- Growing calls to promote BTC might gas a rebound in the direction of $68,600

- An essential metric revealed that the coin has not but hit the height of this cycle

In an fascinating flip of occasions, Bitcoin’s [BTC] fall under $63,400 has fueled a lot Concern, Uncertainty, and Doubt [FUD] available in the market. This assertion might be supported by taking a look at merchants’ sentiment during the last 12-24 hours.

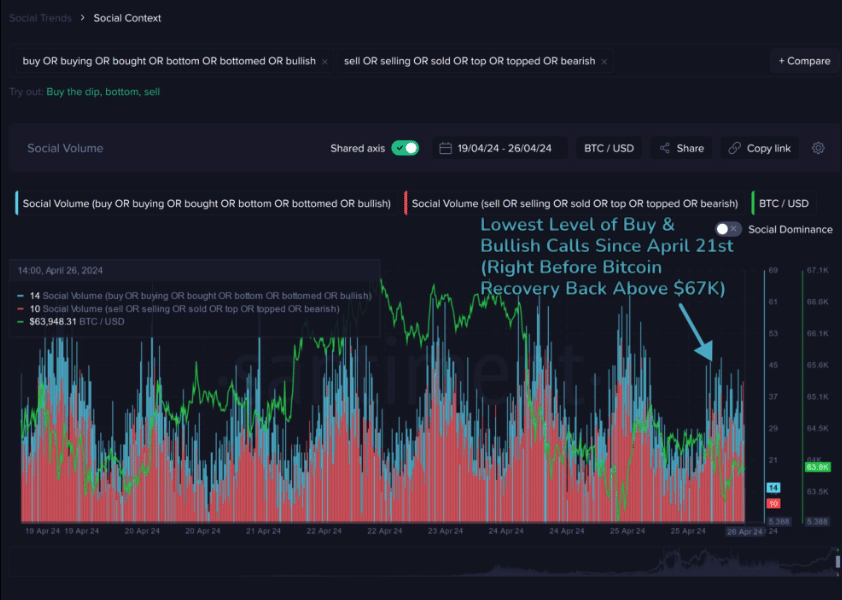

Utilizing Santiment’s on-chain social device, AMBCrypto observed that the calls to promote had been far more than the ‘buy the dip’ screams. A couple of weeks in the past, that was not the case. This, as a result of any slight dip within the cryptocurrency’s worth triggered a wave of bullish calls round that point.

Is worry the facility supply for a hike?

Nevertheless, this case just isn’t fully dangerous for Bitcoin as a peak in FUD may set off a bounce on the charts. Actually, one thing related occurred not too long ago, particularly on 21 April.

On that day, BTC depreciated and fell to $64,531, with many merchants opining {that a} additional decline was imminent. Opposite to these expectations, nonetheless, Bitcoin swung upwards and hit $67,169.

With that in place, it’s attainable to see a repeat of that state of affairs if bears proceed to share their sentiment publicly. Nevertheless, it’s also essential to take a look at the chance from a metric-driven PoV.

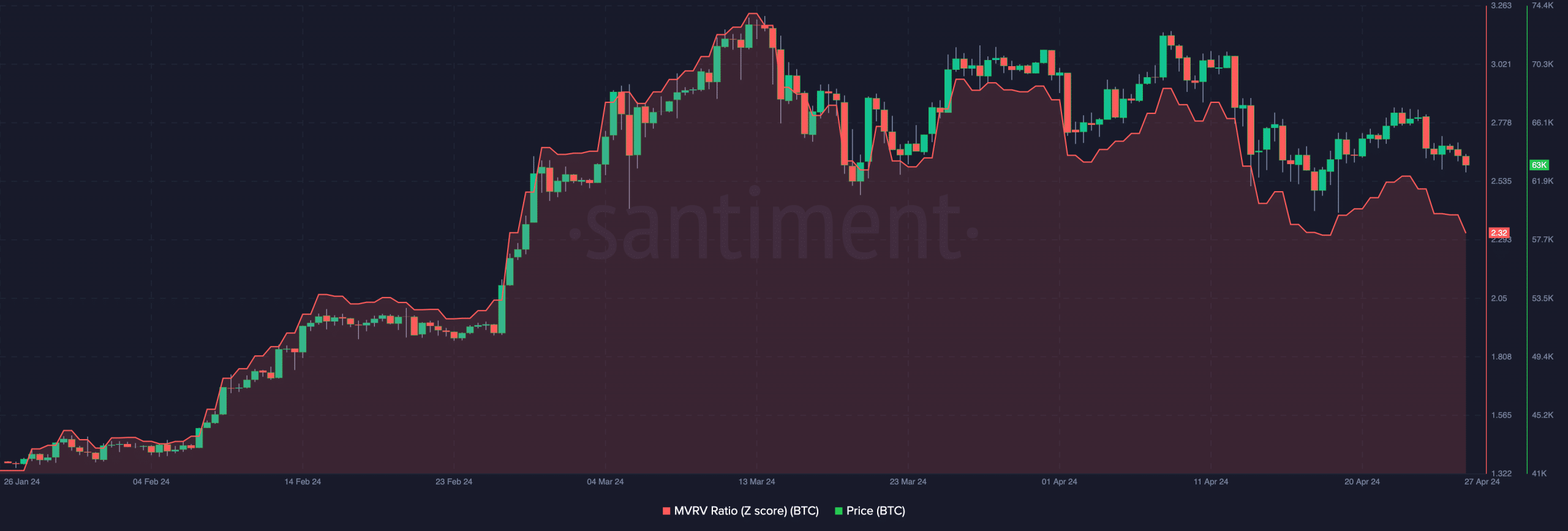

To start out off, AMBCrypto seemed on the Market Worth to Realized Worth (MVRV) Z Rating. For the uninitiated, the MVRV Z Rating can spot the bottoms and tops of a cryptocurrency. It may possibly additionally inform if an asset is overvalued or undervalued.

On the time of writing, Bitcoin’s MVRV Z Rating was 2.32. Wanting on the chart under, we will see that since March, the worth has recovered each single time the metric fell under 2.60.

Nevertheless, there’s a probability that BTC may drop to decrease than $62,400 if bears retain management of the worth. If that’s the case, the revival may very well be higher, and a hike to $68,600 may very well be subsequent.

BTC appears to be like sound for the latter half

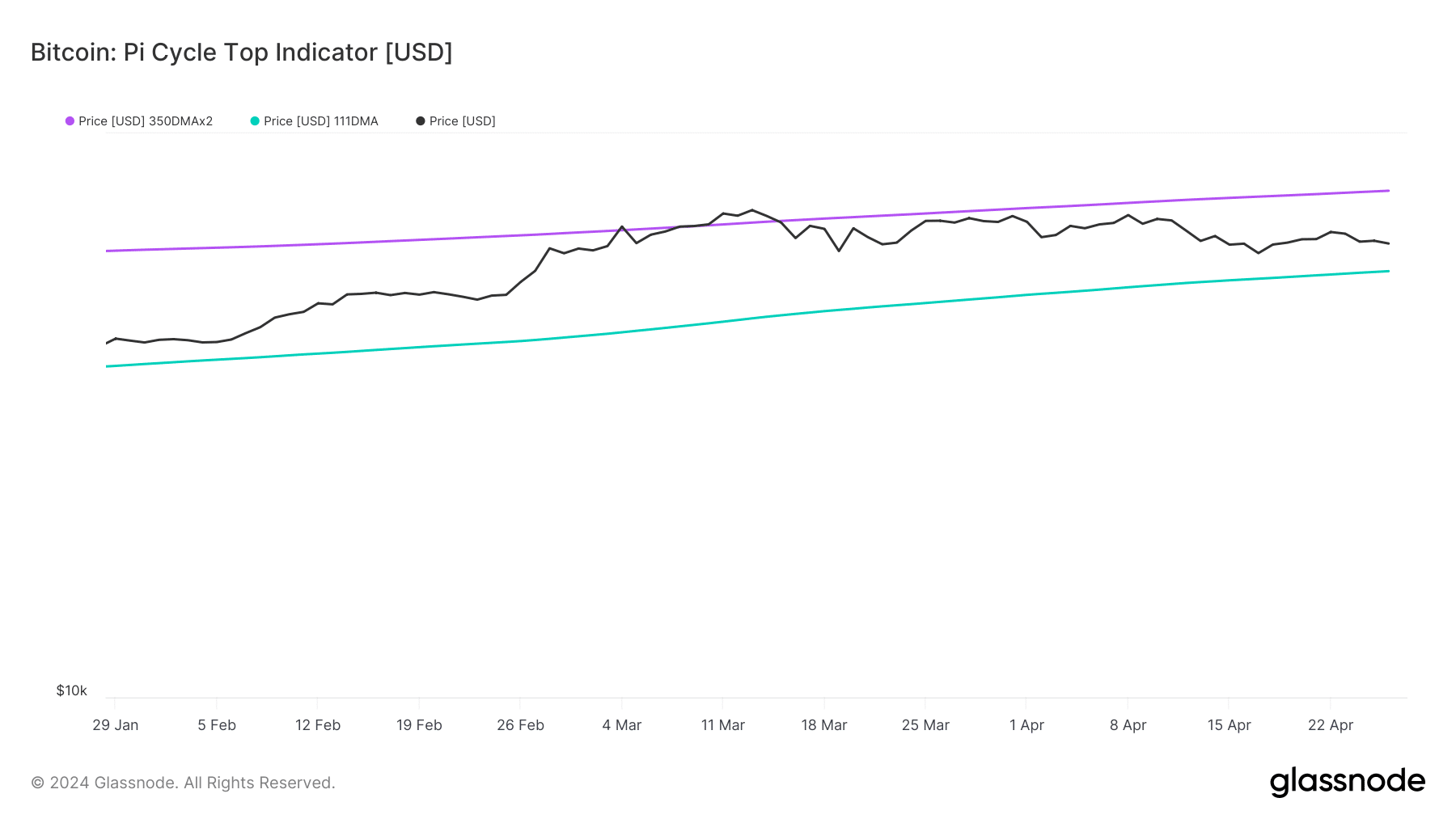

One other metric AMBCrypto evaluated was the Pi Cycle Prime indicator. Traditionally, this metric has been instrumental in figuring out when BTC is overheated or in any other case. On the indicator, you’d discover two strains — A inexperienced one and a purple one. The inexperienced line represents the 111-day Easy Transferring Common (SMA) whereas the purple signifies the 350-day MA.

Usually, Bitcoin closes in on the highest when the 111SMA reaches the identical spot or crosses above the 350SMA. Nevertheless, at press time, that was not the state of affairs because the inexperienced line remained under the purple line.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

The state of this metric appeared nice for Bitcoin bulls not just for the quick time period. however for many of this cycle.

Ought to the Pi Cycle Prime maintain its place within the coming months, BTC could rally. And, a goal of $80,000 to $85,000 may very well be attainable too.