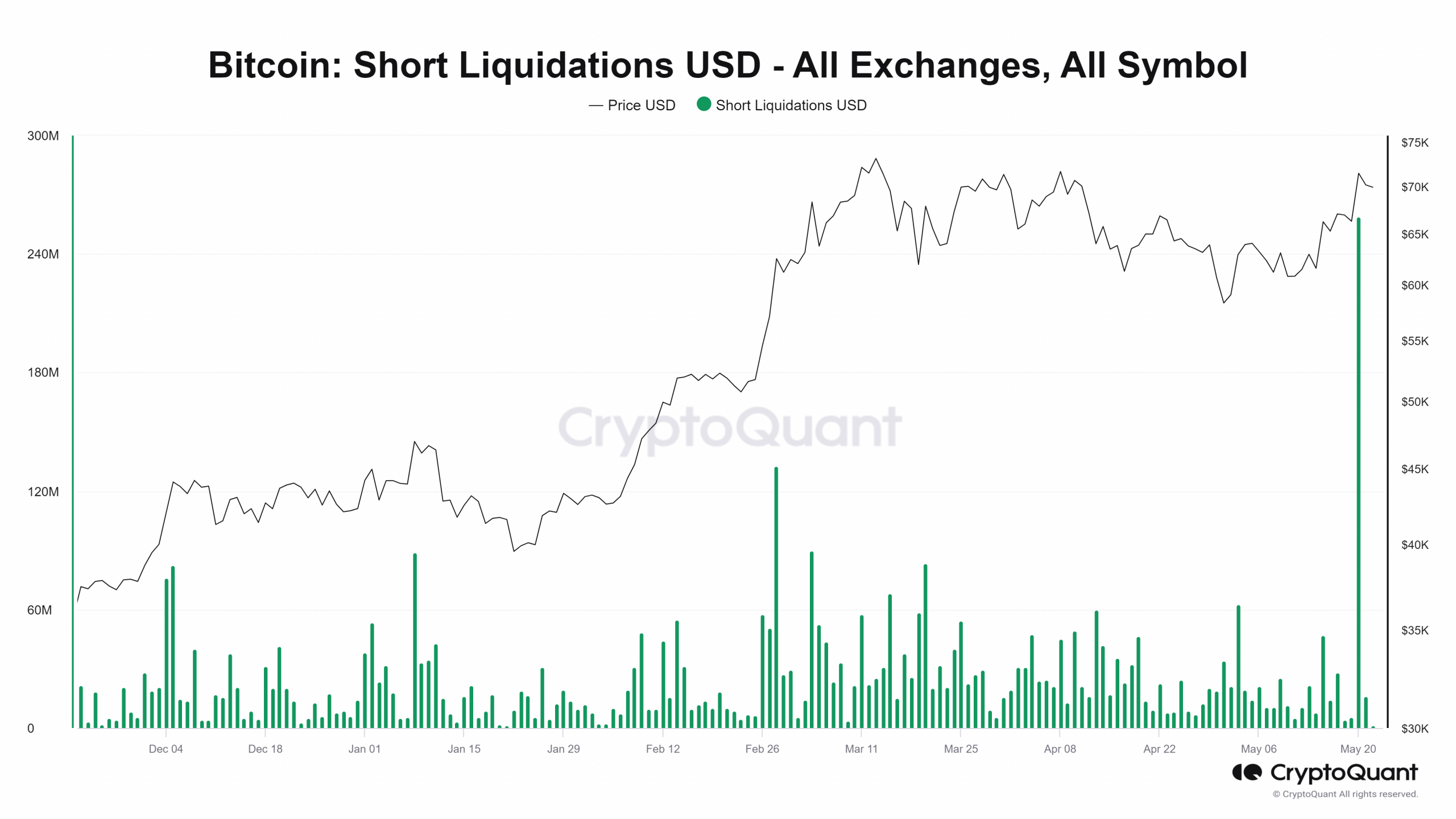

- BTC noticed the most important quantity of brief liquidation in virtually two years.

- BTC has slipped beneath the $70,000 worth zone.

Bitcoin [BTC] is poised for a pivotal yr in 2024, doubtlessly making historical past or repeating previous tendencies. Just lately, its worth surge triggered the most important brief squeeze since 2022, resulting in a major rise in Open Curiosity quantity.

Though the value has since declined, this might be an indication of one other main transfer forward.

Bitcoin knocks out brief merchants

Like a boxing match, Bitcoin and the market have been going head-to-head within the ring. Many spectators guess towards Bitcoin rising victorious, however the reverse noticed them counting their losses.

This state of affairs performed out lately when an increase in BTC’s worth led to an enormous liquidation of brief positions. Based on CryptoQuant, by the top of buying and selling on twentieth Might, over $259 million briefly positions have been worn out.

This occasion, referred to as a brief squeeze, happens when the value of an asset rises sharply, forcing merchants who had guess on a worth drop to shut their positions. Based on knowledge, this was the most important brief contract liquidation since 2022.

In a brief sale, merchants borrow shares of an asset, anticipating its worth to drop to allow them to purchase it again at a cheaper price, return the shares, and pocket the distinction.

If the value rises as a substitute, they need to purchase again the shares at the next worth, incurring a loss. That is what occurred with Bitcoin, driving up the quantity of its Open Curiosity.

Bitcoin Open Curiosity climbs

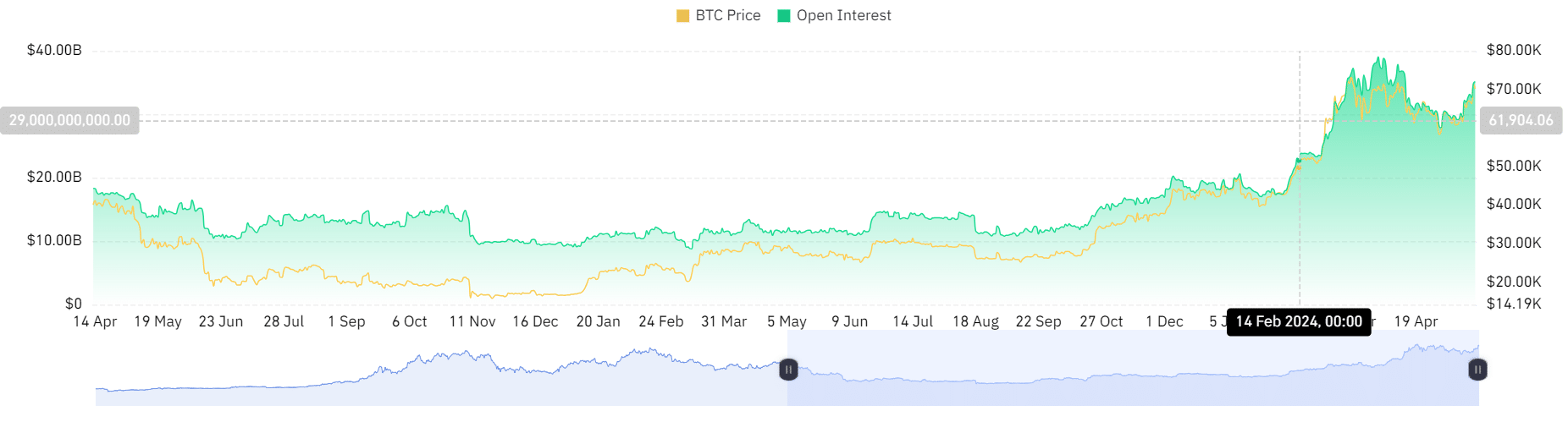

An evaluation of Bitcoin Open Curiosity on Coinglass indicated a considerable latest money influx.

One impact of brief liquidations is that closing positions prompts extra patrons to create new positions, inflicting extra money to circulate into the asset, on this case, Bitcoin, and growing the Open Curiosity.

As of now, BTC’s Open Curiosity was $35 billion. Regardless of the value of BTC falling beneath the $70,000 vary within the final 24 hours, Open Curiosity has continued to rise.

This means that extra merchants are nonetheless betting on one other worth enhance along with brief positions being settled.

How BTC has trended

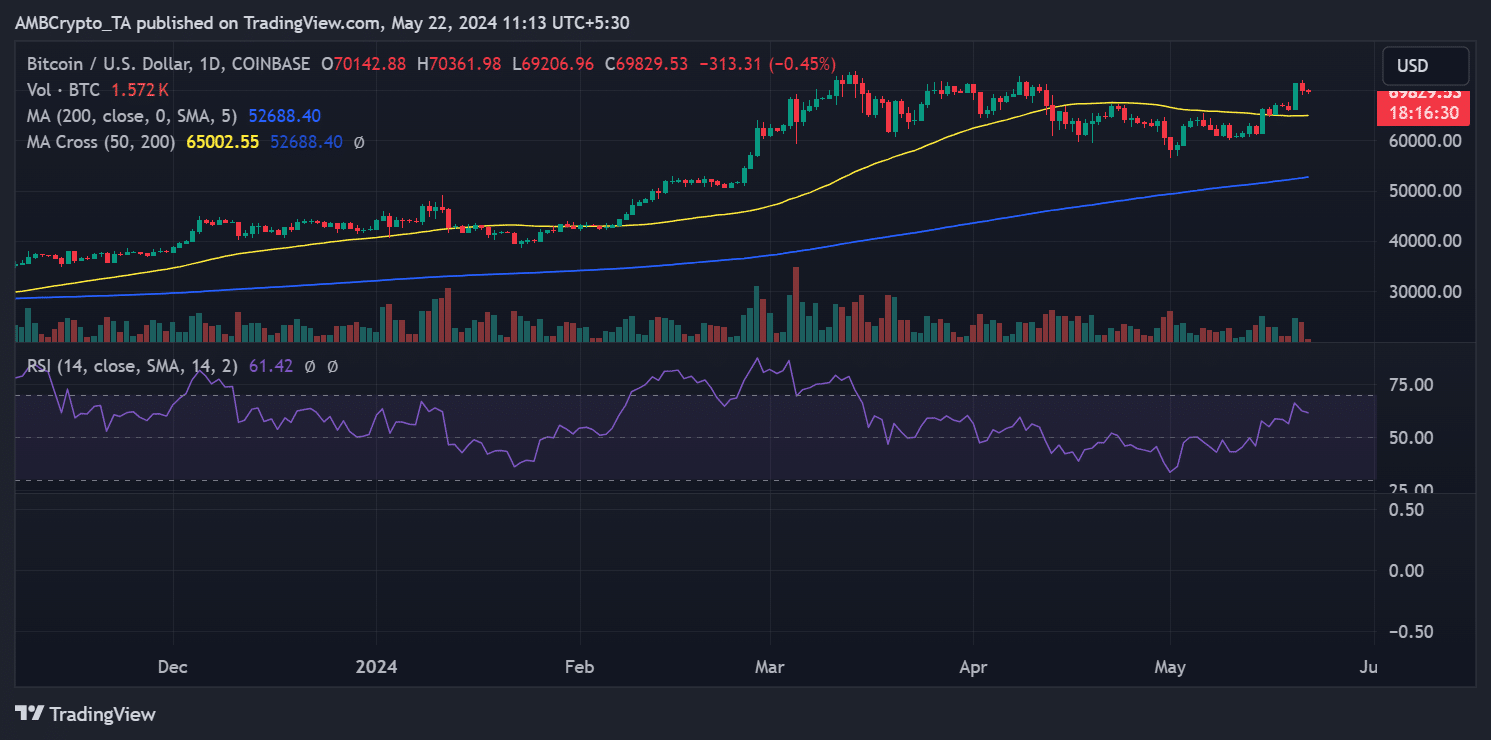

Based on AMBcrypto’s evaluation of Bitcoin on a day by day time-frame, BTC fell from the $71,000 vary by the top of buying and selling on twenty first Might. The chart indicated a decline of roughly 1.8%, bringing the value to round $70,142.

Learn Bitcoin (BTC) Worth prediction 2024-25

As of this writing, BTC was buying and selling at about $69,830, reflecting a decline of lower than 1%. Brief sellers would possibly see this as a possibility to guess towards Bitcoin, however many will nonetheless be observing the pattern.

BTC has managed to rise above its brief Transferring Common (yellow line) and turned it into help round $66,000. If this help holds, BTC would possibly quickly check the $75,000 worth zone.