- Bitcoin shaped a smaller vary inside the vary.

- Bullish conviction has weakened significantly, and promoting strain may quickly dominate.

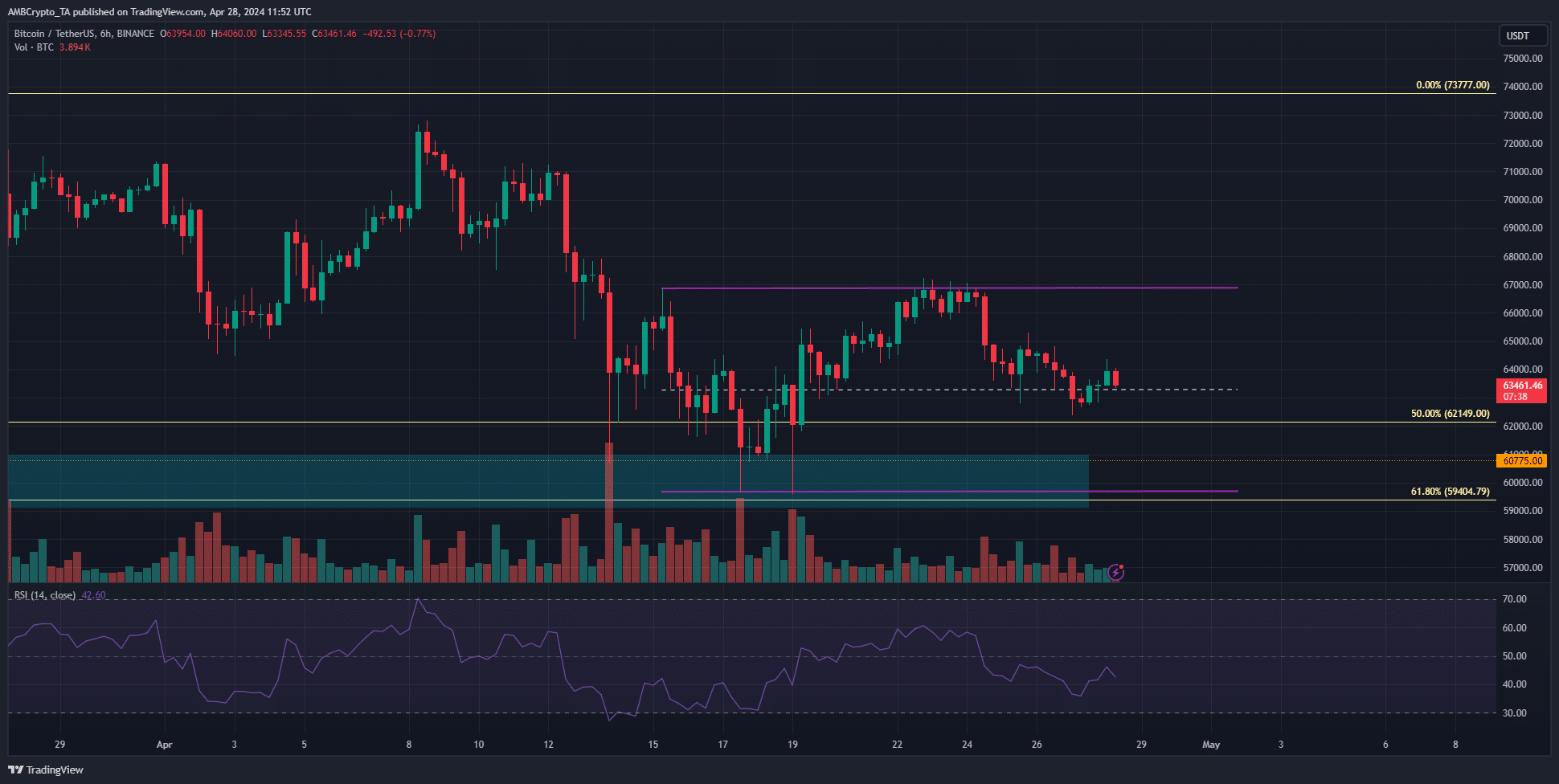

Bitcoin [BTC] continued to commerce between $73k and $60.7k, forming a spread.

In an earlier evaluation, AMBCrypto had reported that bulls have to defend the $64.5k help zone to push above the $66k resistance.

This didn’t happen, as a substitute, we noticed a rejection at $67k and a transfer to $62.8k. This growth got here at a time when whale exercise and ETF inflows had been each slowing down.

Due to this fact, an argument for continued short-term consolidation was legitimate.

The larger-picture metrics that fueled BTC progress have declined

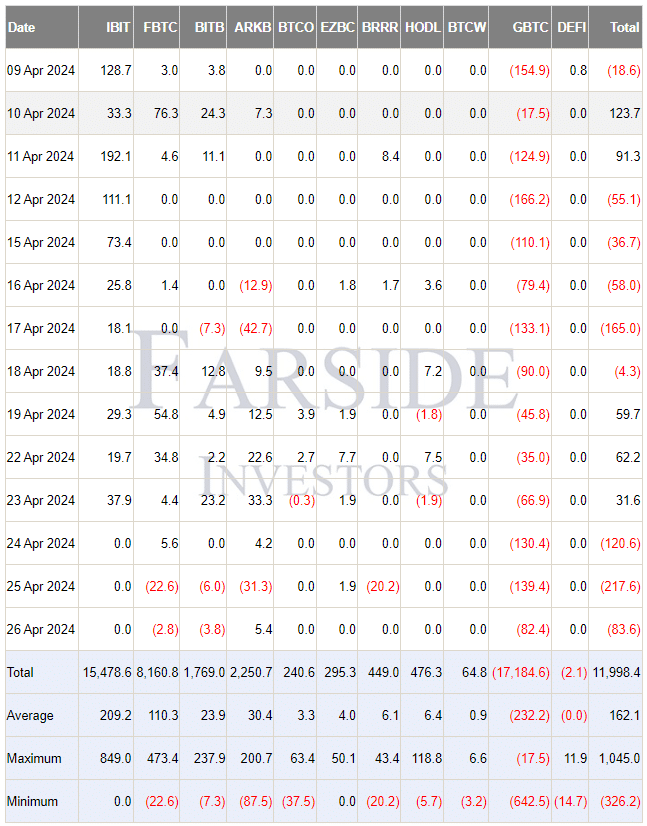

In a publish on X (previously Twitter), crypto analyst Whale Panda famous that Bitcoin ETF flows had been destructive for the third consecutive day on Friday the twenty sixth of April.

Blackrock’s ETF IBIT noticed a 3rd day of zero inflows after receiving the most important inflows earlier this month.

Supply: Farside Traders

A scarcity of demand is seen right here. Solely Grayscale Bitcoin ETF (GBTC) noticed constant outflows, however some others akin to ARKB joined it on the twenty fifth of April.

This was a mirrored image of the dearth of bullish conviction after the halving.

Supply: Ali_charts on X

Crypto analyst Ali Martinez introduced one other attention-grabbing issue into the dialog. The whale transaction rely has been in decline since mid-March.

The worth of Bitcoin additionally misplaced its increased timeframe bullish impetus in the course of the previous month.

What do the futures markets reveal about Bitcoin market sentiment?

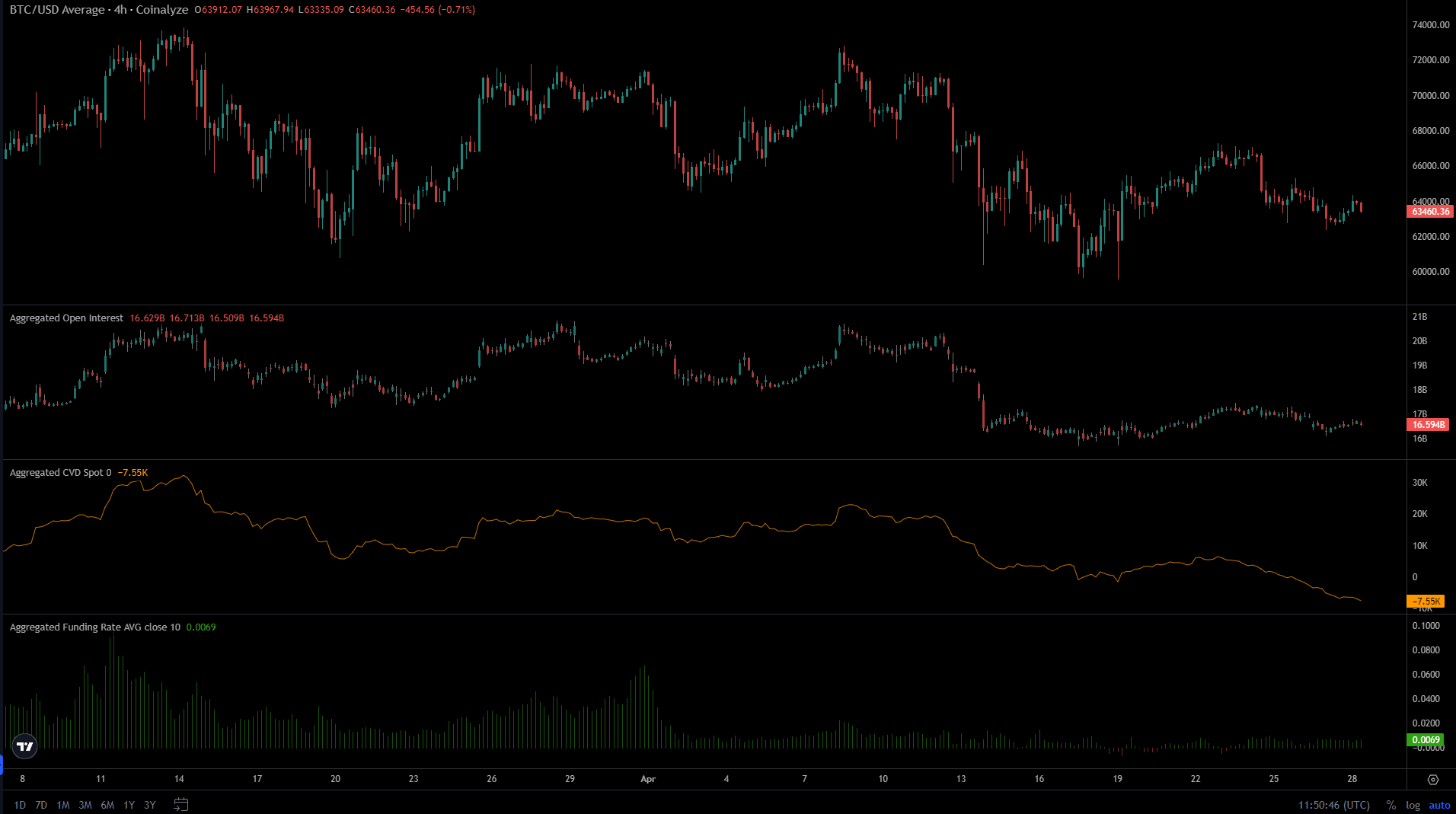

Supply: Coinalyze

The Open Curiosity in Bitcoin has been waning because the tenth of April. This got here alongside the worth drop beneath $70k that took BTC to $60k and highlighted bearish sentiment. Speculators had been unwilling to go lengthy.

The Funding Fee, which had been very constructive in March, was solely simply over zero in April, as soon as once more exhibiting the speculator hesitancy.

The spot CVD climbed increased from twentieth March to the tenth of April. This meant consumers had been current within the spot market again then, giving value a cause to attempt to push above $70k.

Up to now three weeks, it has been on a relentless downtrend. Due to this fact, it was probably that we’d see BTC development downward, or keep inside a spread.

A brief-term vary between $66.9k and $59.7k (purple) was noticed. This was on the decrease finish of the $60k-$73k vary that BTC was already buying and selling inside.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

The mid-range mark at $63.3k was breached over the weekend, and we may see one other drop to $60k later this week.

The RSI on the 6-hour chart was beneath impartial 50 and signaled bearish momentum. Mixed with the dearth of demand, it appeared probably that one other downturn would quickly be on us.