- Bitcoin’s worth uptick contrasted with merchants closing positions, indicating market warning.

- Evaluation steered a short-term surge to $65K earlier than a possible downtrend.

Bitcoin’s [BTC] market efficiency has just lately proven a notable uptick, with a 2.8% enhance prior to now 24 hours and a 6.8% rise over the week, pushing its worth to hover above the $63,000 mark.

This upward motion in worth comes amidst numerous market actions that recommend a extra advanced state of affairs than an easy bullish pattern.

Bitcoin: Strategic actions

Regardless of the constructive worth motion, deeper market evaluation revealed important conduct modifications amongst merchants.

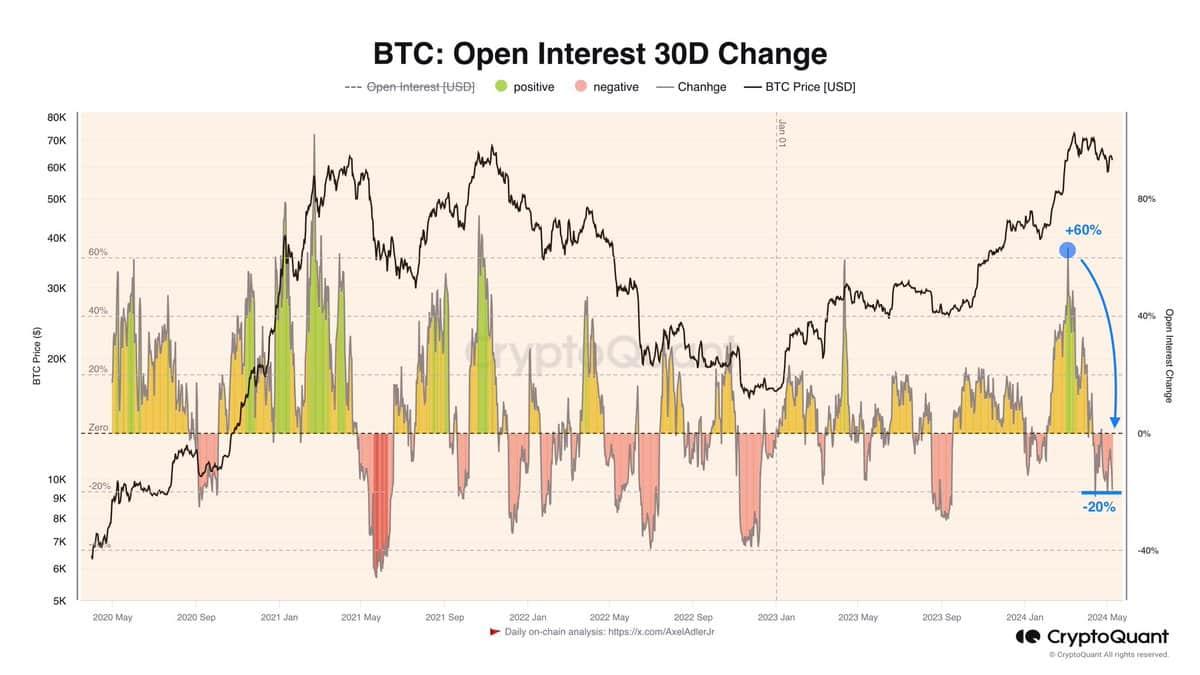

Axel Adler Jr, an analyst on the social media platform X (previously Twitter), using CryptoQuant information, has noticed that leveraged merchants on perpetual buying and selling platforms like Binance [BNB] are more and more closing their positions.

This pattern was highlighted by a -20% month-to-month change in Open Curiosity, indicating a cautious strategy the place extra merchants are opting to shut positions to attend and see how costs will evolve.

This cautious conduct amongst merchants shouldn’t be essentially indicative of a bearish outlook for Bitcoin.

Instead, Adler steered that this contraction in open positions mirrored a strategic, cautiously optimistic stance by merchants who are usually not exiting the market however are as an alternative ready for clearer indicators.

The analyst famous,

“I think the market needs this negativity for short positions to accumulate, which could then be used to push upwards.”

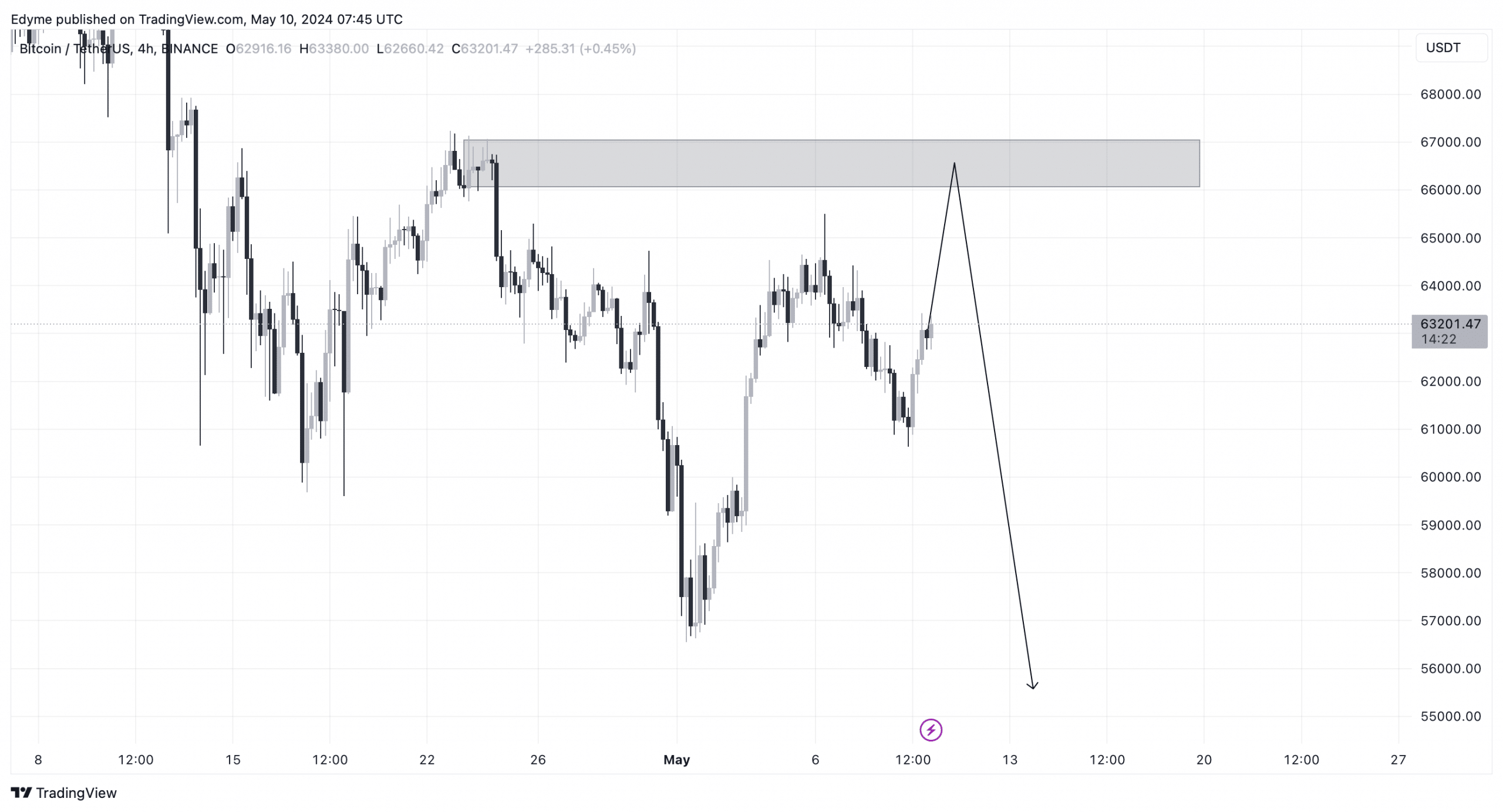

AMBCrypto’s look into Bitcoin’s market sentiment confirmed that whereas the king coin was bearish on the day by day chart, there is perhaps a short-term upward motion to across the $65,000 stage first.

This potential rise could possibly be a strategic play by the market to take out liquidity at larger ranges earlier than a extra important downturn, presumably going under the $56,000 area.

What do liquidation patterns recommend?

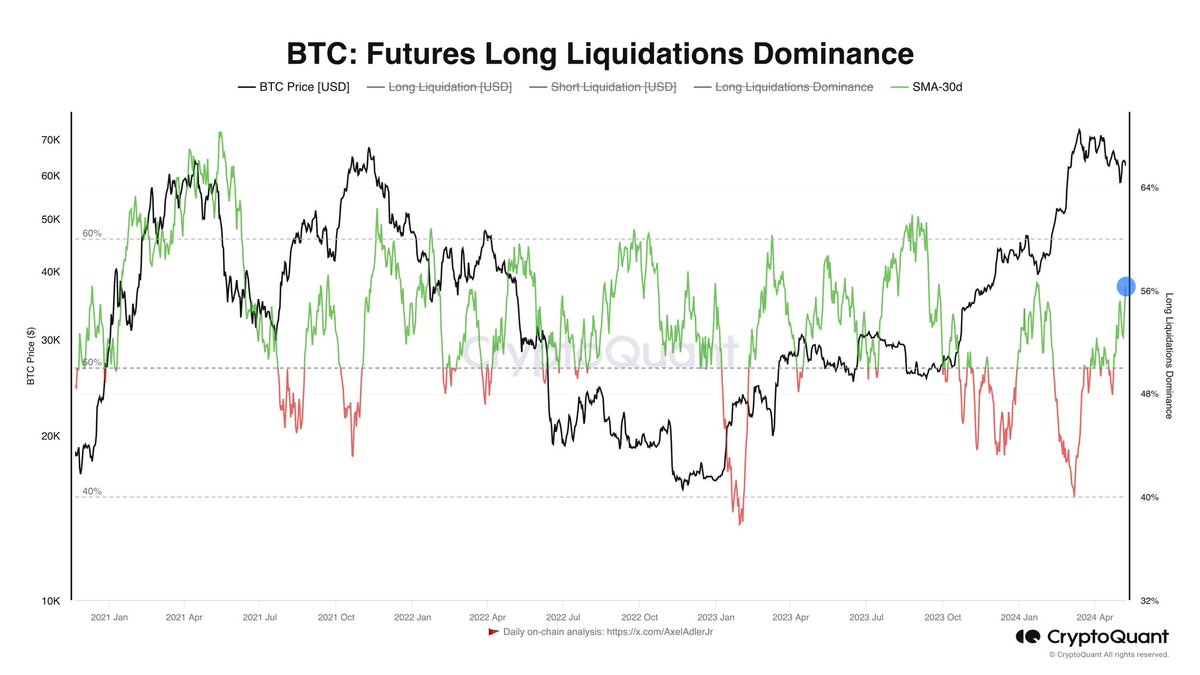

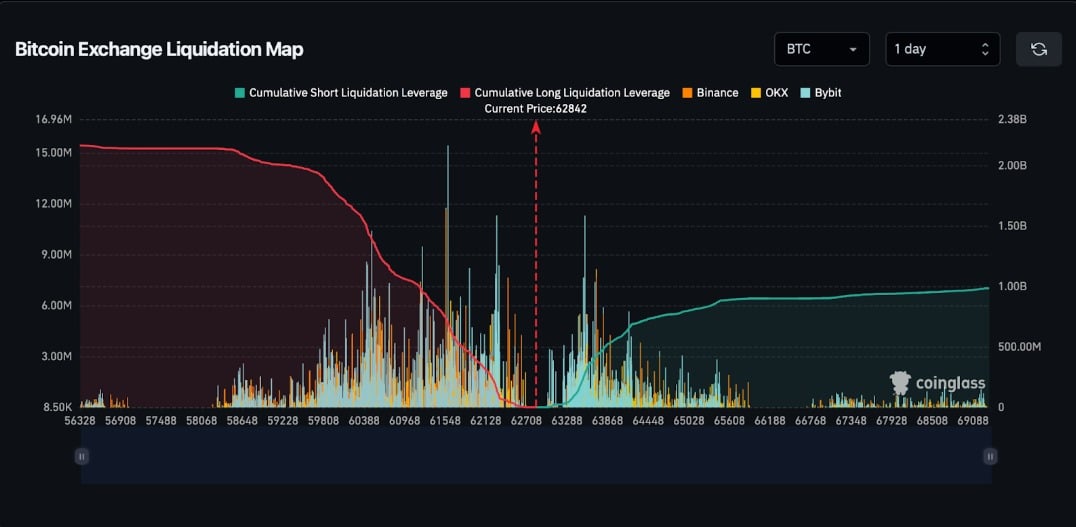

The market’s present state can be mirrored within the liquidation patterns noticed.

Knowledge from Coinglass confirmed that Bitcoin brief merchants outnumbered lengthy merchants at press time, with cumulative brief liquidations standing at $2.16 billion, in comparison with $984.31 million in lengthy liquidations.

This imbalance confirmed a prevailing expectation of additional worth drops amongst a considerable portion of market individuals.

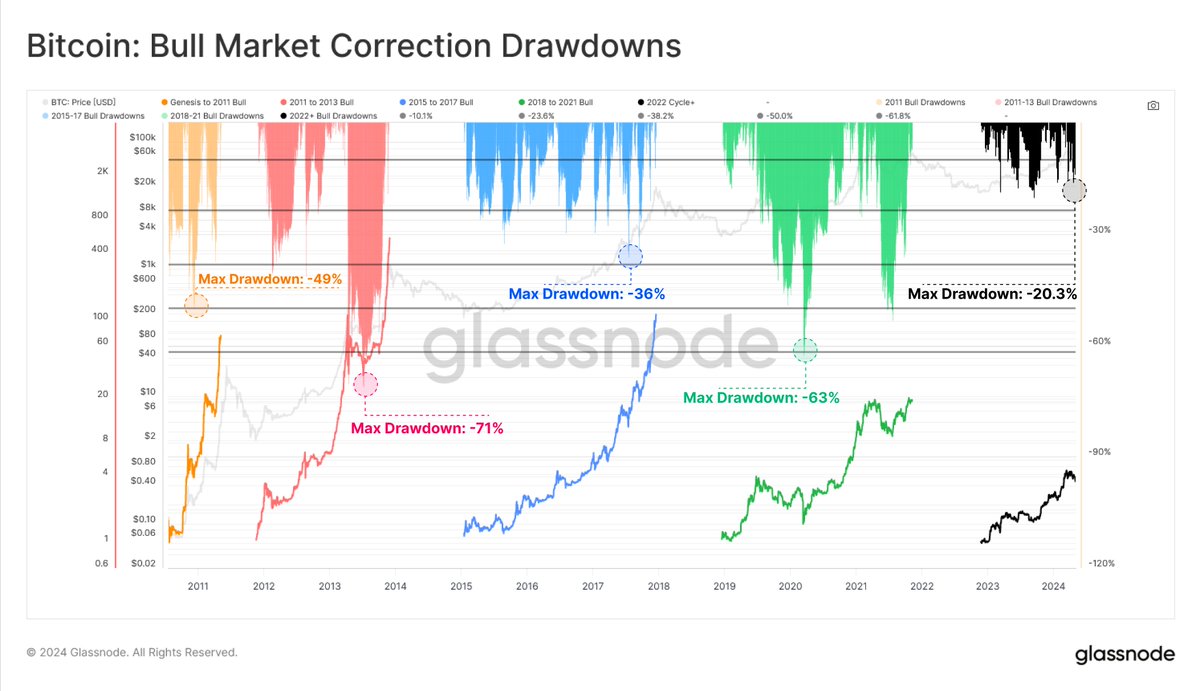

AMBCrypto’s take a look at Glassnode additionally added context to this sentiment, which famous that Bitcoin has to date recorded a 20.3% correction from its all-time excessive of $73,000.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This correction is the deepest on a closing foundation for the reason that lows following the FTX disaster in November 2022.

Nevertheless, Glassnode identified that the present macro uptrend remained resilient, with shallower corrections than in earlier cycles, indicating underlying market energy regardless of short-term fluctuations.