Market Overview: Bitcoin

Bitcoin skilled a big surge in February, demonstrating a robust bullish breakout on the month-to-month chart. Nonetheless, this value motion remained inside a beforehand established vary. March introduced much more pleasure, with Bitcoin reaching a brand new all-time excessive of $73,835. The month’s candlestick appears set to shut above 2021’s peak.

Whereas this new excessive is noteworthy, the previous 6-bull micro channel holds extra weight. Furthermore, there’s the opportunity of a double high sample forming with the earlier all-time excessive, which wants shut statement.

Particular: The Bitcoin halving

The following Bitcoin halving will happen through the upcoming month, April. A halving is a pre-programmed occasion designed to manage the availability. Roughly each 4 years, the reward for miners who confirm Bitcoin transactions is reduce in half. This discount in new Bitcoin getting into circulation creates shortage, which is believed that has had a constructive influence on its value traditionally. Nonetheless, when one thing is for certain within the markets, it’s most likely already priced in.

Bitcoin

The costs depicted on our charts are sourced from Coinbase’s Change Spot Worth. It’s essential to notice that the spot value of Bitcoin is repeatedly in movement; buying and selling exercise by no means ceases. Which means market fluctuations and value modifications happen across the clock, reflecting the dynamic nature of cryptocurrency buying and selling.

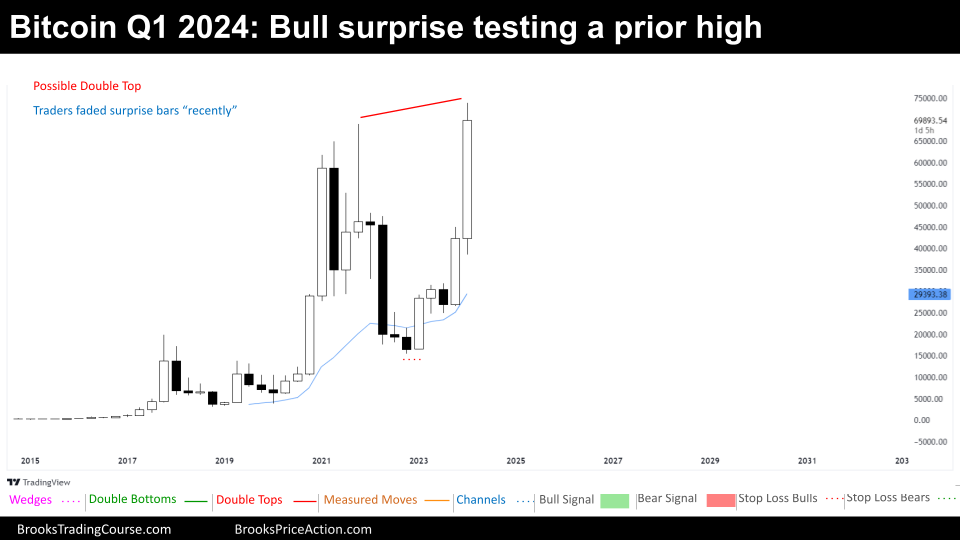

The 3-month chart of Bitcoin

Bitcoin’s value motion all through 2020 and 2021 was dramatic, with a strong surge adopted by a pointy 80% decline. Nonetheless, a outstanding restoration happened between early 2023 and the primary quarter of 2024, propelling Bitcoin to a brand new all-time excessive.

The three-month chart suggests an all the time in lengthy market. But, the current market cycle seems extra like a buying and selling vary than a sustained bull breakout, primarily because of the robust bearish leg instantly previous it. Whereas a possible spike and channel bull development may kind, it stays too untimely to verify.

At present, the opportunity of sideways or downward motion looms, probably stemming from a double high sample forming close to the 2021 excessive or the earlier all-time excessive. Regardless of this, the bulls have displayed surprising power. Following such excessive volatility, a contraction sample with tighter ranges or a triangle formation is widespread earlier than important strikes happen.

Shopping for on the present all-time excessive presents a problem, as many bulls are possible taking income. Many merchants may select to fade this transfer, probably putting preliminary stop-losses at a measured distance from the 2021 excessive to 2022 low vary. They may possible exit their positions if Q2 of 2024 demonstrates a robust follow-through to the bullish breakout. Merchants fading the development may goal income of a $10,000 or $20,000 downward transfer.

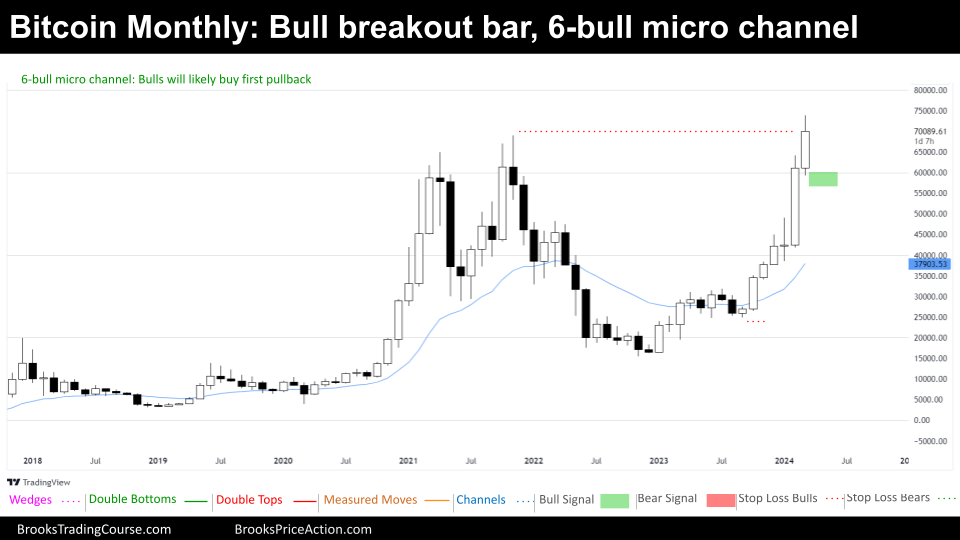

The Month-to-month chart of Bitcoin

Bitcoin’s month-to-month chart reveals an all the time in lengthy market that has skilled a big bull breakout market cycle. This breakout has propelled the worth to a brand new all-time excessive, although its sustainability stays unsure. March’s candlestick displays a outstanding higher tail, probably hinting at early indicators of weak spot.

All through the bull breakout, shopping for the shut has been difficult on account of a number of resistances, together with a significant decrease excessive, a 50% retracement, and promote zones. Bulls ought to method shopping for the shut at this main resistance stage with warning.

The preliminary bear reversal after such a breakout may probably fail. Alternatives for favorable trades might come up by shopping for under the newest bar after a 6-bar micro channel formation, or shopping for after a robust bear bar shut. Buying pullbacks seems to be a extra prudent technique on the present value stage. Merchants count on, at the very least, one other leg sideways to up.

Bears who bought above the all-time excessive have already profited from a substantial scalp-sized transfer ($5,000 to $10,000), as seen on the weekly or each day charts. When Bears begin to earn a living, Bull tendencies weaken.

The Weekly chart of Bitcoin

The market maintains its all the time in lengthy construction and is presently exhibiting a Tight Bull Channel market cycle after a current pullback. Whereas a late bull breakout inside a long-lasting bull channel usually alerts a purchase climax take a look at of resistance, bullish buying and selling methods have the next success fee on this market surroundings.

Bulls who purchased under the primary of the bull breakout of the bull channel, have earned scalp-sized income. These shopping for above a Excessive 1 should see positive factors, however the Excessive 1’s small bear physique suggests it’s not a very robust bullish sign.

Usually, bulls discover worthwhile shopping for on the primary robust bear bar that follows a sturdy bull breakout or tight bull channel. They anticipate additional positive factors even with a deeper pullback, given the presence of the 20-week exponential shifting common (20-week EMA). Merchants are conditioned to purchase after 20+ bars above the shifting common. Within the occasion of a pullback, they count on a retest of the highs slightly than a direct transfer towards the key greater low under $40,000.

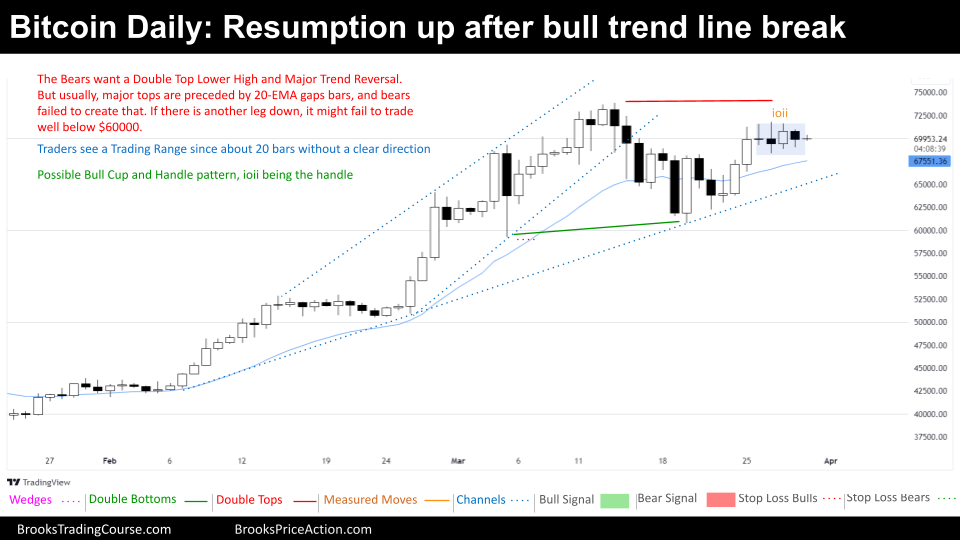

The Every day chart of Bitcoin

The each day chart presents a much less decisive image, with no clear “always in long” or “always in short” bias. The market has been buying and selling sideways for the previous 20 bars, following a beforehand robust bullish development. And as commented, the current motion broke the steeper bull channel’s decrease development line.

This break within the bull development line prompts bears to maintain a watch out for a possible Main Pattern Reversal setup. One other issue price noting is the upward resumption of value motion after the bull development line break. Regardless of this, bears have didn’t create a niche bar under the 20-day EMA, which frequently precedes a big high.

Given the prevailing bullish development and the worth nonetheless residing inside a broader bull channel, bears possible want stronger affirmation earlier than initiating brief positions. This might manifest as consecutive bear closes, a transparent “always in short” sample, or some type of surprising bearish occasion.

For bulls, shopping for on the greater finish of a 20-bar buying and selling vary is a dangerous proposition. They may select to attend for one more bearish try earlier than getting into lengthy positions, or look ahead to a transparent shift again to an “always in long” construction.

Thanks for studying this week’s market evaluation! We hope you discovered the insights into the Bitcoin charts useful. Please don’t have any hesitation to go away feedback under together with your ideas, questions, or any explicit areas you’d wish to see explored in future experiences. Your participation makes this evaluation much more precious!

Market evaluation experiences archive

You possibly can entry all of the weekend experiences on the Market Evaluation web page.