- Bitcoin’s Open Curiosity surged 9% on the weekly shifting common.

- Technical evaluation and short-term holder income confirmed a bullish breakout was extremely probably.

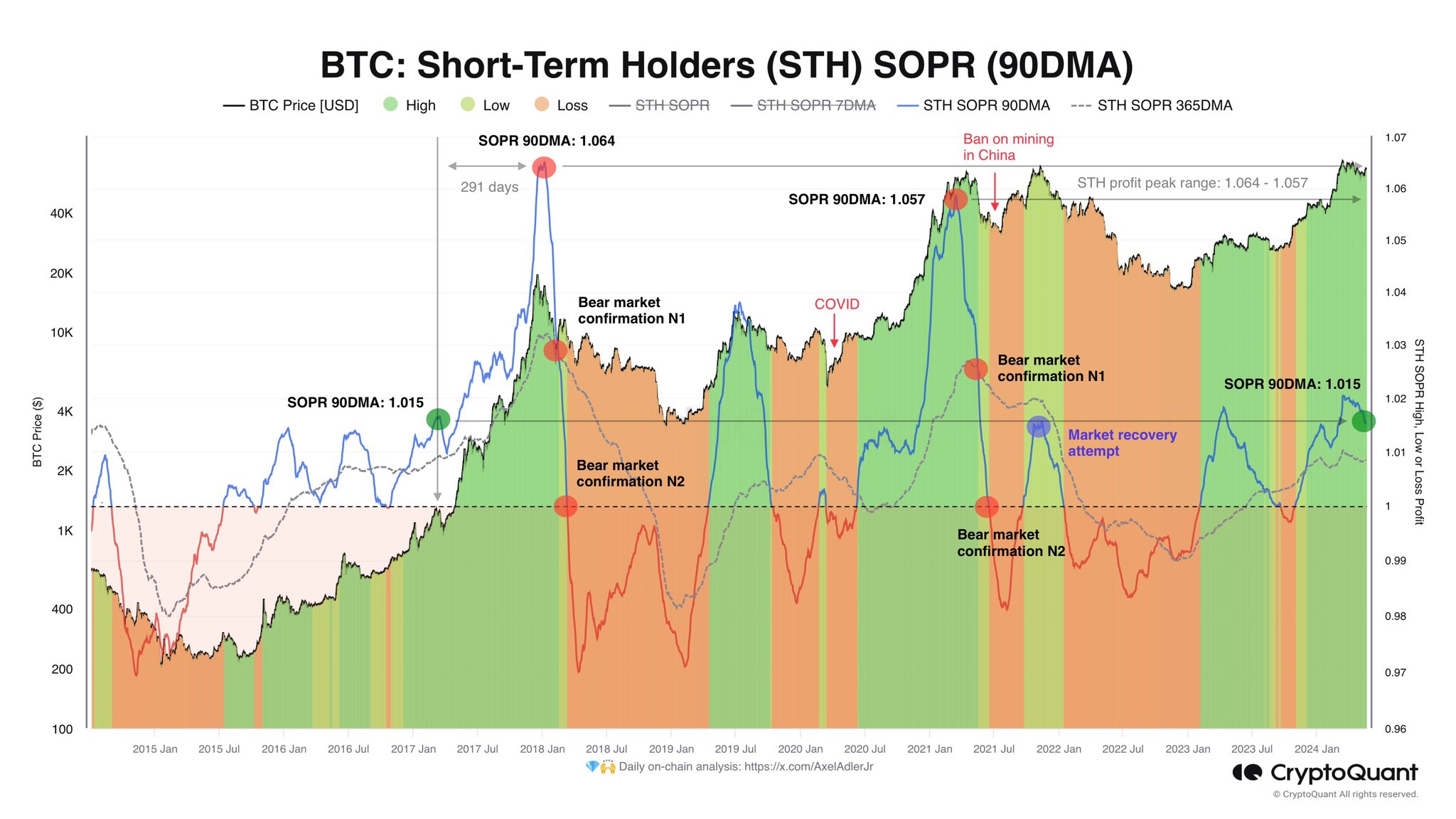

Bitcoin [BTC] may enter a 300-day bull run, in keeping with crypto analyst Axel Adler. Information from CryptoQuant for the Quick-term holder income, he acknowledged that the bull market was in full swing.

With costs simply 4.2% beneath the $73.7k ATH from two months in the past and the halving occasion previous us, the shopping for stress could be trending larger right here on.

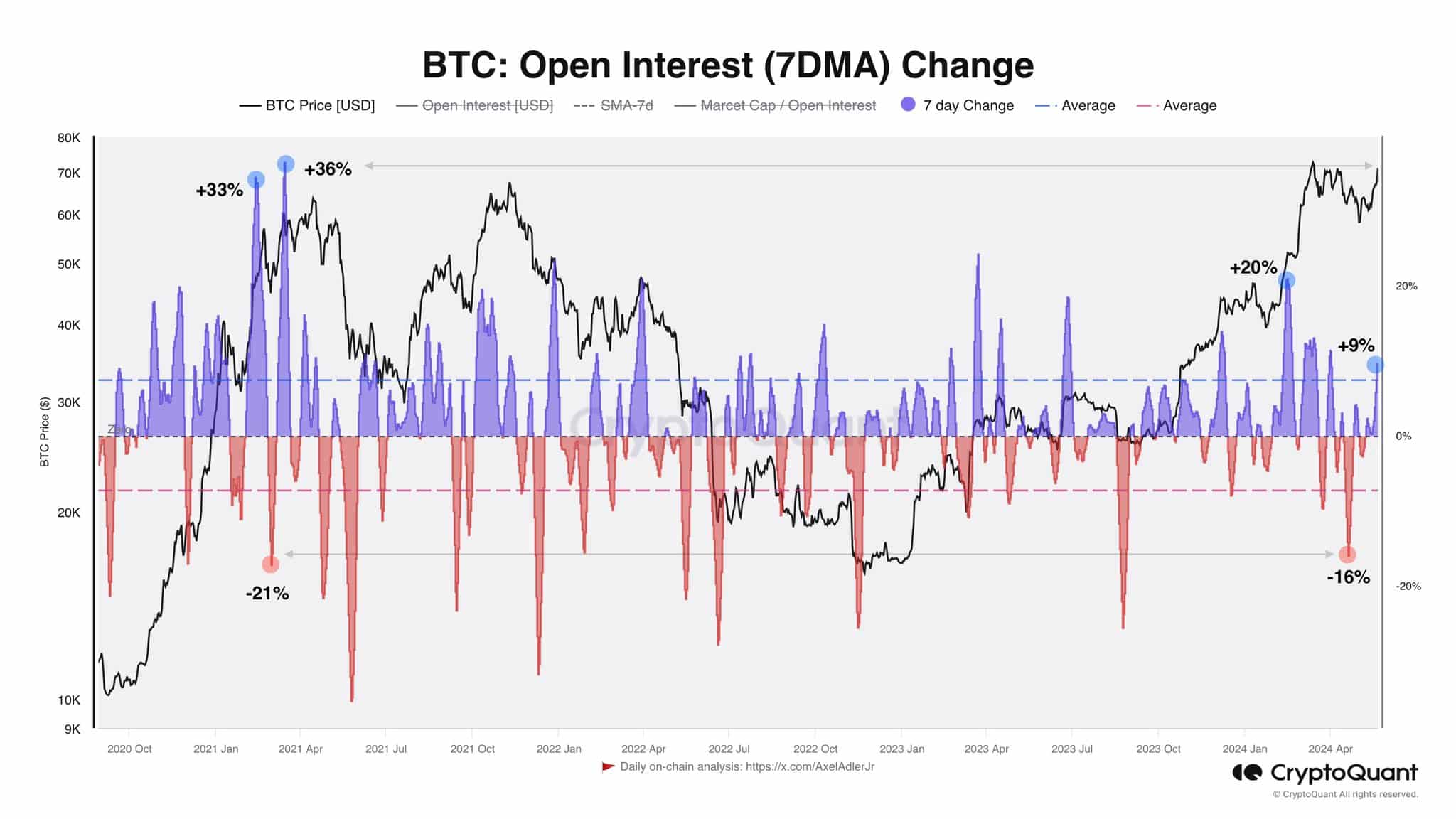

The Open Curiosity instructed that there’s extra room for costs to develop.

Assessing the earlier peaks and what they forecast for the long run

Supply: Axel Adler on X

The 90-day SMA for the short-term holder spent output revenue ratio (STH SOPR) peaked at 1.064 in January 2018 and at 1.057 in March 2021. This instructed that the STH revenue peak vary is at 1.064-1.057.

At press time, the STH SOPR’s 90-day shifting common was at 1.015.

This indicated that there’s extra room for good points and the highest was very probably not in. Moreover, there have been 291 days between the SOPR 90DMA reaching 1.015 and the cycle peak.

Nonetheless, there have been solely 105 days between the identical values within the 2020-21 cycle. Therefore, we could be in for anyplace from three to 12 months of a bull run.

Supply: Axel Adler on X

The analyst additionally identified that 7-day shifting common of the Open Curiosity was solely up 9% through the current transfer.

By comparability, the 2024 January one had 20%, with the 2021 run additionally seeing a number of OI 7DMA strikes shut to twenty%.

Taken collectively, each observations assist the concept the Bitcoin market has solely begun to rally.

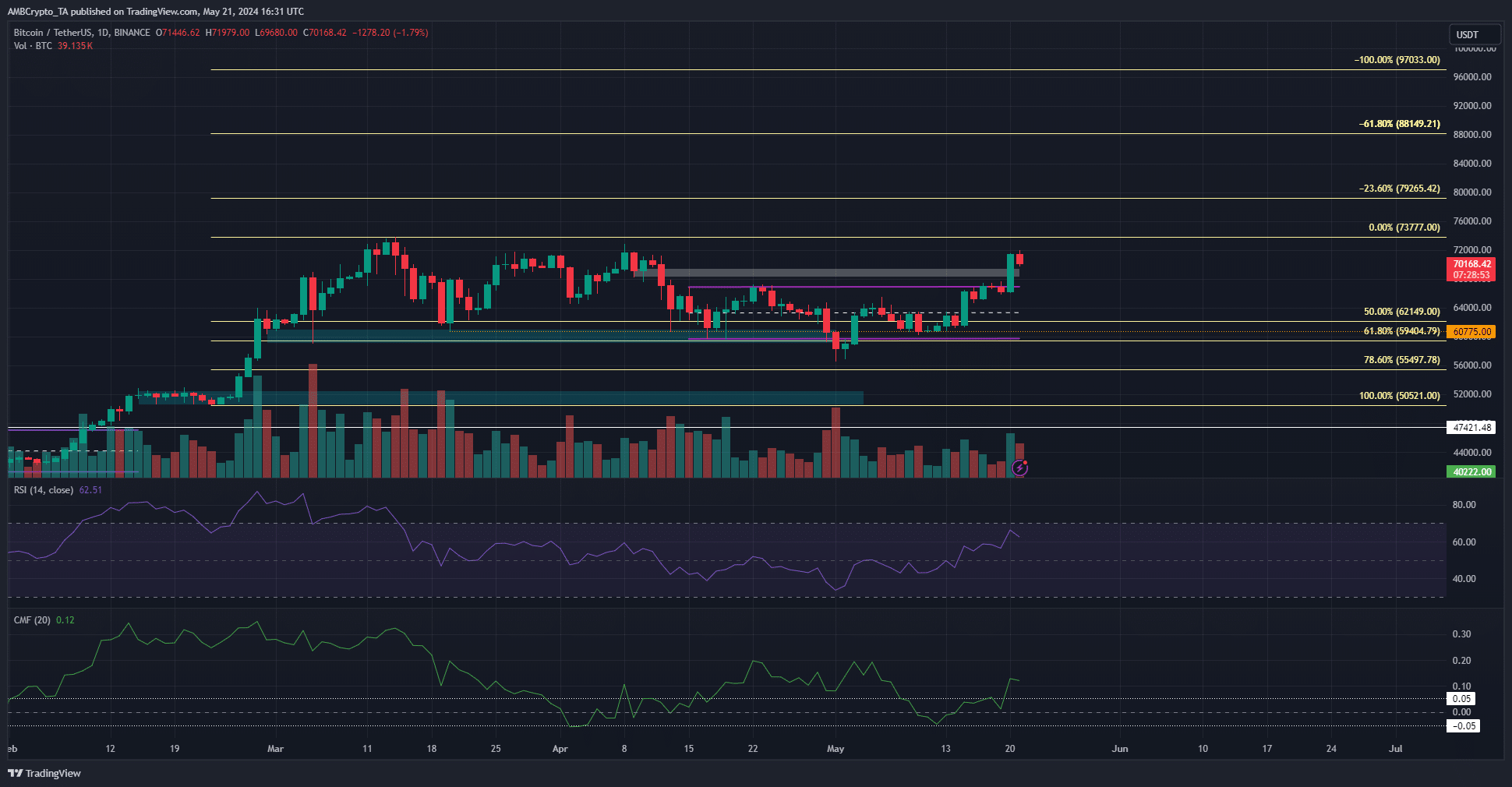

What are the resistance ranges to be careful for previous the ATH?

The native vary (purple) and imbalance (white) have been each convincingly damaged. The excessive at $73.7k might be swept apart quickly if the momentum continues.

The RSI has not but pushed previous 70, which might be a robust signal of BTC bullish dominance close to the all-time excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The CMF surged previous +0.05 to indicate vital capital influx and elevated demand.

The Fibonacci extension ranges (pale yellow) confirmed that $79.2k, $88.1k and $97k are the subsequent resistance ranges to be careful for.