- Lengthy-term holders started to maneuver their BTC holdings.

- Quick sellers received liquidated, whereas merchants turned bullish.

Bitcoin’s [BTC] worth has been hovering on the $70,000 mark for fairly a while. As a result of stagnancy of BTC’s worth, many addresses have been considering promoting their holdings.

Lengthy-term holders make strikes

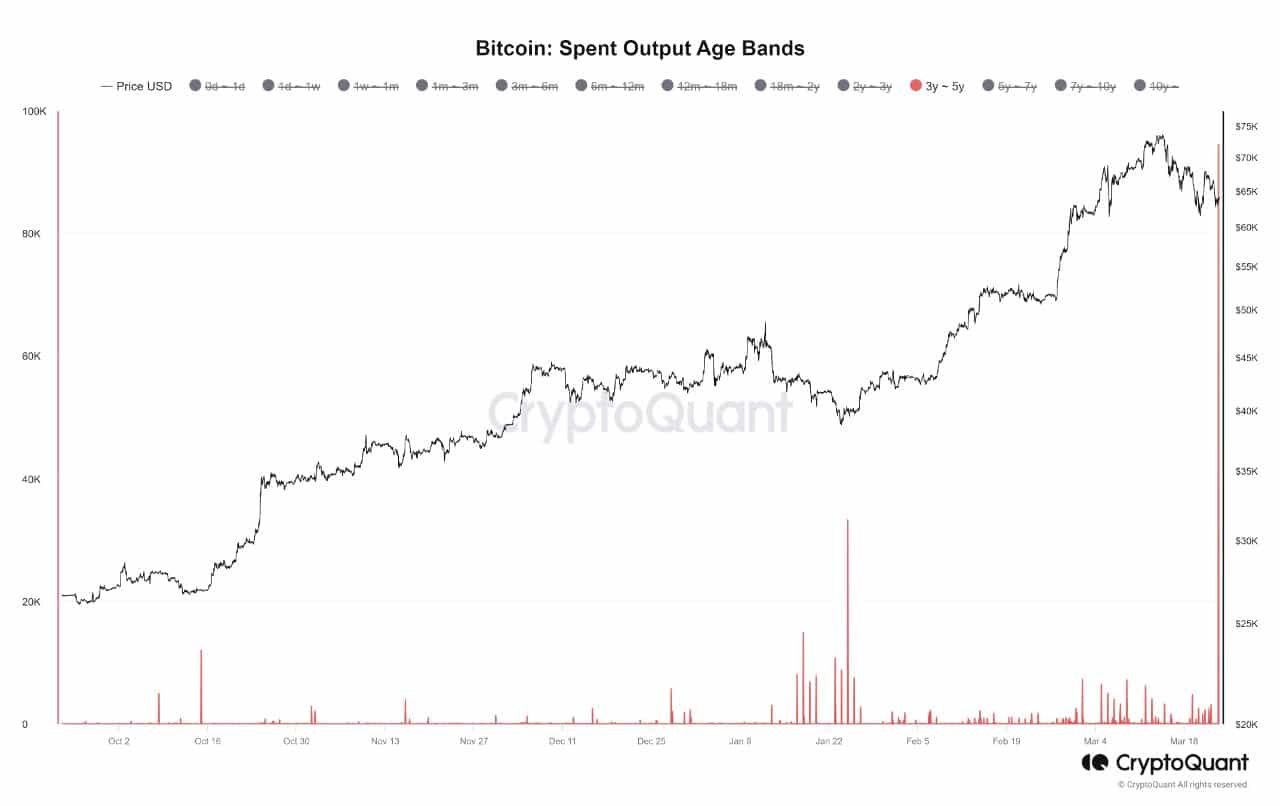

Current knowledge indicated an enormous development of great motion amongst long-term holders (3 to five years), with roughly 90,000 Bitcoin transferred over the previous few weeks. These transfers predominantly contain wallets probably owned by particular person customers, fairly than exchanges or different middleman platforms.

Lengthy-term holders are more and more liquidating their holdings, it might point out a insecurity sooner or later worth appreciation of BTC or a necessity for liquidity for different functions.

Moreover, a big inflow of BTC onto exchanges from long-term holders might exert downward strain on costs as a result of elevated promoting strain.

Moreover, the Sharpe Ratio skilled a major enhance. For context, the Sharpe Ratio is a measure of risk-adjusted returns. It could possibly probably influence Bitcoin negatively if it signifies an excessively excessive degree of danger relative to returns.

A rising Sharpe Ratio may recommend that the chance related to holding Bitcoin has elevated disproportionately in comparison with potential good points, which might deter buyers searching for a extra favorable risk-return profile.

This heightened notion of danger could result in lowered investor confidence and a subsequent lower in demand for Bitcoin, in the end placing downward strain on its worth.

Liquidations on the rise

Regardless of this, merchants continued to stay bullish round BTC. This was indicated by the rising variety of lengthy positions taken by merchants.

One of many causes for the rising variety of lengthy positions might be as a result of current losses confronted by quick sellers. AMBCrypto’s evaluation of coinglass’ knowledge indicated that 41.81 million quick positions had been liquidated previously 24 hours.

The rising quantity of liquidations could deter quick sellers from betting towards BTC within the close to future.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

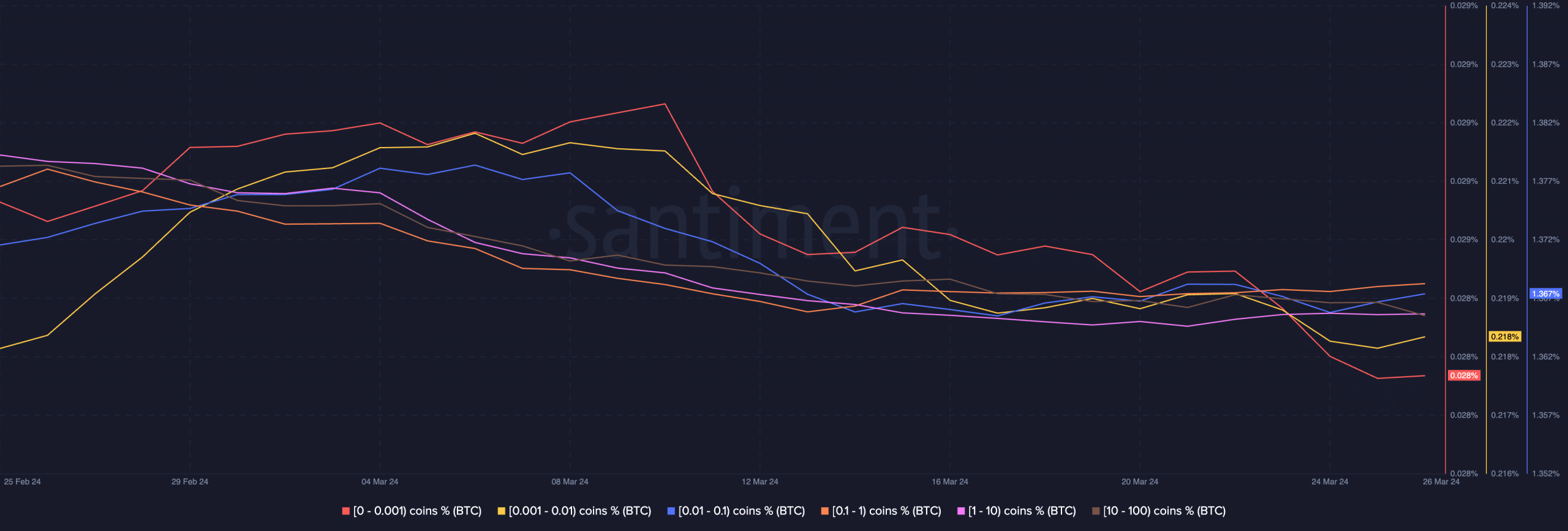

Though merchants had been bullish on BTC, the general curiosity showcased by retail buyers had declined. Current knowledge showcased that the holdings of addresses that possess 0.001 to 1 BTC had fallen in the previous couple of days.

At press time, BTC was buying and selling at $70,732.95 and its worth had grown by 0.59% within the final 24 hours. Furthermore, the quantity at which it was buying and selling at had additionally grown by 27.05% throughout the identical interval.