- The FOMC’s charge choice attracts criticism; Peter Schiff and David Solomon predict ‘no cuts’ quickly.

- The crypto market faces a downturn — resilience is noticed, with a deal with long-term methods.

Amidst considerations concerning the rising inflation within the U.S., the Federal Reserve has determined to carry rates of interest regular.

Minutes from the Federal Open Market Committee (FOMC) assembly revealed policymakers’ apprehension about easing charges.

The minutes pointed to the truth that regardless of some progress, inflation has remained above the FOMC’s 2% goal, with many shopper sentiment surveys exhibiting rising worries about future inflation.

FOMC’s choice receives criticism

Criticizing the choice, Peter Schiff, CEO and Chief World Strategist of Euro Pacific Capital, in an X (previously Twitter) publish, famous,

Becoming a member of an identical prepare of thought, David Solomon, CEO of Goldman Sachs Group Inc., acknowledged at a Boston Faculty occasion that he presently predicted “zero” charge cuts. He mentioned,

“I still don’t see the data that’s compelling to see we’re going to cut rates here.”

Detrimental affect on the crypto market

Evidently, specialists started questioning the consequences of the FOMC’s choice on the general market circumstances.

The affect was notably damaging, as evidenced by its direct impact on main cryptocurrencies.

On the twenty second of Could, Bitcoin [BTC] dropped under the $70K mark, and Ethereum [ETH], which had just lately surged from $3,064 to $3,790, turned crimson as effectively.

In actual fact, on the time of writing, most high cash confirmed crimson bars on the each day charts.

Optimistic sentiments persist

Regardless of the crypto market bleeding, @cryptosanthoshK, a Crypto & DeFi Analyst, famous,

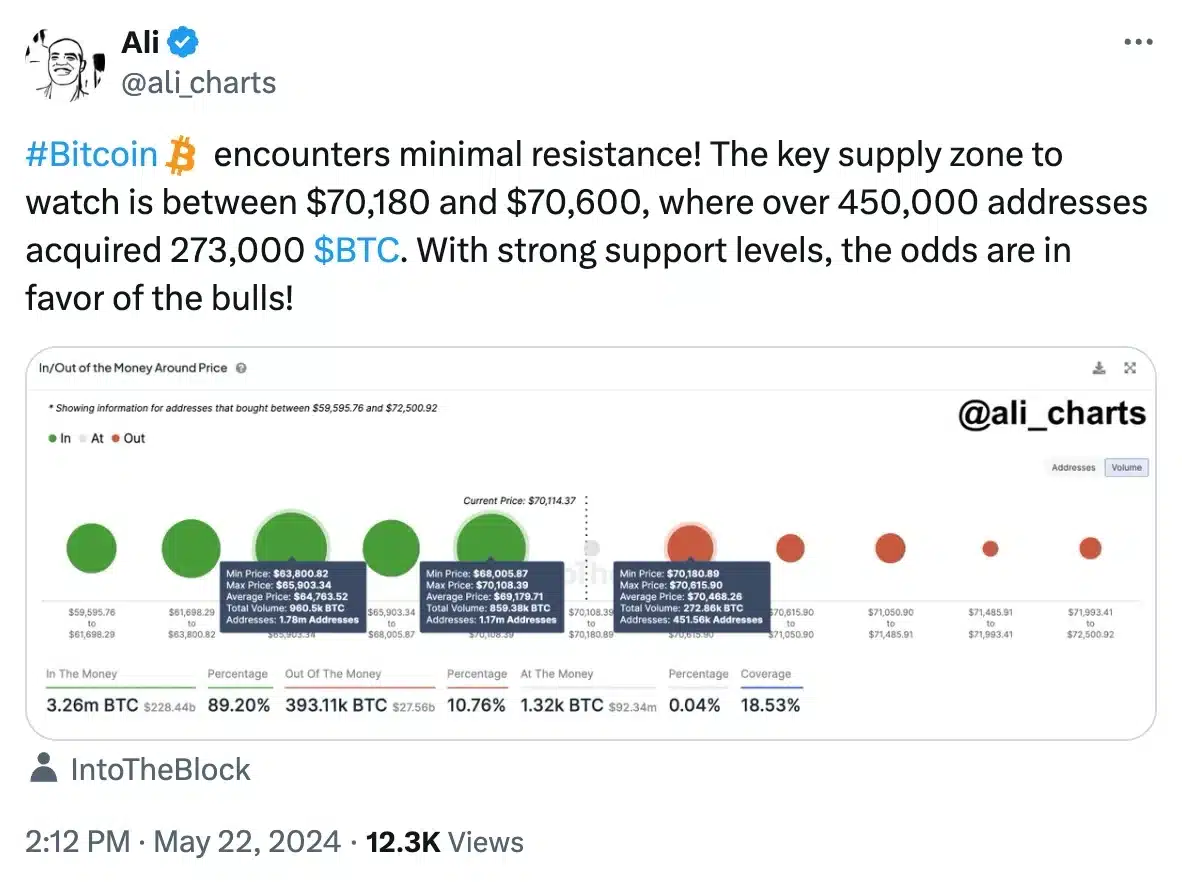

Ali Martinez, the technical and on-chain analyst, echoed an identical sentiment and mentioned,

Glassnode’s Bitcoin liveliness metric additional confirmed this, by exhibiting an increase in coinday creation versus destruction, indicating a shift in the direction of long-term holding over profit-taking.

Anticipating ETH to expertise a big worth enhance as a result of anticipation of an exchange-traded fund (ETF) approval, Satoshi Flipper, an investor/dealer added,

“$ETH will deliver an epic ETF pump this week. Market prices can’t stay irrational forever.”

Inventory market declined

Regardless of the prevailing constructive sentiment surrounding cryptocurrencies, consideration must also be paid to the efficiency of the inventory market, which skilled a decline on the twenty second of Could.

The Dow Jones Industrial Common dropped by 201.95 factors, or 0.51%, closing at 39,671.04, marking its worst session of the month.

Equally, the S&P 500 fell by 0.27% to succeed in 5,307.01, whereas the Nasdaq Composite, specializing in tech shares, recorded a lack of 0.18%, ending at 16,801.54.