- Bitcoin veterans realized income on their BTC stashes.

- The dip within the on-chain spent output ratio may very well be a warning of a deeper correction.

Bitcoin’s [BTC] SOPR metric fashioned one more peak, and buyers have purpose to concern market volatility.

The previous ten days noticed an uptick in promoting strain forward of the halving as uncertainty set in. Lengthy-term holders (LTHs) contributed to this strain.

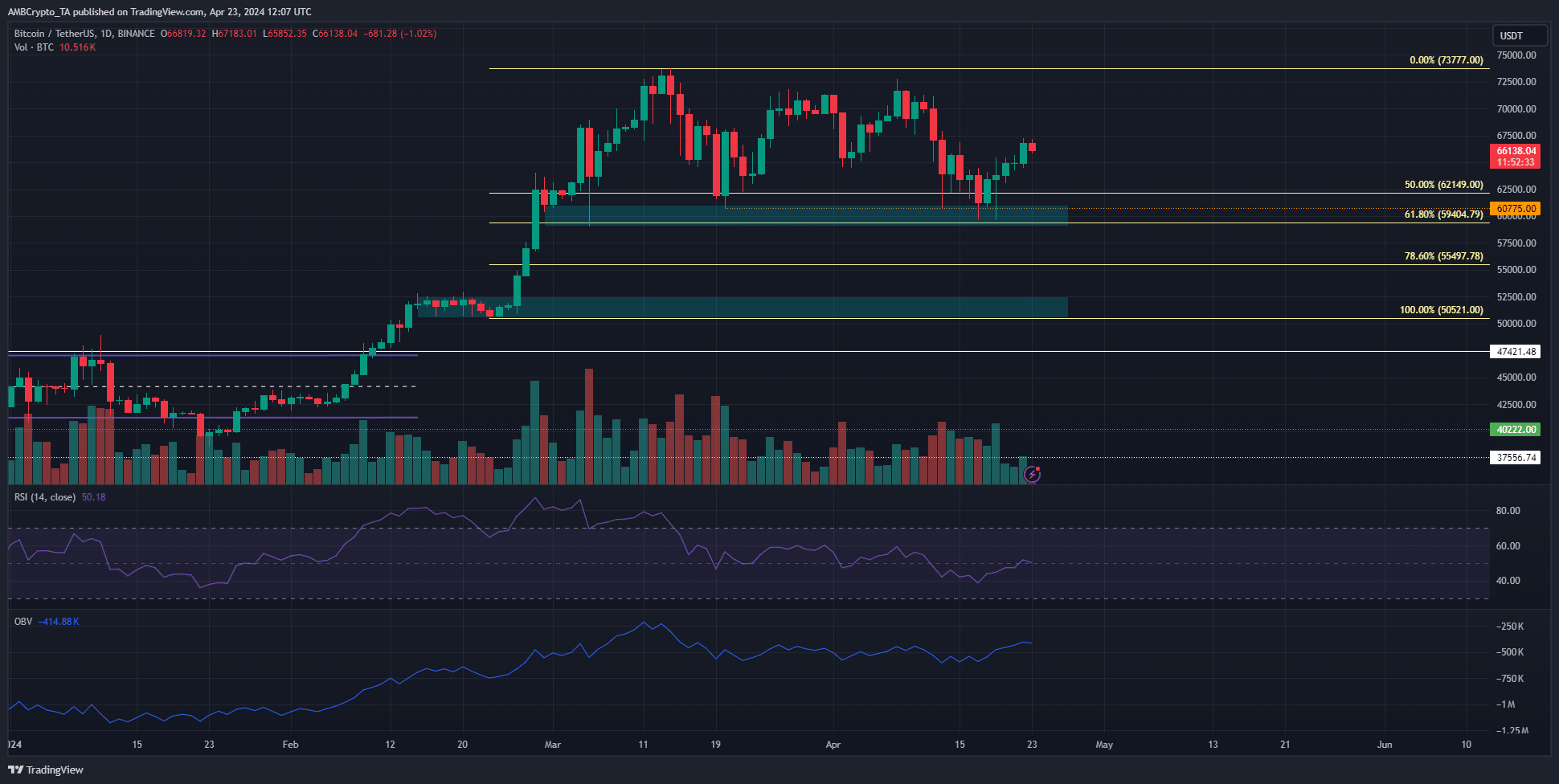

Evaluation of the liquidation heatmap in an earlier AMBCrypto report confirmed that the $66k-$66.8k area was an vital short-term resistance.

BTC has not crossed above this zone, heightening the possibilities of volatility within the coming days.

The SOPR trendline and why merchants ought to take word

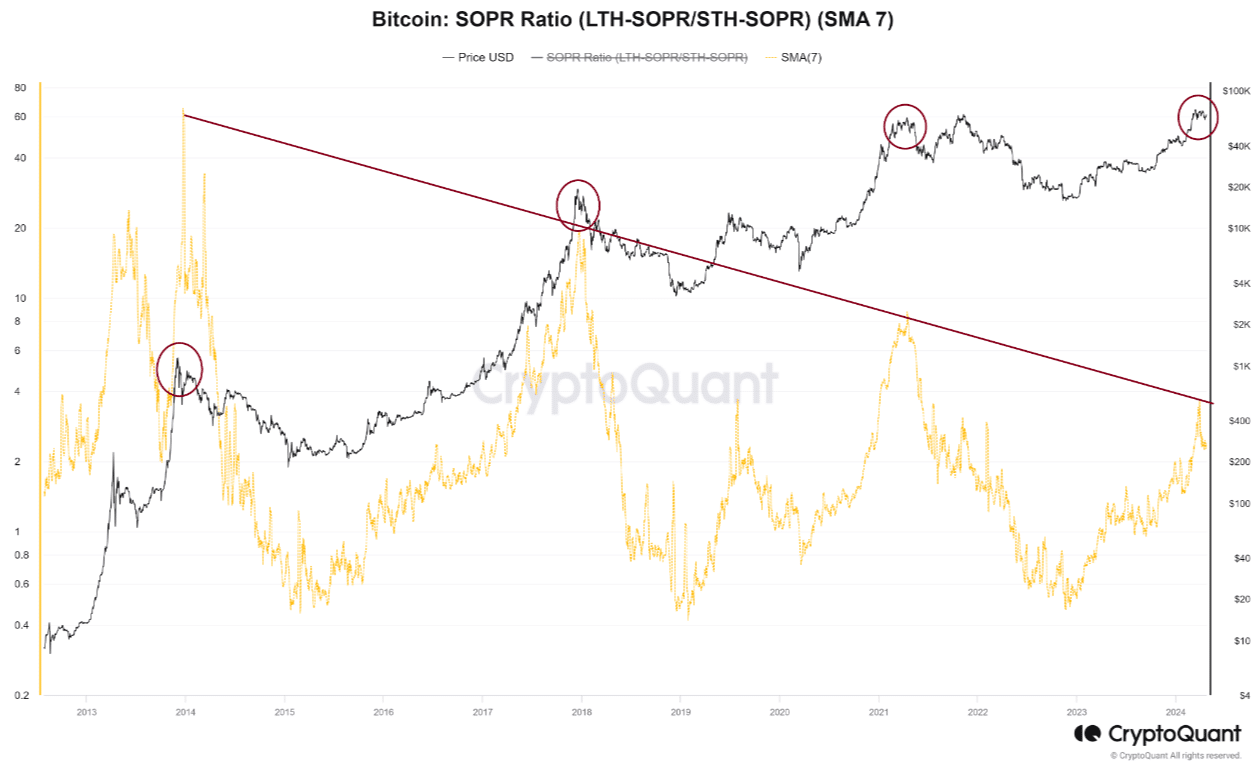

The Spent Output Revenue Ratio (SOPR) displays the diploma of realized revenue and loss for all cash moved on-chain.

It’s measured because the ratio of the USD worth of Bitcoin’s spent outputs on the frolicked, or realized worth, to the spent outputs on the created worth.

This enables analysts to get a good suggestion of whether or not holders are at a revenue. Per CryptoQuant Insights, a selected variation of the SOPR ratio confirmed that an rising quantity of long-term holders have been cashing out.

Supply: CryptoQuant

The descending trendline from a decade in the past confirmed {that a} potential market high was upon us. The potential for a deeper Bitcoin correction was current because of the metric’s agency rejection from this trendline.

Quick-term holders’ exercise — what’s the present worth pattern for Bitcoin?

Supply: CryptoQuant

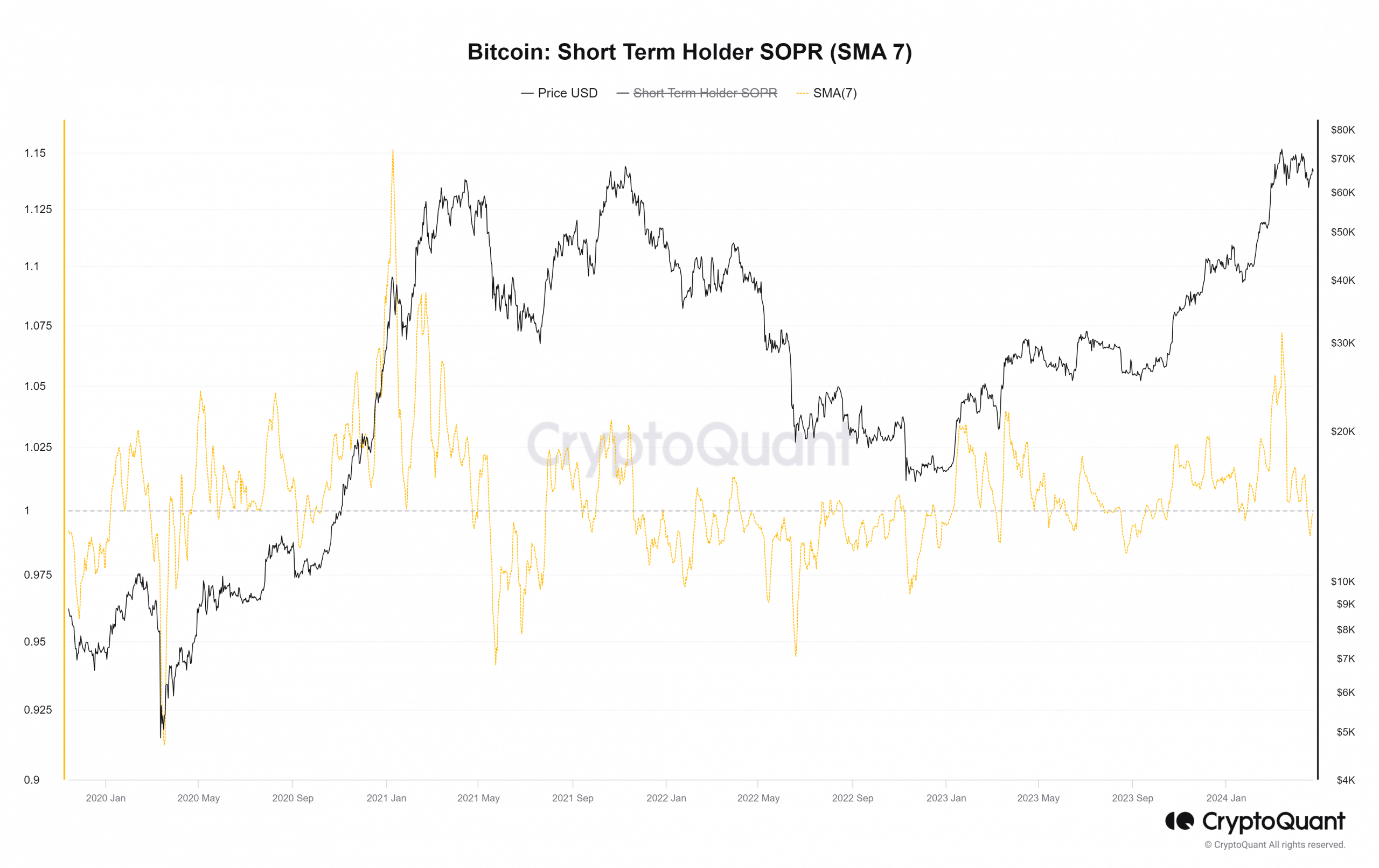

The short-term SOPR offers with Bitcoin alive for over one hour however lower than 155 days. The STH SOPR fell to 0.998 on the twenty second of April, exhibiting that short-term buyers have been promoting at a minor loss.

Evaluating it with the 2020 bull run, the metric didn’t drop under zero after September. The halving for that cycle was in Could, and a correction in August noticed this ratio fall under 1.

Bitcoin could also be shifting down the same path throughout this cycle.

The each day chart confirmed that Bitcoin was buying and selling inside a spread since March. The upper timeframe pattern and market construction have been firmly bullish.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, the RSI has meandered between 40 and 60 values prior to now month, exhibiting an absence of sturdy momentum.

The OBV was additionally unable to avoid the highs it made in mid-March. Encouragingly, it has crept larger prior to now ten days to replicate elevated shopping for strain. Total, a worth correction remained attainable.