- Bitcoin spot ETF sees zero netflow.

- GBTC holdings proceed to say no.

Following the approval and launch of the spot Bitcoin [BTC] ETF, Grayscale’s Bitcoin holdings have skilled a decline. After the ETF’s launch, most platforms have witnessed zero flows for the primary time.

Grayscale’s Bitcoin holdings halves

An examination of establishments that not too long ago obtained spot Bitcoin ETF approvals revealed that Grayscale held the best BTC market capitalization.

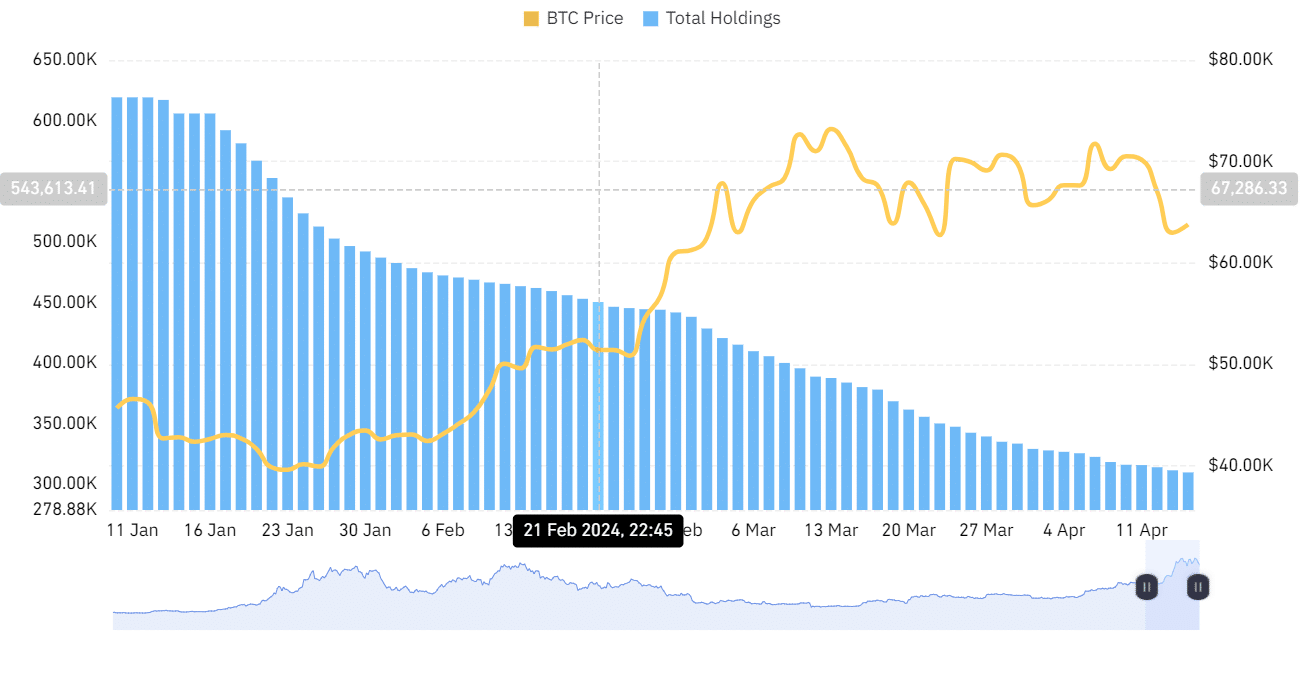

Nonetheless, a deeper dive into the info revealed a decline within the quantity of BTC held by Grayscale over current months.

Coinglass information indicated that as of January, Grayscale held over 619,000 BTC. But, as of press time, their complete holdings stood at round 310,000 BTC.

Grayscale’s pre-existing Bitcoin Belief, GBTC, transitioned into an ETF relatively than launching afresh.

Regardless of the lower in Grayscale’s holdings, it has continued to expertise important quantity in ETF flows. Nonetheless, sure spot ETF platforms have not too long ago recorded zero flows.

Spot Bitcoin ETFs see consecutive outflows

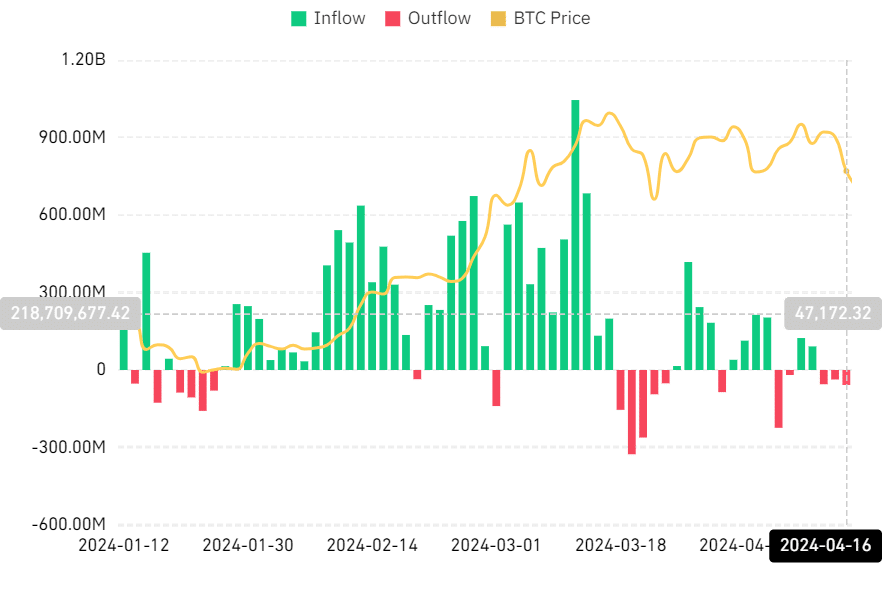

An evaluation of the Bitcoin spot ETF netflow on Coinglass signifies consecutive outflows over the previous few days. On the fifteenth and sixteenth of April, outflows amounted to $26.7 million and $58 million, respectively.

This isn’t the primary prevalence of consecutive unfavourable flows, with the best quantity noticed in March. In March, information revealed consecutive outflows for 5 days.

Notably, BlackRock’s IBIT and Grayscale’s GBTC are the one U.S. spot BTC ETFs to document any flows for the reason that starting of the week.

Zero flows dominate ETF flows

Additional evaluation of the Bitcoin spot ETF movement revealed that on the fifteenth of April, GBTC skilled an outflow of $157.50 million, adopted by one other outflow of $109 million on the sixteenth of April, persevering with the development of consecutive outflows.

In distinction, IBIT noticed a unique movement sample, with an influx of $76.23 million on 15 April and practically $26 million on 16 April.

Notably, there have been no flows from different platforms. Nonetheless, James Seyffart famous that this doesn’t point out the failure of the product.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In his publish, he defined that on most days, the overwhelming majority of all United States ETFs publish zero inflows, which is taken into account regular for any ETF in a given sector.

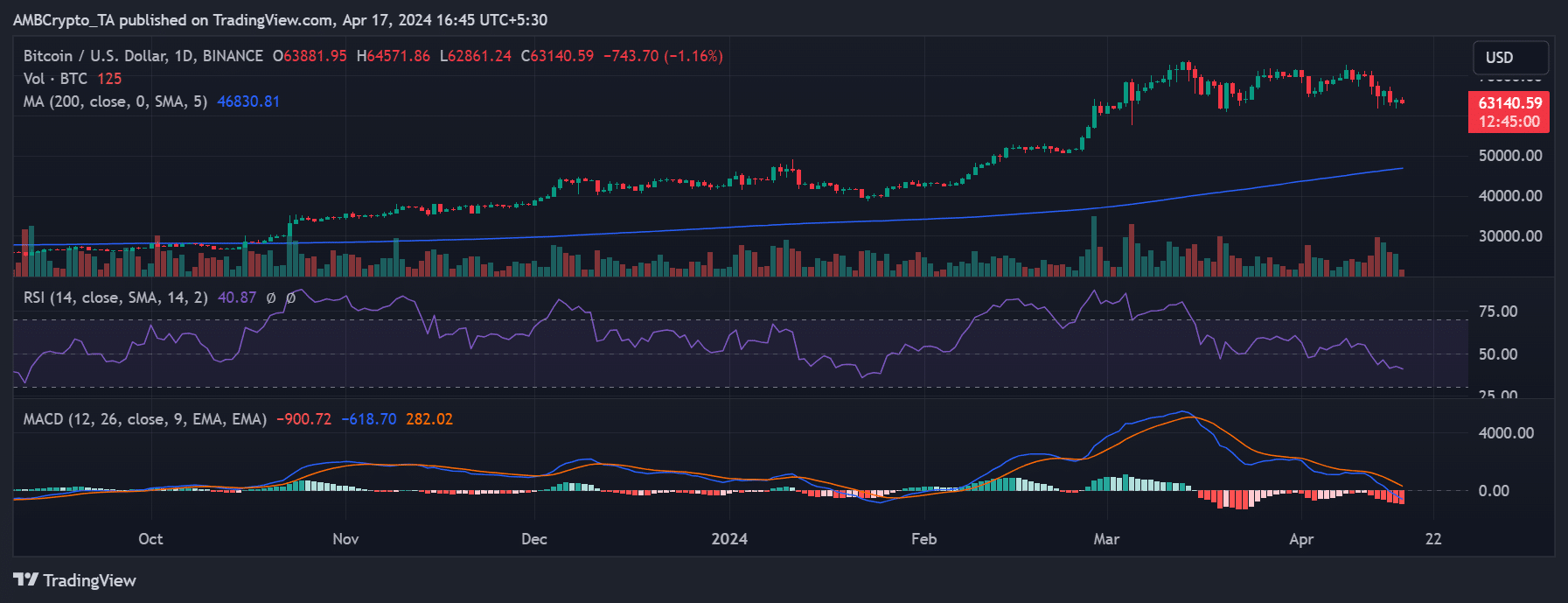

As of this writing, Bitcoin was buying and selling at round $63,170, representing a decline of over 1%.