Current developments within the crypto market point out a robust bullish sentiment amongst Ethereum merchants, significantly within the choices market.

Amid the rising anticipation for potential approvals of spot Ethereum exchange-traded funds (ETFs), there was a noticeable shift in possibility pricing, with Ethereum name choices changing into dearer than put choices throughout all expiries.

This pricing sample suggests the market is optimistic about Ethereum’s worth prospects. Notably, A name possibility provides the holder the proper, however not the duty, to purchase an asset at a specified worth inside a particular time-frame.

Associated Studying

This selection kind is usually bought by merchants who imagine the asset’s worth will enhance. Conversely, a put possibility supplies the holder the proper to promote the asset at a predetermined worth and is usually used as safety towards a decline within the asset’s worth.

Market Indicators Level To A Bullish Ethereum

Luuk Strijers, CEO of Deribit, highlighted this pattern in his communication with The Block. He famous that the “put minus call skew is negative across all expiries and increasing further beyond the end-of-June expiry, a quite bullish signal.”

Moreover, the premise, or the annualized premium of the futures worth over the spot worth, has elevated to round 14%, additional reinforcing the bullish outlook.

The evaluation reveals that merchants desire to buy name choices at a premium in comparison with put choices, significantly for these set to run out on the finish of June and later.

This sample is an indication of a bullish market, indicating that merchants should not as inquisitive about securing safety towards potential worth drops as they’re in anticipating that Ethereum’s worth will hold climbing.

In the meantime, after the US Securities and Change Fee (SEC) unexpectedly requested for adjustments in filings, there was a resurgence in optimism concerning the doable approval of spot Ethereum ETFs.

This optimism has translated into vital market exercise, with Deribit experiencing practically unprecedented buying and selling volumes. Strijers remarked, “We recorded an almost unprecedented trading volume of $12.5 billion notional over the last 24 hours.”

This surge in buying and selling quantity and market curiosity displays how merchants and buyers place themselves to capitalize on the potential approval of spot Ethereum ETFs.

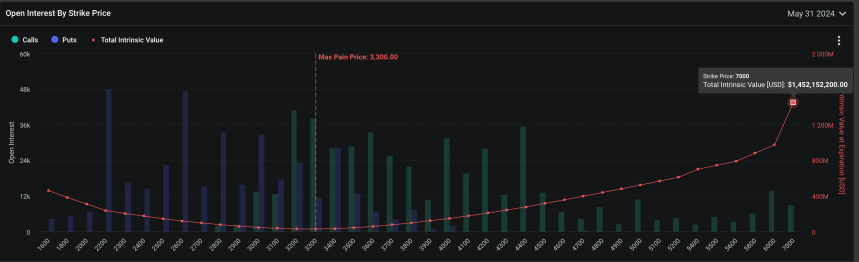

In keeping with information from Deribit, over $480,000 calls will expire by the tip of this month, with a notional worth of greater than $1.7 billion.

The information additional reveals that the strike worth reaches as excessive as $7,000, with a complete intrinsic worth of $1.452 billion, indicating that many Ethereum choices merchants are extremely bullish on ETH.

ETH Worth Efficiency And Forecast

In the meantime, Ethereum is present process slight retracement, down by 2.4% previously 24 hours, with a buying and selling worth of $3,690. Regardless of this pullback, the asset has maintained a robust uptrend, rising practically 25% over the previous seven days.

Because the market’s anticipation round spot ETH ETFs grows, a outstanding crypto analyst has steered a possible worth motion for Ethereum, indicating a quick pullback at round $4,000 earlier than surging to new all-time highs.

Associated Studying

In keeping with the analyst, whereas there could be some bumps, reaching an all-time excessive of $5,000 appears “inevitable” for Ethereum.

$ETH: I feel we pullback briefly round 4k however this definitely breaks all time highs if/when ETF will get accredited. This nonetheless looks as if a free commerce for ETH going to ATH, which is at 5k. May very well be some bumps alongside the best way nevertheless it appears inevitable.

I’ve each SOL and ETH and never… pic.twitter.com/IznlJ0RAyl

— Altcoin Sherpa (@AltcoinSherpa) Might 22, 2024

Featured picture created with DALL·E, Chart from TradingView