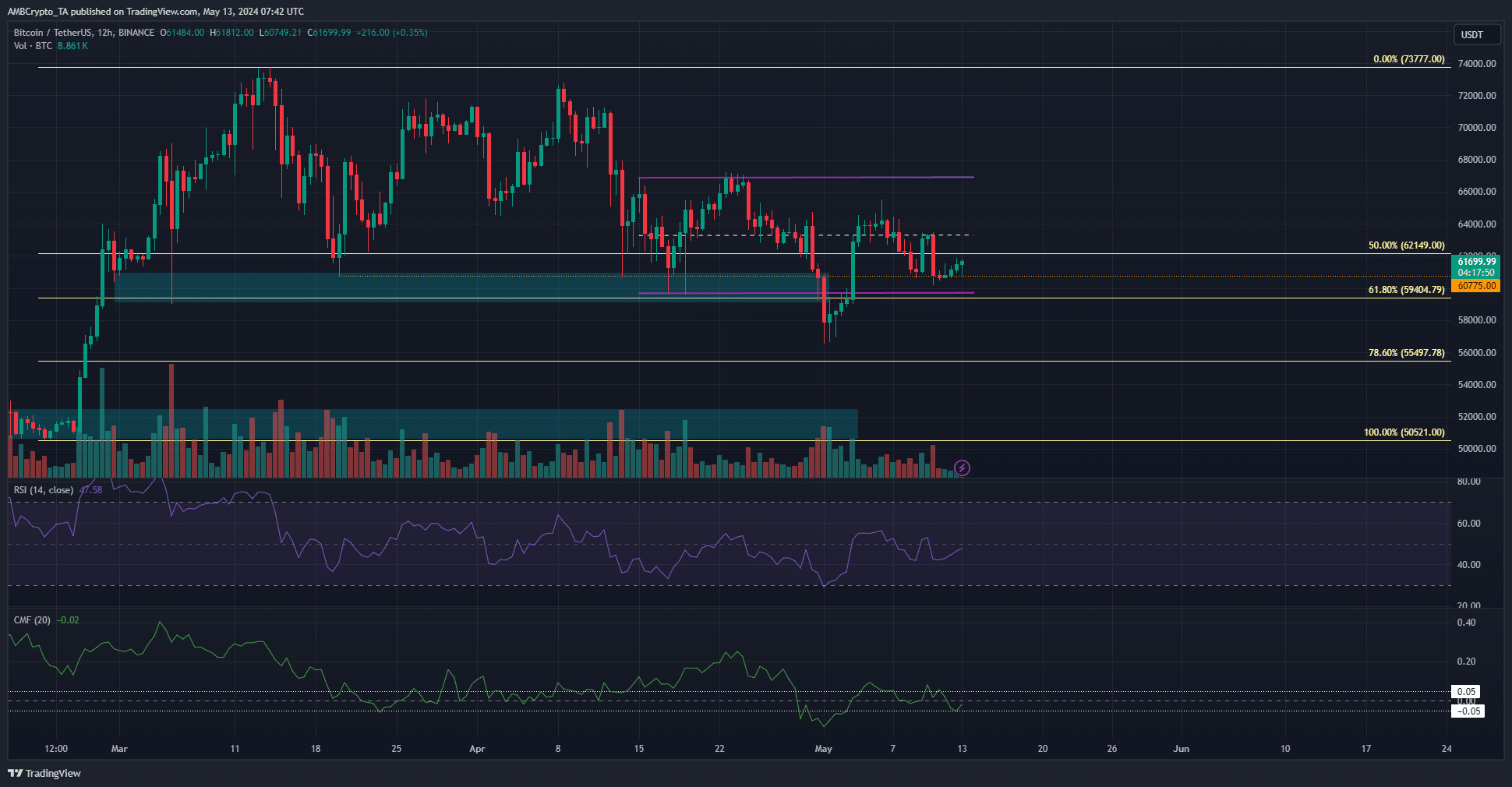

- Bitcoin has a bearish short-term outlook with its collection of decrease highs prior to now month

- The drop to $56.5k meant the liquidity beneath it could possible be examined quickly

Bitcoin [BTC] clung to the $60.7k assist stage over the weekend, however its short-term bearish expectation held weight.

A current AMBCrypto liquidity evaluation confirmed the place a worth reversal may happen for this week’s worth motion.

Information of two dormant wallets, inactive for practically 11 years, waking as much as promote BTC value $60.9 million may spook market contributors. The report additionally highlighted a drop in key on-chain Bitcoin metrics.

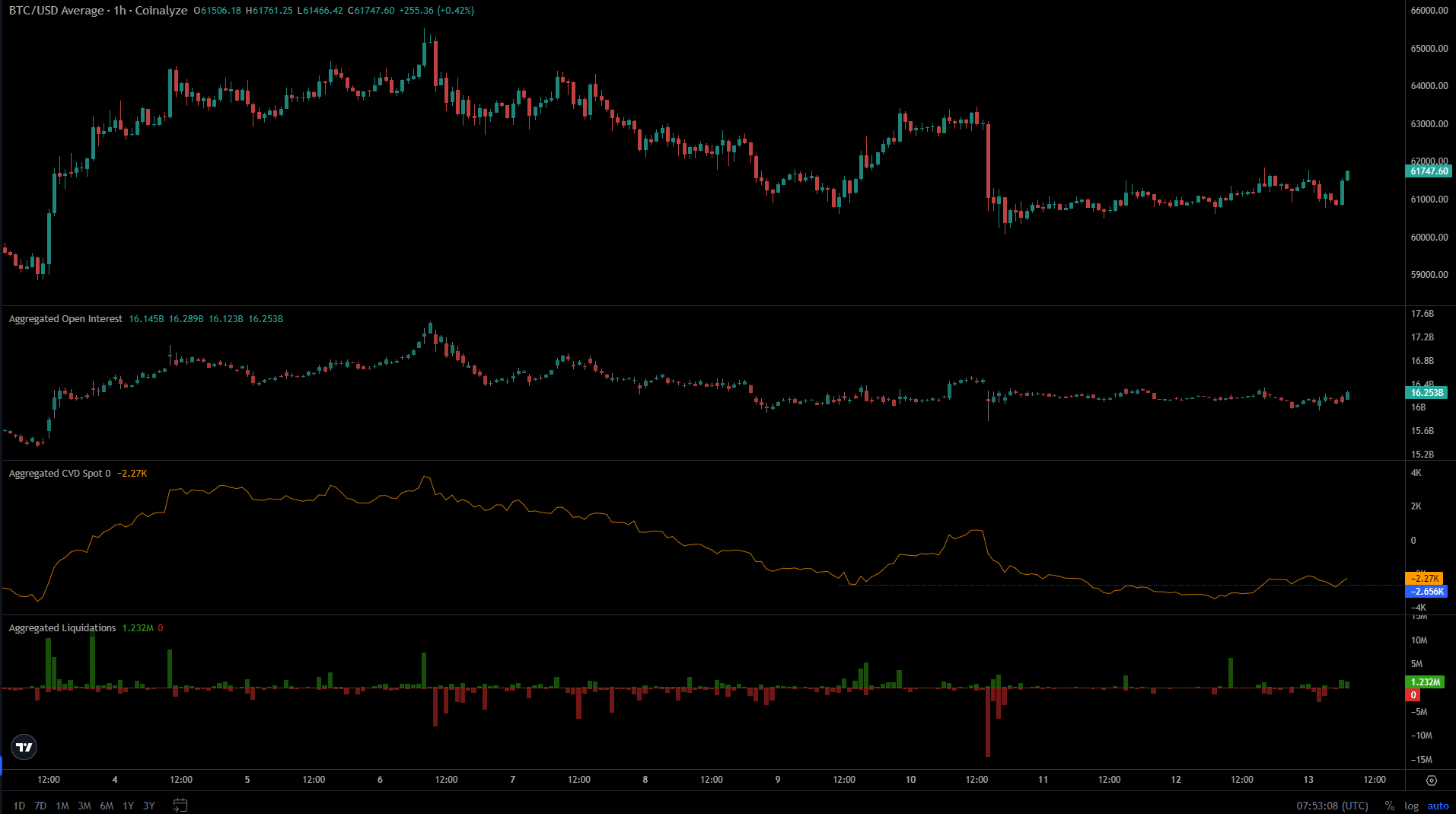

The capital inflows for BTC confirmed indecisiveness

The vary formation was breached conclusively on the first of Could, when Bitcoin dropped like a rock to $56.5k. Despite the fact that it bounced to $65.5k per week later, its decrease timeframe market construction was bearish.

AMBCrypto’s Bitcoin worth prediction leans towards a drop to the $56k mark and doubtlessly decrease. At press time, it possessed regular downward momentum, signaled by the RSI’s studying of 47.

The value has fashioned decrease highs since mid-April.

The 78.6% HTF Fibonacci retracement stage at $55.5k is perhaps revisited earlier than the underside is in. It’s unclear how issues would unfold, however merchants and buyers ought to be ready for this state of affairs.

The spot CVD disagreed with the CMF indicator’s findings

Supply: Coinalyze

Capital influx and bullish conviction are vital for an asset to development upward. The Open Curiosity chart has been passive and lackluster over the previous week as Bitcoin additionally struggled to type a development.

Nonetheless, the spot CVD started to climb increased, and reclaimed a former short-term assist stage.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This indicated shopping for strain within the spot markets. Moreover, the previous two days noticed brief positions liquidated.

This pressured market purchase orders of the liquidated place and, if the development continues, may see Bitcoin bounce increased.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.