- BTC’s worth moved marginally within the final 24 hours.

- Metrics and indicators prompt that BTC would possibly flip risky within the subsequent seven days.

A number of traders speculated a contemporary bull rally for Bitcoin [BTC] as its worth gained upward momentum on the third of Could.

Nevertheless, the expansion dropped because the king of cryptos’ worth solely moved marginally within the final 24 hours. Does this trace at one more worth correction?

Is Bitcoin really bullish?

Moustache, a preferred crypto analyst, just lately posted a tweet highlighting a couple of developments that hinted in direction of a bull rally.

For the uninitiated, BTC’s worth plummeted beneath $61k on the thirtieth of April. Nevertheless, the king coin managed to return again above that mark, turning it right into a help and hinting at an additional worth uptick.

The tweet highlighted that BTC bounded up after touching a key trendline. Traditionally, at any time when BTC’s worth rebounded after touching the trendline, its worth has risen sharply.

Moreover, the Relative Power Index (RSI) broke above a falling wedge sample. This indicated that the RSI would improve, which supported the opportunity of BTC’s bull run.

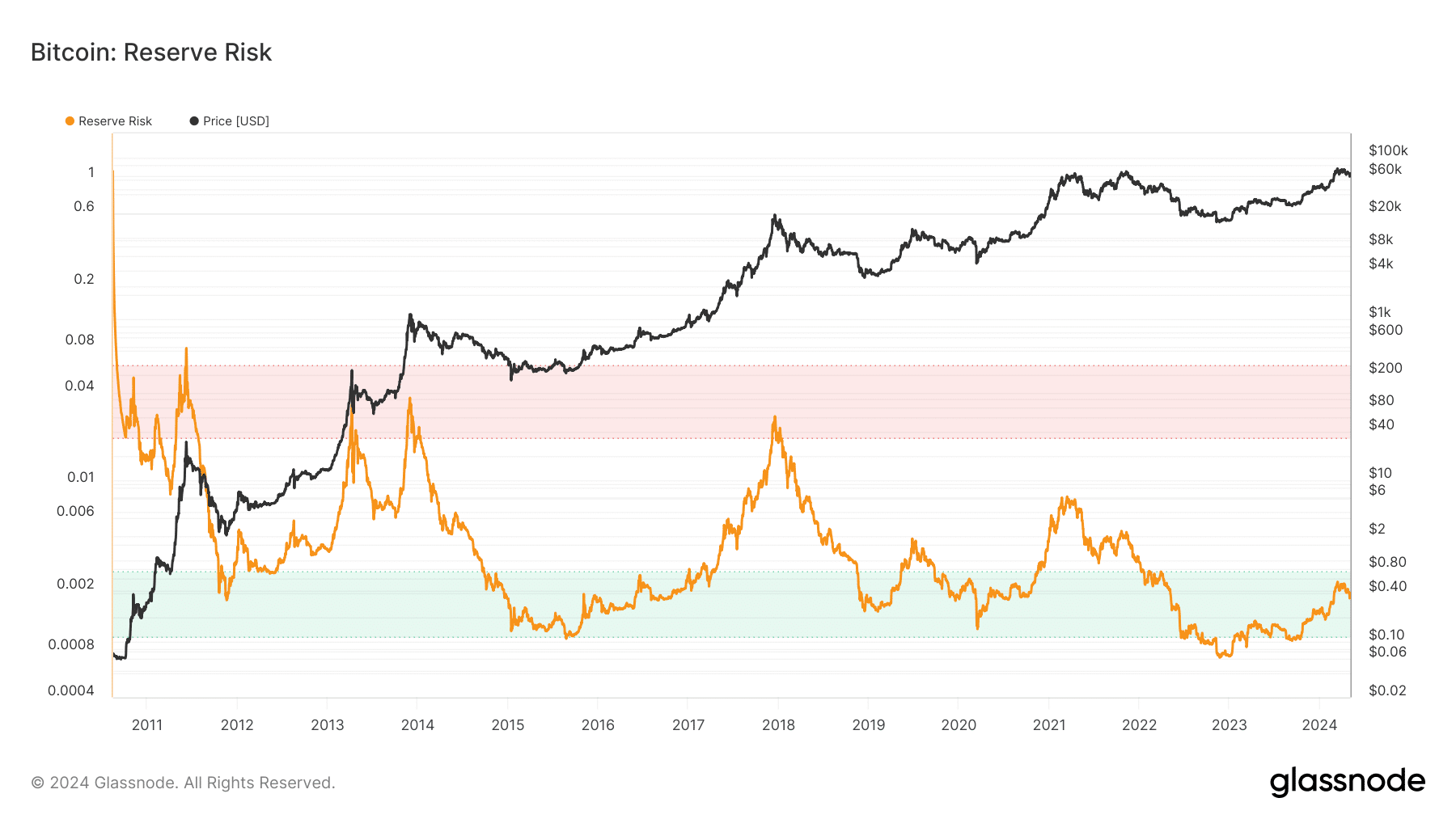

AMBCrypto’s take a look at Glassnode’s knowledge revealed one more bullish sign. We discovered that Bitcoin’s reserve danger gained upward momentum contained in the inexperienced zone.

Every time this occurred prior to now, BTC’s worth gained bullish momentum.

What to anticipate from BTC

Although these aforementioned metrics seemed bullish, BTC’s worth motion didn’t correspond. As per CoinMarketCap, BTC’s worth solely moved marginally within the final 24 hours.

On the time of writing, the coin was buying and selling at $63,368.70 with a market capitalization of over $1.25 trillion.

Nevertheless, traders mustn’t lose hope but, as a couple of metrics trace at a rise in BTC’s volatility.

AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed that BTC’s web deposit on exchanges was low in comparison with the final seven days’ common, suggesting low promoting stress.

The coin’s Coinbase premium was additionally inexperienced, which means that purchasing sentiment was dominant amongst U.S. traders.

A number of of the market indicators additionally prompt that BTC might flip risky in a northward route within the subsequent seven days.

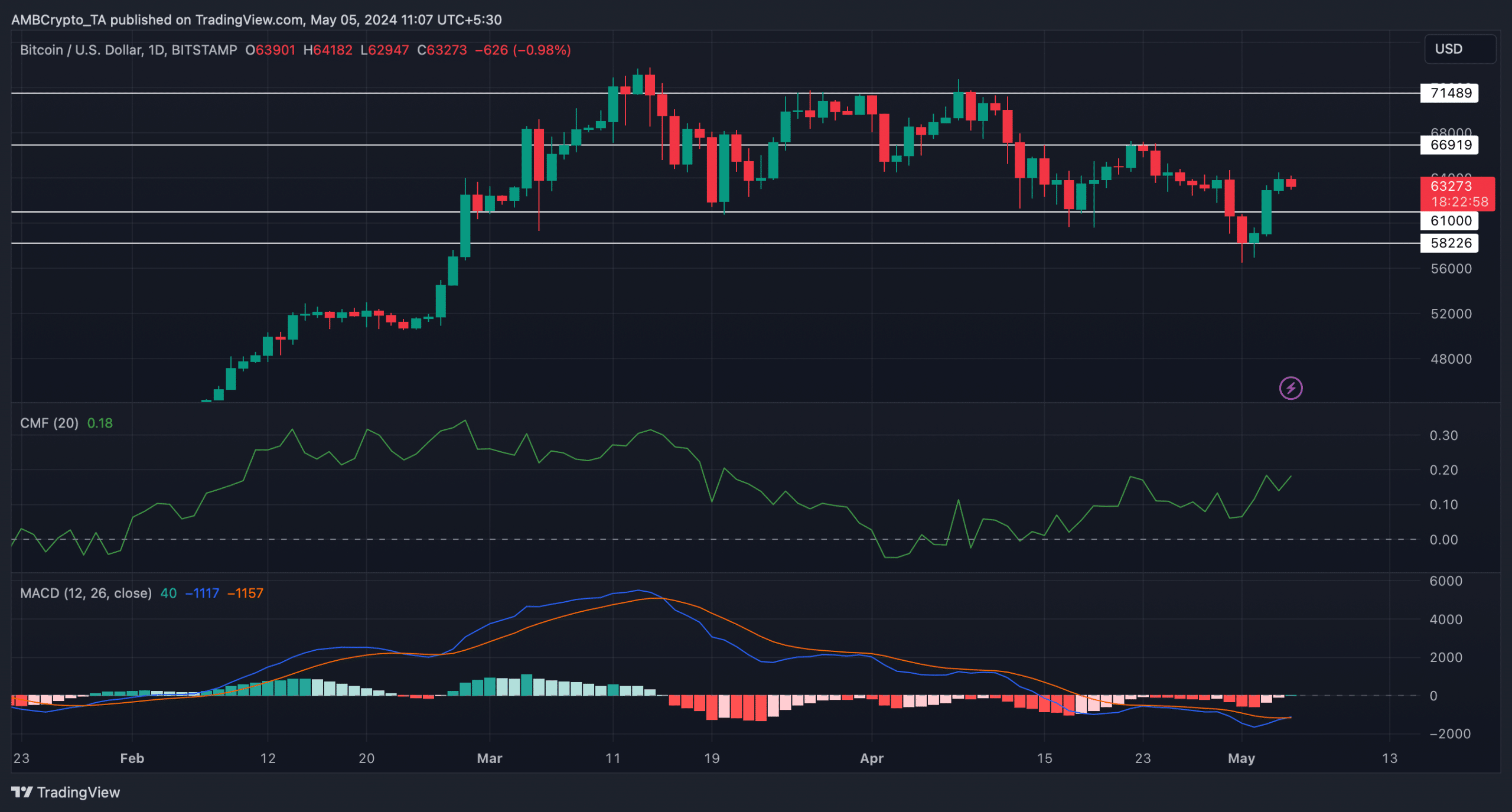

Notably, the coin’s Chaikin Cash Circulate (CMF) registered a pointy uptick. Its MACD displayed the opportunity of a bullish crossover.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

If BTC manages to show risky subsequent week, then it will likely be essential for the coin to go above the $66.9k resistance degree. A profitable breakout above that degree might permit BTC to the touch $71k.

If every thing stays bullish, then BTC may even cross its all-time excessive in coming days.