Because the facilitators of the community’s safety and transaction verification course of, Bitcoin miners considerably affect the provision of BTC available in the market.

Because of this no market evaluation may be full with out analyzing the adjustments in miners’ balances and exercise. Firstly, adjustments in miner stability and exercise present perception into the sector’s financial well being and operational stability. Secondly, miners’ selections to promote or maintain their BTC replicate their confidence in future worth and might sign adjustments in market sentiment. Furthermore, since miners are the first supply of latest BTC coming into the market, their promoting and holding patterns can immediately impression Bitcoin’s worth volatility and liquidity.

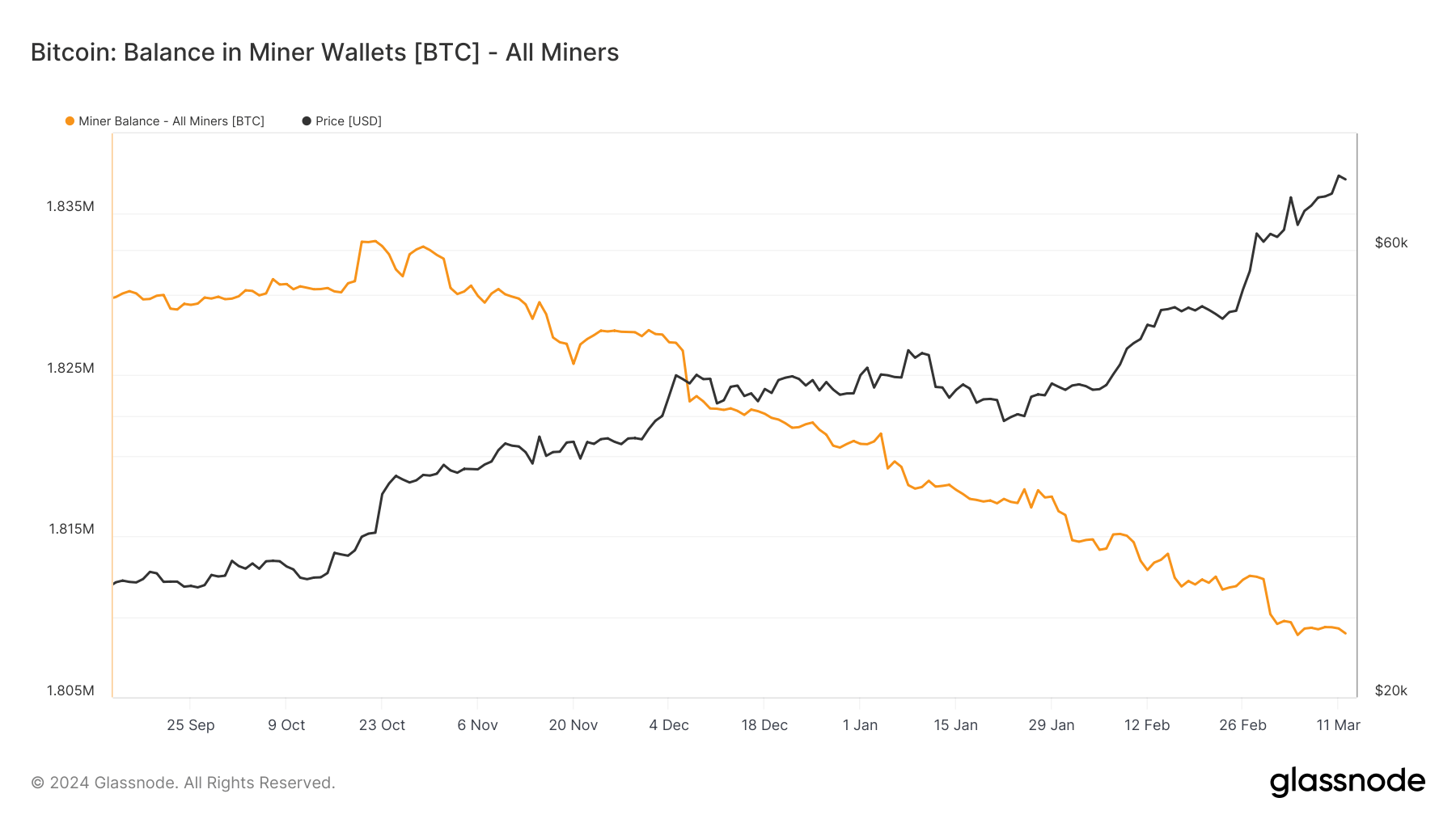

Information from Glassnode reveals that there was a gradual decline within the stability of BTC held in miner wallets for the reason that fall of 2023. The stability decreased from 1.833 million BTC on Oct. 22, 2023, to 1.808 million BTC by Mar. 12.

Over 4,000 BTC left miner balances for the reason that starting of March. This lower, which appears to have sped up considerably this month, reveals constant promoting stress from miners, who might be lowering their holdings to cowl operational prices or capitalize on worth will increase.

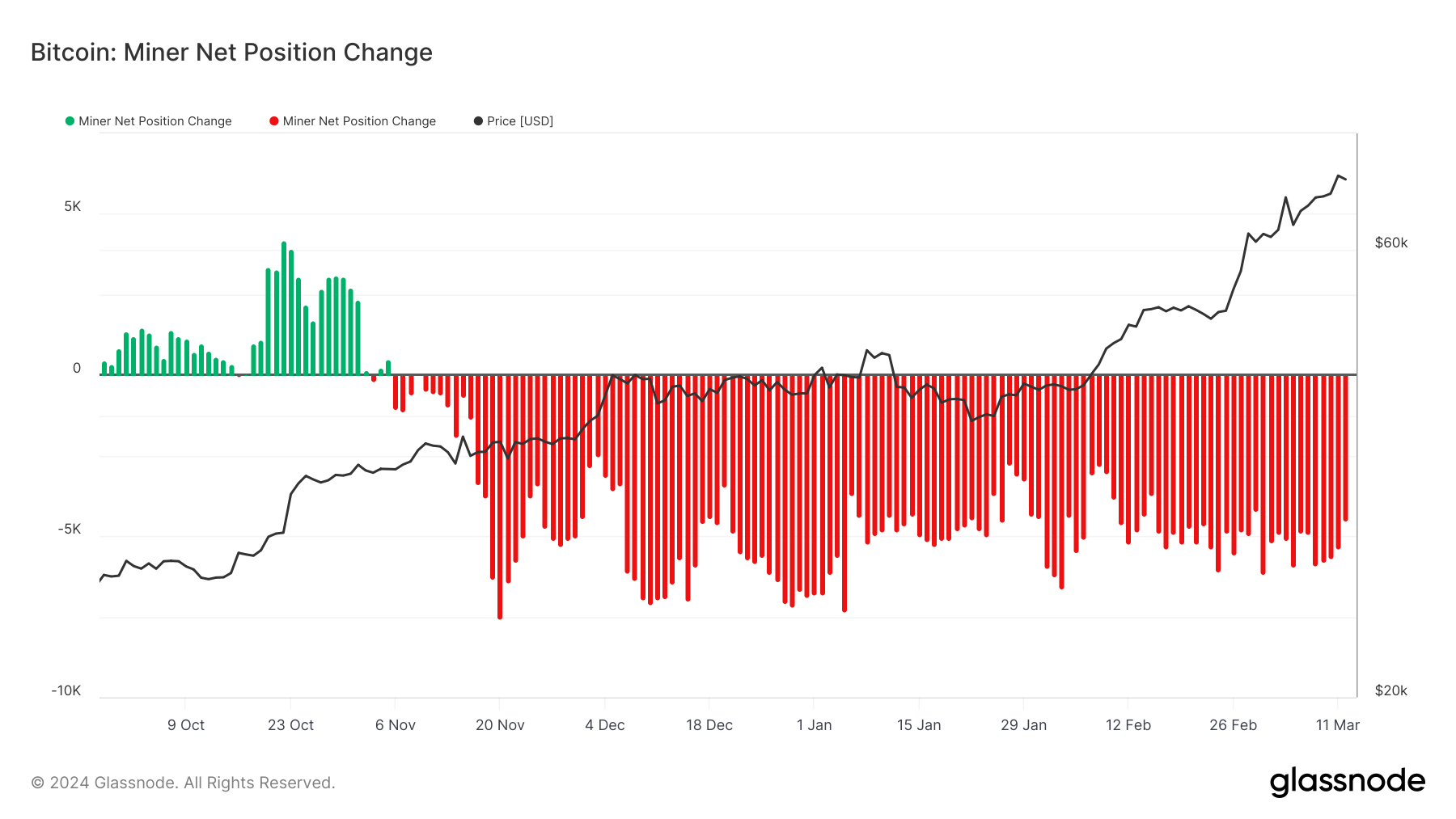

The online change in miner balances, which has been persistently damaging since November 2023, reveals the depth of this promoting pattern. The biggest outflow of seven,310 BTC was recorded on Jan. 5, with one other main outflow of 6,165 BTC seen on Mar. 1.

These outflows have preceded essential market occasions — the launch of spot Bitcoin ETFs within the US and the aggressive rally that pushed Bitcoin’s worth above $70,000 — and present the miners have been anticipating main market actions.

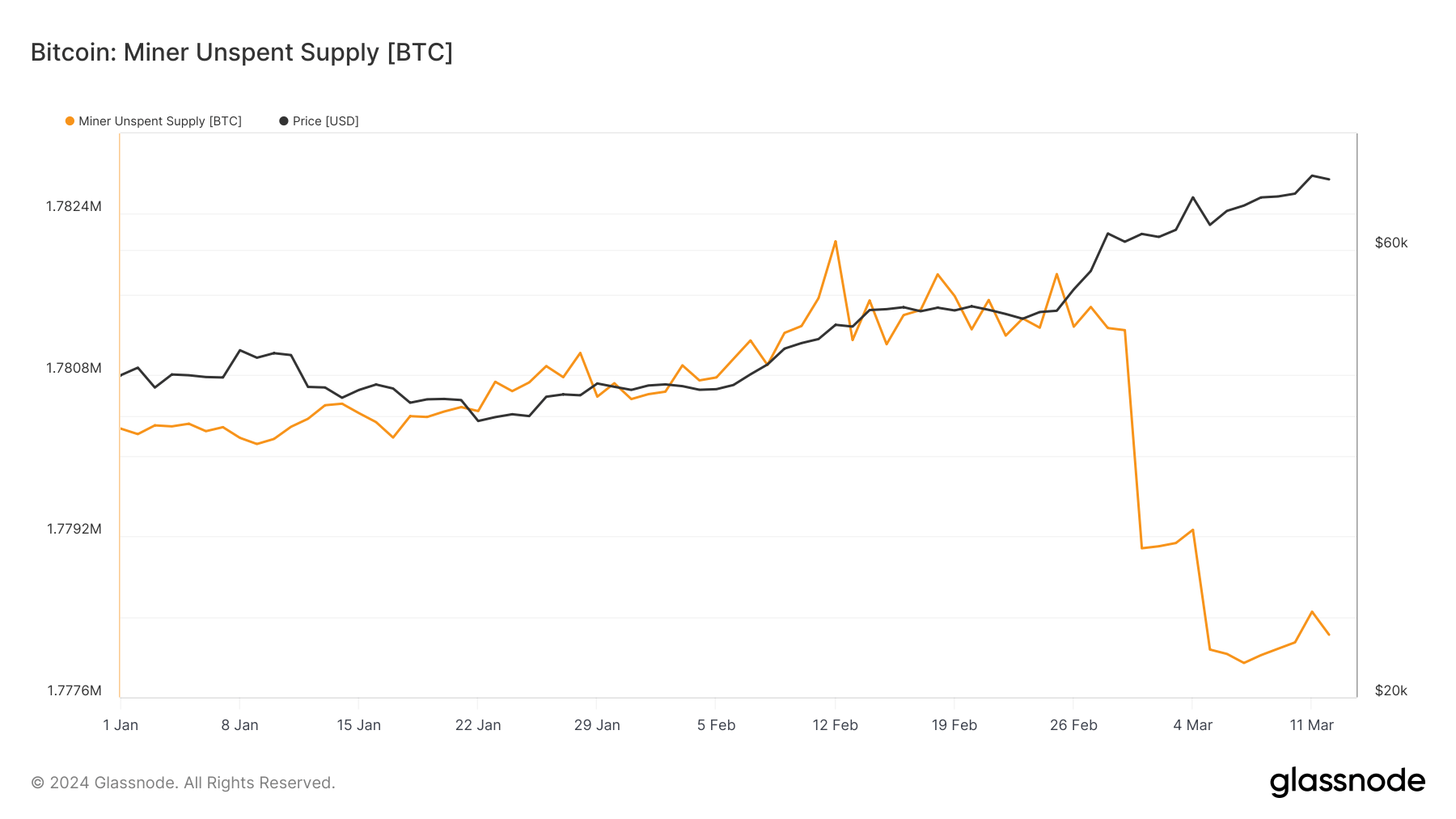

Apparently, regardless of the promoting, the miner unspent provide — BTC that miners have mined however not but bought — has proven relative stability, fluctuating barely from 1.780 million BTC at the beginning of the 12 months to 1.778 million BTC by Mar. 12. This means that whereas miners have been promoting, the speed of latest BTC mined and held is almost balancing out the BTC bought.

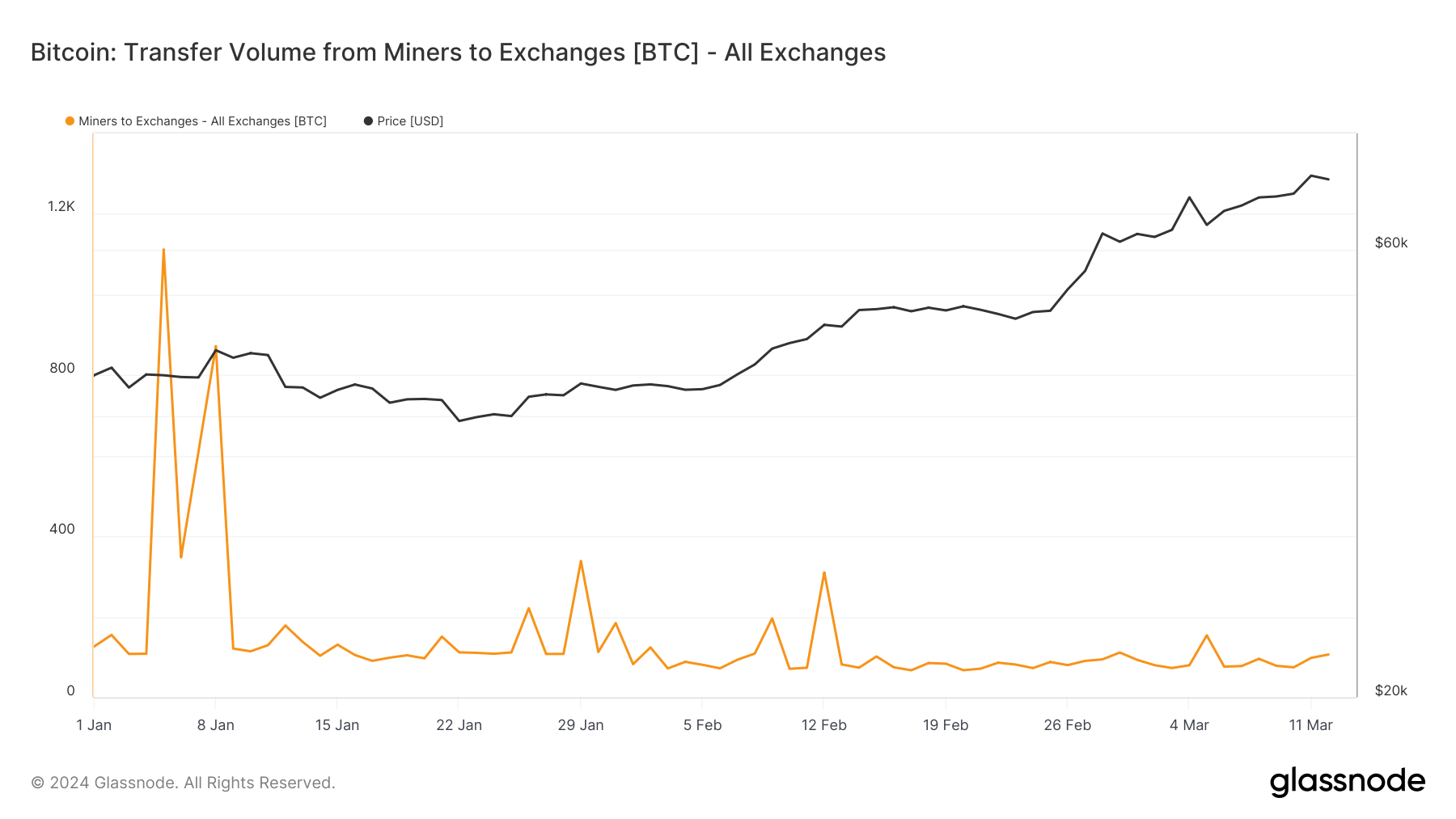

The switch of cash from miners to alternate wallets, peaking notably across the launch of spot Bitcoin ETFs, reveals miners capitalizing on alternatives or managing liquidity wants.

With transfers averaging between 67 BTC and 150 BTC within the first quarter of 2024 and a notable peak of 106 BTC on Mar. 12, it’s clear miners are actively managing their holdings, however not at a scale that implies mass liquidation.

Whereas Bitcoin miners have been internet sellers for the final six months, the introduction and adoption of spot ETFs within the US have injected substantial liquidity and shopping for stress into the market. The promoting by miners, though vital, has been absorbed by the market with out derailing the bullish momentum established for the reason that begin of the 12 months.

The publish Bitcoin maintains worth resilience regardless of elevated miner promoting appeared first on CryptoSlate.