- Bitcoin volumes in U.S surged and reached 2022 ranges.

- The profitability of holders grew together with the speed of BTC.

Bitcoin [BTC] witnessed a large surge in worth over the previous few days, inflicting a spike in optimism for BTC throughout this era. Because of this surge in worth, there was a large spike when it comes to quantity for BTC as nicely.

Volumes on the rise

In keeping with new information, BTC commerce quantity throughout US hours had returned to 2022 ranges. The excessive quantity of BTC transactions in America indicated that the U.S market was exhibiting huge curiosity in BTC and will have even reached saturation.

Nevertheless, on APAC (Asia Pacific) entrance, it wasn’t the case. The quantity throughout APAC buying and selling hours had been considerably decrease. This meant that there was a big cohort of those that had nonetheless not interacted with BTC.

As the recognition of BTC grows, merchants working throughout APAC hours might quickly make investments and commerce BTC which can drive the worth of BTC to new heights.

As BTC started to achieve its beforehand established all time highs, many elderly holders had been noticed to be shifting their holdings. Just lately, an on-chain motion of over 10-year-old Bitcoin was recorded.

A transaction involving 2,000 BTC was despatched in block 844625, marking a major shift in long-held belongings.

Whales make strikes

This whale behaviour may trigger an increase in FUD amongst holders and merchants alike, and will trigger a adverse affect on BTC’s worth.

At press time, BTC was buying and selling at $69,750.53 and its worth had grown by 0.04% within the final 24 hours.

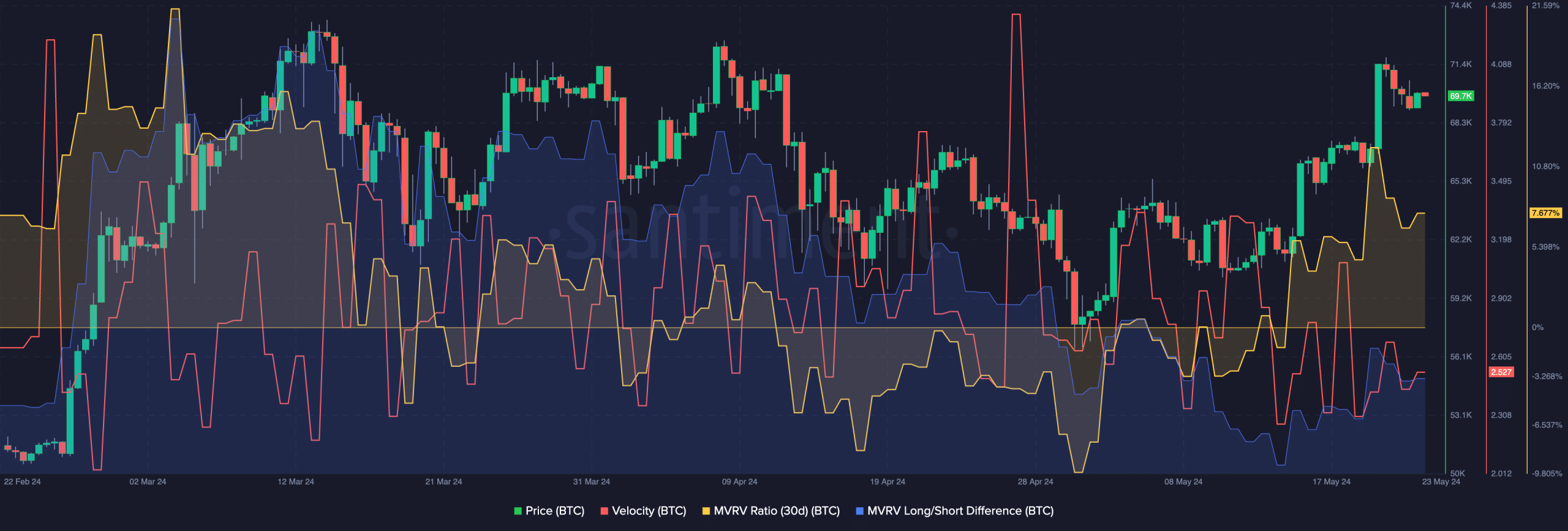

Furthermore, the speed at which it was buying and selling at had grown, implying the frequency at which BTC was buying and selling at had additionally elevated.

Coupled with that, the MVRV ratio for BTC had additionally considerably grown, implying that almost all addresses had been worthwhile on the time of writing. Despite the fact that that is constructive for the holders, it may imply hassle for BTC’s worth.

As profitability rises, so does the motivation to promote. If holders start to bask in profit-taking, BTC’s worth will be negatively impacted. An element that may decide the chance of an tackle promoting their BTC is the Lengthy/Brief ratio.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The Lengthy/Brief ratio showcases the variety of long run holders in comparison with short-term holders on the community.

At press time, this ratio was declining, indicating a prevalence of quick time period holders who usually tend to promote their holdings.