- Technical evaluation instructed BTC could quickly dip to $60k to collect liquidity earlier than launching into a significant rally.

- Information developments indicated that the promoting of BTC by smaller wallets to bigger ones is a bullish signal.

As Bitcoin [BTC] continues to dominate the cryptocurrency market, its current value actions have caught the eye of buyers and analysts alike. Over the previous few months, Bitcoin has proven a major enhance, with a surge of over 100% yr so far, and a notable rise of 9.8% in simply the previous week.

Regardless of reaching a brand new peak above $73,000 in March, Bitcoin is at the moment dealing with challenges in surpassing the $67,000 resistance stage. Not too long ago, after hitting a 24-hour excessive of $67,697, it barely retracted by 0.7%, bringing its present buying and selling value to round $66,800.

This value motion happens amid broader market developments, the place analysts are intently observing Bitcoin’s efficiency.

Rekt Capital, a widely known crypto analyst, has identified that Bitcoin is in its ultimate halving retrace earlier than it’s anticipated to renew an upward development.

The analyst highlighted that this yr, the Halving Retrace reached -23.6%, the deepest retrace of the present cycle, signaling what many think about the “final bargain-buying opportunity” earlier than a major rally post-halving.

Understanding the re-accumulation part and predicting future actions

Based on Rekt Capital, the completion of the Halving Retrace has set the stage for the Re-Accumulation Vary, a vital part in Bitcoin’s market cycle. This vary sometimes kinds a couple of weeks earlier than the halving and concludes with a breakout a couple of weeks afterward.

The value throughout this part is predicted to fluctuate between roughly $60,000 and $70,000, with potential extensions past these limits. The length of this Re-Accumulation part can last as long as 150 days (or about 5 months), after which Bitcoin would possibly enter a “parabolic uptrend,” marked by a notable spike in value.

Historic knowledge from 2020 reveals the same sample, the place Bitcoin underwent a -19% retracement round its halving occasion, adopted by a 160-day consolidation interval earlier than coming into a speedy development part.

In 2024, Bitcoin’s almost -24% retracement round its halving means that, if historical past repeats, then Bitcoin would consolidate for the same interval earlier than breaking into a major uptrend.

This potential for a considerable value enhance after a interval of stability provides perception into Bitcoin’s habits following halving occasions.

Indicators level to a Bitcoin rally

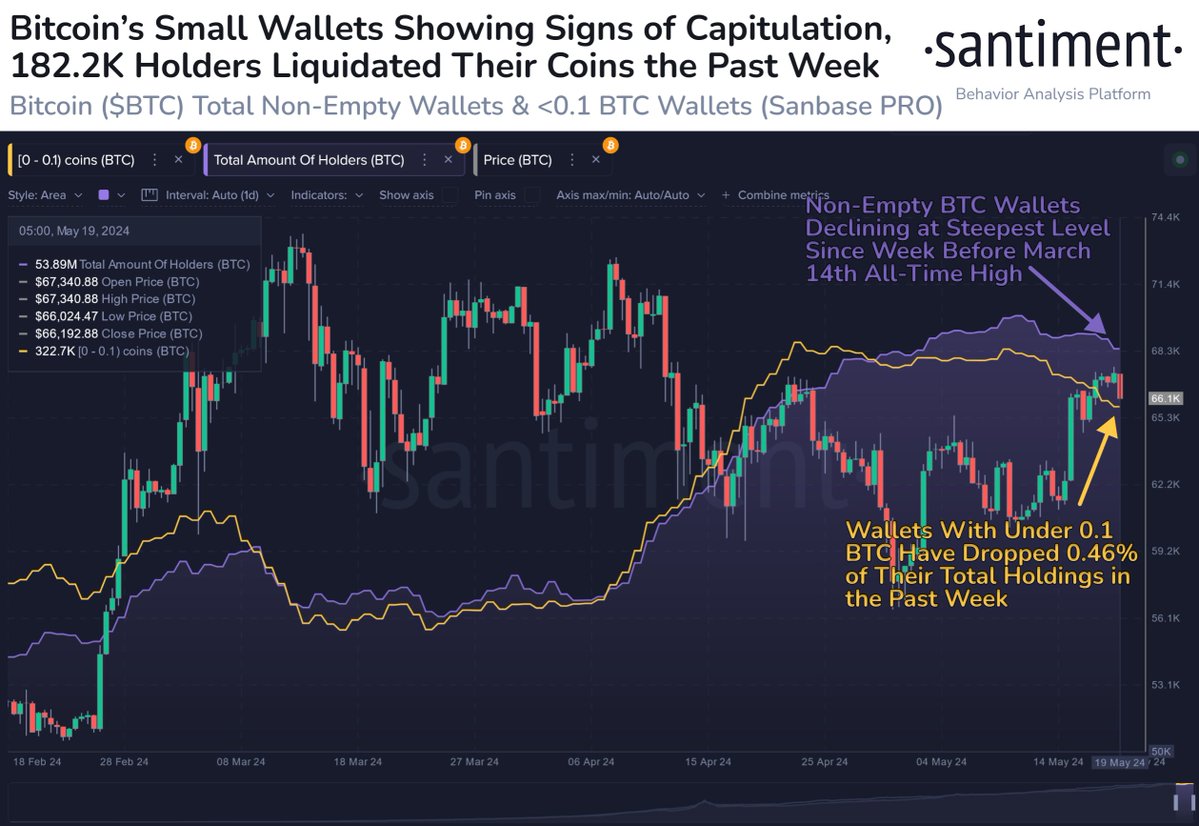

Including to this evaluation, knowledge from Santiment signifies that Bitcoin is hovering simply above $66,100 as smaller merchants liquidate their holdings amid a common market rebound over the previous week.

Traditionally, this development of smaller wallets promoting to bigger ones has been considered as a bullish indicator for Bitcoin.

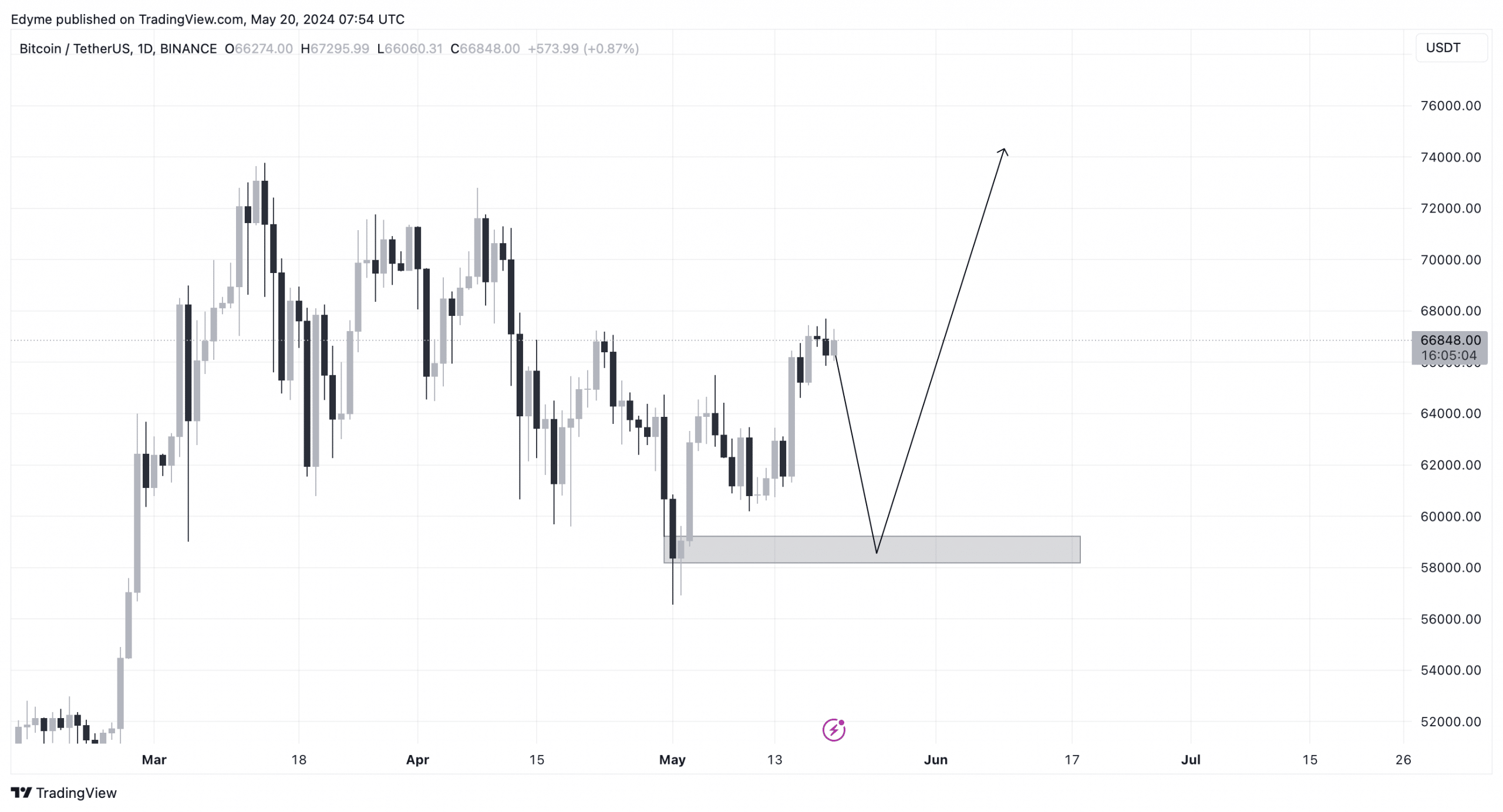

Furthermore, technical evaluation of BTC’s each day chart signifies a possible retracement to the $60,000 ranges to collect extra liquidity earlier than a parabolic rise.

Ought to Bitcoin attain this retracement stage, it may pave the way in which for a powerful rally, enabling the cryptocurrency to interrupt by means of the $67,000 resistance with ease.

AMBCrypto’s current report provides one other layer of perception, noting that the stablecoin provide ratio was under the 200-period Easy Transferring Common however above the decrease Bollinger Band.

When Bitcoin’s value hit $56k in early Might and rebounded, it was a key second of curiosity. The oscillator stays within the decrease band, suggesting additional beneficial properties are seemingly, and the stablecoin provide ratio has seen a downtrend over the previous month.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

This aggressive development larger since October 2023, together with intervals of “stasis or pullback” like these seen in early January and mid-Might, precede important value actions.

Following the January pullback, Bitcoin costs soared previous the $46k resistance effortlessly. Within the coming 2–4 weeks, the same rally may doubtlessly push Bitcoin effectively past the $73k mark, as instructed by market developments and analytical forecasts.