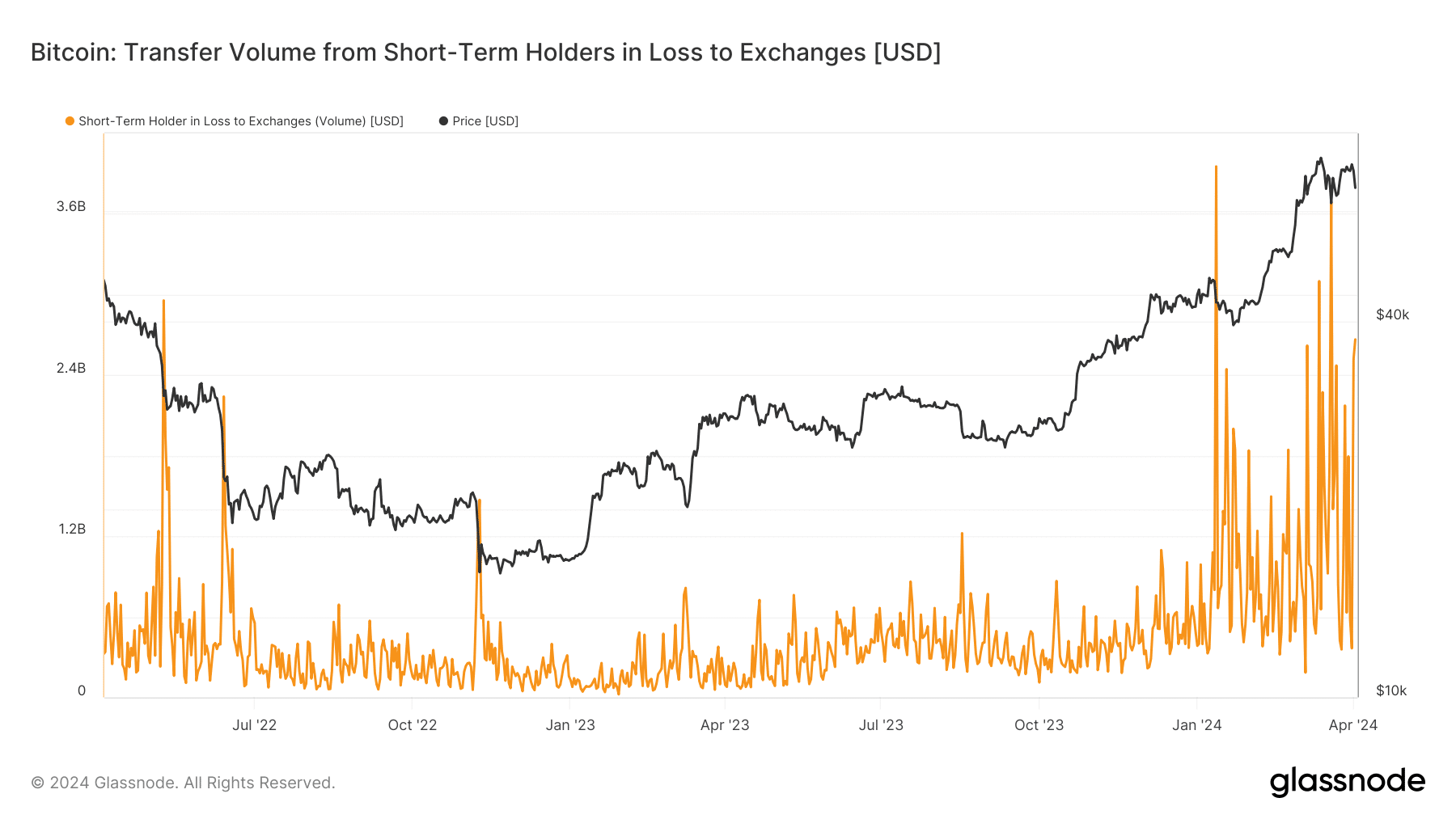

- Quick-term Bitcoin holders started to promote their holdings.

- Curiosity in Bitcoin ETFs remained excessive regardless of worth fluctuations.

Bitcoin’s [BTC] fall from $70,000 has impressed combined reactions from the cryptocurrency market. Many addresses, who weren’t anticipating this sort of volatility, had been noticed to be panicking.

Quick-term holders panic

Based mostly on current information, over the previous forty-eight hours, Quick Time period Holders (STH) despatched $5.2 billion value, equal to 76,000 Bitcoin, to exchanges at a loss. This motion elevated promoting stress on BTC.

The inflow of Bitcoin into exchanges might briefly saturate the market with provide, resulting in downward stress on costs.

This bearish sentiment can unfold all through the market and trigger panic promoting amongst different traders.

Extended downward stress on costs might affect long-term traders, who might expertise paper losses or rethink their funding methods.

As a result of current fluctuations of worth, liquidations amounting to $40.98 million have occurred. Out of this, $26.6 million had been lengthy positions.

The excessive quantity of lengthy liquidations might affect bullish sentiment round BTC in the long term.

Nonetheless, within the conventional finance markets, BTC was doing comparatively nicely. On the time of writing, Bitcoin ETF holdings had simply hit an all-time excessive of $12.2 billion. This signified rising institutional curiosity.

Establishments investing in Bitcoin ETFs typically achieve this as a approach to achieve publicity to the cryptocurrency market with out straight holding Bitcoin, which may entice extra conservative traders.

With market giants resembling BlackRock advocating for BTC, extra conventional traders may very well be interested in spend money on Bitcoin, regardless of the current volatility showcased by the king coin.

On the time of writing, BTC was buying and selling at $65,775.97 and its worth had fallen by 0.76% within the final 24 hours. Furthermore, the amount at which BTC was buying and selling at had additionally declined by 33.14% throughout this era.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Every day Lively Addresses on the Bitcoin community additionally fell in the previous couple of weeks.

This advised that the general curiosity in Bitcoin’s ecosystem had fallen in the previous couple of days, which might additional affect BTC’s future prospects negatively.