Market Overview: Bitcoin

Bitcoin finds itself at a pivotal juncture. The extended bullish momentum that propelled costs to report highs is exhibiting indicators of waning. Whereas the long-term outlook stays favorable, the approaching days and weeks may see a shift in market dynamics.

Latest worth motion reveals a climactic surge adopted by consolidation, with patrons hesitant to push greater. This means a possible take a look at to the draw back, although robust help ranges may mood any bearish strikes. The day by day chart highlights a fragile stability inside a Triangle Sample, signaling a interval of range-bound buying and selling is probably going.

Are we witnessing a brief pause earlier than the bulls regain management, or is a extra vital correction looming? The complete report delves deeper, analyzing key worth ranges, potential eventualities, and the implications for merchants. Keep tuned for an in depth breakdown of the weekly and day by day Bitcoin charts!

Bitcoin

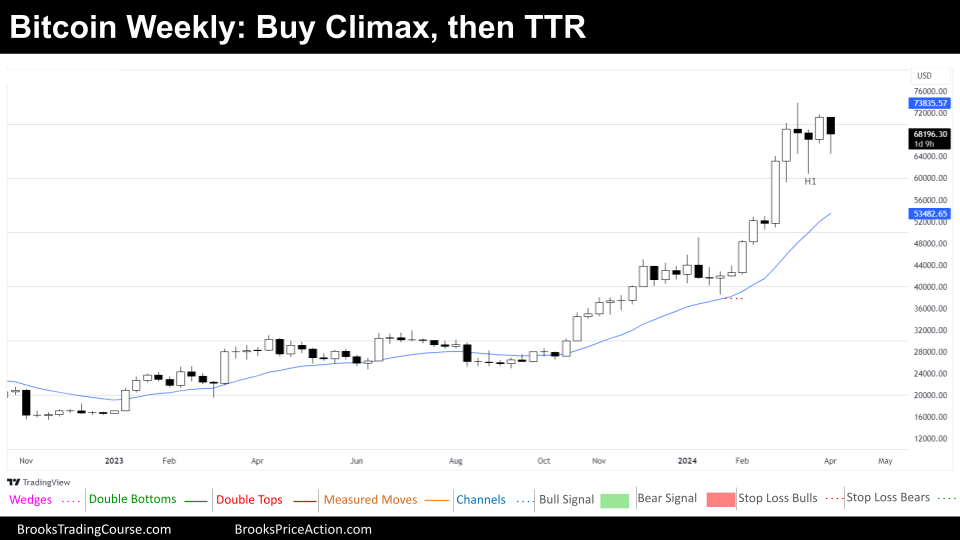

The Weekly chart of Bitcoin

Bitcoin continues All the time in Lengthy, sustaining its place inside a chronic Tight Bull Channel. But, current volatility and worth conduct counsel patrons could also be shedding a few of their earlier dominance, probably resulting in a shift within the near-term market dynamic.

After a climactic take a look at of the prior all-time highs, Bitcoin has entered a four-week characterised by sideways worth motion. This follows final week’s robust bull bar, which finally confronted vital promoting strain. Notably, the H1 setup signaled indecision with a doji formation inside a Purchase Climax context. The hesitation of patrons to maintain upward momentum after robust bull bars may level to a possible draw back take a look at.

Nonetheless, the presence of potential patrons beneath the H1 degree, coinciding with the primary low of a 6-bull micro channel on the month-to-month chart, might serve to restrict the extent of any bearish strikes. This means that whereas the trail of least resistance may favor some draw back exploration, a pointy decline appears much less seemingly. As an alternative, we anticipate a interval of range-bound buying and selling to unfold.

Whereas technical patterns just like the Purchase Climax usually point out a 40% likelihood of reaching a measured transfer up round $100,000, there’s additionally a 60% chance of revisiting the Purchase Climax low beneath $40,000. These targets, nevertheless, appear distant within the present surroundings. Efficient danger administration taking part in these ranges would show difficult. A extra possible situation entails prolonged sideways motion or a gradual drift downwards.

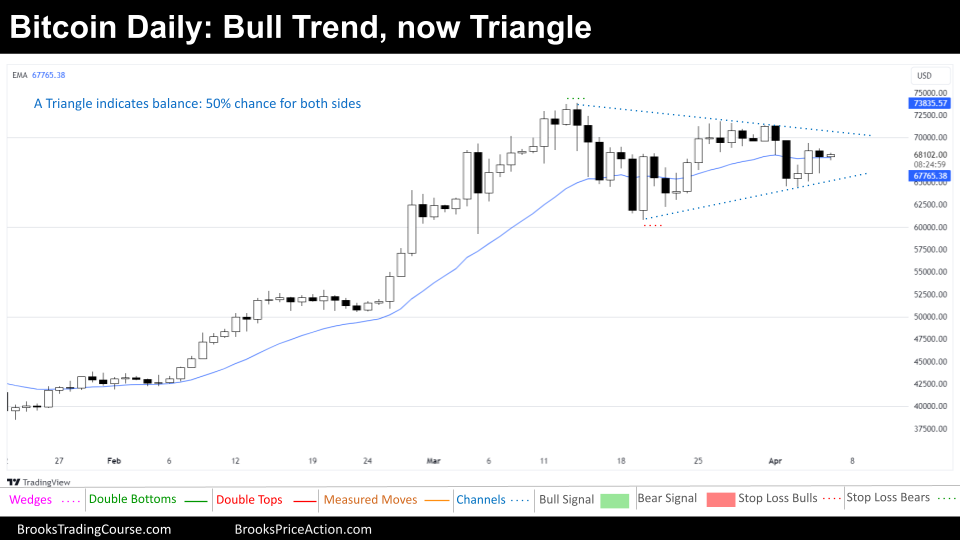

The Each day chart of Bitcoin

The day by day chart for Bitcoin paints an image of neutrality. Neither bulls nor bears have managed to determine a decisive leg, leading to a range-bound buying and selling surroundings. Moreover, the market has shaped a Triangle Sample, a particular sort of buying and selling vary characterised by converging worth motion. This highlights the present stability of energy between patrons and sellers.

Inside a Triangle Sample, the chances of a profitable breakout to both the upside or draw back are roughly equal at 50%. Bulls are inclined to view this sample as a continuation sign, representing a reaccumulation section earlier than additional upward motion. Conversely, bears see it as a possible reversal sample, suggesting a distribution section earlier than a downtrend.

Nonetheless, it’s essential to acknowledge that the market may merely proceed sideways, quickly breaking above the Triangle’s decrease excessive earlier than reversing downwards, or dipping beneath the upper low earlier than reversing upwards. It will possibly additionally prolong this sample, with the value oscillating above and beneath the Triangle’s boundaries earlier than ultimately returning throughout the vary.

Keep in mind, greater timeframes point out an overextended market that has already surpassed common dimension strikes. Whereas the long-term outlook should still favor bulls, a chronic buying and selling vary is more likely to precede any continuation of the bullish development.

All market cycles start with a breakout. If a transparent breakout happens on both facet, the present buying and selling vary thesis will probably be invalidated. Merchants ought to stay vigilant and be ready to reassess their market outlook within the face of such a decisive worth transfer.

Thanks for studying! Your engagement and insights are invaluable. Please share your ideas, feedback, and questions beneath. Let’s foster a dynamic dialogue amongst fellow merchants. And don’t overlook to share this report inside your community!

Market evaluation experiences archive

You possibly can entry all of the weekend experiences on the Market Evaluation web page.