- Bullish sentiment soars as halving occasion nears.

- Nevertheless, some indicators counsel the potential of an extra drop in BTC’s worth.

Because the market awaits a worth hike post-Bitcoin’s halving occasion, pseudonymous CryptoQuant analyst Gaah famous in a brand new report {that a} additional decline within the coin’s worth continues to be doable.

The halving occasion, scheduled for the nineteenth of April, is anticipated to cut back the variety of BTC in circulation by slashing miner rewards in half, from 6.25 BTC to three.125 BTC.

Historical past books inform us this in regards to the coin’s subsequent transfer

Traditionally, the coin’s worth has surged following halving occasions. In accordance with Bloomberg’s knowledge, BTC’s worth climbed 8,691% one 12 months after the 2012 halving, 295% after the 2016 occasion, and 559% after the 2020 occasion.

Regardless of latest market troubles, these precedents have led to a spike in bullish sentiment. Nevertheless, based on Gaah, some indicators trace at the potential of an extra decline in BTC’s worth.

Gaah assessed BTC’s Funding Charges on a 30-day shifting common and famous that it has climbed,

“To the levels of the 2021 all-time high.”

When an asset’s Futures Funding Charge witnesses a surge and are considerably constructive, it suggests a robust demand for lengthy positions.

It’s thought-about a bullish sign and a precursor to an asset’s continued worth progress.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Nevertheless, excessively excessive Funding Charges improve the chance of lengthy liquidations, usually resulting in excessive market volatility and unpredictable worth swings.

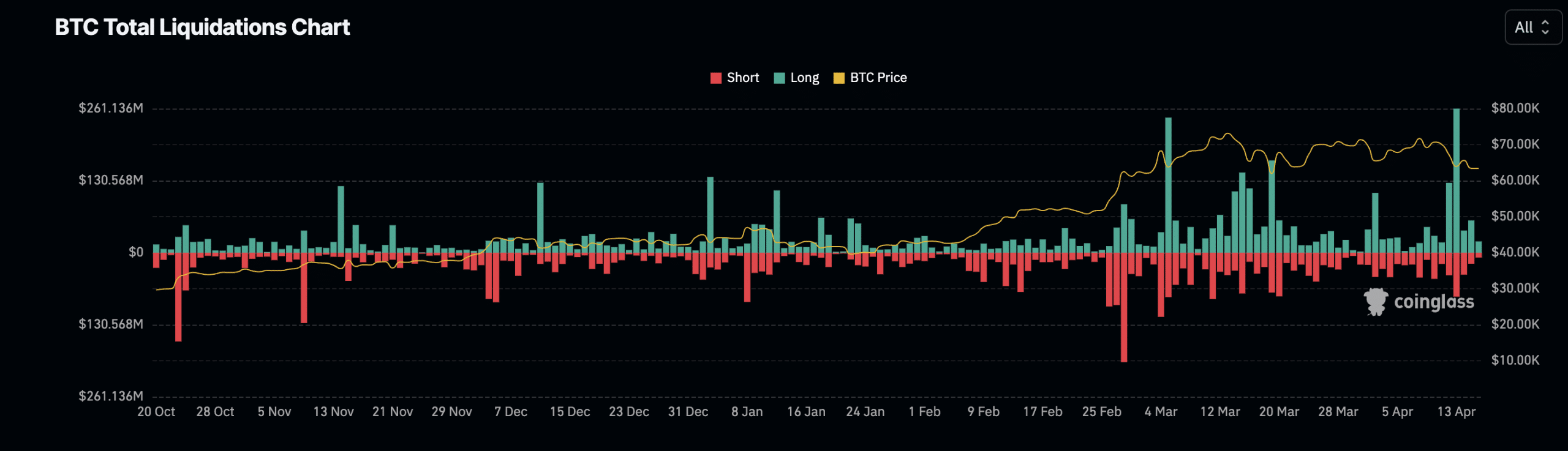

This occurred on the thirteenth of April, when the coin’s worth out of the blue fell from the $67,000 worth area to shut the day at $62,000.

On that day, lengthy liquidations rose to a multi-month excessive of $261 million, based on AMBCrypto’s take a look at Coinglass’ knowledge.

Gaah famous that BTC’s present all-time excessive, $73,750, represents,

“Its greatest resistance ever.”

This implies there may be excessive promoting stress at this worth degree, making it tough for the worth to rally previous it to succeed in new highs.

Moreover, Gaah discovered that the rally in BTC’s worth since October 2023 has spiked retail exercise out there, saying,

“It’s the first time in 3 years that the Retail flow hasn’t reached values above the mid-range, strongly indicating the presence of this category of investors in the market.”

Taking a cue from BTC’s historic efficiency, the analyst famous {that a} spike in BTC’s retain exercise –

“Means a potential top is in the making.”

Therefore, a worth drop could also be on the horizon.